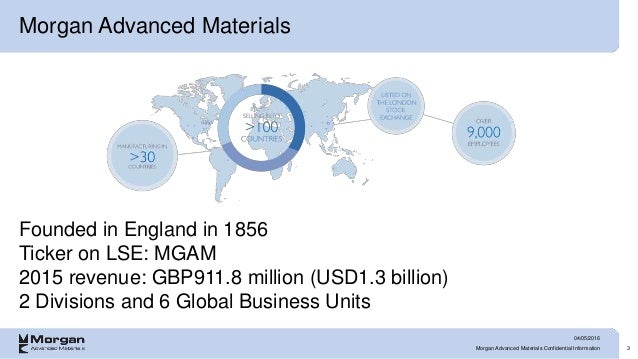

Okay, so picture this: I'm at a super dull networking event, right? The kind where the cheese and crackers are sad, and everyone's talking about "synergy" and "leveraging assets." My eyes glaze over. Then, someone starts droning on about...*materials science*. Seriously? I almost choked on my lukewarm Chardonnay. But then he mentions Morgan Advanced Materials, and something clicks. He was talking about how they make, like, the *stuff* that makes other stuff work. Suddenly, less boring. A lot less. Which leads me to the deep dive I took into their 2012 Annual Report. Buckle up, buttercup, because this is surprisingly interesting!

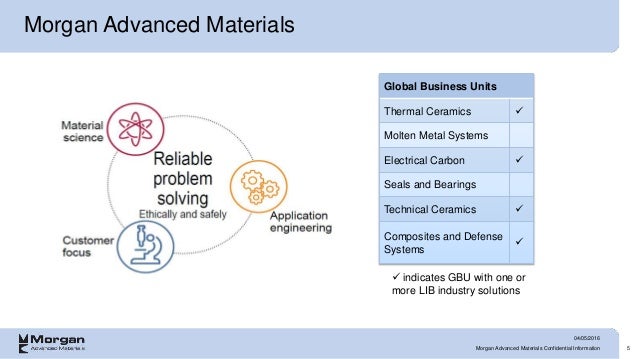

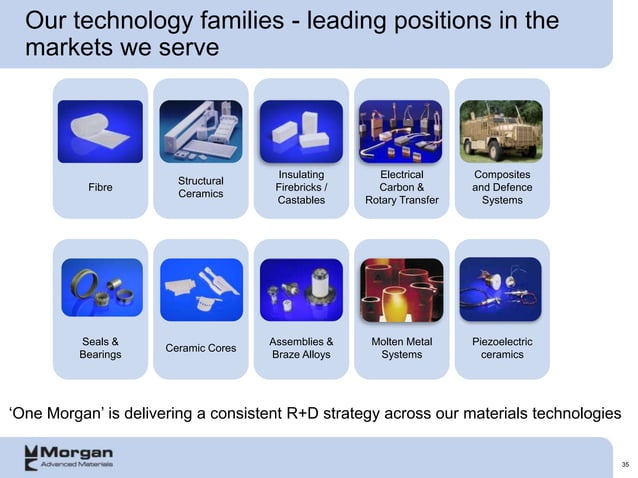

I know, I know. Annual reports. Snore. But hear me out! It's like peeking under the hood of a really complicated, really powerful machine. And Morgan Advanced Materials? They're powering a lot of machines – literally and figuratively. Think about it: everything from brakes in your car to the high-tech components in medical scanners. That's their game.

