Hey there! So, we're chatting about interest on investments today, right? It sounds kinda dry, I know. Like something your accountant drones on about. But trust me, it's actually fascinating. Okay, maybe not "fascinating," but definitely important. And we can make it fun! Promise! Think of it as free money! Who doesn't like free money?

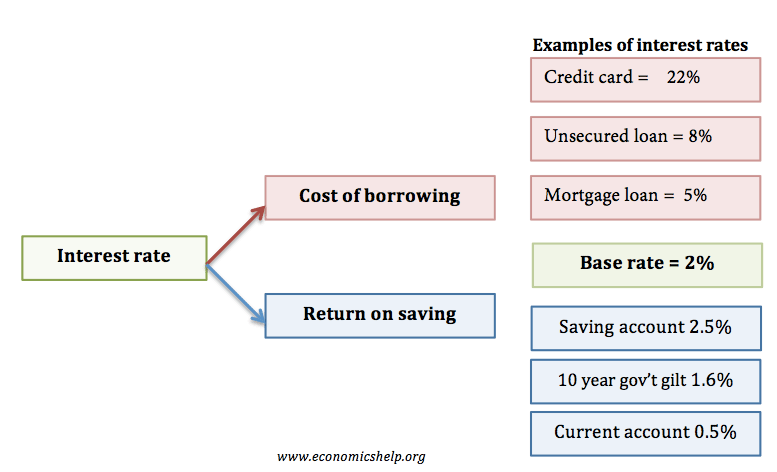

Basically, interest is what you get paid for letting someone else (a bank, a company, even the government) use your money. You lend it to them, and they give you a little somethin' somethin' in return. It's like renting out your money! Cool, huh?

The Nitty-Gritty: What Is Interest, Really?

Imagine you've got a hundred bucks burning a hole in your pocket. You *could* blow it on that limited-edition Funko Pop (no judgement!), but you decide to be responsible (good for you!). You deposit it in a savings account. The bank is all like, "Thanks! We'll give you, say, 2% interest per year for letting us hold onto it."

That 2%? That's your interest rate. It's the price they're paying to borrow your cash. So, after a year, you'll have your original $100 plus $2 in interest. Boom! $102. Not exactly a fortune, but hey, it's a start! And it was practically effortless! Did you even break a sweat?

Simple vs. Compound Interest: The Plot Thickens!

