Investing activities are a crucial element in understanding a company's financial health and future prospects. They represent the acquisition and disposal of long-term assets and investments that a company undertakes to generate future income. While it's important to know what falls under investing activities, it's equally important to understand what does not.

Understanding Investing Activities

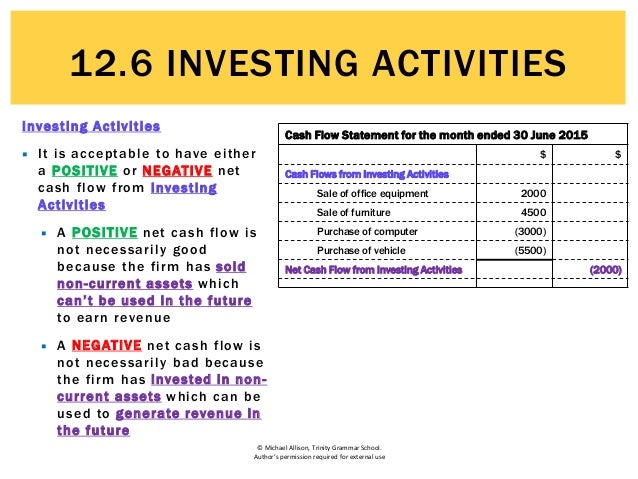

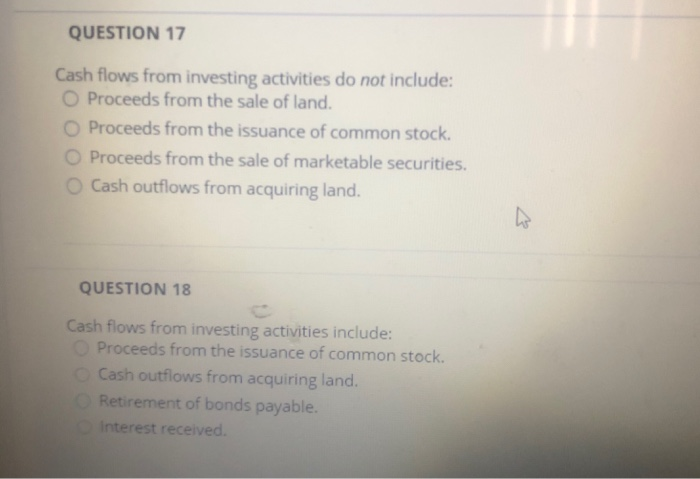

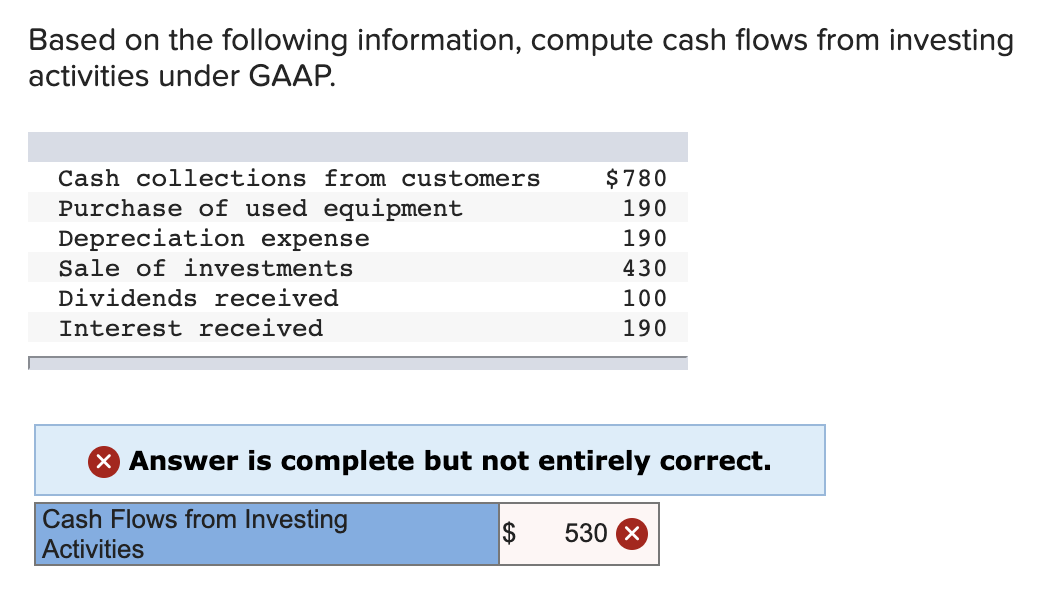

Before diving into what investing activities don't include, let's define what they do involve. Investing activities are generally those related to the purchase and sale of:

- Property, Plant, and Equipment (PP&E) – like land, buildings, machinery, and equipment.

