Alright, settle in, folks! Grab your lattes (or that questionable gas station coffee, no judgment) because we're diving into the thrilling, nail-biting world of... payday loans! Specifically, whether they're installment or revolving credit. Now, I know what you're thinking: "Thrilling? Payday loans? Are you okay?" Bear with me. It's all about perspective. Think of it as a financial escape room, except the prize is avoiding even *more* financial stress.

So, the million-dollar question (or, more accurately, the $300-dollar-until-next-paycheck question): are payday loans installment loans, or are they revolving credit? Let’s unravel this mystery, shall we?

Payday Loans: The Quick and Dirty (and Often Expensive) Version

First, let's define our contestant. A payday loan is basically a short-term, high-interest loan designed to tide you over until – you guessed it – your next payday. Think of it as that friend who promises to cover you for pizza, but charges you a "convenience fee" equivalent to a small island nation's GDP.

They are usually for smaller amounts, like a few hundred bucks, and the entire loan amount, plus those "reasonable" (read: astronomical) fees, is due in a single lump sum on your next payday. We're talking two weeks, maybe a month, tops. It's like a financial flash in the pan – quick, bright, and likely to burn you if you're not careful.

Installment Loans: The Slow and Steady (and Hopefully Less Scalding) Option

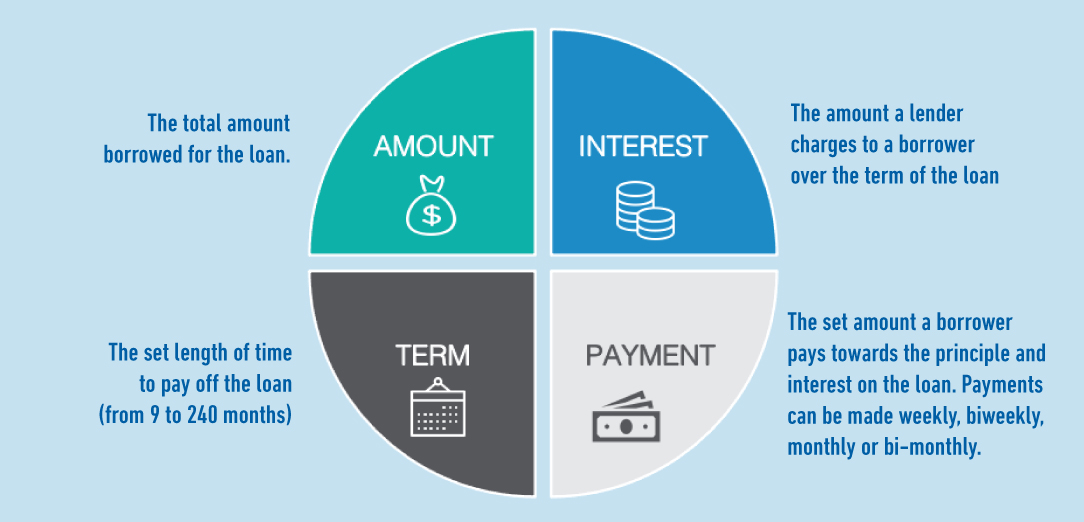

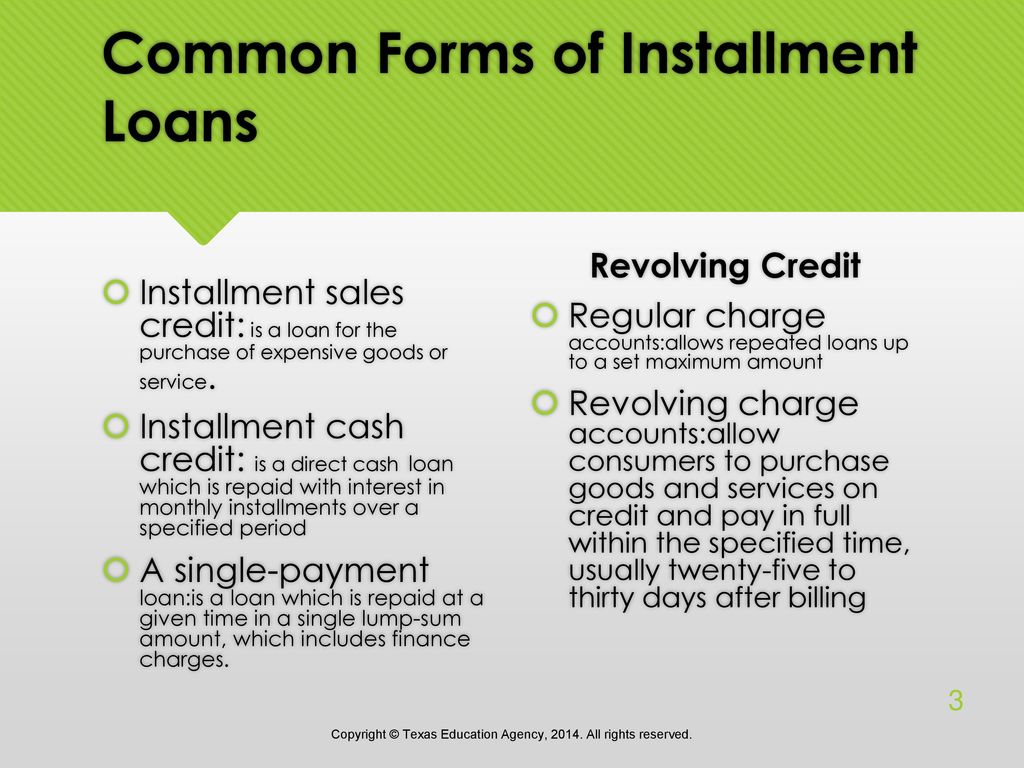

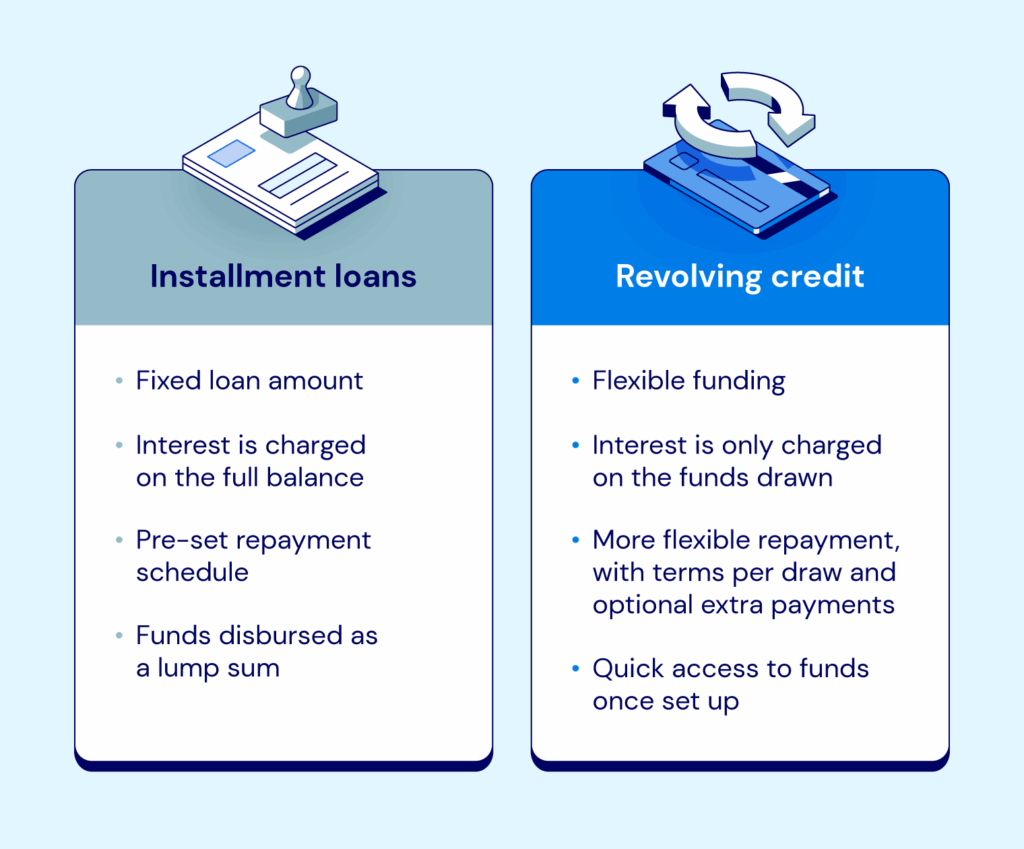

Now, let's talk installment loans. Imagine a responsible adult financing a new washing machine. That's the vibe we're going for. An installment loan is a loan you repay in fixed, regularly scheduled payments over a set period. Think car loans, mortgages, even those fancy Peloton bikes you swear you'll use every day (until Netflix calls, of course).

With each payment, you chip away at both the principal (the original loan amount) and the interest. The key here is predictability. You know exactly how much you owe each month and when the loan will be paid off. It’s like a financial marathon – grueling, but at least you know where the finish line is.

