The JPMorgan Liquid Assets Money Market Fund is a type of mutual fund that invests primarily in short-term, high-quality debt securities. Understanding its characteristics, risks, and potential benefits is crucial for investors considering adding it to their portfolio. This article provides a structured explanation of this type of fund.

What is a Money Market Fund?

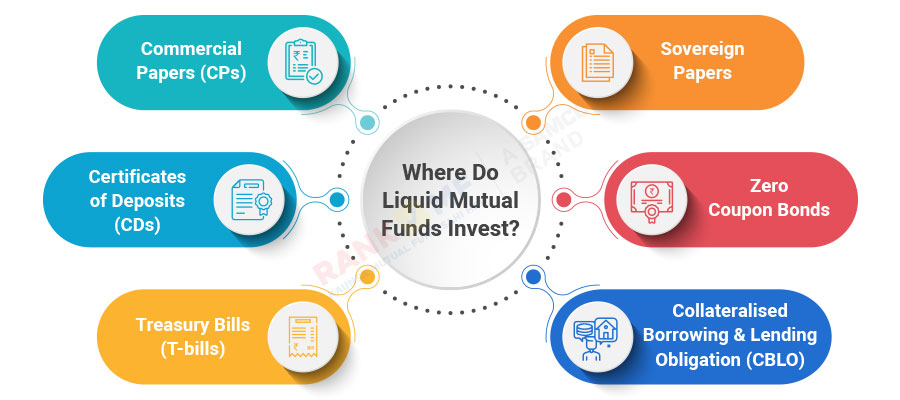

Before delving into the specifics of the JPMorgan Liquid Assets Money Market Fund, it's important to define what a money market fund is in general. A money market fund is a type of mutual fund that invests in short-term debt instruments such as Treasury bills, commercial paper, and certificates of deposit (CDs). The primary goal of a money market fund is to provide investors with a safe and liquid investment option, aiming to preserve capital while generating modest income. These funds are often used as a cash equivalent due to their high liquidity and low risk profile (relative to other investments).

Money market funds are regulated and aim to maintain a stable net asset value (NAV) of $1.00 per share. However, it's important to note that money market funds are not FDIC-insured and it is possible to lose money by investing in them.

Key Characteristics of Money Market Funds:

- Short-Term Investments: Money market funds invest in securities with short maturities, typically less than 13 months, and an average portfolio maturity of 60 days or less. This helps to minimize interest rate risk.

- High Credit Quality: These funds focus on investing in high-quality debt instruments with minimal credit risk. This ensures that the fund is less likely to experience losses due to defaults.

- Liquidity: Money market funds offer daily liquidity, allowing investors to easily buy and sell shares.

- Stable Net Asset Value (NAV): Money market funds aim to maintain a stable NAV of $1.00 per share. However, this is not a guarantee.

JPMorgan Liquid Assets Money Market Fund: Specifics

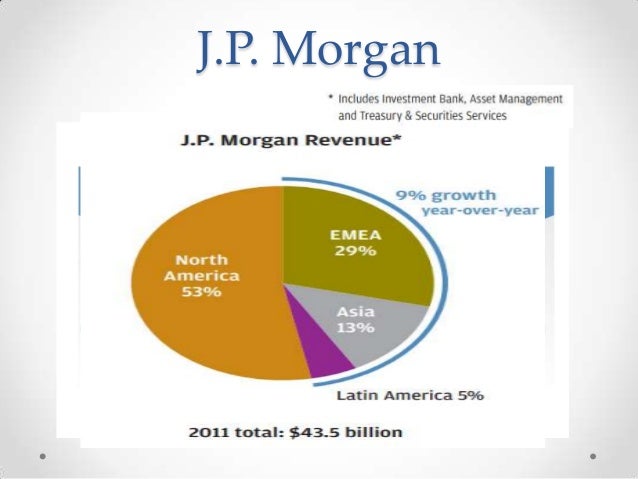

The JPMorgan Liquid Assets Money Market Fund is a specific money market fund offered by JPMorgan Asset Management. Like other money market funds, it invests in a portfolio of short-term, high-quality debt securities. However, the specific holdings and investment strategies employed by the fund can vary depending on market conditions and the fund's management team.

Investment Objectives and Strategy:

The fund's stated investment objective is typically to seek as high a level of current income as is consistent with the preservation of capital and maintenance of liquidity. The fund pursues this objective by investing primarily in U.S. dollar-denominated money market instruments, including:

- U.S. Government Securities: Treasury bills, notes, and other obligations issued or guaranteed by the U.S. government.

- Repurchase Agreements: Agreements to purchase securities with an agreement to resell them at a later date. These are typically collateralized by U.S. government securities.

- Commercial Paper: Short-term, unsecured promissory notes issued by corporations.

- Certificates of Deposit (CDs): Time deposits issued by banks.

- Bankers' Acceptances: Short-term credit instruments guaranteed by a bank.

Fund Variations and Share Classes:

JPMorgan, like many fund providers, often offers various share classes of the Liquid Assets Money Market Fund. These share classes may have different expense ratios and minimum investment requirements. For example, institutional share classes often have lower expense ratios but require higher minimum investments. Retail share classes are typically accessible to individual investors with lower minimum investment amounts. It's crucial to compare the expense ratios and minimums of different share classes to determine which is most suitable based on individual investment size and needs.

Example: Share class A might have a minimum investment of $1,000 and an expense ratio of 0.20%, while share class I might have a minimum investment of $1,000,000 and an expense ratio of 0.10%. An investor with $5,000 to invest would likely choose share class A, even with the higher expense ratio.

