Ever wondered how those folks who magically help you navigate the mortgage maze actually become mortgage brokers? It's not like they get bitten by a radioactive calculator, although sometimes it feels that way! In Texas, becoming a mortgage broker is a process, but hey, if you can survive the summer heat, you can definitely conquer this. Think of it like learning to two-step – a few steps, a bit of coordination, and before you know it, you're gliding across the dance floor... or helping someone buy their dream home.

So, You Want to Be a Mortgage Broker in the Lone Star State? Buckle Up!

Let's be honest, the term "mortgage broker" doesn’t exactly scream "thrilling career choice" to everyone. But hear me out. If you're the kind of person who enjoys helping others, likes a bit of a challenge, and doesn't mind looking at numbers (think of it as deciphering secret codes!), this could be a fantastic path. Plus, you get to play a crucial role in what is often the biggest financial decision of someone's life. That’s kinda cool, right? It's like being a financial superhero, minus the cape (although a business-casual blazer can be your equivalent).

Step 1: Meeting the Basic Requirements – Are You "Texas Material?"

First things first, Texas has some ground rules, like any good BBQ cook-off. You need to be at least 18 years old. Obvious, maybe, but hey, gotta state the obvious! You also need a high school diploma or its equivalent. Think GED or some other fancy-pants academic achievement. And of course, you need to be a person of "good moral character." Basically, don't be a crook. They'll run a background check, so leave those bank-robbing schemes to the movies.

Then there's the fun part – the NMLS. That's the Nationwide Mortgage Licensing System and Registry. It’s like the central hub for all things mortgage-related. You'll need to get an NMLS ID, which is kind of like your social security number for the mortgage world. You get this by creating an account on their website and getting your unique number.

Step 2: Education is Key – Sharpening Your Mortgage Mind

Alright, now for the slightly less-fun but completely necessary part: education. Think of it as training for the mortgage Olympics. Texas requires you to complete 20 hours of NMLS-approved pre-licensure education. These courses cover everything from federal mortgage laws (think Dodd-Frank and RESPA – sounds intimidating, but you'll get the hang of it!) to ethics (don't be shady!).

These 20 hours are broken down into specific categories:

- 3 hours of Federal law and regulations

- 3 hours of ethics

- 2 hours of non-traditional mortgage lending

- 12 hours of undefined education (Electives)

Finding these courses is easier than finding a Whataburger in Texas. Just head over to the NMLS website, and they have a list of approved providers. Shop around and find a course that fits your learning style and budget. Some are online, some are in person – it’s like choosing your favorite flavor of Blue Bell ice cream, there’s something for everyone.

Pro-tip: Don't procrastinate! Get the education done sooner rather than later. It's one less thing to worry about, and you'll feel a lot more confident going into the next steps.

Step 3: Passing the NMLS Exam – Time to Prove Your Stuff!

Okay, deep breaths! You've done the education, now it's time to put that knowledge to the test. The NMLS exam is a standardized test that assesses your understanding of mortgage-related topics. It's multiple-choice, and it covers a wide range of subjects, from mortgage origination to compliance.

Now, I'm not going to lie, the exam can be challenging. It's not like taking a pop quiz on your favorite Netflix show. But, with proper preparation, you can definitely pass it. Treat it like learning the lyrics to a George Strait song – repetition and practice are key!

Here are a few tips for acing the NMLS exam:

- Study, study, study! Use practice exams, flashcards, and whatever other study methods work best for you.

- Understand the concepts, don't just memorize the facts. You'll be asked to apply your knowledge to real-world scenarios.

- Manage your time wisely during the exam. Don't get bogged down on any one question.

- Read each question carefully. Pay attention to the wording and look for keywords.

- Don't panic! Take a deep breath and trust in your preparation.

You'll need to schedule your exam through the NMLS website and pay a fee. The passing score is 75%, so aim high! If you don't pass the first time, don't despair. You can retake the exam, but you'll have to wait 30 days between attempts. Think of it as a chance to refine your BBQ sauce recipe before the next cook-off.

Step 4: Sponsorship – Finding Your Mortgage Home

Once you've passed the NMLS exam, you need to find a sponsoring mortgage company. This is a licensed mortgage company that will employ you and be responsible for your activities. Finding a sponsor is like finding the perfect pair of cowboy boots – it needs to be a good fit.

