Alright folks, gather 'round! Let me tell you a tale. A tale of deadlines, forms, and enough acronyms to make your head spin. I'm talking, of course, about the thrilling saga of filing your 1094 and 1095 forms electronically. Now, I know what you're thinking: "Thrilling? Really? Sounds more like a root canal." But trust me, with a little humor and a dash of caffeine, we can navigate this bureaucratic beast together. Think of me as your Indiana Jones, but instead of a whip and a fedora, I have a slightly-stained coffee mug and an encyclopedic knowledge of IRS publications. Let's dive in!

Why Bother Filing Electronically Anyway?

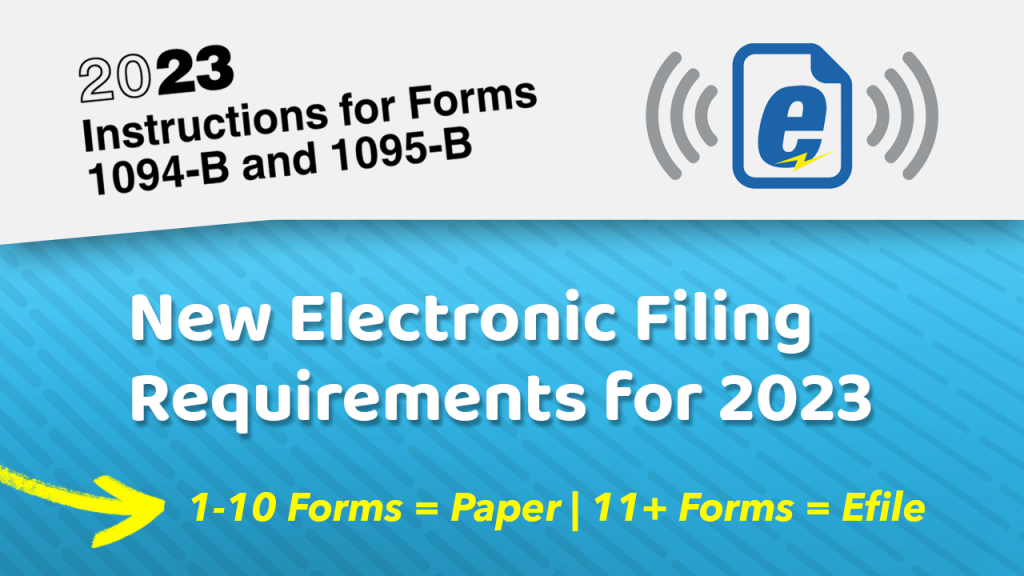

First things first, why even bother going electronic? Why not just print everything out, stuff it in an envelope, and hope for the best? Well, my friend, let me enlighten you. For starters, if you're filing 250 or more of any information returns (think W-2s, 1099s, the whole gang), the IRS requires you to file electronically. That's the law! And let me tell you, the IRS isn't known for their sense of humor when it comes to these things. Think of it as a really, REALLY stern librarian.

But even if you're filing fewer than 250 forms, electronic filing is still a smart move. Why? Because:

- It's faster: Think of it as teleporting your forms to the IRS instead of relying on snail mail.

- It's more accurate: Less chance of human error, which means fewer headaches down the road (and fewer letters from our stern librarian friend).

- It's more secure: Less risk of your sensitive data getting lost or stolen in the mail. Nobody wants their social security number ending up on the dark web!

- It's eco-friendly: Save a tree! And feel good about yourself while doing it. High five!

Plus, let's be honest, who *actually* enjoys printing things out these days? It's like using a rotary phone – technically functional, but incredibly inconvenient. And probably dusty.

Okay, I'm Convinced. How Do I Do This Thing?

Alright, so you're ready to embrace the digital age and file your 1094 and 1095 forms electronically. Excellent! Here's the breakdown:

Step 1: Get Your Ducks (and TINS) in a Row

Before you even think about touching a computer, you need to gather all your information. This includes:

- Your Employer Identification Number (EIN): This is your business's social security number. Don't lose it!

- The Taxpayer Identification Numbers (TINs) for everyone covered: That means social security numbers (SSNs) or Individual Taxpayer Identification Numbers (ITINs) for all employees and their dependents. Make sure these are accurate! A typo here can cause major delays and potential penalties. Imagine explaining to the IRS that you accidentally assigned your employee's SSN to your cat. Awkward!

- All the relevant health coverage information: Dates of coverage, months of enrollment, cost of coverage… the whole shebang.

