Hey there, friend! So, you're diving into the wild world of transactions, huh? Don't worry, it's not as scary as it sounds, even though sometimes accounting *does* feel like learning a new language. Today, we're tackling the classic "Match the Following" game. It's like playing detective, but with numbers... and less chalk outlines. Promise!

Ready to put on your thinking cap? Grab your coffee (or tea, I don't judge!), and let's break this down into bite-sized pieces. We'll look at some common transaction types and then match 'em up. Think of it as a financial version of speed dating. 😉

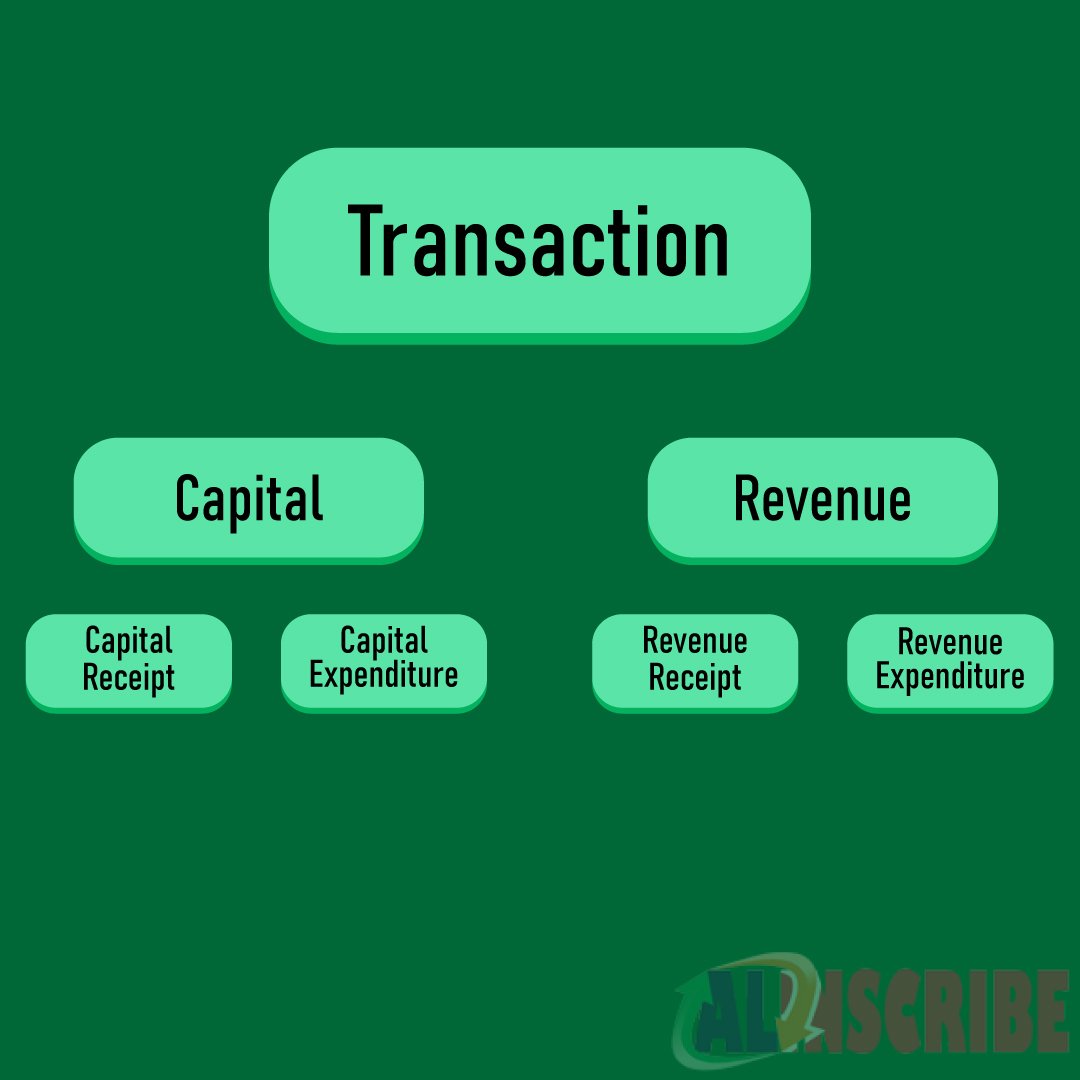

Transaction Types: A Quick & Dirty Overview

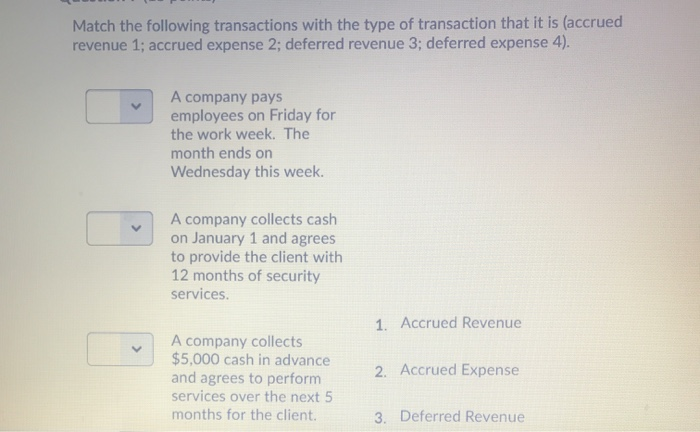

Alright, before we start matching like we're setting up a friend on a blind date, let's get a handle on what we're actually looking at. Here are some of the usual suspects:

1. Cash Sales

Pretty straightforward, right? You sell something, BOOM, you get cash. Think lemonade stands, garage sales, or that impulse buy you made at the grocery store checkout (we've all been there!). Basically, money in exchange for goods or services *immediately*.

2. Credit Sales

Ah, the land of "buy now, pay later!" This is where you sell something, but the customer doesn't pay you right away. You're extending them credit, meaning they owe you money. This creates something called an account receivable. You know, that reminder that someone owes you money. It's all fun and games until you have to chase them down for it (though hopefully, you won't have to!).

3. Purchases on Credit

Flip the script! Now *you're* the one buying something but not paying immediately. You're on the receiving end of that sweet, sweet credit. This creates an account payable. Basically, a reminder to *you* that you owe someone money. Try to remember to pay on time, or you might get some nasty late fees. Ouch!

4. Cash Purchases

Again, pretty simple. You buy something, you pay cash (or use your debit card, which is basically the same thing for our purposes). Instant gratification, instant transaction. No owing, no waiting, just pure, unadulterated purchase power! Like buying a coffee... or maybe some more yarn because, well, you can never have enough yarn, right?

