The LegalZoom Fast Break for Small Business is a grant program designed to support and empower entrepreneurs, particularly those from underrepresented communities, in launching and growing their businesses. It provides financial assistance and resources to help these businesses overcome challenges and achieve success. This article will delineate the key aspects of the program, including eligibility criteria, the application process, selection criteria, and the types of support offered.

Eligibility Requirements

Before embarking on the application process, it is crucial to ascertain whether one meets the established eligibility criteria. While specific requirements may vary from year to year, certain general prerequisites are typically consistent. These often include:

Business Stage

The Fast Break program usually targets businesses at a specific stage of development. It often prioritizes startups that are either in the early stages of launch or have been operating for a relatively short period. This focus enables the program to provide critical support during the formative years, when businesses are most vulnerable. Established businesses seeking to expand may also be considered, but the emphasis is typically on fostering new ventures.

Business Location

Geographic location is another factor frequently considered. The program may be restricted to businesses operating within a specific region, state, or even a particular set of cities. This geographic focus can be driven by the program's overall mission to support businesses in underserved areas or to contribute to local economic development. Applicants should carefully verify whether their business location aligns with the program's specified geographic scope.

Underrepresented Groups

A core tenet of the LegalZoom Fast Break for Small Business is its commitment to supporting entrepreneurs from underrepresented groups. This can encompass a variety of categories, including:

Minority-owned businesses: Businesses where a majority ownership stake is held by individuals from racial or ethnic minority groups.

Women-owned businesses: Businesses where a majority ownership stake is held by women.

Veteran-owned businesses: Businesses where a majority ownership stake is held by individuals who have served in the military.

Businesses located in low-income communities: Businesses operating in areas designated as economically disadvantaged.

The specific definition of "underrepresented" may vary, so applicants are advised to consult the official program guidelines for clarification.

Legal Structure

The program may also have requirements regarding the legal structure of the business. For example, it might only accept applications from businesses that are formally registered as corporations, limited liability companies (LLCs), or sole proprietorships. Informal ventures operating without a legal structure may not be eligible. Applicants should ensure that their business is legally registered in accordance with the program's requirements.

Application Process

The application process for the LegalZoom Fast Break for Small Business typically involves several steps. These steps are designed to gather comprehensive information about the applicant's business, its goals, and its potential for success.

Online Application Form

The initial step usually involves completing an online application form. This form will request basic information about the business, such as its name, address, industry, and legal structure. It will also ask for information about the applicant, including their background, experience, and qualifications. Be prepared to provide detailed information about your business operations.

Business Plan

A well-articulated business plan is often a critical component of the application. The business plan should outline the company's mission, vision, and values. It should also provide a detailed description of the company's products or services, its target market, and its competitive advantage. A comprehensive financial projection, including revenue forecasts, expense budgets, and funding needs, is also essential. The business plan serves as a roadmap for the business and demonstrates the applicant's strategic thinking and planning capabilities. For example, a coffee shop business plan should include an analysis of the local market, pricing strategy, and marketing plan.

Financial Statements

Applicants may be required to submit financial statements, such as balance sheets, income statements, and cash flow statements. These statements provide insights into the financial health of the business and its ability to generate revenue and manage expenses. Startups may need to submit projected financial statements instead of historical data. These projections should be realistic and based on sound assumptions.

Supporting Documents

Additional supporting documents may be required to substantiate the information provided in the application. These documents could include:

Licenses and permits: To demonstrate that the business is operating legally and in compliance with all relevant regulations.

Tax returns: To verify the business's income and expenses.

Contracts: To provide evidence of business relationships and agreements.

Marketing materials: To showcase the business's products or services and its brand identity.

Video Submission (Optional)

Some programs may encourage or require applicants to submit a short video highlighting their business and their passion for entrepreneurship. This video provides an opportunity to showcase the personality and vision of the business owner. It also allows the selection committee to gain a more personal understanding of the applicant's motivation and commitment.

Selection Criteria

The selection process is typically competitive, with a large number of applicants vying for a limited number of grants. The selection committee will evaluate applications based on a variety of criteria.

Business Viability

A primary consideration is the viability of the business. The selection committee will assess the potential for the business to generate revenue, achieve profitability, and sustain long-term growth. Factors such as market demand, competitive landscape, and the business's unique selling proposition will be considered.

Impact and Innovation

The program often prioritizes businesses that have a positive impact on their communities or that offer innovative solutions to pressing problems. Businesses that create jobs, provide essential services, or address social or environmental challenges may be given preferential consideration. Innovation in the business model, product or service offering, or operational processes can also be a significant factor.