- Long-term investments in securities – like stocks and bonds of other companies.

- Loans made to other entities.

- Other long-term assets.

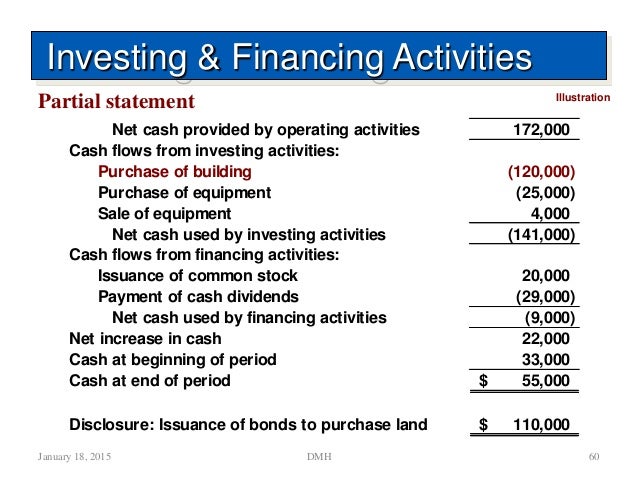

The Statement of Cash Flows segregates these activities and reports the total cash inflow or outflow from investing activities during a specific period. This provides insight into how a company is using its resources to grow and maintain its business.