Think of your sponsor as your mentor and guide in the mortgage world. They'll provide you with training, support, and resources to help you succeed. They'll also ensure that you're complying with all applicable laws and regulations.

Here are a few tips for finding a good sponsor:

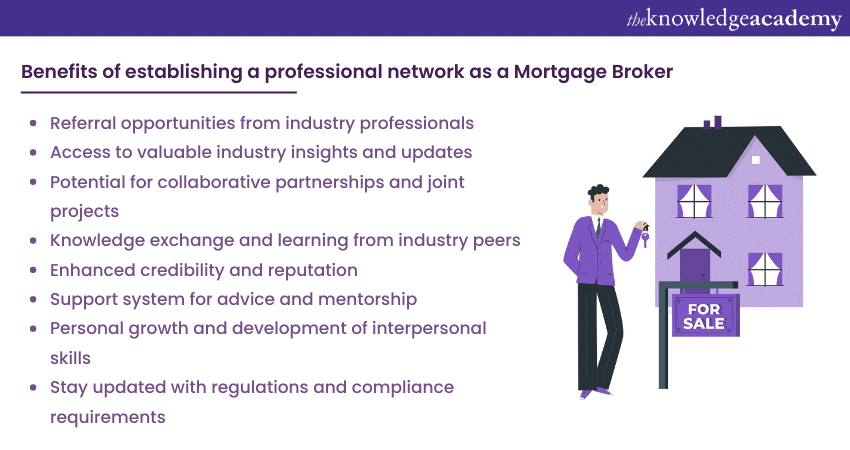

- Network! Talk to other mortgage professionals, attend industry events, and reach out to companies that interest you.

- Research potential sponsors. Look at their reputation, culture, and the types of loans they offer.

- Ask questions! Don't be afraid to ask about their training programs, compensation structure, and support systems.

- Trust your gut. Choose a sponsor that you feel comfortable with and that you believe will help you grow as a mortgage professional.

Once you've found a sponsor, they'll need to sponsor you through the NMLS. This involves submitting some paperwork and paying a fee. It's like getting officially inducted into the mortgage broker club.

Step 5: Getting Licensed – Officially a Texan Mortgage Broker!

Now for the final step! Once your sponsor has sponsored you, you can apply for your Texas mortgage broker license through the Texas Department of Savings and Mortgage Lending (TDSML). This involves submitting an application, paying a fee, and undergoing a background check.

The TDSML will review your application and ensure that you meet all the requirements. If everything checks out, they'll issue you a mortgage broker license. Congratulations! You are officially a licensed mortgage broker in the great state of Texas!

Here are some things to keep in mind during the licensing process:

- Be honest and accurate on your application. Any misrepresentations could result in denial or revocation of your license.

- Respond promptly to any requests from the TDSML. They may need additional information or documentation.

- Keep your contact information up to date with the NMLS and the TDSML.

- Renew your license on time. Texas mortgage broker licenses are typically good for one year.

Beyond the License: Continuing Education and Staying Sharp

Getting your license isn't the end of the road, it's just the beginning! To maintain your license, you'll need to complete continuing education (CE) courses each year. This is to ensure that you stay up-to-date on the latest laws, regulations, and industry trends.

Think of CE as keeping your mortgage knowledge finely tuned, like maintaining a classic car. The NMLS requires 8 hours of CE annually, which includes:

- 3 hours of Federal law and regulations

- 2 hours of ethics

- 2 hours of non-traditional mortgage lending

- 1 hour of undefined education (Elective)

Also, remember to stay active in the industry, network with other professionals, and continue to learn and grow. The mortgage world is constantly evolving, so you need to be prepared to adapt and change. It’s kind of like learning a new dance step – you gotta keep up with the latest trends!

Is It Worth It? The Rewards of Being a Texas Mortgage Broker

So, there you have it – a crash course on becoming a mortgage broker in Texas. It's not a walk in the park, but it's definitely achievable with the right dedication and effort. And the rewards can be significant.

You get to help people achieve their dreams of homeownership, which is incredibly fulfilling. You have the potential to earn a good income, and you have the flexibility to set your own hours and be your own boss (if you choose to work independently). Plus, you get to be part of a dynamic and exciting industry that's constantly changing.

Think of it this way: You're not just selling mortgages; you're selling dreams, security, and a place to call home. And that's a pretty good feeling, y'all!

Now, go on out there and make Texas proud. Just remember to wear sunscreen and always be honest – both are essential for success in the Lone Star State!