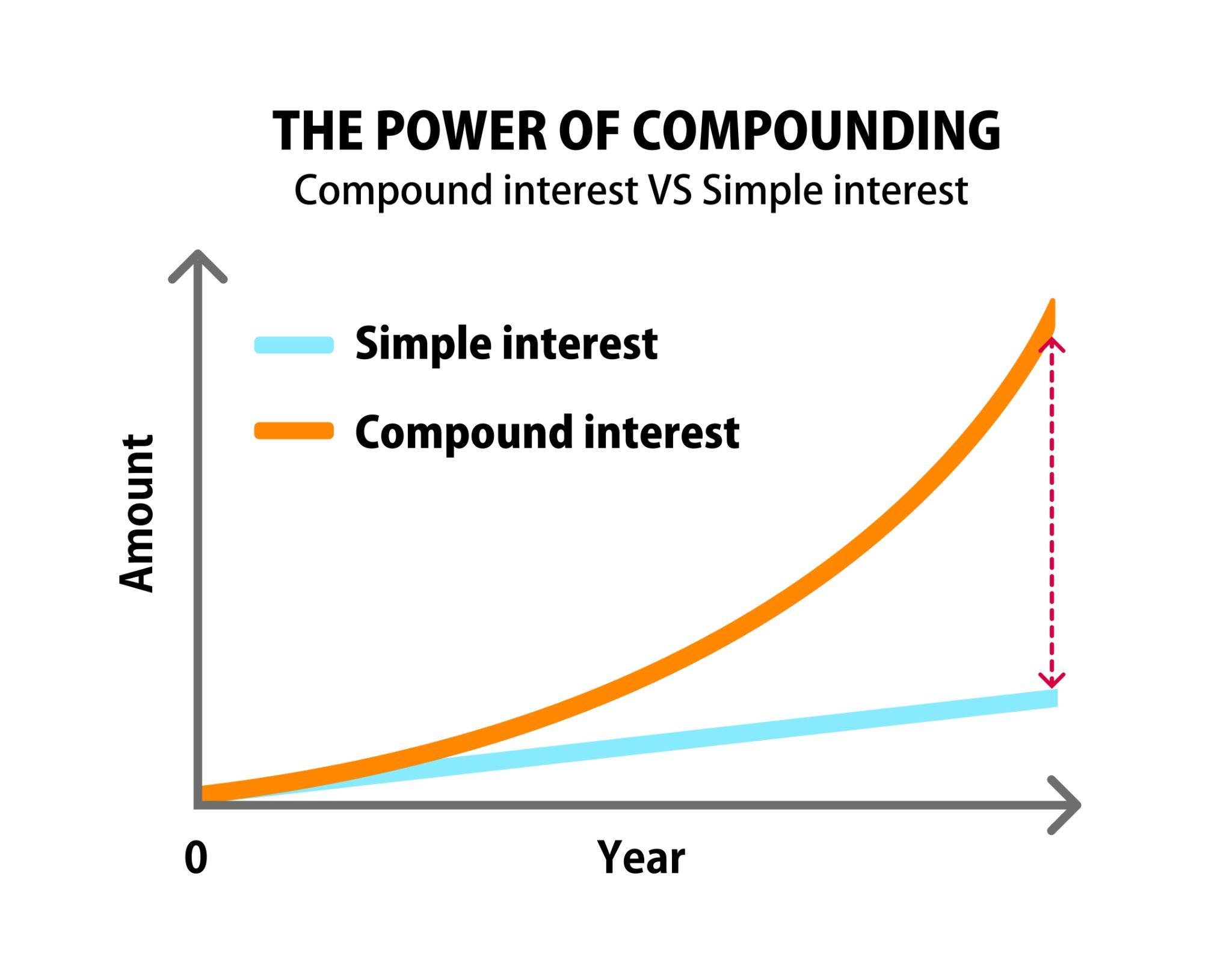

Now, here's where things get interesting. There are two main types of interest: simple and compound. Simple interest is... well, simple. It's calculated only on the principal, which is the original amount you invested.

Using our previous example, with simple interest, you'd earn $2 every year on your $100, no matter what. Year after year, just two bucks. Predictable, reliable, but not exactly setting the world on fire, is it?