The Big Picture: 2012 in a Nutshell

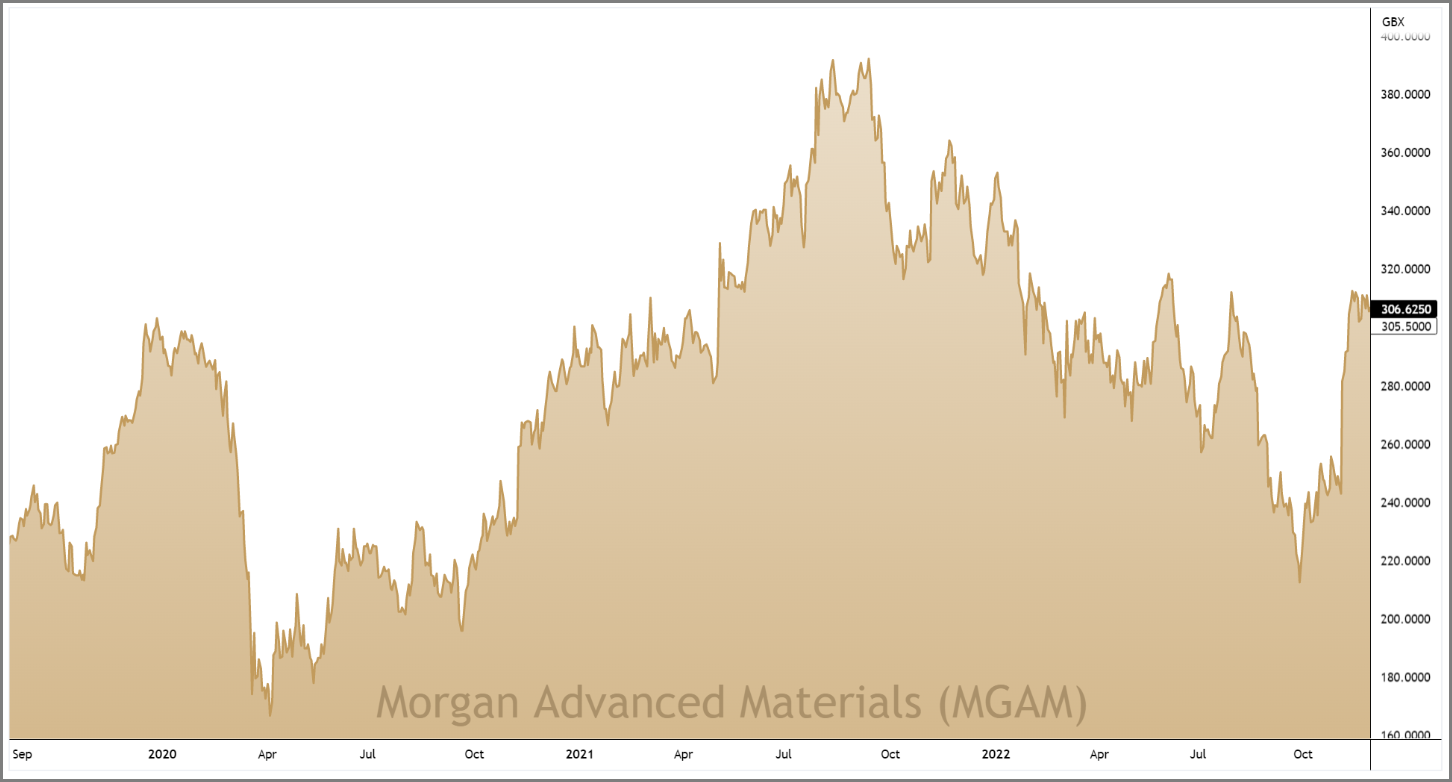

So, let's get down to brass tacks. 2012 for Morgan Advanced Materials wasn’t exactly a walk in the park. Remember 2012? The global economy was still doing the limbo under a "recession" bar. Their report paints a picture of resilience in a challenging market. They faced headwinds from pretty much everywhere – Europe being a particularly grumpy customer, if you read between the lines. Think about that for a sec – the whole continent wasn't doing so hot, and they were selling stuff *there*!

But despite the economic gloom, they managed to keep the ship relatively steady. How? Well, that’s what the rest of this article is about! (Spoiler alert: it involves a lot of fancy words like "portfolio management" and "operational efficiency.")

