Forward Funding is a financial services company that provides business funding solutions, primarily focusing on merchant cash advances (MCAs) and small business loans. Determining its legitimacy requires a thorough examination of its operational practices, customer reviews, and adherence to industry standards.

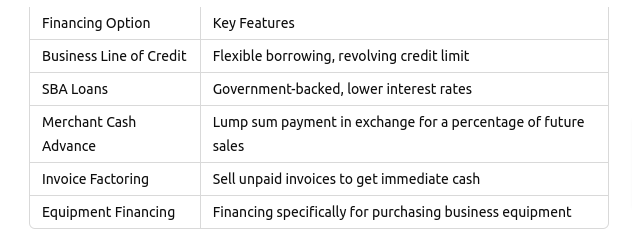

Understanding Forward Funding's Services

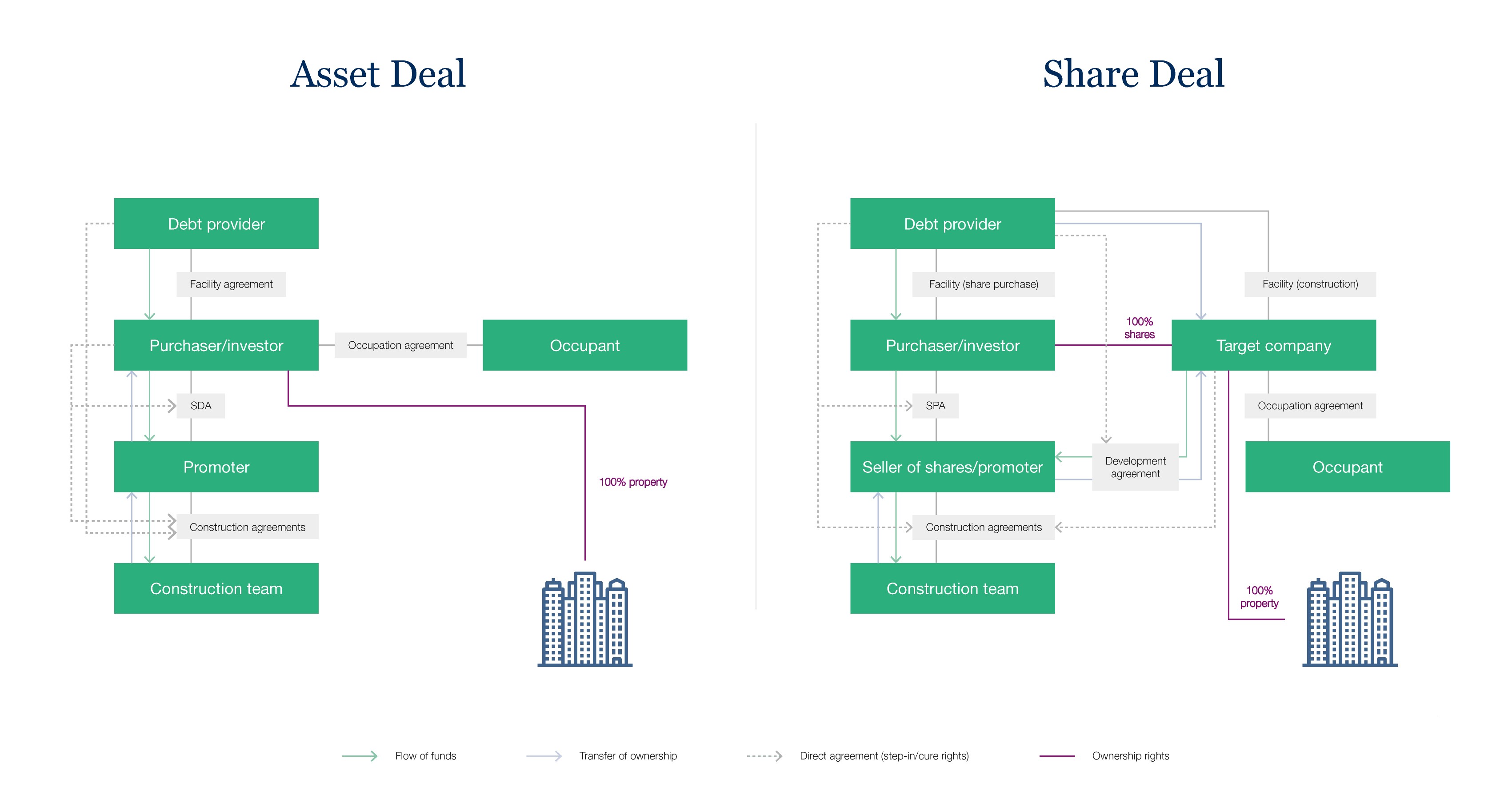

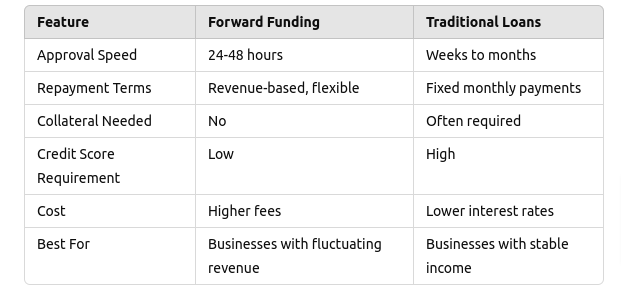

Forward Funding primarily offers revenue-based financing, often structured as merchant cash advances. MCAs are not technically loans; rather, they are purchases of a business's future receivables. This distinction is crucial because MCAs are often subject to less stringent regulations than traditional loans. Forward Funding's website details various funding options, emphasizing speed and accessibility for businesses that may not qualify for conventional bank loans.

The company claims to work with a diverse range of industries, providing capital for purposes such as inventory purchase, marketing campaigns, and general operational expenses. Forward Funding highlights its streamlined application process and quick funding times as key differentiators. However, potential clients should carefully evaluate the terms and conditions associated with these funding options.

Assessing Legitimacy: Key Factors

Transparency and Disclosure

A legitimate financial company will provide clear and transparent information about its products, fees, and repayment terms. While Forward Funding offers some information on its website, a thorough assessment necessitates reviewing customer contracts and discussing the specific terms with a company representative. Lack of transparency regarding fees or repayment structures would be a red flag.

The Annual Percentage Rate (APR) equivalent for MCAs can be significantly higher than traditional loans. Prospective clients should seek full disclosure of all costs involved and understand the total amount they will be required to repay.

Hidden fees or unclear repayment schedules are indicative of potentially predatory lending practices.

Customer Reviews and Reputation