Financial Need

The applicant's financial need is also taken into account. The program is intended to support businesses that may face challenges accessing traditional sources of funding. The selection committee will assess the applicant's current financial situation and their ability to leverage the grant to achieve their business goals. Clearly demonstrate the financial need and how the grant will positively impact the business.

Leadership and Management

The selection committee will also evaluate the leadership and management capabilities of the applicant. Factors such as experience, skills, and commitment will be considered. The ability to effectively manage the business, navigate challenges, and build a strong team are crucial for success.

Types of Support Offered

The LegalZoom Fast Break for Small Business provides a range of support to grant recipients. This support can include:

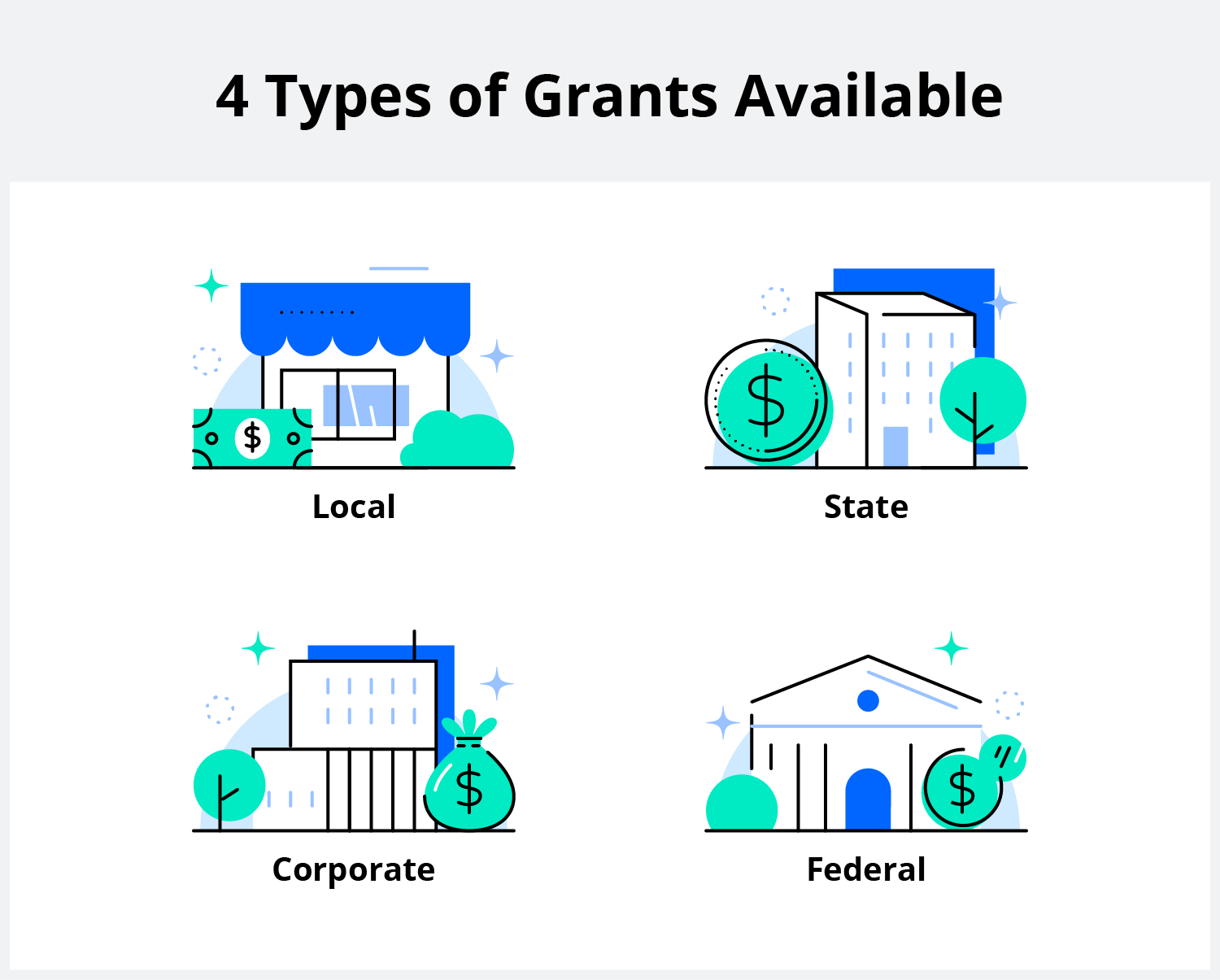

Financial Grants

The most significant form of support is typically a financial grant. The amount of the grant can vary depending on the program and the applicant's needs. These grants are often unrestricted, meaning that recipients can use the funds for a variety of purposes, such as:

Working capital: To cover day-to-day operating expenses.

