The initiation of a payday loan company requires meticulous planning, significant capital, and a thorough understanding of legal and regulatory frameworks. This article delineates the key steps involved in establishing such a business.

Step 1: Develop a Comprehensive Business Plan

A robust business plan serves as the foundational document for your payday loan venture. It outlines your strategic goals, operational procedures, and financial projections. Key components include:

Executive Summary

A concise overview of your business concept, target market, and financial objectives. For example, "Our payday loan company will provide short-term loans to underserved communities within a 50-mile radius of the city center, aiming for a 15% market share within the first three years."

Company Description

A detailed explanation of your company's mission, vision, and values. Specify your legal structure (e.g., sole proprietorship, LLC, corporation) and management team. Example: "The company will operate as a Limited Liability Company (LLC) under the name 'Quick Cash Solutions,' managed by a team with over 10 years of experience in financial services."

Market Analysis

Research and identify your target market. Analyze demographic data, income levels, and the existing competitive landscape. Consider factors such as unemployment rates and the prevalence of unbanked or underbanked individuals.

For instance, a market analysis might reveal a high demand for payday loans in areas with a significant population of hourly wage earners and limited access to traditional banking services.

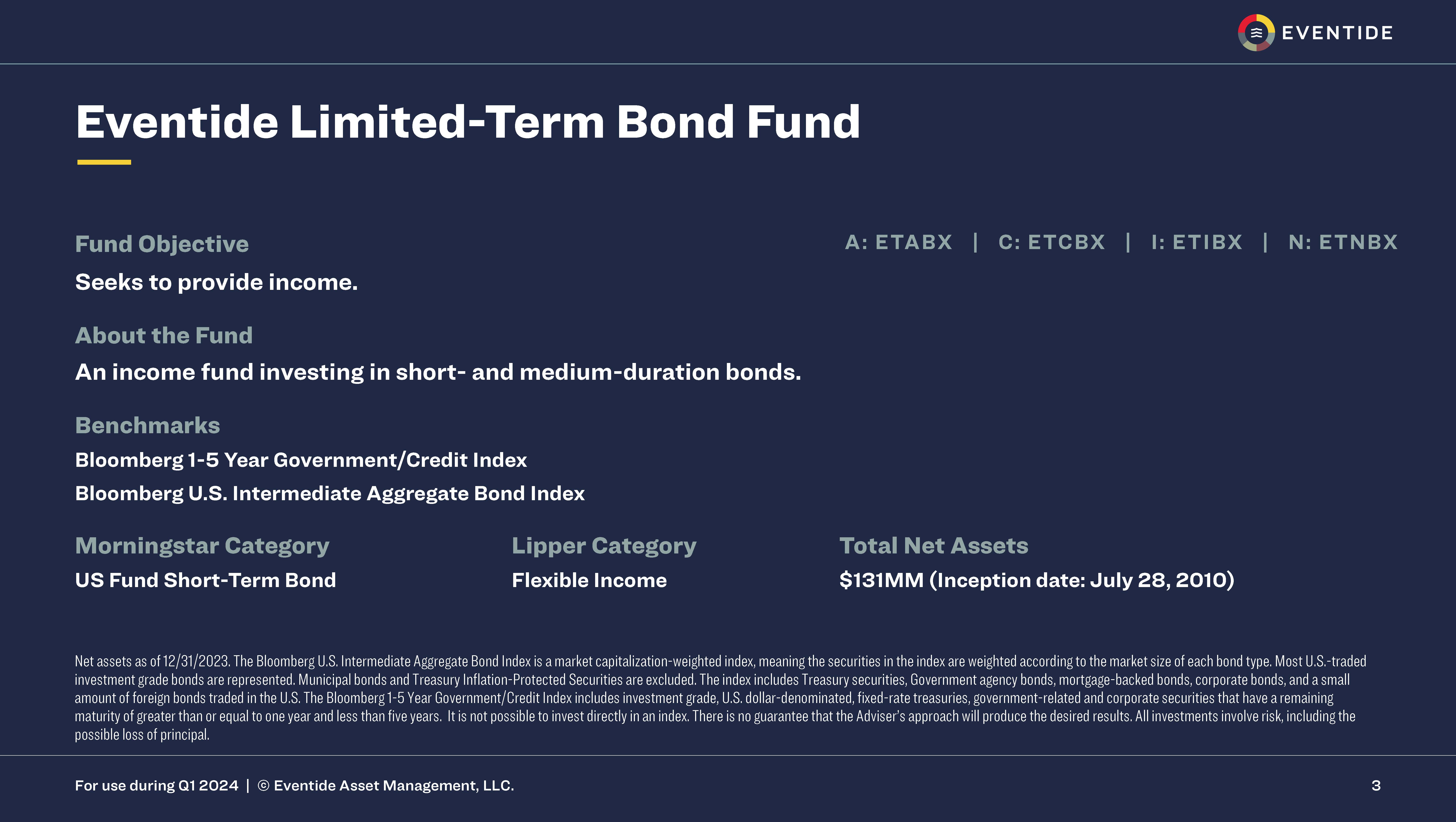

Products and Services

Define the specific loan products you will offer, including loan amounts, interest rates, repayment terms, and any associated fees. Offer diverse loan options to attract a broader customer base. Example: "We will offer payday loans ranging from $100 to $500, with APRs compliant with state regulations, and repayment terms typically between 14 and 30 days."