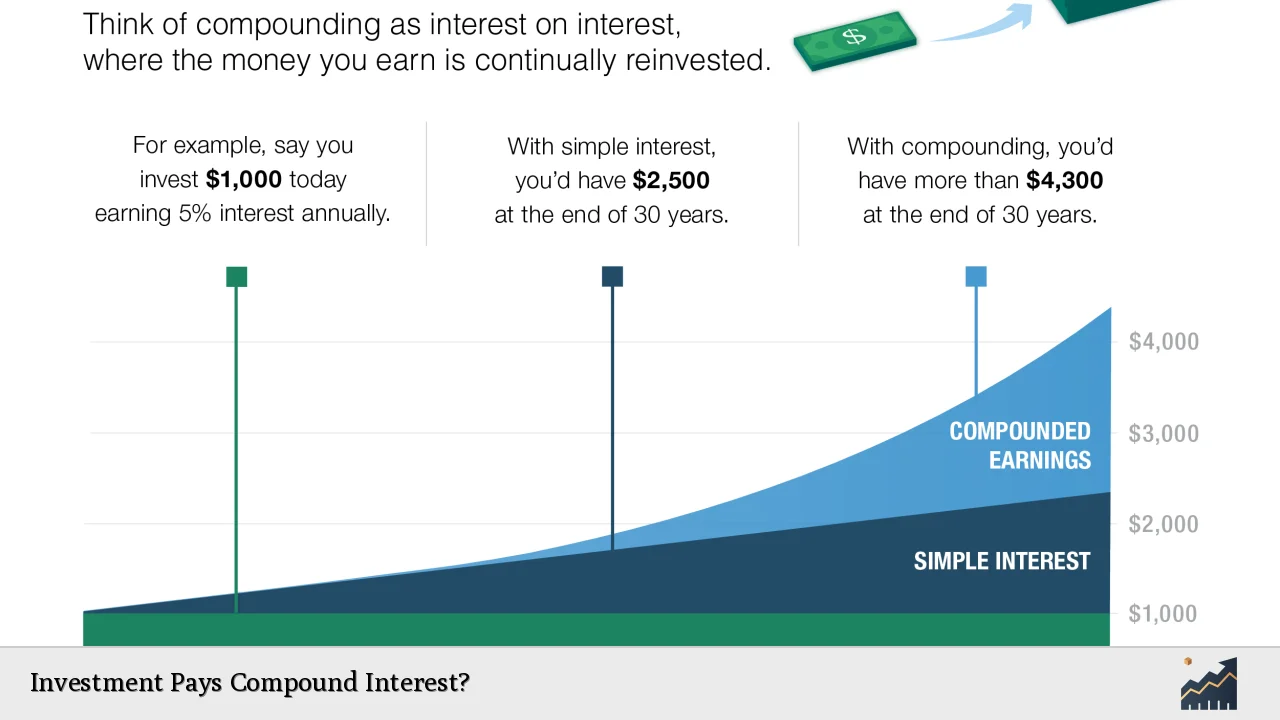

But compound interest? Ah, that's the magic. That's the secret sauce. That's where things get really exciting (okay, *relatively* exciting). Because compound interest isn't just calculated on the principal; it's calculated on the principal plus any accumulated interest. Get it? It's interest *on* interest! It's a snowball effect of money-making goodness!

So, in our example, after the first year, you have $102. In the second year, you don't just earn 2% on $100; you earn 2% on $102! That means you get $2.04 in interest. Now you have $104.04. See how it's growing faster? It might not seem like much at first, but over time, that compounding effect can be HUGE. Like, retire-early huge. Maybe. Probably not with just $100, but you get the idea!

Where Can You Earn Interest? (Besides Your Savings Account)

