Encountering the frustrating "Insufficient Slippage" error during a cryptocurrency transaction can halt your progress and even cost you money in failed transaction fees. Understanding and adjusting your slippage tolerance is a crucial skill for navigating decentralized exchanges (DEXs) and optimizing your trades.

Understanding Slippage in Practice

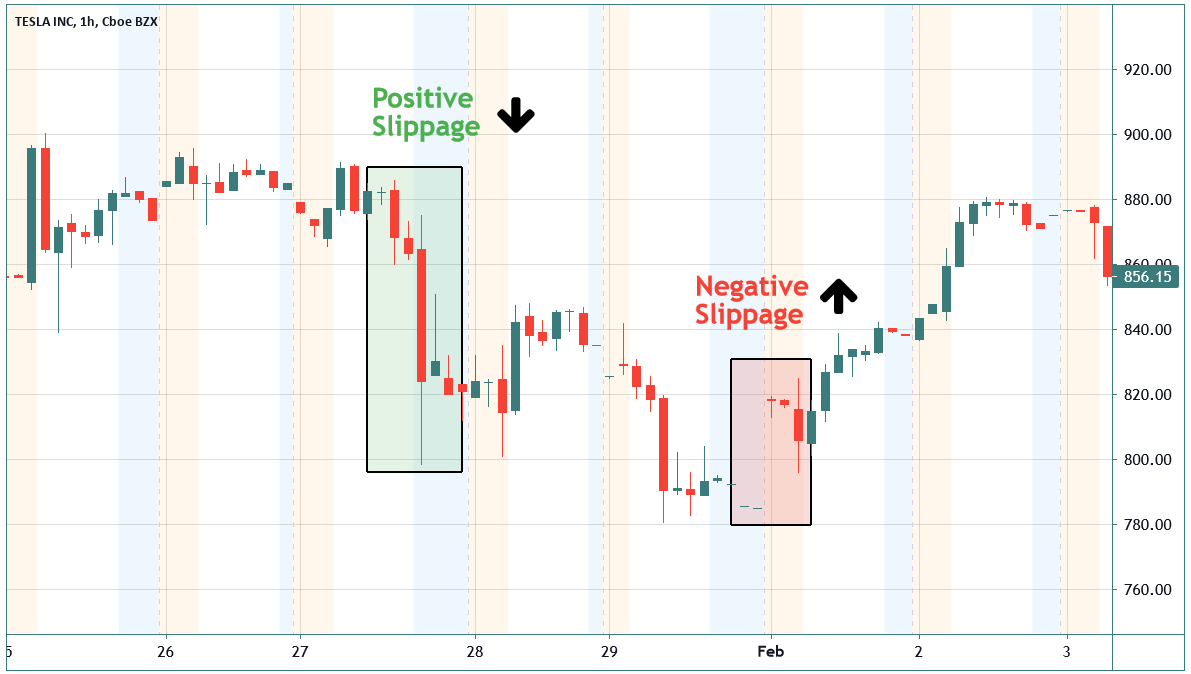

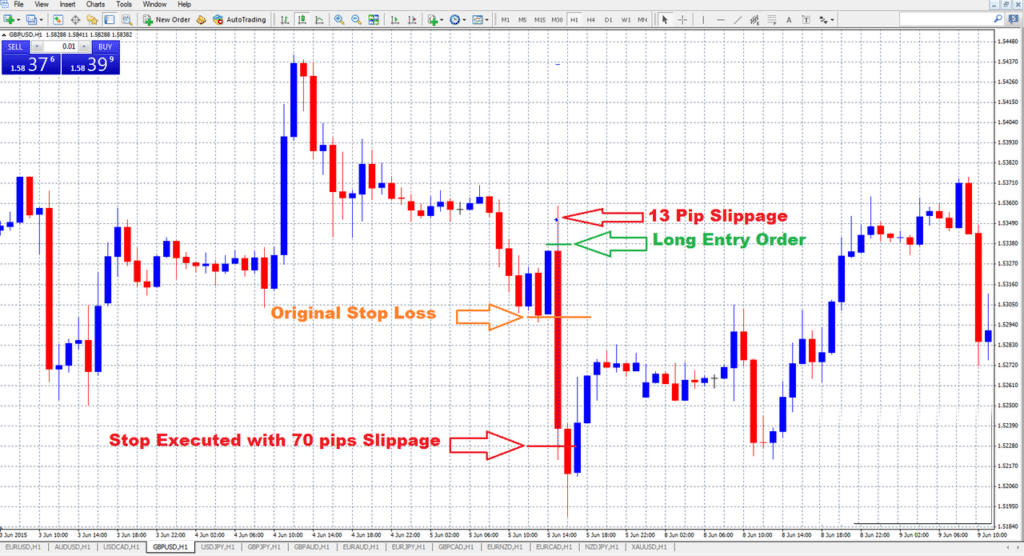

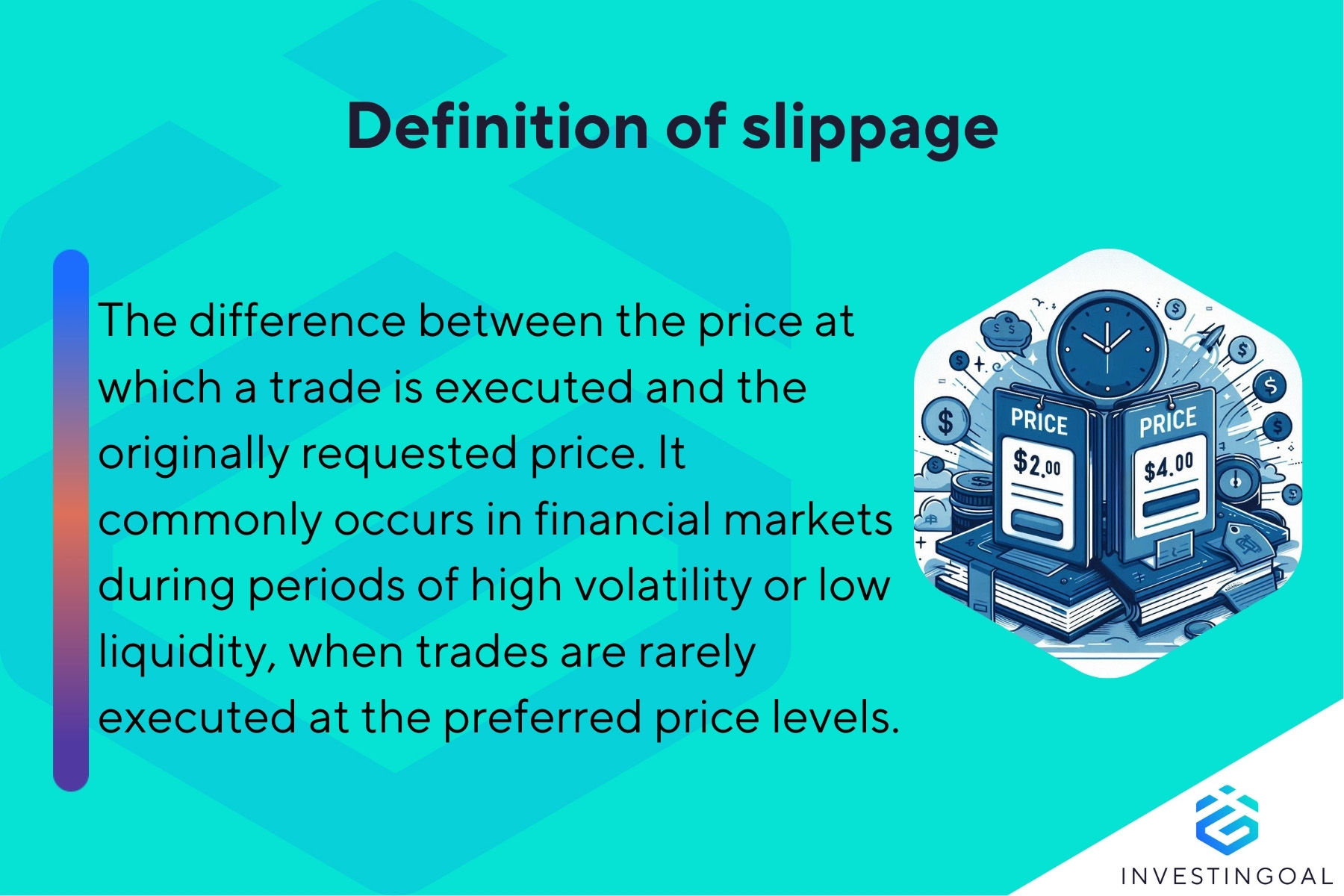

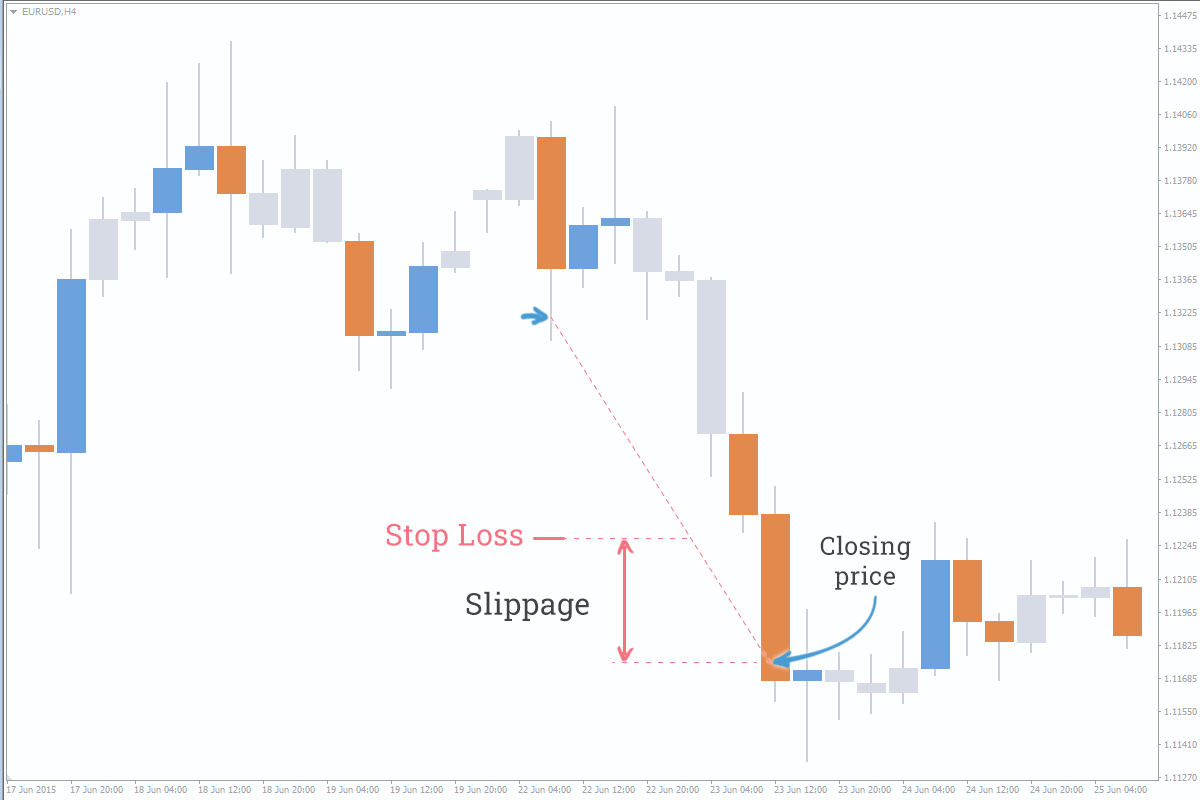

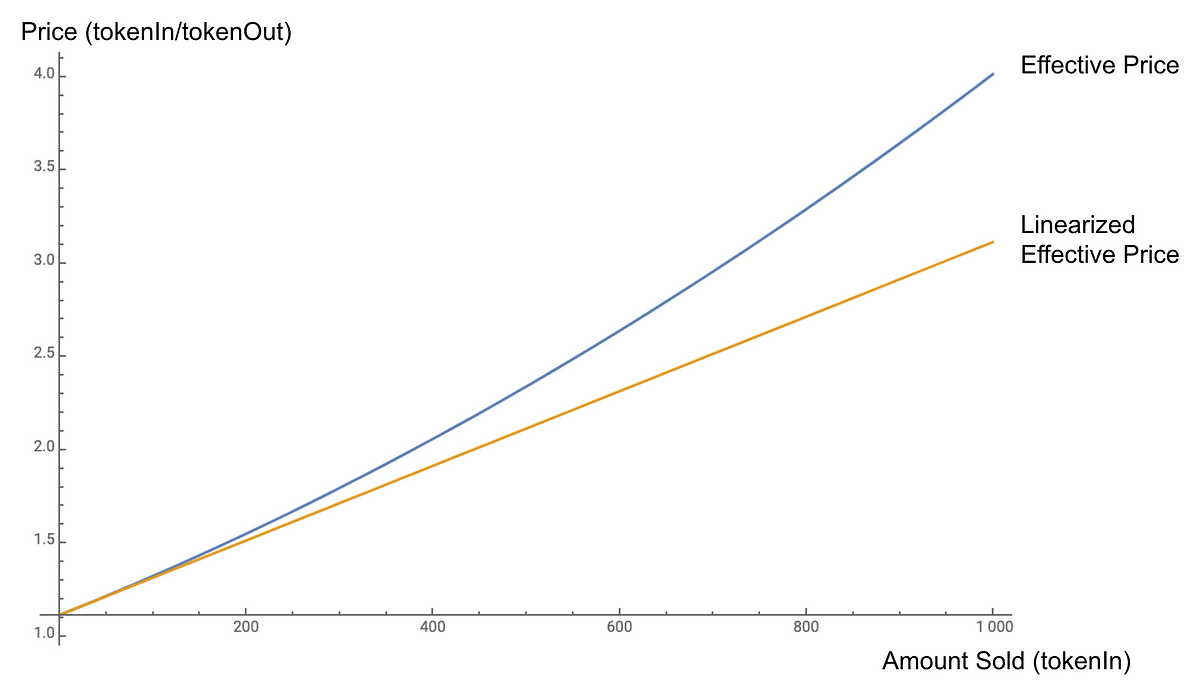