Equipment purchases: To acquire essential equipment and machinery.

Marketing and advertising: To promote the business and attract customers.

Inventory: To purchase raw materials or finished goods for sale.

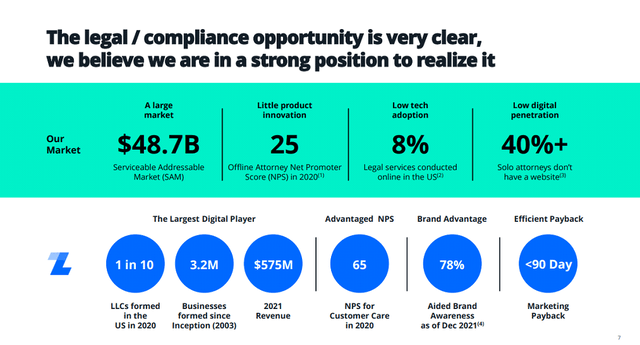

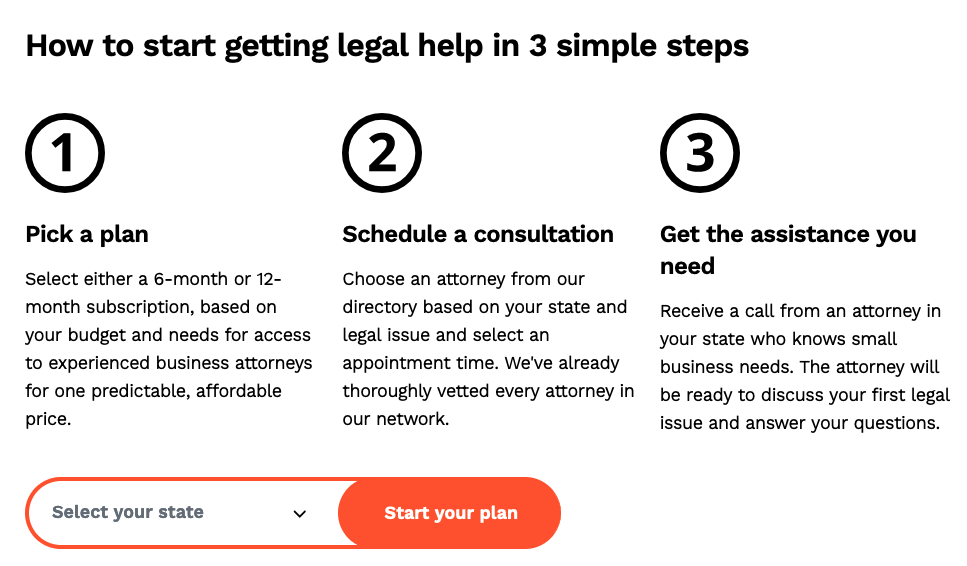

Legal Services

LegalZoom, as a legal services provider, often provides grant recipients with access to its legal services platform. This can include assistance with business formation, contract drafting, intellectual property protection, and other legal matters. Access to professional legal advice can be invaluable for startups, helping them to navigate the complex legal landscape and avoid costly mistakes.

Mentorship and Networking

The program may also offer mentorship and networking opportunities. Grant recipients may be paired with experienced business owners or industry experts who can provide guidance and support. Networking events can provide opportunities to connect with other entrepreneurs, investors, and potential partners.

Educational Resources

Access to educational resources, such as workshops, webinars, and online courses, may also be provided. These resources can help entrepreneurs to develop their business skills and knowledge in areas such as finance, marketing, and management.

Practical Advice

Applying for grants like the LegalZoom Fast Break for Small Business can be daunting. Here's some practical advice to improve your chances of success:

- Start early: Don't wait until the last minute to start your application. Give yourself ample time to gather the necessary information, write a compelling business plan, and prepare any required supporting documents.

- Read the instructions carefully: Pay close attention to the program's eligibility requirements, application guidelines, and deadlines. Failure to follow the instructions can result in disqualification.

- Seek feedback: Ask trusted advisors, mentors, or business professionals to review your application and provide feedback. Constructive criticism can help you to improve the clarity, completeness, and persuasiveness of your application.

- Be authentic: Let your passion for your business shine through in your application. The selection committee wants to see that you are genuinely committed to your venture and that you have the drive and determination to succeed.

By understanding the eligibility requirements, application process, selection criteria, and types of support offered, entrepreneurs can maximize their chances of securing funding and resources through the LegalZoom Fast Break for Small Business. This program represents a valuable opportunity for small businesses, particularly those from underrepresented communities, to gain a competitive edge and achieve their entrepreneurial aspirations.