Microstrategy, a publicly traded company best known for its enterprise analytics software, has garnered significant attention in recent years due to its substantial investment in Bitcoin. While the company's common stock (MSTR) is widely discussed, its preferred stock offers a different investment avenue. Understanding how to acquire Microstrategy preferred stock requires navigating the intricacies of preferred shares and the specific attributes of Microstrategy's offering.

Understanding Microstrategy's Preferred Stock

Before delving into the mechanics of purchasing Microstrategy preferred stock, it is crucial to understand its nature. Preferred stock, in general, sits between common stock and bonds in the capital structure. It typically offers a fixed dividend payment and has a higher claim on assets in the event of liquidation than common stock. However, preferred stockholders usually do not have voting rights.

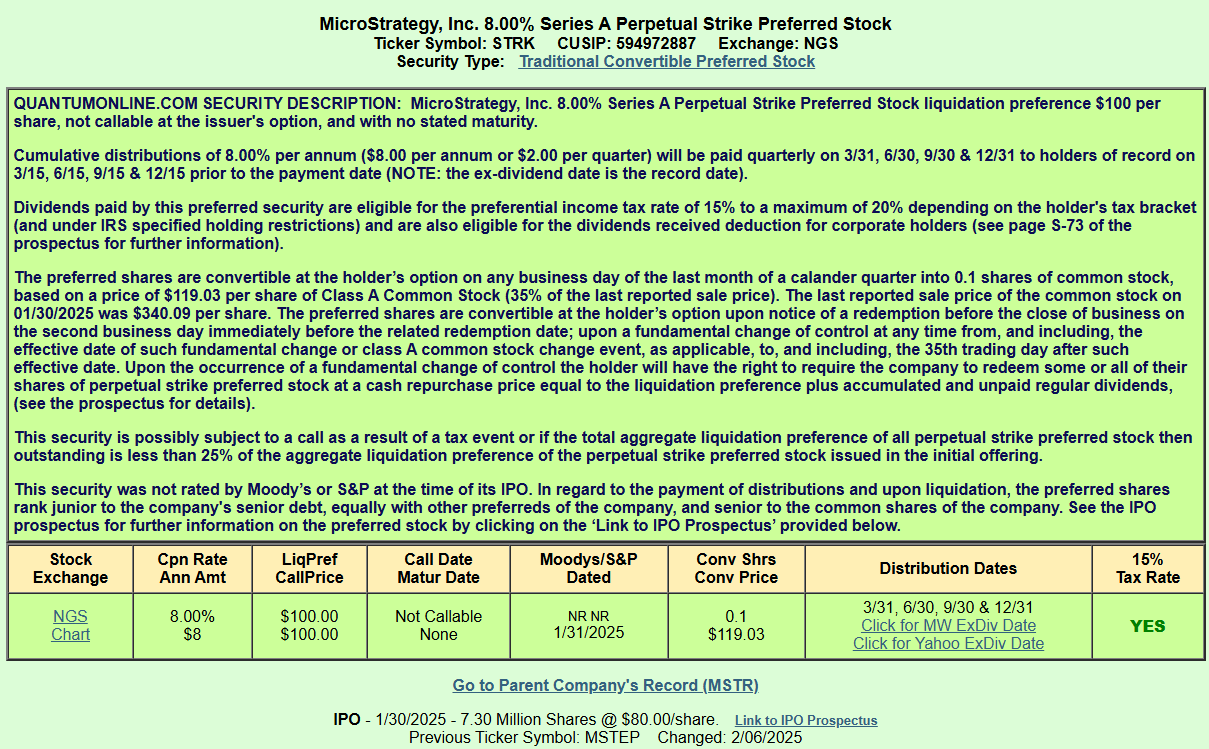

Microstrategy's preferred stock, like other preferred issues, has specific characteristics outlined in its prospectus. These include the dividend rate, redemption terms, liquidation preference, and any conversion options (although Microstrategy's preferred stock typically does not have a conversion feature). The ticker symbol for a specific series of Microstrategy preferred stock is important to note, as different series may exist with varying terms. For example, Microstrategy may have issued Series A preferred stock, Series B preferred stock, etc., each with distinct features.

Causes Influencing Preferred Stock Availability

The availability of Microstrategy preferred stock is primarily influenced by the following factors:

Initial Issuance: When Microstrategy first issues preferred stock, it is typically offered through an underwriter. Institutional investors often get priority in these initial offerings, but individual investors can sometimes participate through their brokers.

