Alright, let's talk investments! Specifically, let's dive into 1847 Holdings. Now, I know what you might be thinking: "Ugh, finance? Sounds boring." But trust me, understanding where to put your money is like leveling up in a real-life video game. It’s about making your money work *for you* and that, my friend, is pretty darn exciting. (And potentially lead to early retirement on a beach somewhere – just sayin'.)

So, the big question: Is 1847 Holdings a good investment? Well, that's not a simple yes or no answer. (Is anything in life *really* that simple? Probably not.) We need to dig a little deeper, look under the hood, and see what makes this company tick. Think of it like choosing the right ingredients for a delicious recipe. You wouldn't just throw everything in the pot, would you? You'd want to know what each ingredient brings to the table.

What Exactly *Is* 1847 Holdings?

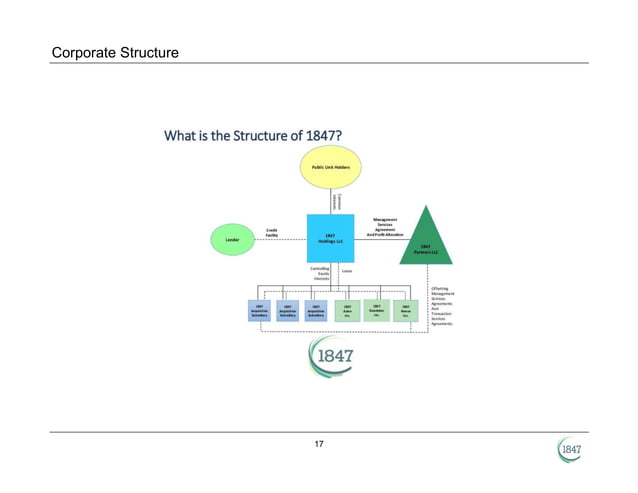

First things first, what does 1847 Holdings even do? They’re a publicly traded diversified acquisition holding company. Okay, that's a mouthful. Basically, they buy and manage a bunch of different businesses across various industries. Think of them as an investment company that plays the role of a holding company that provides operational and financial support to its subsidiaries. They focus on acquiring undervalued, profitable businesses with a clear path to improvement. This diversification can be a good thing, because if one sector hits a rough patch, their other investments might help cushion the blow. It's like having multiple streams of income – smart move, right?

They're not a one-trick pony, dabbling in everything from niche manufacturing to some consumer products. In layman’s terms, they are not putting all their eggs in one basket!

What To Consider Before Investing

Okay, so you're intrigued. That's great! But before you rush off and throw your hard-earned cash at 1847 Holdings (or any investment, for that matter), let’s talk about some key things to consider. Remember, investing always carries risk, and it's crucial to do your homework.

- Financial Performance: This is a big one. How has 1847 Holdings been performing financially? Look at their revenue, profits, debt levels, and cash flow. Are they consistently growing? Are they managing their debt responsibly? You can usually find this information in their quarterly and annual reports, which are publicly available. Don’t be afraid to dive into those reports, it's like reading the financial tea leaves!

- Industry Trends: What's happening in the industries where 1847 Holdings' subsidiaries operate? Are those industries growing or declining? Are there any major disruptions on the horizon? For example, if they have a significant investment in a brick-and-mortar retail business, you'd want to know how that business is adapting to the rise of e-commerce.

- Management Team: Who's running the show? A strong and experienced management team can make all the difference. Look into their backgrounds, their track records, and their overall strategy for the company. Do they have a clear vision for the future? Do they inspire confidence?

- Risk Tolerance: This is all about you. Are you a risk-averse investor, or are you comfortable with a bit more volatility? Generally, smaller companies with higher growth potential may carry higher risk. So, you must weigh your comfort level.

- Investment Goals: What are you hoping to achieve with this investment? Are you looking for long-term growth, or are you hoping to make a quick buck? Your investment goals will influence your investment decisions.

- Diversification of Your Portfolio: Don't put all your eggs in one basket! I know I said it earlier, but it's important enough to say again. Diversifying your portfolio across different asset classes and industries can help reduce your overall risk. 1847 Holding is not a portfolio on its own.

- Company News: Keep an eye out for any news or announcements related to 1847 Holdings. Any major events may impact the company’s stock price.

- Economic Conditions: Broader economic trends, such as interest rates and inflation, can also impact investment performance. What is the current outlook? How might this impact them?

