Okay, let's talk business! But not the boring, stuffy kind. Let's talk about something that can seriously save your bacon: the Limited Liability Company, or LLC. Think of it as your business's superhero suit. It's not bulletproof (nothing is!), but it offers a *major* layer of protection.

So, what are LLCs *primarily* designed to do? The short answer: to separate your personal assets from your business liabilities. Sounds complicated, right? Let's break it down like a freshly baked cookie.

Imagine This: The Lemonade Stand Debacle

Picture this: little Timmy decides to open a lemonade stand. He's got sunshine, lemons, and a whole lotta enthusiasm. He's a budding entrepreneur! He's selling lemonade for 50 cents a cup and business is booming! But uh-oh, disaster strikes. Little Sarah gets a tummy ache after drinking Timmy's lemonade. Turns out, the water Timmy used was...less than pristine. Sarah's mom is NOT happy. She sues. Big time.

Now, if Timmy's just running his lemonade stand as, well, Timmy... his *personal* assets are at risk. That means his bike, his baseball card collection, even the money his grandma saved for his college fund could be in jeopardy to cover the lawsuit! Yikes!

But, what if Timmy had cleverly set up his lemonade stand as "Timmy's Totally Awesome Lemonade, LLC"? (Okay, maybe he needs a better name...). Then, the lawsuit would primarily be against the *LLC*, not Timmy personally.

Think of the LLC as a shield. It's like a little bubble protecting Timmy’s personal belongings from the lemonade stand's misfortunes. If the lawsuit is successful, the LLC's assets (the lemonade stand's profits, the table, the pitcher) are what's at risk, not Timmy’s bike or his college fund. Big difference, right?

Why Should *You* Care About All This?

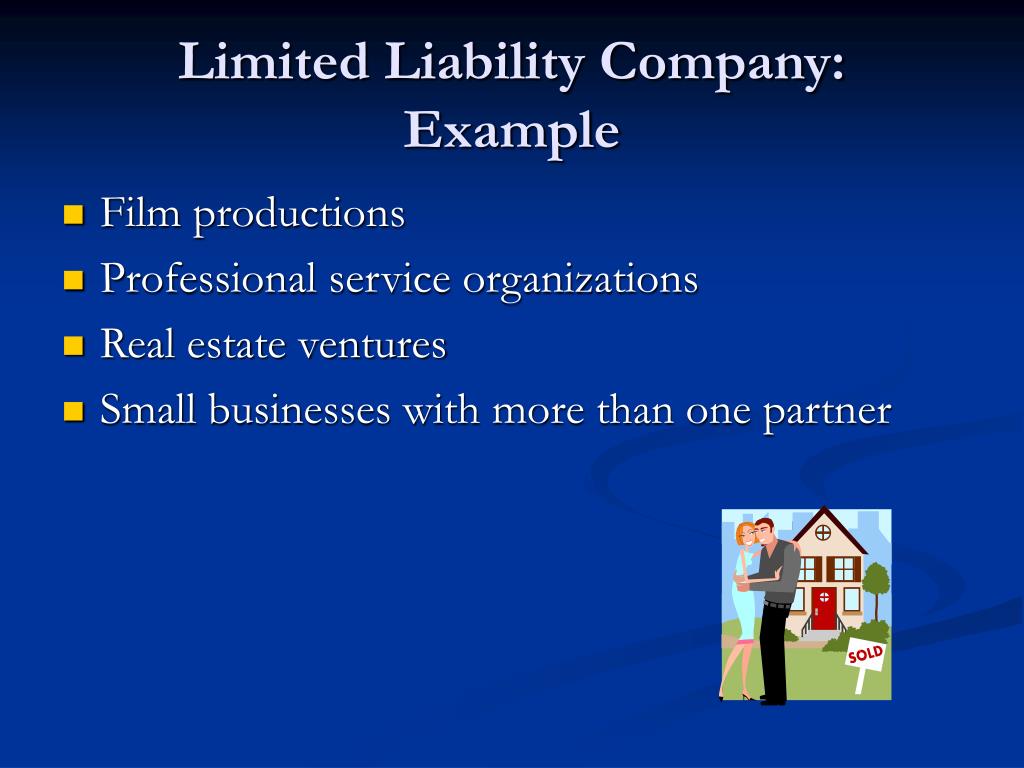

Okay, you might be thinking, "I'm not running a lemonade stand (anymore!). Why should I care about LLCs?" Well, even if you're not selling lemonade, if you're doing *anything* that could potentially lead to a lawsuit or debt, an LLC might be your best friend.

Let's say you're a freelance web designer. You’re churning out beautiful websites for clients. One day, you accidentally use a copyrighted image on a client's site. The copyright holder sues. If you're operating as just *you*, your personal savings, your house, your car… all could be on the line. Ouch!

But if you're operating as "Creative Designs, LLC", the lawsuit is primarily against the LLC. Your personal assets are shielded (mostly!). See the pattern here?