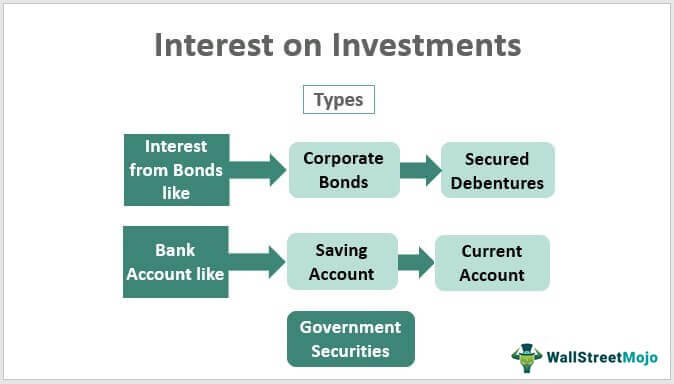

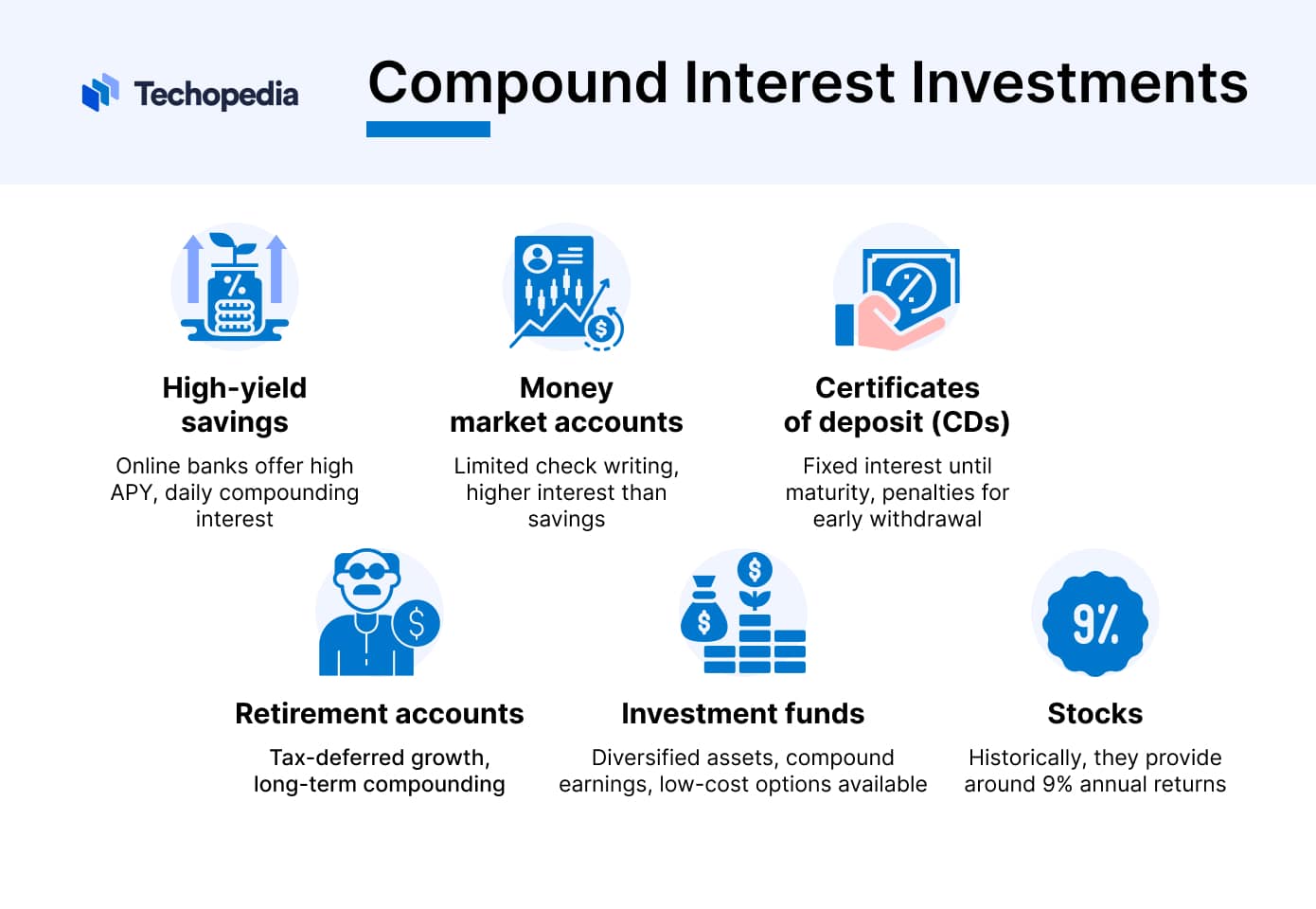

Okay, so savings accounts are one option, but they're not the *only* game in town. There are tons of other ways to earn interest on your investments. Let's take a quick look:

- Certificates of Deposit (CDs): Think of these as time-locked savings accounts. You agree to keep your money deposited for a specific period (like six months, a year, or even five years), and in return, you get a slightly higher interest rate than a regular savings account. The catch? You usually can't touch your money until the CD matures without paying a penalty. Are you patient enough?

- Bonds: When you buy a bond, you're basically lending money to a company or the government. They promise to pay you back with interest over a set period. Bonds are generally considered less risky than stocks, but they also tend to offer lower returns. Safe and steady, or risk it for the biscuit? That's the question!

- Money Market Accounts: These are kind of like a hybrid between a savings account and a checking account. They usually offer higher interest rates than regular savings accounts, but they may also have minimum balance requirements.

- High-Yield Savings Accounts: These are just savings accounts that offer, well, *higher* yields! Often found online, they can be a great way to boost your returns without taking on a lot of risk. Always shop around to find the best rates!

Factors Affecting Interest Rates: Why Does It Go Up and Down?