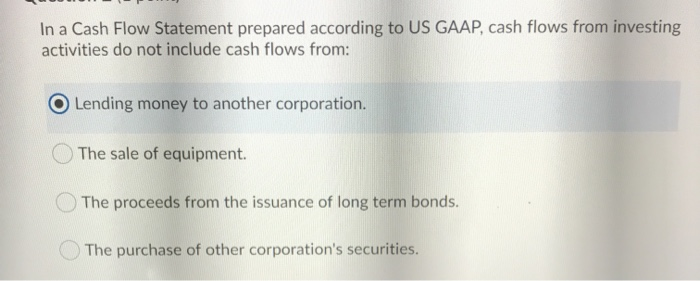

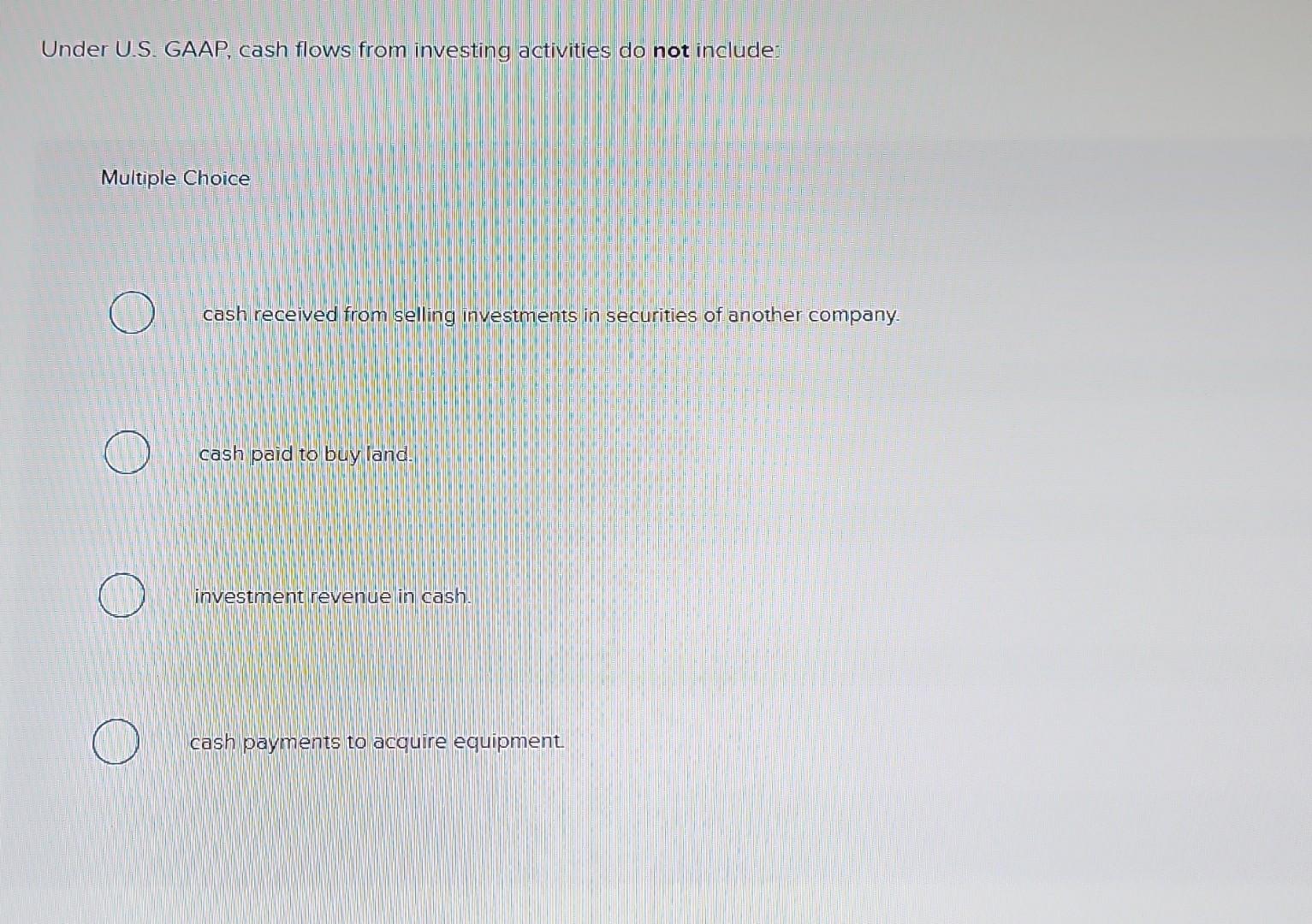

What Investing Activities Do Not Include

The following activities are not considered investing activities and are classified under different categories on the Statement of Cash Flows:

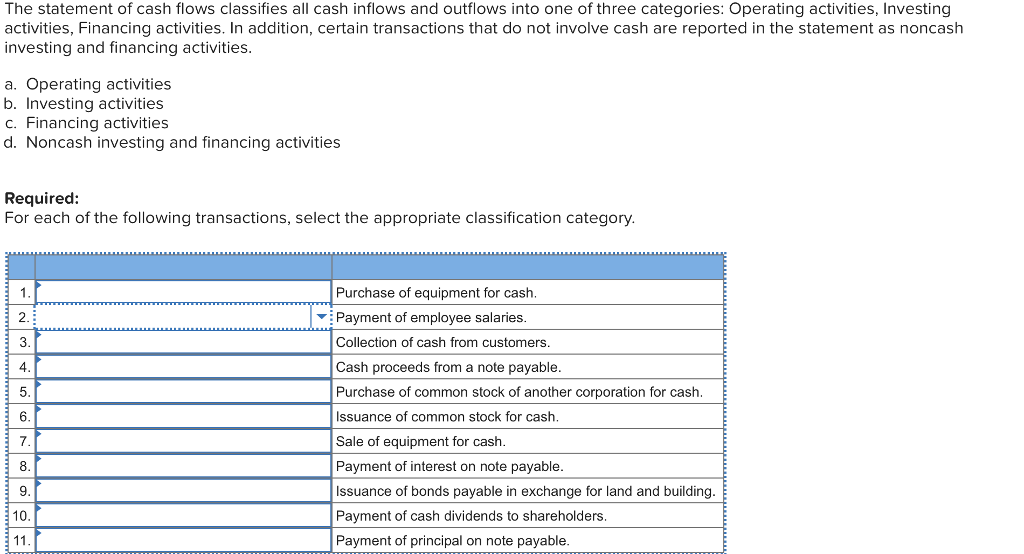

1. Operating Activities

Operating activities are the primary revenue-generating activities of a business. They are the transactions and events that constitute the day-to-day running of the company. They involve producing and selling goods or services.

Examples of activities that fall under operating activities and are not included in investing activities:

- Cash received from sales of goods or services: This is the core of a business's operations. The revenue generated from selling its primary product or service is categorized as an operating inflow. For example, cash collected by a retail store from selling clothes or by a software company from selling software licenses.

- Cash paid to suppliers for inventory: The cost of raw materials or goods purchased for resale are operating outflows. This covers the cash spent to acquire the inventory that a company sells to its customers. For example, a bakery purchasing flour and sugar, or an electronics store buying televisions.

- Cash paid to employees for wages and salaries: Salaries and wages paid to employees are also classified as operating activities. This is because employee compensation is a necessary expense for running the business.

- Cash paid for operating expenses (rent, utilities, marketing): These are expenses incurred in the day-to-day operations of the business. Examples include rent for office space, electricity bills, and advertising costs.