Slippage represents the difference between the expected price of a trade and the actual price at which the trade executes. This occurs due to the dynamic nature of liquidity pools and the time it takes for your transaction to be processed on the blockchain. During periods of high volatility or low liquidity, the price can shift between the moment you submit your transaction and the moment it's confirmed.

When a DEX displays the “Insufficient Slippage” error, it indicates that the price has moved beyond your pre-set tolerance level, preventing the transaction from going through. The exchange is essentially protecting you from potentially unfavorable price swings.

Identifying When to Adjust Slippage

Several situations warrant increasing your slippage tolerance. The most common are:

- Trading Volatile Tokens: When dealing with cryptocurrencies known for rapid price fluctuations, a higher slippage allowance becomes essential. The faster the price moves, the more likely it is to exceed your initial tolerance.

- Low Liquidity Pairs: If you're trading tokens with low trading volume, your order can significantly impact the available liquidity, leading to more substantial price slippage.

- Large Transactions: Executing large trades naturally exerts more pressure on the liquidity pool, making slippage more pronounced. Consider splitting large orders into smaller ones.

- Peak Network Congestion: During periods of high network activity, transaction processing times increase. This delay allows for greater price fluctuations, necessitating a higher slippage setting.

- Trading newly listed coins: Newly listed coins are generally more volatile and have lower liquidity.

