Alright, buckle up! We're diving into the wild world of National Financial Services LLC and something called a 1099-DIV. Sounds boring? Trust me, it's got its quirks. Think of it as a treasure map... but instead of gold, it leads to understanding your investment income. We're going on an adventure!

What's National Financial Services LLC Anyway?

First things first: who are these guys? National Financial Services LLC (NFS) is basically a super-organized custodian. They hold and manage assets for other companies, especially broker-dealers. Think of them as the bank vault for your investments. They don’t necessarily give you investment advice, but they ensure your stuff is safe and sound. They're like the strong, silent type of the finance world.

Imagine a huge warehouse filled with certificates and digital records. That's kind of what they do, just way more high-tech. They handle the behind-the-scenes stuff, so your broker can focus on helping you choose investments that (hopefully!) make you money. They're the unsung heroes of your portfolio.

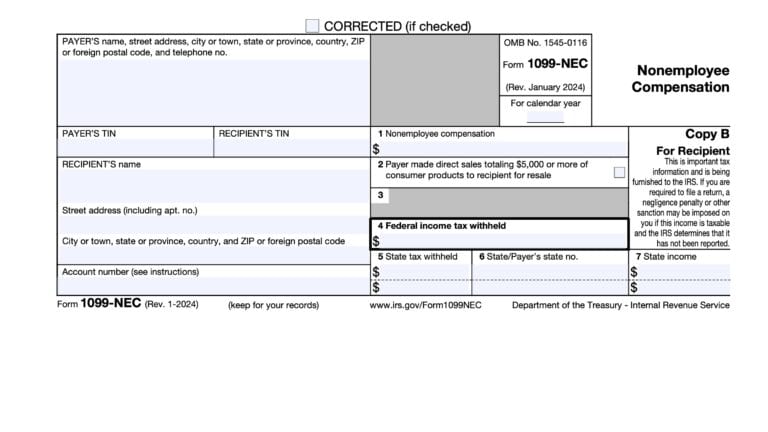

Enter the Mysterious 1099-DIV

Okay, now for the star of the show: the 1099-DIV form. This little piece of paper (or digital file, let's be real) is your key to understanding any dividend and capital gains distributions you received during the year. Dividends are essentially little "thank you" payments from companies you've invested in. They're like tiny pats on the back for being a shareholder. Capital gains are profits you made from selling investments for more than you bought them.

Think of it like this: You buy a fancy limited-edition rubber ducky for $10. A year later, its value skyrockets, and you sell it for $30. That $20 difference? That's your capital gain! Cha-ching!

The 1099-DIV is important because the IRS wants to know about all that lovely dividend and capital gains income. They want their cut! It's used to report these earnings on your tax return. So, pay attention to this form. It’s not just a piece of paper; it’s your ticket to tax compliance (and avoiding potential penalties!).

Why Did NFS Send Me a 1099-DIV?

Good question! If you received one from National Financial Services, it likely means you own investments that generate dividends or capital gains that are held through a brokerage firm that uses NFS as their custodian. NFS is reporting those earnings to both you and the IRS. They’re basically the messenger, delivering the news (good or bad!) about your investment income.

Maybe you own stock in a company that pays regular dividends. Or perhaps you sold some mutual fund shares at a profit. Whatever the reason, NFS is just letting you know about it so you can accurately report it on your taxes. Don’t blame them for the taxes, though! They're just doing their job!