Understanding the Prospectus:

The prospectus is a key document for any mutual fund, including the JPMorgan Liquid Assets Money Market Fund. The prospectus provides detailed information about the fund's investment objectives, strategies, risks, expenses, and past performance. It is essential to read the prospectus carefully before investing to fully understand the fund's characteristics and potential risks. The prospectus can be found on the JPMorgan Asset Management website or through your broker.

Risks Associated with Money Market Funds

While money market funds are generally considered low-risk investments, they are not risk-free. Investors should be aware of the following potential risks:

- Interest Rate Risk: Although money market funds invest in short-term securities, changes in interest rates can still affect the fund's yield. When interest rates rise, the fund's yield may increase, but when interest rates fall, the yield may decrease.

- Credit Risk: While money market funds invest in high-quality securities, there is still a risk that an issuer could default on its obligations. This is mitigated by the fund's focus on high-credit-quality instruments and diversification.

- Inflation Risk: The returns from money market funds may not keep pace with inflation, especially during periods of high inflation. This can erode the real value of your investment.

- "Breaking the Buck": Although rare, a money market fund's NAV can fall below $1.00 per share. This is known as "breaking the buck" and can occur if the fund experiences significant losses due to defaults or other market events. While regulators have implemented measures to reduce this risk, it is still possible.

Practical Advice and Insights

Understanding the nuances of money market funds like the JPMorgan Liquid Assets Money Market Fund can be beneficial for managing your finances. Here are some practical insights:

- Emergency Fund: Money market funds can be a suitable place to park your emergency fund. Their high liquidity allows you to access your funds quickly in case of unexpected expenses.

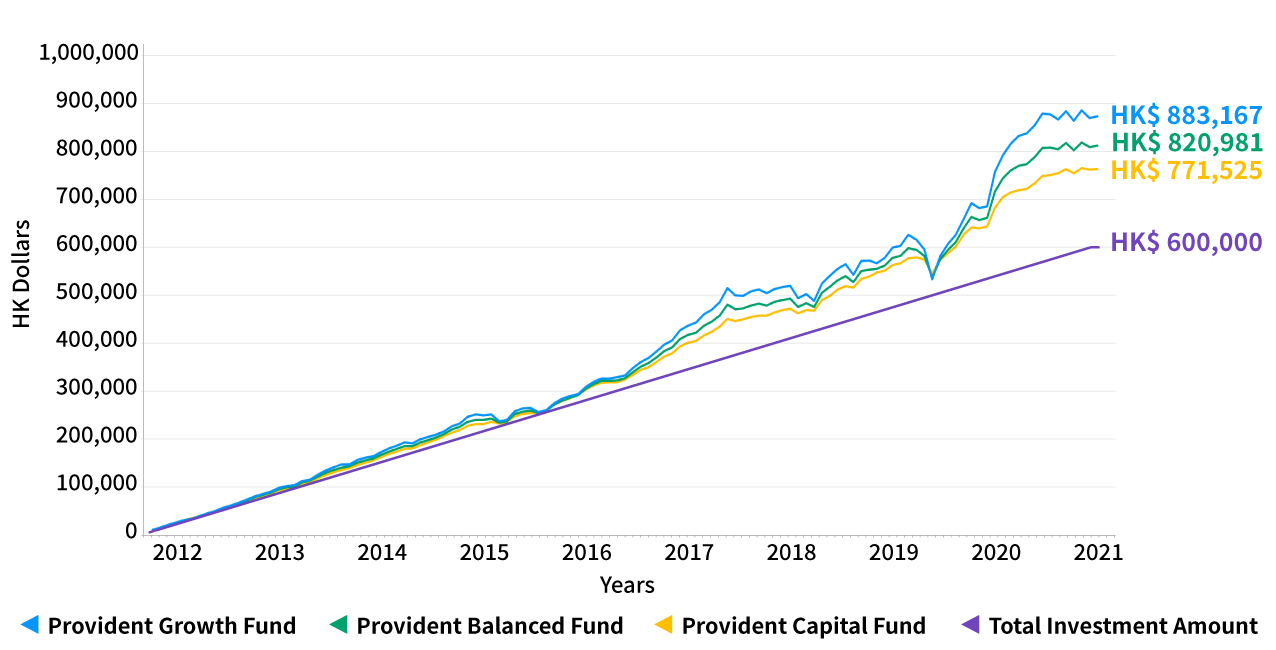

- Short-Term Savings Goals: If you have short-term savings goals, such as saving for a down payment on a car or a vacation, a money market fund can provide a safe and liquid place to store your funds.

- Cash Management: Money market funds can be used as a cash management tool to earn a modest return on cash balances that you are not currently using for other investments.

- Diversification: While money market funds offer stability, they should not be the only investment in your portfolio. Diversification across different asset classes is essential for long-term financial success.

- Compare Options: Before investing in the JPMorgan Liquid Assets Money Market Fund, compare its yields, expense ratios, and investment strategies to those of other money market funds. Online tools and resources can help you with this comparison.

- Consider Tax Implications: The income generated by money market funds is typically taxable. Consider the tax implications of investing in a money market fund, especially if you are in a high tax bracket.

Example: Let's say you have $10,000 in a savings account earning 0.5% interest per year. You could consider moving a portion of those funds to the JPMorgan Liquid Assets Money Market Fund if it offers a higher yield, even after considering taxes. However, remember to factor in the risks and ensure you understand the fund's investment strategy.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

_-_EUR__LU0159053015_EUR_historical_p.png?1559703474)

.png)