5. Receipt of Payment from Customers

Cha-ching! This is when someone who previously owed you money (remember those accounts receivable?) finally pays up. It's a beautiful thing, like finding money in your old jeans. Your bank account gets a little boost, and your accounts receivable goes down. Everyone's happy!

6. Payment to Suppliers

Okay, time to pay the piper. This is when you pay someone you previously owed money (those pesky accounts payable!). Your bank account goes down, and your accounts payable goes down. It's less fun than *receiving* money, but hey, gotta keep those suppliers happy, right?

7. Expense Payments (Rent, Utilities, etc.)

The joys of adulthood! These are the recurring costs of doing business. Rent, utilities, salaries – the stuff that keeps the lights on (literally and figuratively). These payments reduce your cash and increase your expenses. Fun fact: tracking these is *crucial* for understanding your profitability.

8. Revenue Earned (Service Revenue, etc.)

This is the good stuff! This represents the money you've earned from providing services or goods. It increases your revenue and, hopefully, your profits. Think of it as the reward for all your hard work. Go you!

9. Loan Proceeds Received

Need a boost of capital? Taking out a loan brings cash into your business. It increases your cash balance but also creates a liability (that loan you have to pay back!). It's like getting a temporary superpower... with some strings attached.

10. Loan Repayments (Principal and Interest)

Time to pay back those borrowed funds. This involves both the principal (the original amount you borrowed) and the interest (the cost of borrowing). Loan repayments decrease your cash and decrease your liability (the loan balance). Slowly but surely, you're chipping away at that debt!

Let the Matching Begin!

Okay, now that we've got our transaction types sorted, let's play "Match the Following"! I'll give you a scenario, and you try to match it with the correct transaction type. Ready? Let's do this!

Scenario 1: A coffee shop sells a latte to a customer who pays with cash.

What transaction type is this? (Drumroll please...)