- Cash paid for income taxes: Payments related to income tax are typically classified as operating activities.

Why are these activities not investing activities? These activities are directly related to the core operations and revenue generation. Investing activities, on the other hand, focus on long-term investments and asset acquisitions.

2. Financing Activities

Financing activities involve how a company funds its operations and capital structure. These activities relate to obtaining resources from owners (equity) and creditors (debt), as well as repaying those resources.

Examples of activities that fall under financing activities and are not included in investing activities:

- Cash received from issuing stock: When a company sells shares of its stock to investors, the cash received is classified as a financing inflow. This represents an influx of capital from owners.

- Cash paid to repurchase stock (treasury stock): If a company buys back its own shares from the market, this is a financing outflow. This decreases the number of outstanding shares.

- Cash received from borrowing money (loans, bonds): Obtaining loans or issuing bonds to raise capital are financing activities. The company receives cash in exchange for a promise to repay the debt in the future.

- Cash paid to repay debt (principal payments): When a company repays the principal amount of a loan, this is a financing outflow.

- Cash paid for dividends: Dividends paid to shareholders represent a return of capital to the owners and are classified as a financing outflow.

Why are these activities not investing activities? Financing activities deal with the funding of the company, whereas investing activities deal with the deployment of those funds into long-term assets.

3. Changes in Current Assets and Liabilities Directly Related to Operations

Fluctuations in current assets (like accounts receivable and inventory) and current liabilities (like accounts payable) that are directly linked to a company's operating cycle are typically handled within the operating activities section of the Statement of Cash Flows using the indirect method.

Examples:

- Increase in accounts receivable: This means the company has recognized more revenue but hasn't yet received the cash. This is an adjustment to net income within the operating activities section using the indirect method. It’s not an investing activity, even though it might seem like a form of lending. It directly relates to the sales process.

- Decrease in inventory: A decrease in inventory indicates the company has sold more goods than it purchased. This is also an adjustment to net income within operating activities.

- Increase in accounts payable: An increase signifies the company purchased more goods or services on credit, but hasn’t paid for them yet. This, again, is an adjustment to net income in the operating activities section.

Why are these not investing activities? These fluctuations are inherent to the company's operating cycle and are directly tied to its sales and purchasing activities.

4. Stock Splits and Stock Dividends

Stock splits and stock dividends involve distributing additional shares to existing shareholders. These activities don't involve an actual inflow or outflow of cash and therefore are not reported in the Statement of Cash Flows, in any of the three sections (operating, investing, or financing).

Why are these not investing activities? Stock splits and stock dividends are purely accounting adjustments that change the number of outstanding shares and the par value per share but don't affect the company's cash position.

5. Depreciation and Amortization

Depreciation (for tangible assets) and amortization (for intangible assets) are non-cash expenses that reflect the decline in value of long-term assets over time. While they impact net income, they do not involve an actual cash outflow in the current period. They are adjustments to net income when calculating cash flow from operating activities (indirect method).

Why are these not investing activities? Depreciation and amortization are accounting methods for allocating the cost of assets over their useful lives. The actual cash outflow occurred when the asset was initially purchased, which *is* classified as an investing activity.

Practical Advice and Insights

Understanding the difference between investing activities and other activities can be useful in your everyday life and in making informed financial decisions:

- Personal Finance: When analyzing your own finances, think of your investments (stocks, bonds, real estate) as your "investing activities." Day-to-day expenses (groceries, rent, utilities) are your "operating activities." Taking out a mortgage or repaying student loans are your "financing activities." This framework helps you understand where your money is going and how you're building wealth.

- Company Analysis: If you're considering investing in a company, carefully review its Statement of Cash Flows. A company with strong cash flow from investing activities (e.g., selling assets for a profit) might seem appealing, but you need to understand why they're selling those assets. Are they downsizing or strategically reallocating resources? Conversely, a company heavily investing in new equipment might signal future growth.

- Business Management: If you run a business, tracking your investing activities helps you make informed decisions about capital expenditures. It allows you to monitor the returns on your investments and assess whether your resources are being used effectively.

- Career Development: Understanding these concepts is essential for various careers in finance, accounting, and business analysis. It forms the foundation for more advanced financial analysis techniques.

In conclusion, while investing activities play a vital role in a company's financial health, it's crucial to recognize what falls outside this category. Operating activities, financing activities, and certain accounting adjustments are distinct and provide a more complete picture of a company's overall financial performance. By understanding these distinctions, you can make more informed financial decisions, whether it's managing your personal finances or analyzing a company for investment.