Important Note: Past performance isn't always indicative of future results, but it can give you a good idea of the company's track record.

The Potential Upsides

Okay, we've covered the basics. Now, let's talk about some potential upsides of investing in 1847 Holdings.

- Diversification: As we've already discussed, 1847 Holdings' diversified portfolio can offer some protection against downturns in specific industries.

- Growth Potential: They focus on acquiring undervalued businesses and improving their operations. If they're successful, this could lead to significant growth in the company's overall value. They are trying to acquire businesses with a hidden upside.

- Operational Expertise: 1847 Holdings actively manages its portfolio companies, providing them with operational and financial support. This hands-on approach can help them improve performance and unlock hidden value.

- Potential for Value Creation: By acquiring, improving, and potentially selling businesses, 1847 Holdings has the opportunity to create value for its shareholders. Imagine getting in on the ground floor before the business really booms!

The Potential Downsides

Now, for the not-so-fun part: the potential downsides. Remember, every investment comes with risks, and it's important to be aware of them.

- Small-Cap Risk: 1847 Holdings is a smaller company, which means it can be more volatile than larger, more established companies. Small-cap companies can experience more dramatic price swings.

- Acquisition Risk: There's always a risk that an acquisition won't work out as planned. The acquired business might not integrate well, or the company might overpay for it. Any of these scenarios can negatively impact 1847 Holdings' performance.

- Management Execution: Even with a strong management team, there's always a risk that they won't be able to execute their strategy effectively. Maybe they can't turn the companies around as planned, or maybe they fail to identify and acquire promising new businesses.

- Economic Sensitivity: Some of 1847 Holdings' businesses may be sensitive to economic conditions. A recession, for example, could negatively impact their revenue and profits.

- Liquidity Risk: Some investors may find that 1847 holdings may not have the same liquidity that some larger companies may exhibit.

Doing Your Own Research: Don't Just Take My Word For It!

Alright, I've given you a broad overview of 1847 Holdings. But don't just take my word for it! (I'm just a friendly internet guide, after all.) It's crucial to do your own thorough research before making any investment decisions.

Here are some resources you can use:

- 1847 Holdings' Investor Relations Website: This is your primary source of information about the company. You'll find their financial reports, press releases, and investor presentations.

- Financial News Websites: Keep up with the latest news and analysis about 1847 Holdings on reputable financial news websites like Yahoo Finance, Bloomberg, and MarketWatch.

- Financial Analysts' Reports: Some brokerage firms and research companies provide reports on 1847 Holdings. These reports can offer valuable insights, but remember that they may have a bias.

- Talk to a Financial Advisor: If you're unsure about whether 1847 Holdings is a good investment for you, consider talking to a qualified financial advisor. They can help you assess your risk tolerance, investment goals, and overall financial situation.

- Sec Filings: Dig into the required filings from the Securities and Exchange Commission. Public companies must disclose a lot of information!

So, Is It A Good Investment? (The Verdict – Sort Of)

Okay, let's get back to the original question: Is 1847 Holdings a good investment? The truth is, I can't tell you definitively. Every investor is different, and what's right for one person may not be right for another. However, here's a framework for thinking about it:

If you're a risk-averse investor looking for stable, predictable returns, 1847 Holdings might not be the best fit for you. This company is a smaller, growth-oriented business, which comes with inherent risks.

However, if you're comfortable with a bit more risk and you're looking for the potential for higher returns, 1847 Holdings might be worth considering. Just make sure you do your homework, understand the risks, and are prepared for potential volatility. You need to be comfortable if the share price fluctuates.

Ultimately, the decision of whether or not to invest in 1847 Holdings is yours. Weigh the potential upsides against the potential downsides, consider your own risk tolerance and investment goals, and do your own research. You want to be comfortable with the investment. It is *your* money, after all!

The Fun Part: Learning More and Taking Control

Investing might seem intimidating at first, but it's actually incredibly empowering. It's about taking control of your financial future and making your money work for you. The more you learn about investing, the more confident you'll become, and the more fun you'll have! So, what are you waiting for? Go forth, do your research, and start building the financial future of your dreams! The world of finance awaits! It is not just for Wall Street types. Investing is for *everyone*!

Ready to dive deeper? Start with 1847 Holdings' investor relations website. Read their latest annual report. Listen to their earnings calls. Follow them on social media. The more you learn, the better equipped you'll be to make informed investment decisions. And who knows, maybe you'll discover the next big thing! Happy investing, and remember to always stay curious!