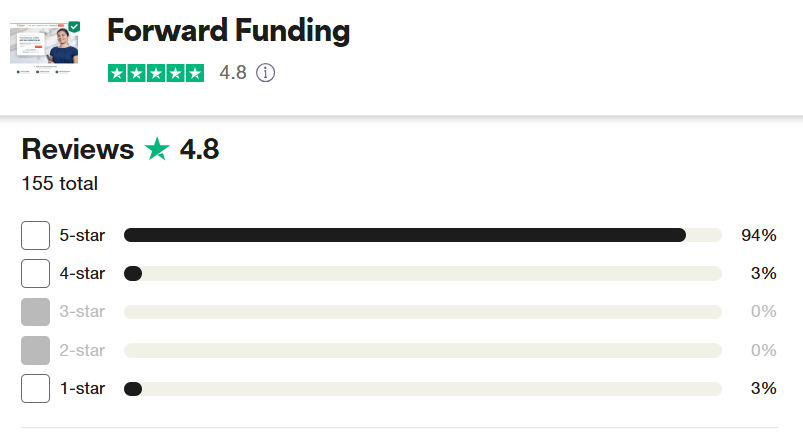

Customer reviews provide valuable insights into the experiences of other businesses that have worked with Forward Funding. Reputable review platforms such as the Better Business Bureau (BBB), Trustpilot, and Google Reviews offer a range of perspectives. A preponderance of negative reviews, particularly those citing deceptive practices, excessive fees, or poor customer service, should raise concerns.

It is important to note that online reviews can be subjective and potentially biased. However, consistent patterns of complaints across multiple platforms provide a more reliable indicator of a company's practices. A legitimate company typically demonstrates a commitment to addressing customer concerns and resolving disputes.

Regulatory Compliance

The financial services industry is subject to various regulations designed to protect consumers and businesses. While MCAs are less regulated than traditional loans, Forward Funding is still expected to adhere to general business practices and ethical standards. Failure to comply with relevant regulations can be a sign of illegitimacy. Consider checking with state-level consumer protection agencies to verify that Forward Funding is operating within legal boundaries.

Specific regulations that may apply include truth-in-lending laws (depending on the specific structure of the financing) and fair debt collection practices. A legitimate company will be knowledgeable about and compliant with these regulations.

Contractual Terms and Conditions

Carefully reviewing the contract is paramount before entering into any agreement with Forward Funding. Pay close attention to the following:

- Total repayment amount: Understand the exact amount you will be required to repay, including all fees and charges.

- Repayment schedule: Clarify the frequency and amount of each payment.

- Default terms: Know what happens if you are unable to make payments. What are the penalties, and what recourse does Forward Funding have?

- Governing law: Determine which state's laws govern the contract.

- Dispute resolution: Understand the process for resolving disputes, such as mediation or arbitration.