Revolving Credit: The Ever-Present (and Potentially Bottomless) Pit

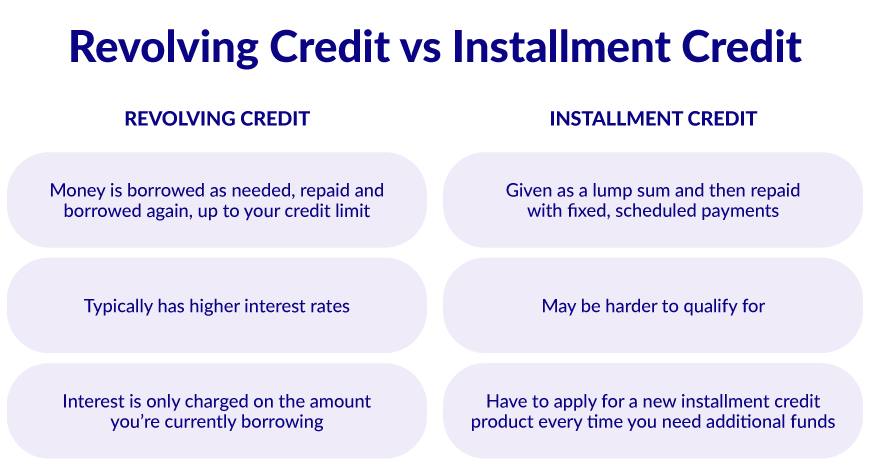

Then there's revolving credit. Ah, revolving credit, the gift that keeps on giving... debt! Think credit cards and lines of credit. You have a credit limit, and you can borrow money up to that limit, repay some, and borrow again. It's like a financial hamster wheel. You can use it, pay it down, and then immediately use it again for that impulse buy of a ceramic gnome wearing a tiny hat. No judgment… mostly.

The important thing about revolving credit is that your available credit replenishes as you make payments. So, if you have a $1,000 credit card, spend $500, and then pay back $200, you now have $700 in available credit. It’s a beautiful, and dangerous, cycle.

So, Are Payday Loans Installment or Revolving? The Grand Reveal!

Drumroll please... Payday loans are typically NOT installment loans or revolving credit. They're more like a hybrid of desperation and financial quicksand. They don't fit the mold of either of the other two types of credit. Here's why:

- Single Lump Sum Repayment: Unlike installment loans, you don't make multiple payments over time. It's all due at once. It’s the financial equivalent of ripping off a band-aid – painful and sudden.

- No Revolving Credit Availability: Once you repay a payday loan (assuming you can), the loan is done. You can't just re-borrow the money immediately unless you take out a brand-new loan. It’s a one-time shot.

- Short-Term Nature: The loan term is incredibly short, typically two weeks to a month. Installment loans and revolving credit usually have much longer repayment periods.

Think of it this way: imagine you borrowed money from your exceptionally grumpy Aunt Mildred. She expects the whole amount back, with interest (and maybe a freshly baked pie for her troubles), on a specific date. No payment plans, no revolving credit – just cold, hard cash (or a certified check, because Aunt Mildred doesn't trust technology).

Why Does It Matter? (Besides the Obvious "Avoiding Financial Ruin" Reason)

Understanding the difference between these types of loans matters for a few key reasons:

- Budgeting: Knowing how your debt is structured helps you plan your finances and avoid those uh-oh moments when you realize you can't afford to feed yourself after paying off that loan.

- Credit Score Impact: Different types of loans impact your credit score differently. Responsible use of installment loans and revolving credit can *improve* your credit score. Payday loans, on the other hand, are often associated with predatory lending and can negatively impact your credit, especially if you can’t repay them on time.

- Interest Rates: This is where things get REALLY spicy. Payday loans have notoriously high interest rates. We're talking rates that could make a loan shark blush. Installment loans and revolving credit generally have lower, more manageable interest rates, although they can still add up if you're not careful.

- Avoiding the Debt Trap: Payday loans are designed to be addictive. The high fees and short repayment periods often lead borrowers to take out another loan to cover the first one, creating a vicious cycle of debt. It’s like a financial hamster wheel… except the hamster is sobbing uncontrollably.

Alternatives to Payday Loans (Because Seriously, There Are Better Options)

Okay, so we've established that payday loans are basically the financial equivalent of eating expired gas station sushi. What are the alternatives? I hear you cry! Fear not, there are less risky (and less tummy-ache inducing) ways to manage short-term financial needs:

- Negotiate with Creditors: Talk to your bill providers and see if you can work out a payment plan or extension. You might be surprised at how willing they are to help.

- Credit Counseling: A non-profit credit counseling agency can help you create a budget, manage your debt, and negotiate with creditors.

- Personal Loans: If you need a larger amount of money, a personal loan from a bank or credit union may be a better option.

- Credit Cards: If you have a credit card, using it for a short-term expense and paying it off quickly can be a better option than a payday loan, *provided* you can pay it off promptly.

- Ask for Help: Talk to family or friends. Borrowing money from loved ones can be embarrassing, but it's often a much cheaper and safer option than a payday loan.

Ultimately, understanding the difference between payday loans, installment loans, and revolving credit is crucial for making informed financial decisions. Payday loans are a unique beast, and one that is best avoided if possible. So, next time you're tempted by the quick fix of a payday loan, remember this story, and maybe treat yourself to some *safe* sushi instead. Your wallet (and your stomach) will thank you.

Now, if you'll excuse me, I'm going to go check my credit card bill... I have a feeling that ceramic gnome may have been a mistake.

:max_bytes(150000):strip_icc()/Differences-between-revolving-credit-and-installment-credit_sketch_final-ccac21e2a4a94aeb90443ea2b92ec759.png)