Key Highlights from the Report: The Good, The Bad, and The Interesting

Let’s break it down, shall we? (Think of this as your cheat sheet to pretending you know what you're talking about at the next painfully boring networking event.)

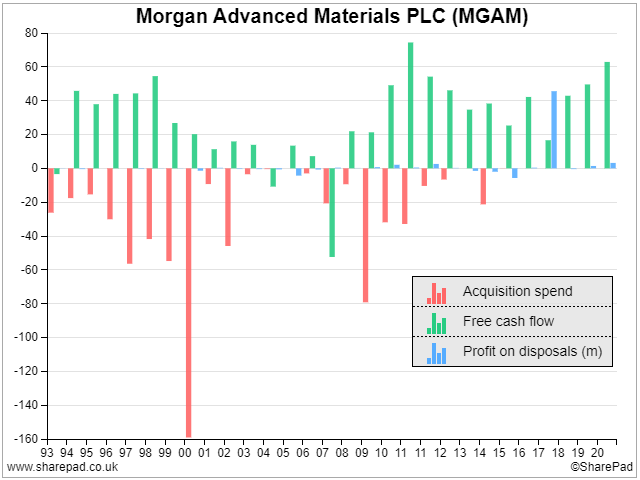

- Revenue: Okay, the report shows a bit of a dip in revenue compared to the previous year. Nothing catastrophic, but definitely a sign that the economic climate was being a real downer. But don't panic! They also highlight areas of *growth*, particularly in some of their niche markets. (More on that later.)

- Profit: Profit margins were also under pressure, which is never a good sign. This was partly due to the lower revenue, but also because of increasing input costs. Basically, the stuff they needed to make their stuff was getting more expensive. Classic squeeze.

- Strategic Focus: This is where things get interesting. The report emphasizes a renewed focus on "high-growth" markets and applications. Translation: they were doubling down on areas where they saw the biggest potential for future expansion. Smart move!

- Operational Efficiency: Every company loves to talk about "operational efficiency," but it’s actually pretty important. In this case, it meant streamlining their processes, cutting costs, and generally trying to run a tighter ship. Basically, cutting the fat without cutting the muscle. (Easier said than done, of course.)

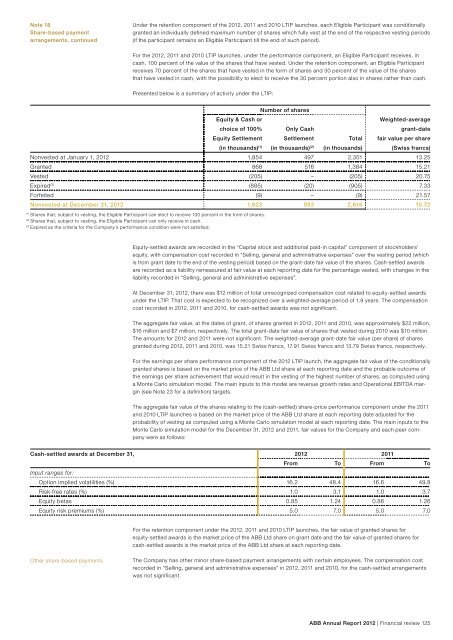

- R&D Investment: They *increased* their investment in research and development. Now *that's* a company thinking long-term! Even when times are tough, they're still betting on innovation. I like that. It says, "We're not just surviving, we're building the future!" Or something equally inspirational.

- Acquisitions and Divestments: The report also mentions some strategic acquisitions and divestments. Translation: they bought some companies and sold off others. This is all part of the portfolio management thing I mentioned earlier – basically, pruning the dead branches and nurturing the healthy ones.

Digging Deeper: Where Was the Growth?

So, where exactly were those pockets of growth in 2012? The report highlights a few key areas:

- Aerospace: Turns out, airplanes need advanced materials too! Shocking, I know. They saw solid growth in this sector, driven by demand for lighter and more efficient components. Think about it: every ounce saved on an airplane translates to fuel savings and happier passengers. And Morgan Advanced Materials is helping make that happen!