Or maybe you’re renting out your spare room on Airbnb. A guest trips and falls and breaks their arm. They decide to sue. If you don't have an LLC, your personal assets are fair game. But with an LLC, it's *primarily* the LLC's assets that are at risk. Your personal home and savings are typically shielded by the limited liability protection.

It is *primarily* designed to protect you.

The "Limited" in Limited Liability

Now, it's important to emphasize the word "limited." An LLC isn't a magical force field. It doesn't protect you from *everything*. There are situations where the "corporate veil" can be pierced, meaning your personal assets *can* be at risk. This usually happens if you've done something illegal, fraudulent, or acted irresponsibly. If you, as Timmy, are knowingly serving contaminated water for profit, an LLC won't save you.

For example, if you personally guarantee a business loan, you're still on the hook for that loan, even if your business is an LLC. Or if you intentionally commit fraud, the LLC won't protect you from personal liability. It's crucial to run your business ethically and responsibly.

Think of it like this: the LLC is like wearing a seatbelt. It significantly reduces your risk of injury in an accident, but it doesn't guarantee you'll walk away unscathed. You still need to drive safely!

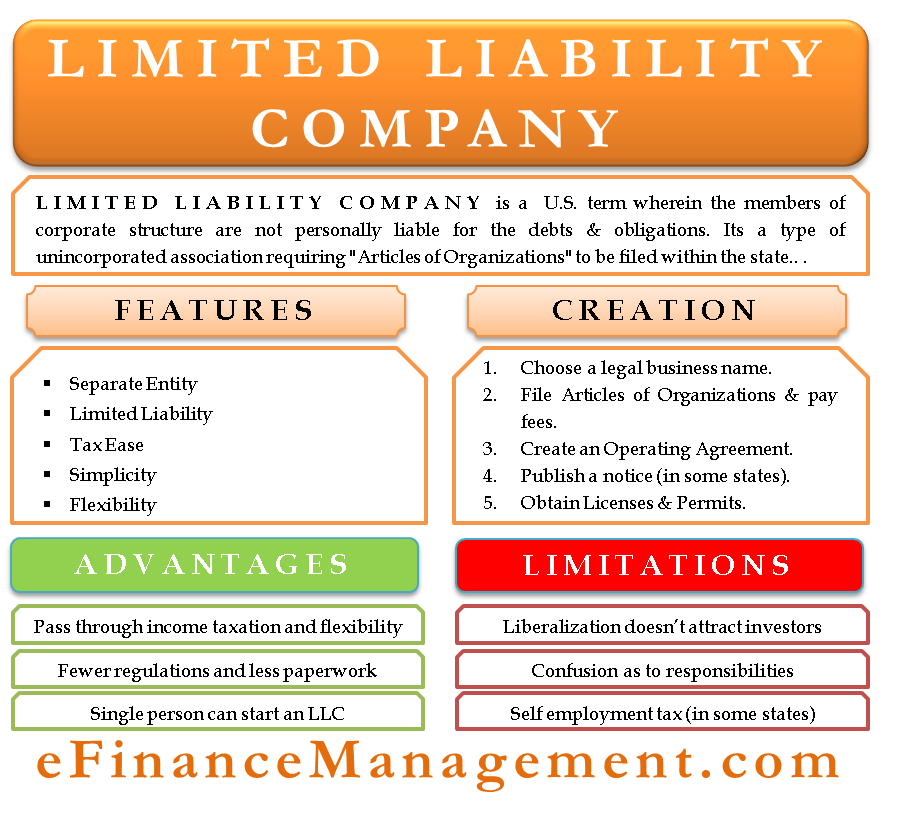

Beyond Protection: Other Perks of an LLC

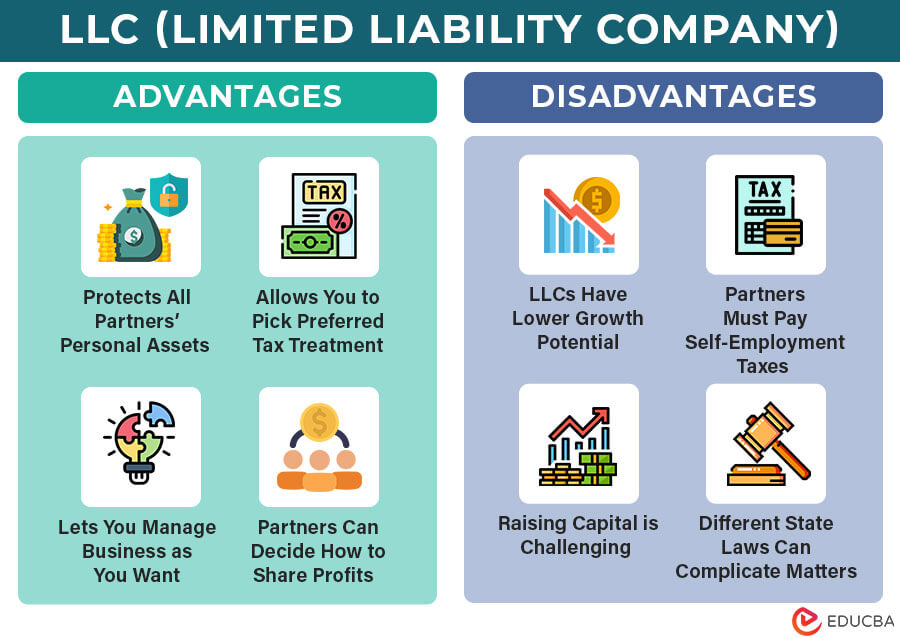

Besides asset protection, LLCs offer other benefits too!

- Simplicity: They're generally easier to set up and maintain than corporations. Think of it as ordering pizza instead of preparing a five course meal, a lot less complicated.

- Flexibility: LLCs offer flexibility in how they're taxed. You can choose to be taxed as a sole proprietorship, partnership, or corporation. It depends on which works best for your business.