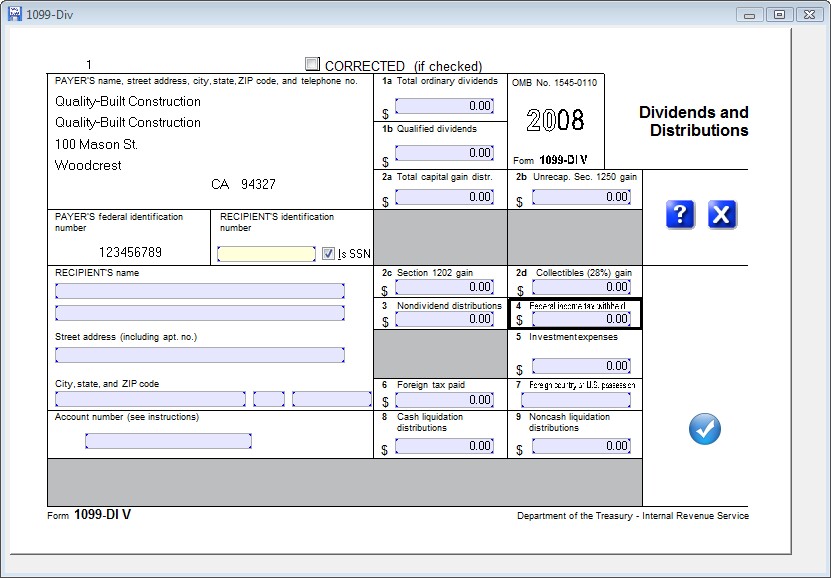

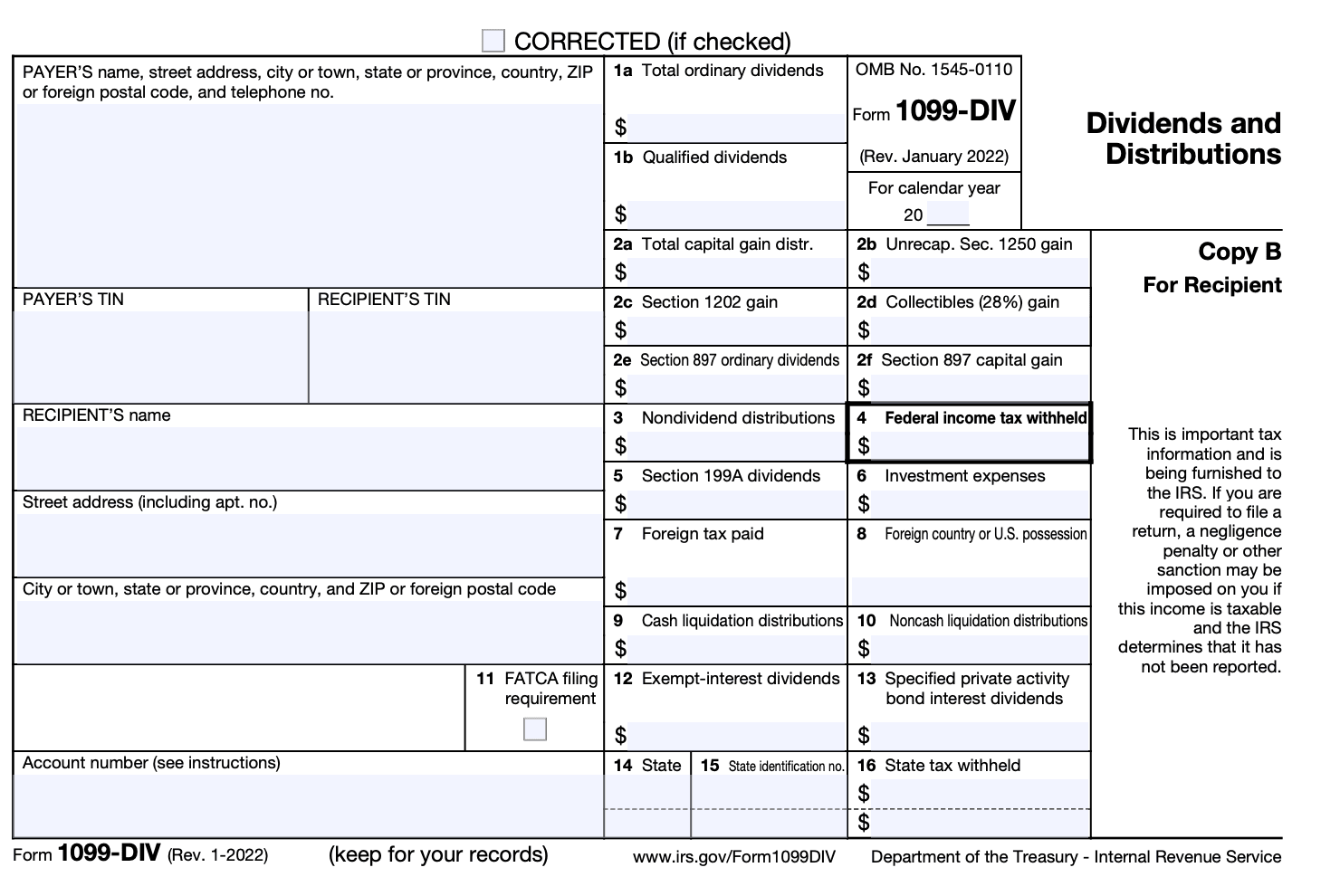

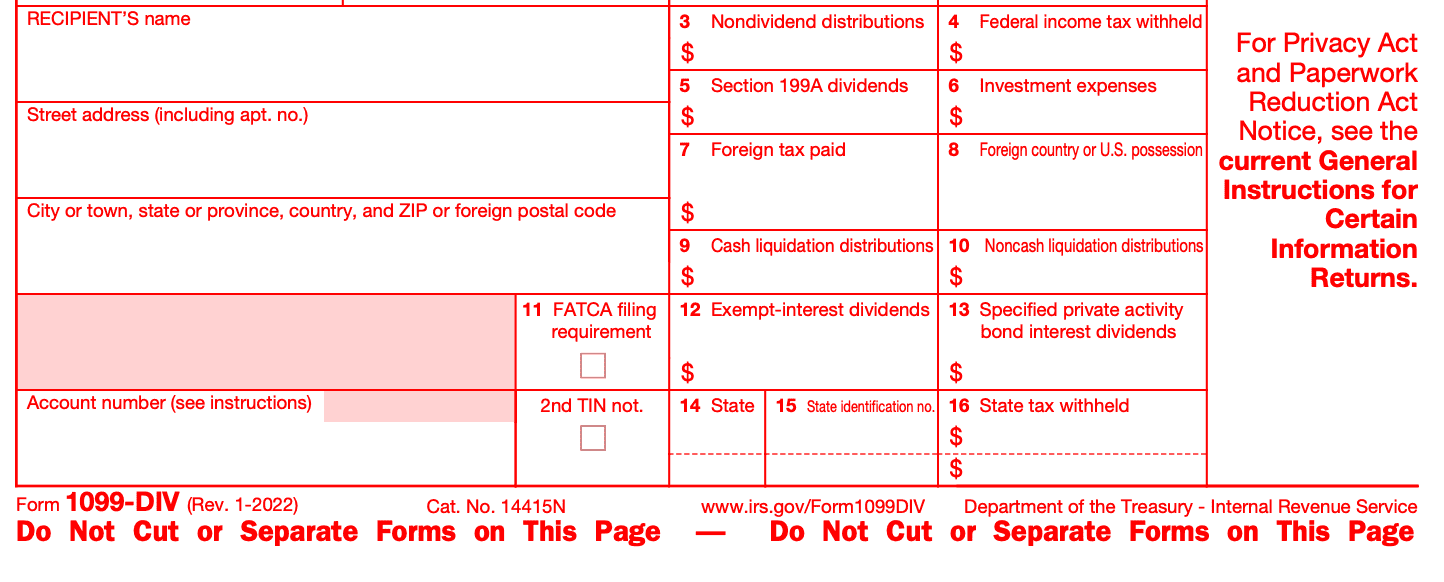

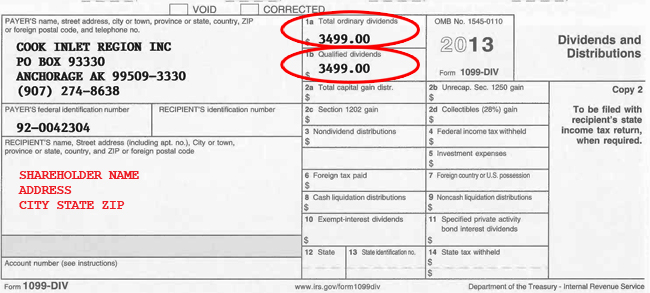

Decoding the 1099-DIV: It's Not as Scary as It Looks!

Okay, let's break down the 1099-DIV. It's not written in a secret code, I promise. Here are a few key boxes to watch out for:

- Box 1a: Total Ordinary Dividends. This is the total amount of your dividends. Plain and simple!

- Box 1b: Qualified Dividends. These are dividends that are taxed at a lower rate than your ordinary income. Score!

- Box 2a: Total Capital Gain Distributions. This shows the total amount of capital gains distributed to you.

- Boxes 2b, 2c, 2d: These break down the capital gains into different categories (like long-term or short-term). Don't worry too much about the details unless you're a tax whiz.

The 1099-DIV also includes other information, like the payer's (NFS) name and address, your name and address, and your tax identification number (usually your Social Security number). Double-check that all this information is correct!

What to Do with Your 1099-DIV

So, you've got your 1099-DIV. Now what? Here's the game plan:

- Double-Check the Numbers: Compare the amounts on the 1099-DIV with your own records. Do they match? If not, contact your broker or NFS to investigate. It's always better to be safe than sorry!

- Report It on Your Taxes: Use the information from the 1099-DIV to complete your tax return. If you're using tax software, it will usually walk you through the process.

- Keep It for Your Records: Store the 1099-DIV with your other tax documents. You never know when you might need it!

