Navigating the world of "sugar dating" requires caution and awareness. While some individuals may find mutually beneficial arrangements, the potential for exploitation and scams is significant. Protecting yourself from financial and emotional harm is paramount. This article outlines specific steps to minimize your risk.

Understanding the Landscape

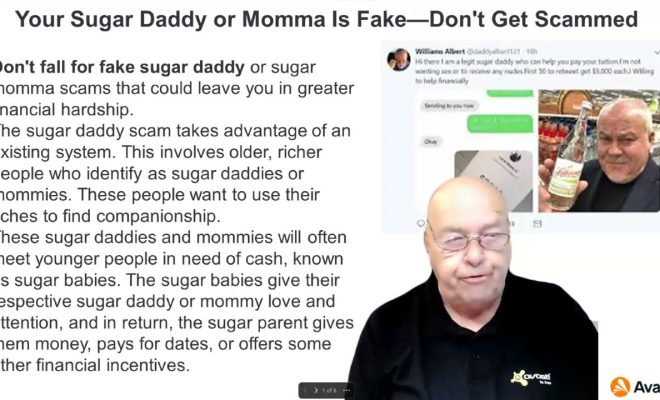

Before engaging in any form of sugar dating, understanding the common tactics used by scammers is crucial. These tactics often exploit vulnerability and a desire for financial assistance.

Common Scam Tactics:

- Advance Fee Scams: Promises of substantial financial support are made, contingent on the "sugar baby" paying an initial fee for various reasons (e.g., setting up an account, verification).

- Check Overpayment Scams: A seemingly generous check is sent, exceeding the agreed-upon amount. The "sugar daddy" requests the difference be returned, but the original check later bounces, leaving the "sugar baby" responsible for the entire amount.

- Gift Card Scams: Requests are made for gift cards from various retailers. These cards are then used anonymously, and no actual support is ever provided.

- Personal Information Harvesting: Scammers may attempt to gather sensitive personal information (e.g., bank account details, social security number) under false pretenses, leading to identity theft or financial fraud.

- Emotional Manipulation: Scammers may feign deep emotional connection to manipulate individuals into providing financial assistance or personal favors.

Protecting Yourself: A Step-by-Step Guide

Adhering to the following steps can significantly reduce your risk of being scammed.

Step 1: Research and Verification

Online Presence: Conduct a thorough online search of the potential "sugar daddy." Look for social media profiles, business affiliations, and any potential red flags. A lack of online presence or inconsistencies in their stated identity should raise suspicion.

Reverse Image Search: Use reverse image search tools to verify the authenticity of profile pictures. Scammers often use stolen images from other sources.

Background Checks: Consider utilizing online background check services, although caution is advised, and legality varies by jurisdiction. Focus on confirming basic identifying information and any potential criminal records.

Example: A profile picture shows a man in a business suit with a company logo in the background. A reverse image search reveals that the image is a stock photo used on multiple websites.

Step 2: Communication and Boundaries

Cautious Initial Contact: Approach initial communication with skepticism. Avoid sharing personal or financial information until a solid level of trust has been established.

Set Clear Boundaries: Define your expectations and limitations from the outset. Be explicit about what you are and are not willing to do. This demonstrates your self-respect and discourages manipulative behavior.

Refuse Pressure: Do not be pressured into doing anything that makes you uncomfortable, regardless of promises or incentives. A legitimate individual will respect your boundaries.

Example: A "sugar daddy" immediately asks for your bank account details to deposit funds. This is a significant red flag and a common tactic used in fraud.

Step 3: Financial Prudence

Never Send Money: Under no circumstances should you send money to a "sugar daddy," regardless of the reason provided. Legitimate individuals will not ask for money from you.

Verify Funds: Before spending any money received, ensure that the funds have cleared your bank account and are not subject to reversal. Do not rely solely on the initial deposit appearing in your account balance.

Avoid Gift Card Requests: Refuse any requests for gift cards or other forms of indirect payment. These requests are virtually always indicative of a scam.

Protect Your Financial Information: Never share your bank account details, social security number, or other sensitive financial information with anyone you meet online, regardless of how trustworthy they may seem.

Example: A "sugar daddy" sends you a check for $5,000 and asks you to deposit it, keep $1,000 for yourself, and wire the remaining $4,000 back to him. The check will likely bounce, and you will be responsible for the $5,000.

Step 4: Meeting in Person (If Desired)

Public Place: Always meet in a public place for the first few meetings. Avoid meeting at their home or in isolated locations.

Inform Someone: Tell a trusted friend or family member where you are going, who you are meeting, and when you expect to return. Share the individual's contact information with them.

Trust Your Instincts: If something feels off or uncomfortable, leave the situation immediately. Your safety and well-being are paramount.

Example: Upon meeting in person, the individual does not resemble the person in the profile pictures, or their behavior is inconsistent with their online persona. This should raise immediate concerns.

Step 5: Document Everything

Keep Records: Maintain records of all communication, including emails, messages, and financial transactions. These records may be helpful in the event of a scam or dispute.

Screenshot Conversations: Take screenshots of important conversations, especially those that involve financial agreements or promises.

Recognizing Red Flags

Certain behaviors and patterns should immediately raise your suspicion.

- Love Bombing: Excessive flattery and declarations of love early in the relationship.

- Inconsistency: Discrepancies in their stories, background, or online presence.

- Refusal to Meet: Consistently avoids meeting in person or provides flimsy excuses.

- Financial Urgency: Expresses urgent financial needs or requests for immediate assistance.

- Poor Grammar and Spelling: While not always indicative of a scam, consistently poor grammar and spelling can be a sign that the individual is not who they claim to be.

Practical Advice for Everyday Life

The principles outlined above extend beyond the realm of sugar dating. Always exercise caution when interacting with strangers online, especially when money is involved.

Be skeptical of unsolicited offers: If something seems too good to be true, it probably is.

Protect your personal information: Be mindful of the information you share online and with whom you share it.

Trust your instincts: If something feels wrong, do not ignore your gut feeling.

Report suspicious activity: If you suspect that you have been targeted by a scam, report it to the relevant authorities, such as the Federal Trade Commission (FTC) or your local law enforcement agency.

By staying informed and vigilant, you can significantly reduce your risk of falling victim to scams and protect your financial and emotional well-being.