How to Effectively Increase Slippage

Most DEX interfaces provide a setting to adjust your slippage tolerance. The location and presentation of this setting may vary, but it’s usually found within the transaction settings or advanced options. Here’s a step-by-step guide to increasing your slippage effectively:

- Locate the Slippage Setting: Look for a gear icon, a “settings” button, or an “advanced options” link on the DEX interface.

- Understand the Default Value: Most DEXs have a default slippage tolerance, often around 0.5% or 1%. This might be sufficient for stablecoins but insufficient for riskier assets.

- Incrementally Increase Slippage: Start by increasing the slippage tolerance in small increments (e.g., from 1% to 2%, then to 3%). Avoid immediately jumping to a very high number.

- Monitor the Estimated Output: Many DEX interfaces display an estimated output amount for your transaction. Observe how this amount changes as you adjust the slippage. Be mindful that a higher slippage allows for a greater potential price deviation, which can reduce the quantity of tokens you receive.

- Test with a Small Amount: Before executing a large trade, test your slippage setting with a smaller amount of the token. This helps you confirm whether your chosen setting allows the transaction to complete without excessive slippage.

- Consider Gas Fees: Increasing slippage doesn’t directly affect gas fees, but failed transactions do result in wasted gas fees. Setting adequate slippage prevents repeated failed transactions.

Examples of Slippage Adjustments

Let's consider a few hypothetical scenarios:

Scenario 1: Trading a Stablecoin for ETH during low network congestion.

You're swapping USDT for ETH. The network isn't particularly busy, and the USDT/ETH pair has decent liquidity. A slippage of 0.5% might be sufficient.

Scenario 2: Trading a newly listed meme coin for ETH during high network congestion.

You're trying to buy a newly listed meme coin during a spike in network activity. The coin is highly volatile, and the liquidity is low. You may need to increase the slippage to 5% or even higher, but closely monitor the estimated output.

Scenario 3: Executing a large order of a mid-cap altcoin.

You’re swapping a significant amount of a mid-cap altcoin for ETH. The price impacts are already noticeable due to the size of your trade. In this case, a 2-3% slippage may be required.

Risks of High Slippage

While a higher slippage tolerance increases the likelihood of a successful transaction, it also introduces risks. Primarily, you risk receiving fewer tokens than initially anticipated. This is often referred to as getting "slippage front-run" or being "slippage exploited". If the price moves unfavorably within your tolerance range, the DEX will still execute the transaction at the new, less advantageous price. Never set it higher than what you're comfortable with losing in a worst-case scenario.

Always prioritize careful consideration of your risk tolerance and the potential for price slippage.

Alternatives to Increasing Slippage

Besides increasing slippage, other strategies can help mitigate the "Insufficient Slippage" error:

- Reduce Transaction Size: Splitting large orders into smaller ones reduces the impact on the liquidity pool, lessening the potential for slippage.

- Trade During Low Volatility: Execute your trades when the market is less volatile, typically during off-peak hours.

- Use Limit Orders (if available): Some DEXs offer limit order functionality, which allows you to specify the maximum price you're willing to pay for a token. If the price exceeds your limit, the order won't execute.

- Consider a Centralized Exchange (CEX): CEXs generally offer better liquidity and lower slippage compared to DEXs, especially for popular trading pairs. However, they also require KYC (Know Your Customer) verification and involve custodial risks.

Slippage Adjustment Checklist

Before adjusting your slippage tolerance, consider the following:

- Token Volatility: Is the token prone to rapid price swings?

- Liquidity: Is the liquidity pool deep enough to handle your trade size?

- Network Congestion: Is the network experiencing high traffic?

- Estimated Output: Closely monitor the estimated output amount as you adjust the slippage.

- Trade Size: Can you reduce the transaction size to minimize slippage?

- Risk Tolerance: What is the maximum price deviation you're willing to accept?

By understanding the dynamics of slippage and carefully applying these strategies, you can navigate DEXs more effectively and avoid the frustration of failed transactions.