Marketing and Sales Strategy

Outline your plan for attracting and retaining customers. This might involve online advertising, local partnerships, direct mail campaigns, or community outreach programs. Clearly define your target customer profile. Example: "Our marketing strategy will focus on online advertising through search engines and social media, targeting individuals searching for 'fast cash' or 'emergency loans.' We will also partner with local businesses to offer discounts to their employees."

Financial Projections

Develop detailed financial forecasts, including projected revenue, expenses, and profitability. Include a break-even analysis and a cash flow statement. These projections are crucial for attracting investors and securing funding. Example: "We project to originate $500,000 in loans in the first year, with a net profit margin of 10%."

Management Team

Highlight the qualifications and experience of your management team. Emphasize their expertise in finance, lending, and compliance. This adds credibility to your business plan. Consider background checks and credit reports for key personnel.

Step 2: Secure Funding

Payday loan businesses require substantial capital to fund loans and cover operational expenses. Explore various funding options:

Personal Savings

Using your own savings is a common starting point. This demonstrates your commitment to the business.

Loans from Banks and Credit Unions

Securing a loan from a traditional financial institution can be challenging, as they often view payday lending as high-risk. However, a strong business plan and good credit history can increase your chances of approval.

Investors

Attracting private investors or venture capitalists can provide significant capital. Be prepared to offer equity in your company in exchange for investment.

Small Business Loans

Explore government-backed small business loan programs offered by agencies like the Small Business Administration (SBA). These loans often come with favorable terms.

Peer-to-Peer Lending

Online platforms facilitate loans between individuals or businesses. This can be a viable option for securing funding, but interest rates may be higher.

Step 3: Comply with Legal and Regulatory Requirements

Payday lending is heavily regulated at both the federal and state levels. Compliance is essential to avoid legal penalties and maintain a good reputation.

Federal Regulations

Comply with federal laws such as the Truth in Lending Act (TILA), which requires clear disclosure of loan terms and APRs. The Dodd-Frank Wall Street Reform and Consumer Protection Act also has implications for payday lenders.

State Regulations

State laws vary significantly regarding interest rates, loan amounts, repayment terms, and licensing requirements. Obtain the necessary licenses and permits to operate legally in each state where you intend to do business. For example, some states prohibit payday lending altogether, while others impose strict limits on interest rates and fees.

Consumer Financial Protection Bureau (CFPB)

The CFPB regulates the payday lending industry and enforces consumer protection laws. Stay informed about CFPB regulations and ensure compliance.

Anti-Money Laundering (AML) Compliance

Implement an AML program to prevent your business from being used for money laundering activities. This includes verifying customer identities and reporting suspicious transactions.

Step 4: Establish Operational Infrastructure

Setting up the necessary infrastructure is critical for efficient operations.

Office Space

Secure a physical office space or establish an online platform for processing loan applications and managing customer accounts.

Loan Management Software

Invest in loan management software to automate loan origination, underwriting, and collection processes. This software should also track compliance with regulations.

Payment Processing System

Set up a secure payment processing system to facilitate loan disbursements and repayments. Consider options such as ACH transfers, debit cards, and money orders.

Customer Service

Provide excellent customer service to build trust and retain customers. Establish a phone line, email address, and online chat support.

Data Security

Implement robust data security measures to protect customer information from cyber threats and data breaches. Comply with data privacy regulations, such as the California Consumer Privacy Act (CCPA).

Step 5: Implement a Robust Underwriting Process

A sound underwriting process is essential for minimizing loan defaults and maximizing profitability.

Credit Checks

Conduct credit checks to assess the borrower's creditworthiness. While payday loans are often marketed to individuals with poor credit, it's important to evaluate their ability to repay the loan.

Income Verification

Verify the borrower's income to ensure they have sufficient funds to repay the loan. Request pay stubs, bank statements, or other proof of income.

Debt-to-Income Ratio (DTI)

Calculate the borrower's DTI to assess their overall debt burden. A high DTI indicates a higher risk of default.

Loan Amount Limits

Set loan amount limits based on the borrower's income and creditworthiness. Avoid lending more than they can reasonably afford to repay.

Collection Procedures

Establish clear collection procedures for handling delinquent loans. This may involve sending reminders, making phone calls, or engaging a collection agency.

Starting a payday loan company is a complex and highly regulated undertaking. Thorough research, meticulous planning, and unwavering compliance are essential for success. Failure to adhere to legal and ethical standards can result in severe penalties and damage to your reputation.

![How to Make a Payday Loan Website? [Your 2023 Guide] - Northell - How To Start A Payday Loan Company](https://northell.design/wp-content/uploads/2022/01/How-to-Make-a-Payday-Loan-Website_-Nine-Main-Steps.png)