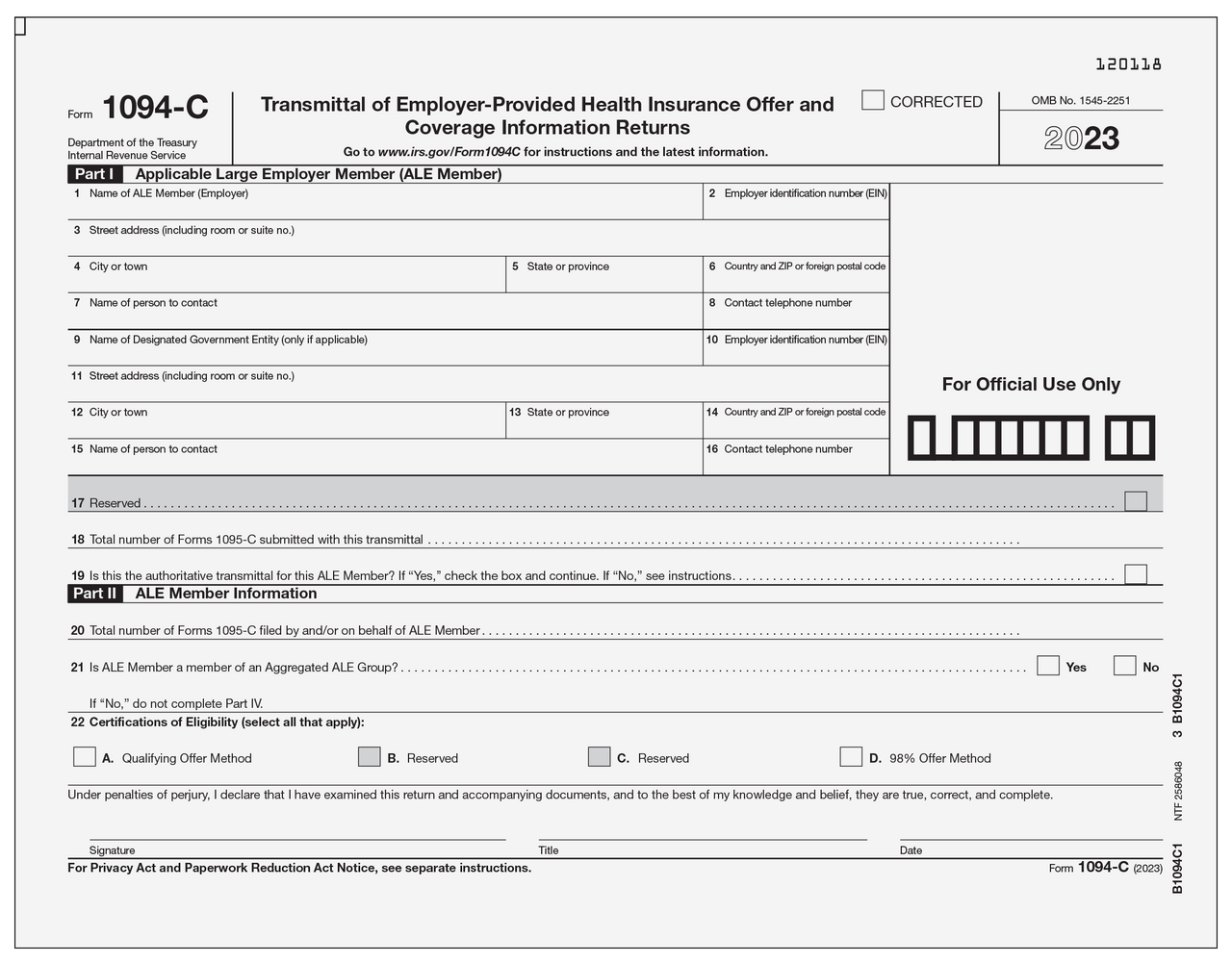

- Your 1094-C and 1095-C forms: You'll need these as a reference point.

Think of this as gathering your ingredients before you start baking a cake. You wouldn't try to make a cake without flour, right? (Unless you're going for a flourless chocolate cake, which, admittedly, is delicious.)

Step 2: Choose Your Weapon (a.k.a. Filing Method)

You have a few options when it comes to filing electronically:

- The ACA Information Returns (AIR) System: This is the IRS's online portal specifically for filing ACA forms. It's like going directly to the source.