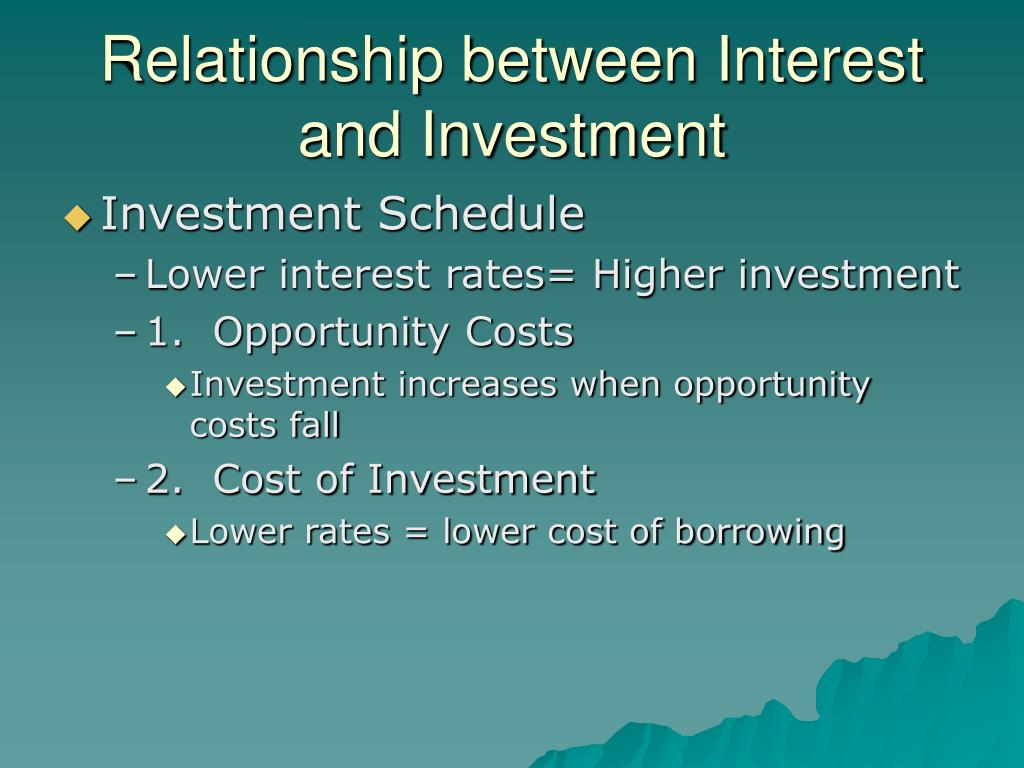

So, why does the interest rate on your savings account sometimes feel like it's doing the limbo? It's all about supply and demand, my friend. And a healthy dose of economic wizardry (or, you know, government intervention).

Here are a few key factors that can influence interest rates:

- The Federal Reserve (The Fed): This is the central bank of the United States. They have a huge influence on interest rates because they control the federal funds rate, which is the rate at which banks lend money to each other overnight. When the Fed raises the federal funds rate, interest rates across the board tend to rise as well. The Fed giveth, and the Fed taketh away!

- Inflation: When prices for goods and services rise (inflation), the Fed often raises interest rates to try to cool down the economy. Higher interest rates make it more expensive to borrow money, which can help slow down spending and bring inflation under control. Basically, they're trying to pump the brakes on the economy!

- The Economy: A strong economy usually leads to higher interest rates, while a weak economy often leads to lower interest rates. When the economy is booming, businesses are more likely to borrow money to expand, which increases demand for loans and drives up interest rates. Conversely, when the economy is struggling, businesses are less likely to borrow, which decreases demand and lowers interest rates. It's all connected!

- Competition: Banks and other financial institutions compete with each other for your business. If one bank offers a higher interest rate on savings accounts, other banks may be forced to raise their rates to stay competitive. It's a battle for your bucks!

The Power of Time: Why Starting Early Matters

Okay, so we've talked about how interest works and where you can earn it. But here's the most important takeaway: the sooner you start investing, the better. Why? Because of that magical compound interest we talked about earlier! Time is your greatest ally when it comes to compounding. Think of it as the ultimate money-making superpower!

Let's say you start investing $100 a month at age 25, earning an average of 7% interest per year (which is a reasonable historical average for the stock market, but past performance is no guarantee of future results, blah blah blah). By the time you retire at age 65, you'll have over $370,000! Not bad for just $100 a month, right?

Now, let's say you wait until age 35 to start investing the same amount. By age 65, you'll only have around $160,000. That's a difference of over $210,000! All because you waited an extra ten years. Ouch! The moral of the story? Don't procrastinate! Start investing today, even if it's just a small amount. Your future self will thank you.