- Credibility: Having "LLC" after your business name can make you look more professional and legitimate to clients and customers. Like wearing a suit to a job interview, it can make a good impression!

LLC vs. Other Business Structures

There are other ways to structure your business, like sole proprietorships, partnerships, and corporations. But LLCs often strike a sweet spot between simplicity and protection.

A sole proprietorship is the simplest to set up, but offers *no* personal liability protection. It's like riding a bike without a helmet. Risky!

A corporation offers strong liability protection, but it's more complex and costly to set up and maintain. It's like driving a tank, very protective, but also very involved!

An LLC is the equivalent of a reliable, safe car with all the key features.

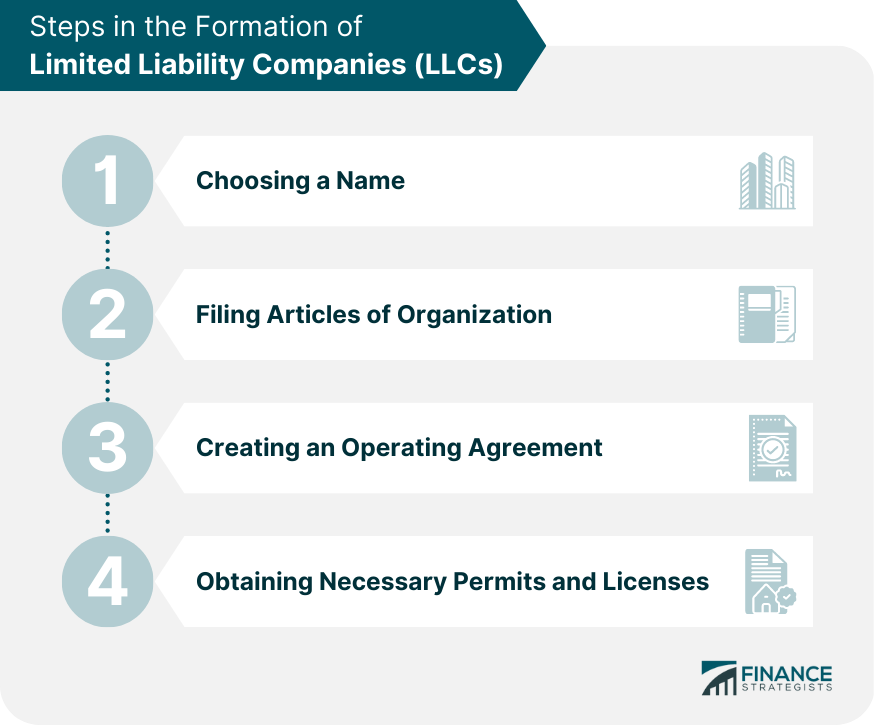

Don't Be A Lone Wolf: Talk to the Pros

Setting up an LLC can seem daunting, but it doesn't have to be! There are tons of resources available online and in your community. Consider consulting with a lawyer or accountant to get personalized advice tailored to your specific business needs. They can guide you through the process and help you make sure you're doing everything right.

Think of it as getting directions before embarking on a road trip. It can save you a lot of time, stress, and wrong turns!

So, Are LLCs Right for You?

Ultimately, whether or not to form an LLC depends on your individual circumstances and risk tolerance. But if you're running a business – even a small one – and you want to protect your personal assets, an LLC is *primarily* designed to offer that protection. It's a smart move that can give you peace of mind and help you build a more secure financial future.

It is *primarily* designed to make you sleep better at night!

So go on, give your business the superhero suit it deserves! You'll thank yourself later.

-copy-(1)-768.webp)

.jpg)

:max_bytes(150000):strip_icc()/LLC-8e9fabc27dd44aec97ae5c5abb372a3c.jpg)