It's a Cash Sale! The customer paid immediately for the latte.

Scenario 2: A clothing boutique sells a dress to a customer who uses a store credit card.

And the answer is...

A Credit Sale! The customer is buying on credit and will pay later.

Scenario 3: Your company buys office supplies and pays with a company credit card.

Ding, ding, ding!

This is a Purchase on Credit! You're buying something and will pay for it later.

Scenario 4: You pay your monthly electricity bill.

The correct match is...

An Expense Payment! Paying for utilities is a recurring expense.

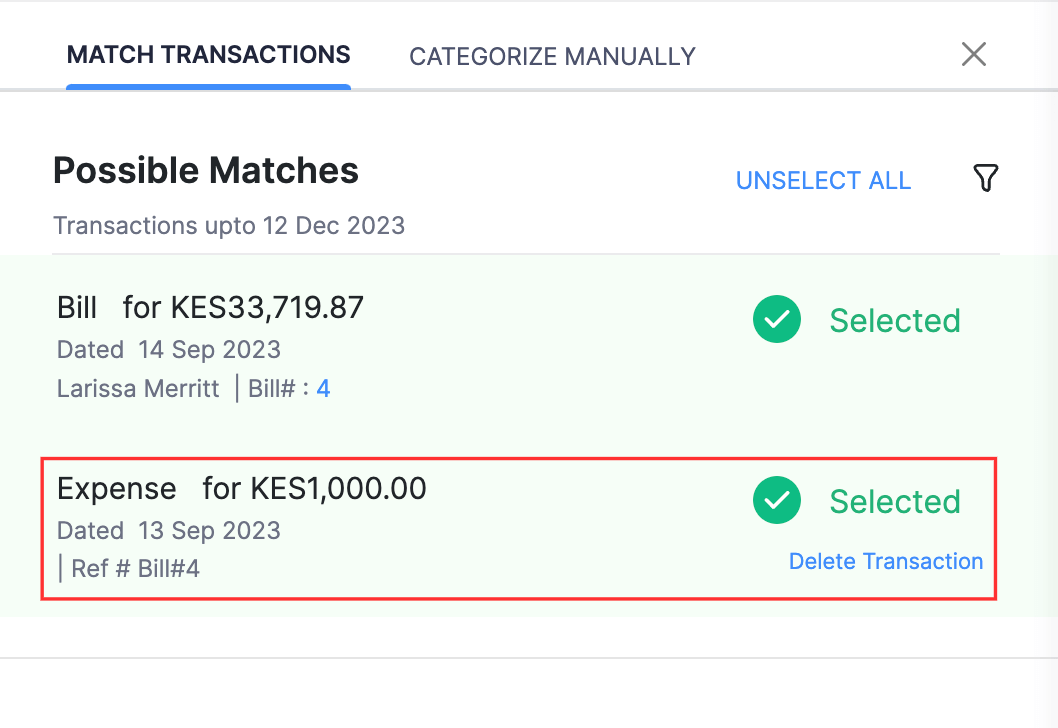

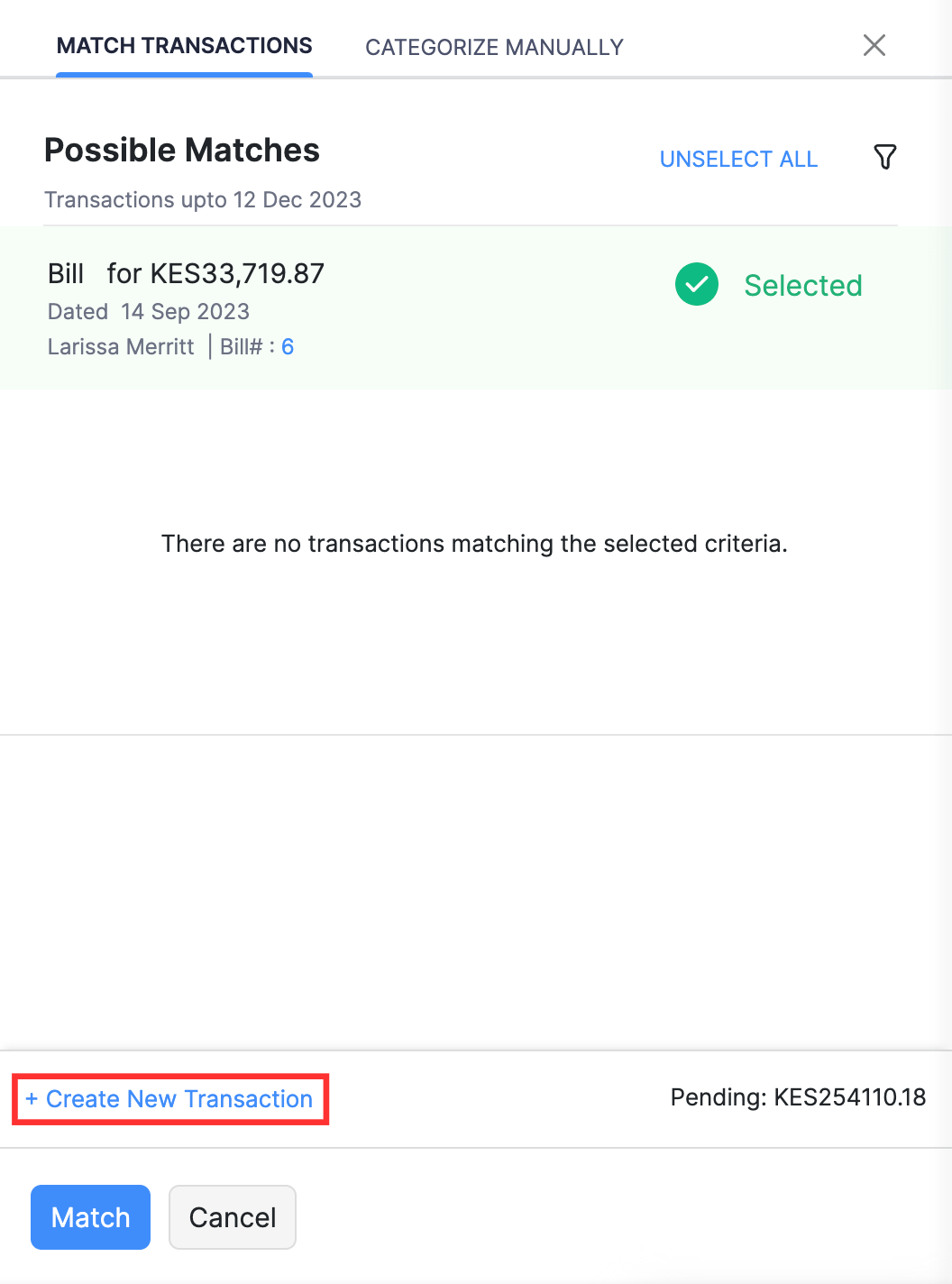

Scenario 5: A customer who previously purchased goods on credit sends you a check to pay off their balance.

The transaction type is...

Receipt of Payment from Customers! Hallelujah! You're getting paid!

Scenario 6: You take out a business loan from the bank.

And the matching transaction is...

Loan Proceeds Received! Your cash is increasing thanks to the loan.

Scenario 7: You provide web design services to a client and receive payment.

The transaction type is...

Revenue Earned (Service Revenue)! You earned money for your services.

Scenario 8: You make a payment to your supplier for the raw materials you purchased last month.

This matches with...

Payment to Suppliers! You're paying off your account payable.

Scenario 9: You make a monthly payment on your business loan, covering both principal and interest.

And finally...

Loan Repayments! You're chipping away at that loan balance.

Scenario 10: You purchase a new laptop for your business and pay for it with cash.

The last match is...

Cash Purchases! You bought an asset and paid for it immediately.

Tips and Tricks for Mastering Transaction Matching

Okay, you've successfully matched a bunch of transactions! Give yourself a pat on the back. But let's equip you with some extra tips to really become a transaction-matching master:

- Ask "Who is receiving what?" This is the golden rule. Always identify who is giving and who is receiving. Are you giving cash? Are you receiving a service? This will help you determine the direction of the transaction.

- Think about the "Before and After." What was the situation *before* the transaction? What is the situation *after*? Did your cash go up or down? Did your liabilities increase or decrease?

- Don't overthink it! Sometimes, the answer is right in front of you. Read the scenario carefully and look for keywords.