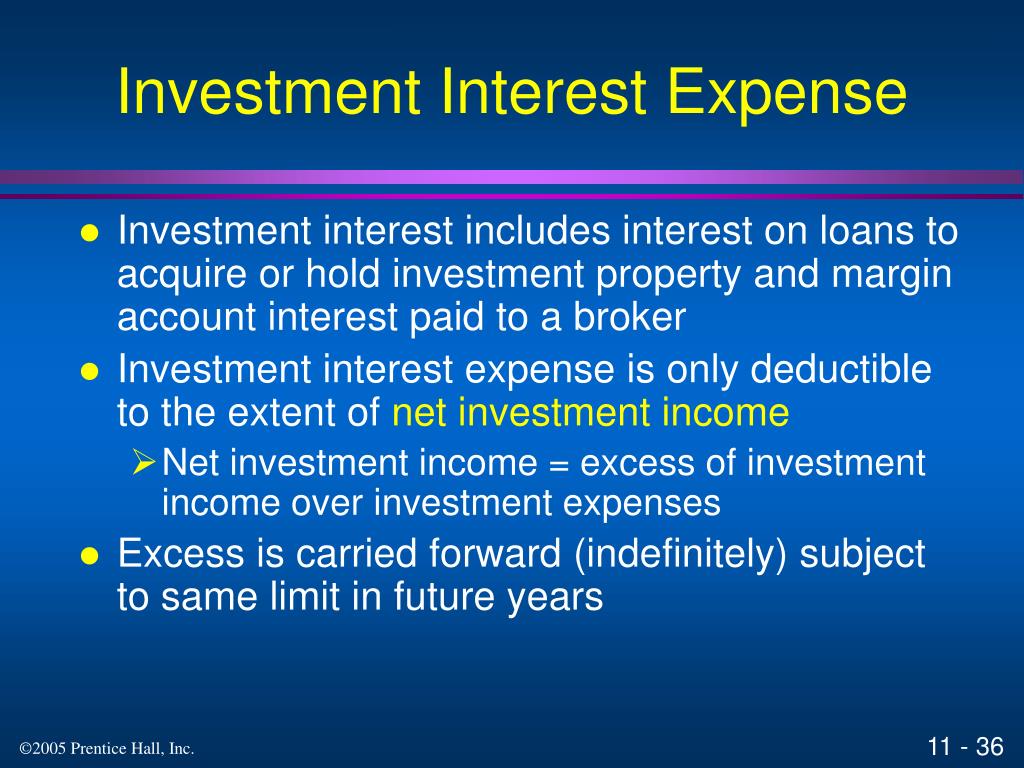

Interest and Taxes: The Inevitable Catch

Okay, so there's always a catch, right? And in the world of investing, the catch is usually taxes. Unfortunately, the interest you earn on most investments is taxable. That means you'll have to pay a portion of your earnings to Uncle Sam (or your local tax authority). Boo!

The good news is that there are some tax-advantaged accounts that can help you minimize your tax burden. For example, a 401(k) or IRA allows you to defer paying taxes on your investment earnings until you retire. And a Roth IRA allows you to withdraw your earnings tax-free in retirement (as long as you meet certain requirements). It's worth exploring these options to see if they're right for you.

Talk to a financial advisor or tax professional to get personalized advice on how to manage your taxes and make the most of your investments. They can help you navigate the complex world of tax law and find strategies to minimize your tax liability. Don't be afraid to ask for help! That's what they're there for.

In Conclusion: Interest Is Your Friend!

So, there you have it! A crash course in interest on investments. It might seem a little complicated at first, but once you understand the basics, it's actually pretty straightforward. And more importantly, it's a powerful tool for building wealth and achieving your financial goals. Is it *the* most powerful? Debatable, but still pretty darn powerful.

Remember, interest is your friend. It's free money that you earn simply by letting someone else use your cash. Whether it's a savings account, a bond, or a high-yield CD, there are tons of ways to put your money to work and earn a return. And the sooner you start, the better! Because time is your greatest ally when it comes to compounding.

So, go forth and invest! And don't forget to have a little fun along the way. After all, life's too short to be boring with your money. Just maybe skip that limited-edition Funko Pop. Maybe.

Disclaimer: I am not a financial advisor, and this is not financial advice. Always do your own research and consult with a qualified professional before making any investment decisions. Seriously!

.jpg)