If the contract contains ambiguous language or terms that are difficult to understand, seek legal advice before signing. A legitimate company will be willing to explain the terms of the contract clearly and answer any questions you may have.

Alternative Funding Options

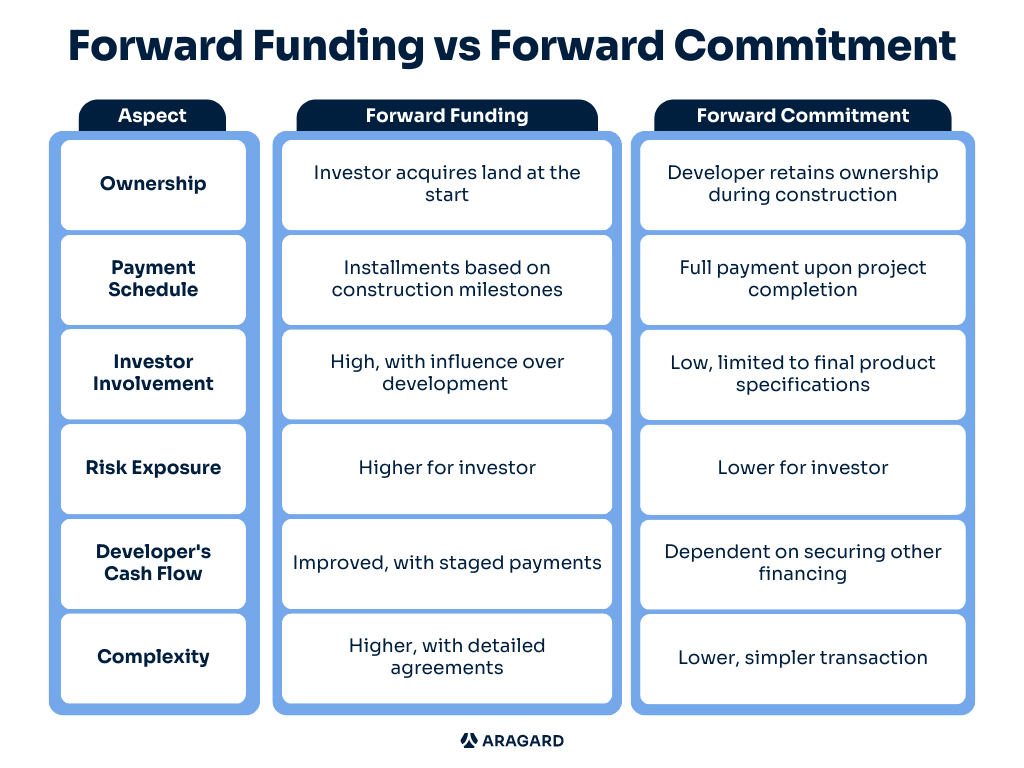

Before committing to Forward Funding, explore alternative funding options such as:

- Small business loans from banks or credit unions: These typically offer lower interest rates and more favorable terms than MCAs.

- SBA loans: The Small Business Administration (SBA) offers loan programs that can provide access to capital with government guarantees.

- Lines of credit: A line of credit can provide flexible access to funds as needed.

- Grants: Explore grant opportunities from government agencies or private foundations.

- Angel investors or venture capital: If your business has high growth potential, consider seeking funding from investors.

Comparing multiple funding options will allow you to make an informed decision and choose the best solution for your business's needs.

Red Flags to Watch Out For

Several red flags should prompt caution when considering Forward Funding or any similar financing provider:

- High-pressure sales tactics: Legitimate lenders will not pressure you into making a quick decision.

- Lack of transparency: Be wary of companies that are unwilling to disclose fees or repayment terms.

- Unsolicited offers: Exercise caution when responding to unsolicited offers of financing.

- Promises that seem too good to be true: If it sounds too good to be true, it probably is.

- Requests for upfront fees: Legitimate lenders typically do not require upfront fees for loan processing.

Always conduct thorough due diligence before entering into any financial agreement.

Conclusion: Key Takeaways

Determining whether Forward Funding is a legitimate company requires careful consideration of several factors. While the company offers a potentially viable funding solution for businesses that may not qualify for traditional loans, it is essential to approach the decision with caution and conduct thorough due diligence. Transparency, customer reviews, regulatory compliance, and contractual terms should all be scrutinized.

The following are key takeaways:

*Understand the nature of merchant cash advances and their associated risks.

*Evaluate Forward Funding's transparency and disclosure practices.

*Research customer reviews and reputation.

*Verify regulatory compliance.

*Carefully review the contract terms and conditions.

*Explore alternative funding options.

*Be aware of potential red flags.

By taking these steps, businesses can make informed decisions about whether Forward Funding is a suitable and legitimate financing partner. Consulting with a financial advisor or attorney is always recommended before entering into any significant financial agreement.