- Practice, practice, practice! The more you practice matching transactions, the easier it will become. Find some practice questions online or create your own scenarios.

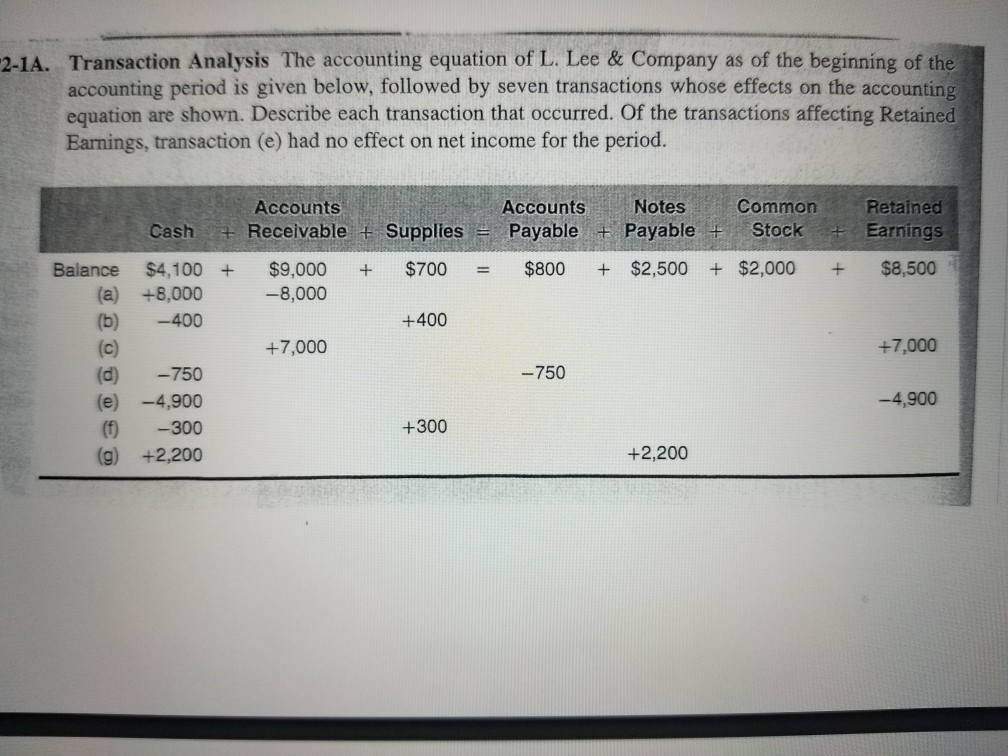

- Remember the Accounting Equation: Assets = Liabilities + Equity Understanding this fundamental equation can help you understand how transactions impact your balance sheet.

- Consider the timing: Is the payment happening immediately? If so, it probably involves cash. Is payment deferred? That screams "credit!"

Pro Tip: Creating a T-account in your head (or on paper!) can be super helpful. Debit on one side, credit on the other. Visualize which accounts are increasing and decreasing.

Why Does This Matter? (Besides the Obvious Accounting Exam)

Okay, so you might be thinking, "Great, I can match transactions. So what?" Well, understanding transaction types is *essential* for:

- Accurate bookkeeping: You need to know what kind of transaction you're dealing with to record it correctly. Garbage in, garbage out, right?

- Financial statement analysis: Knowing how different transactions impact your financial statements (income statement, balance sheet, cash flow statement) is *crucial* for understanding your company's performance.

- Making informed business decisions: Understanding your cash flow, profitability, and financial position allows you to make better decisions about pricing, investments, and financing.

- Keeping the taxman happy: Accurate records are *essential* for filing your taxes correctly. Trust me, you don't want to mess with the taxman.

Basically, mastering transaction matching is a key stepping stone to financial literacy and business success. So, pat yourself on the back again, because you're well on your way!

Final Thoughts (and a virtual high-five!)

Alright, my friend, we've reached the end of our transaction-matching adventure! I hope this chat has made the whole process a little less intimidating and maybe even a little fun. Remember, accounting doesn't have to be a mystery. With a little practice and a good understanding of the basics, you can conquer those transactions like a financial superhero!

Now go forth and match those transactions with confidence! You got this! And if you ever need a refresher, just remember this coffee chat. 😉