Secondary Market Trading: After the initial offering, the preferred stock trades on the secondary market, similar to common stock. The volume of trading and the availability of shares are dependent on investor demand and the willingness of current holders to sell.

Company Actions: Microstrategy may choose to redeem (buy back) its preferred stock, which would decrease the number of shares available. Conversely, the company could issue more preferred stock, increasing the supply.

Market Conditions: Overall market conditions, particularly interest rate movements, can significantly impact preferred stock prices. When interest rates rise, the value of fixed-income securities, including preferred stock, tends to decline, potentially making shares more readily available at lower prices.

Effects of Preferred Stock Ownership

Owning Microstrategy preferred stock has several potential effects for investors:

Fixed Income Stream: The primary benefit is the fixed dividend payment, providing a predictable income stream. The yield on the preferred stock is determined by the dividend rate and the purchase price. For example, if a preferred stock pays an annual dividend of $5 and you purchase it for $100, the yield is 5%.

Priority Over Common Stock: In the event of liquidation, preferred stockholders have a higher claim on assets than common stockholders. This offers a degree of downside protection, although it is still subordinate to the claims of debt holders.

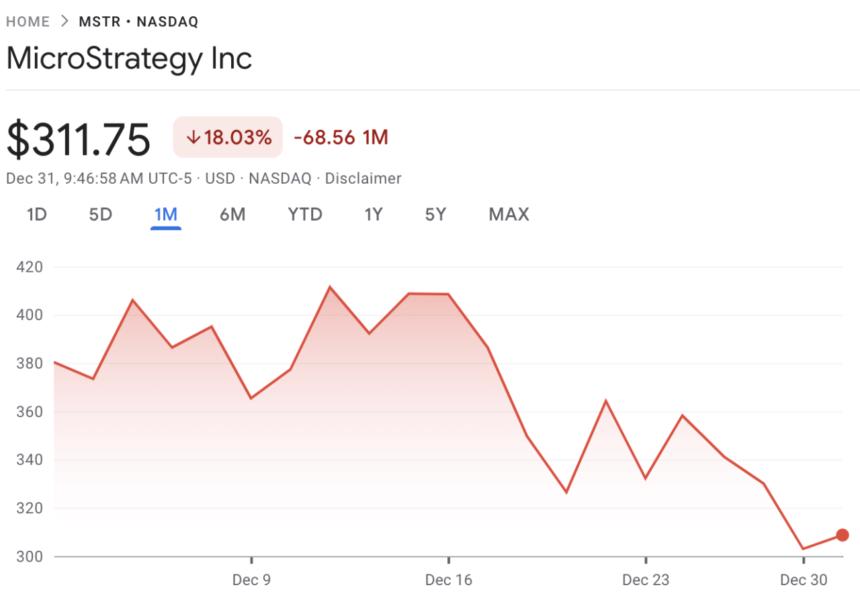

Price Volatility: While generally less volatile than common stock, preferred stock prices can fluctuate due to interest rate changes, credit rating changes, and changes in the company's financial health.

Limited Upside: Unlike common stock, preferred stock typically does not participate in the company's growth beyond the fixed dividend. This limits the potential for capital appreciation.

Implications for Investors

The decision to invest in Microstrategy preferred stock carries several implications that investors must consider:

Risk Assessment: Investors must carefully assess Microstrategy's financial health and its ability to continue paying dividends. The company's significant Bitcoin holdings introduce an element of risk, as the value of Bitcoin is highly volatile and can impact Microstrategy's overall financial performance. Credit rating agencies assess the risk associated with preferred stock, and a lower rating indicates a higher risk of default.

Interest Rate Sensitivity: Preferred stock prices are inversely related to interest rates. If interest rates rise, the value of Microstrategy preferred stock will likely decline, potentially leading to capital losses if the investor needs to sell before maturity or redemption.

Liquidity: The trading volume of Microstrategy preferred stock may be lower than that of its common stock, which could make it more difficult to buy or sell shares quickly at a desired price. This is particularly true for less actively traded series of preferred stock.

Tax Implications: Dividends from preferred stock are typically taxed as ordinary income. However, depending on the specific issue and the investor's tax situation, there may be opportunities for favorable tax treatment. Consulting with a tax advisor is recommended.

Steps to Purchase Microstrategy Preferred Stock

Purchasing Microstrategy preferred stock is generally similar to buying any other publicly traded security:

- Open a Brokerage Account: If you don't already have one, you'll need to open a brokerage account with a firm that allows you to trade preferred stock. Popular options include full-service brokers, discount brokers, and online trading platforms.