- Medical: This is another area where advanced materials are crucial. From MRI scanners to surgical implants, the medical industry relies on high-performance components that can withstand extreme conditions. Morgan Advanced Materials was riding the wave of innovation in this sector. (Helping save lives...not a bad day at the office, eh?)

- Energy: The energy sector is always a mixed bag, but they saw opportunities in areas like renewable energy and energy efficiency. Basically, anything that helps us use less energy or generate it more cleanly.

These growth areas are pretty key. It shows they weren't just blindly flailing in the economic storm. They were targeting specific areas with actual demand and potential. Think of it as aiming for the bullseye while everyone else is just throwing darts at the wall.

The Challenges They Faced: It Wasn’t All Sunshine and Rainbows

Okay, let’s be real. Every company faces challenges, and Morgan Advanced Materials was no exception. The report highlights a few key pain points:

- European Economic Woes: As I mentioned earlier, Europe was a major drag on their performance. The Eurozone crisis was in full swing, and demand from many European customers was sluggish. Basically, they were trying to sell stuff to people who were tightening their belts. Not easy.

- Currency Fluctuations: When you're doing business all over the world, currency fluctuations can really mess with your numbers. The report mentions that unfavorable exchange rates had a negative impact on their earnings. (Math is hard, especially when it involves international finance.)

- Raw Material Costs: As I alluded to earlier, the cost of raw materials was on the rise. This squeezed their profit margins and forced them to find ways to become more efficient. Basically, they were trying to make the same amount of money while their ingredients were getting more expensive. Recipe for stress, anyone?

Strategic Moves: Playing the Long Game

Despite the challenges, Morgan Advanced Materials was making some strategic moves that hinted at a longer-term vision. Here are a few that caught my eye:

- Investing in R&D: I can't stress this enough: their continued investment in research and development was a huge deal. It showed that they weren't just focused on short-term profits. They were willing to invest in the future, even when times were tough. Now *that's* what I call foresight.

- Focusing on Niche Markets: Instead of trying to be everything to everyone, they were focusing on specific niche markets where they had a competitive advantage. This allowed them to command higher prices and build stronger relationships with their customers. Think of it as being a specialist instead of a general practitioner. You might not see as many patients, but you'll probably get paid more for your expertise.

- Improving Operational Efficiency: By streamlining their processes and cutting costs, they were making themselves more resilient to economic shocks. This is like building a fortress instead of a sandcastle. It might not be as flashy, but it'll stand the test of time.

My Takeaways: So, What Does It All Mean?

Okay, so after wading through all the financial jargon and corporate-speak, what's my overall impression of Morgan Advanced Materials' 2012 Annual Report? Here's the gist:

- Resilience in the Face of Adversity: They weren't setting the world on fire, but they managed to weather a pretty tough economic storm. That's a testament to their underlying strength and adaptability.

- Strategic Focus: They were clearly focused on the right things: high-growth markets, innovation, and operational efficiency. This gave them a solid foundation for future growth.

- Long-Term Vision: They weren't just chasing short-term profits. They were investing in the future, which is always a good sign.

Now, I'm not a financial analyst (thank goodness!), but I can appreciate a company that's playing the long game. And that's exactly what Morgan Advanced Materials seemed to be doing in 2012. They were facing headwinds, but they were also laying the groundwork for future success. It was a year of consolidation, adaptation, and strategic positioning. The kind of stuff that doesn't make headlines, but makes all the difference in the long run.

So, next time you're at a boring networking event and someone starts talking about materials science, don't roll your eyes. Remember Morgan Advanced Materials and their surprisingly interesting annual report. You might just learn something. And who knows, you might even impress someone with your newfound knowledge of advanced materials!

And honestly, even if you don't, you'll have a great story to tell about the time you read an annual report and *didn't* fall asleep. That's a win in my book!