If you're feeling overwhelmed, don't hesitate to get help from a qualified tax professional. They can answer your questions and make sure you're filing your taxes correctly.

Fun Facts (Because Why Not?)

- Did you know that the 1099 form series has been around for decades? It's like a financial fossil!

- The IRS probably receives millions of 1099-DIV forms every year. That's a lot of dividends!

- Some people collect vintage 1099 forms. Seriously! There's a collector for everything.

The Big Picture: Why This Matters

Okay, let's zoom out for a second. Understanding your 1099-DIV and how it relates to National Financial Services LLC is all about taking control of your financial life. It's about knowing where your money is, how it's growing (or not!), and how it's being taxed.

It empowers you to make informed decisions about your investments and plan for your future. Plus, it helps you avoid any unpleasant surprises from the IRS. And who wants those?

So, the next time you receive a 1099-DIV from National Financial Services LLC, don't just toss it in a drawer. Take a few minutes to understand it. You might just learn something new about your investments – and yourself!

And remember, managing your finances can be a fun and rewarding experience. Embrace the challenge, ask questions, and don't be afraid to seek help when you need it. You've got this!

Disclaimer

I am an AI chatbot and cannot provide financial or tax advice. This article is for informational purposes only. Consult with a qualified professional before making any financial decisions.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png)

:max_bytes(150000):strip_icc()/Form10994.02.42PM-e20cc398bd144533a948802c6da25ea5.jpg)