- A third-party software provider: Many companies offer software that will help you prepare and file your forms electronically. This can be a good option if you're not comfortable with the technical aspects of the AIR system. Think of it as hiring a professional cake decorator instead of trying to ice the cake yourself.

- A service bureau: These companies will handle the entire filing process for you, from start to finish. This is the most hands-off option, but also the most expensive. Think of it as ordering a cake from a bakery. Delicious, but pricey.

Which option is right for you depends on your technical expertise, your budget, and how much time you want to spend on this process. If you're a tech-savvy whiz with plenty of time on your hands, the AIR system might be the way to go. If you're more comfortable with a user-friendly interface, a third-party software provider might be a better choice. And if you're drowning in paperwork and just want someone else to handle it, a service bureau might be your savior.

Step 3: Get Your TCC (Transmitter Control Code)

If you're using the AIR system or a third-party software provider, you'll need to obtain a Transmitter Control Code (TCC) from the IRS. This is essentially your permission slip to file electronically. You can apply for a TCC online through the IRS's e-services portal. The process can take a few weeks, so don't wait until the last minute! Imagine showing up to the DMV without your driver's license. Not a good look.

The TCC application process involves answering a bunch of questions about your business and your filing intentions. Be prepared to provide detailed information and answer honestly. Remember, the IRS isn't a fan of fibbers.

Step 4: Prepare Your Forms

Now comes the fun part! (Okay, maybe not "fun," but definitely the crucial part.) Using your chosen method (AIR system or third-party software), enter all the information from your 1094-C and 1095-C forms into the system. Double-check everything for accuracy! A misplaced decimal point can cause a world of trouble. Think of it as proofreading your novel before you send it to the publisher. You don't want to accidentally write that your protagonist is a sentient potato.

The IRS provides detailed instructions and publications to help you prepare your forms correctly. Don't be afraid to consult these resources! They're your friends. (Well, maybe not "friends," but definitely helpful acquaintances.)

Step 5: Transmit Your Forms

Once you've prepared your forms and double-checked everything for accuracy, it's time to transmit them to the IRS. This process will vary depending on your chosen method. If you're using the AIR system, you'll upload your forms directly to the IRS's website. If you're using a third-party software provider, the software will typically handle the transmission for you. Just follow the instructions carefully and don't panic if you see a bunch of technical jargon. It's just code, after all. (Mostly.)

Step 6: Bask in the Glory (and Save Your Confirmation)

Congratulations! You've successfully filed your 1094 and 1095 forms electronically. Take a moment to pat yourself on the back and treat yourself to a well-deserved reward (like that flourless chocolate cake we talked about earlier).

But don't get too comfortable just yet. Be sure to save your confirmation receipt from the IRS. This is your proof that you filed on time. You'll need this if the IRS ever comes knocking (hopefully not!). Think of it as your "get out of jail free" card. (Although, filing your taxes correctly is a much better way to stay out of jail.)

Important Dates and Deadlines

Speaking of deadlines, let's not forget the most important part! The deadlines for filing your 1094 and 1095 forms electronically are:

- For furnishing statements to individuals (employees): Usually in late January. (Consult the IRS website for the precise date each year.)

- For filing electronically with the IRS: Usually in late March. (Again, check the IRS website for the exact date.)

Don't miss these deadlines! The IRS doesn't take kindly to late filers. Think of it as showing up late to a job interview. Not a good way to make a first impression.

A Few Final Words of Wisdom (and Silliness)

Filing your 1094 and 1095 forms electronically can seem daunting, but it doesn't have to be. With a little preparation, a dash of humor, and a healthy dose of caffeine, you can conquer this bureaucratic beast and emerge victorious. Remember to:

- Start early: Don't wait until the last minute to start preparing your forms. Give yourself plenty of time to gather your information, choose your filing method, and obtain your TCC.

- Double-check everything: Accuracy is key. A typo can cause major headaches down the road.

- Don't be afraid to ask for help: The IRS provides a wealth of resources to help you file your forms correctly. And if you're really stuck, consider hiring a professional.

- Take breaks: Staring at forms all day can be mind-numbing. Take frequent breaks to stretch your legs, grab a snack, and clear your head.

- Remember to breathe: It's just taxes. It's not the end of the world. (Although, sometimes it feels like it.)

And most importantly, don't forget to laugh! Taxes are serious business, but that doesn't mean you can't have a little fun along the way. Think of it as a challenging puzzle. And once you solve it, you can reward yourself with that flourless chocolate cake. You deserve it!

Now go forth and file those forms! And may the odds be ever in your favor.