- Research and Identify the Specific Series: Determine the specific series of Microstrategy preferred stock you want to purchase (e.g., Series A, Series B). Obtain the correct ticker symbol for that series. Consult financial websites, company filings, and your broker for information about the dividend rate, redemption terms, and other characteristics of the preferred stock.

- Place an Order: Once you've identified the specific series and ticker symbol, you can place an order through your brokerage account. You can choose between a market order (to buy at the current market price) or a limit order (to buy only at a specified price or better).

- Monitor Your Investment: After purchasing the preferred stock, monitor its performance and stay informed about Microstrategy's financial health and any news that could affect the value of your investment.

Broader Significance

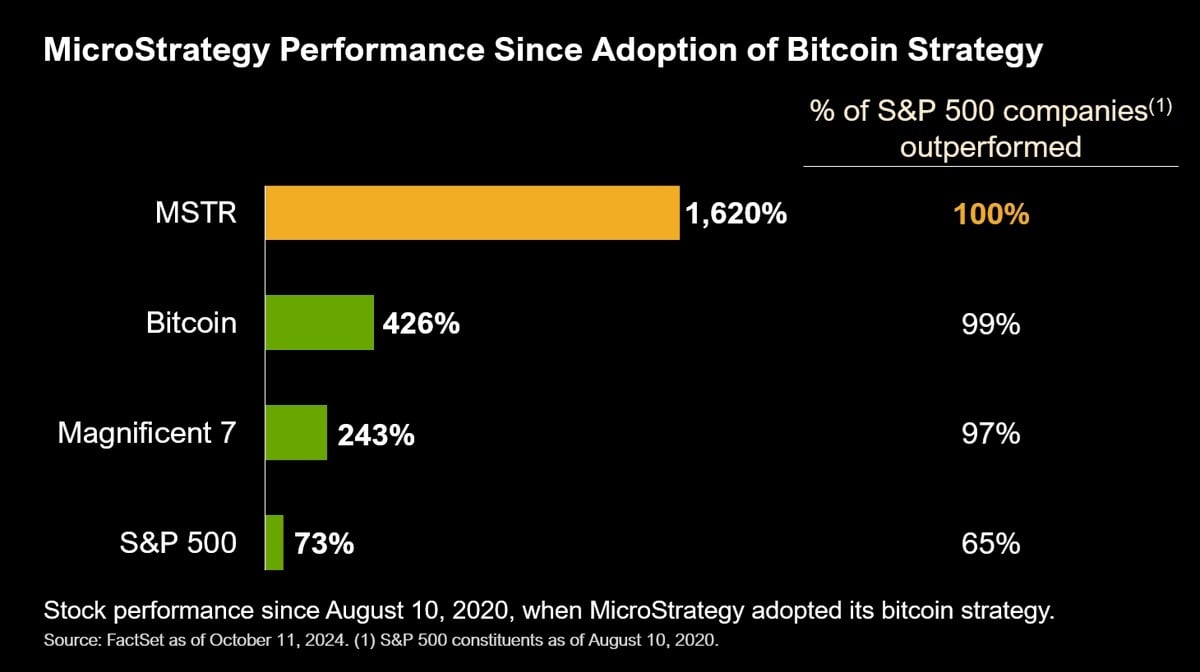

Microstrategy's foray into Bitcoin and its subsequent use of preferred stock as a financing mechanism highlights the evolving landscape of corporate finance. The company's strategy demonstrates how companies can leverage alternative investment strategies and capital structures to pursue growth initiatives. However, it also underscores the importance of understanding the risks associated with these strategies. Investors need to carefully weigh the potential benefits of preferred stock ownership, such as the fixed income stream and priority over common stock, against the risks associated with the underlying company and broader market conditions.

The availability and pricing of Microstrategy's preferred stock also serve as a barometer of investor sentiment towards the company and its Bitcoin strategy. Strong demand for the preferred stock suggests that investors are confident in Microstrategy's ability to generate sufficient cash flow to service its debt and preferred stock dividends. Conversely, weak demand or a decline in the price of the preferred stock could signal concerns about the company's financial health or the sustainability of its Bitcoin strategy. Understanding these dynamics is crucial for both current and prospective investors in Microstrategy's securities.

:max_bytes(150000):strip_icc()/GettyImages-2089840426-05dd6a599af242a1a87b40bb27660a84.jpg)