Okay, let's talk about something that sounds super boring: expense ratios. But trust me, it's important, especially if you're trying to make your money grow without, you know, accidentally shrinking it. We're diving into net expense ratio vs. gross expense ratio. Think of it as the difference between the price tag and the actual amount you end up paying after all those sneaky "convenience" fees. Sound familiar? We've all been there!

Imagine you're buying a suspiciously cheap airline ticket. It says "$50!" Wow, bargain! But then you click through, and BAM! Suddenly, there's a baggage fee, a seat selection fee (because apparently breathing near a window is a premium experience), a fuel surcharge (even though planes have been using fuel for, like, forever), and a "breathing air" fee (okay, I made that one up, but you get the idea). That initial $50 is the net expense ratio – the advertised, low-ball price. The final amount you pay, including all those added fees, is the gross expense ratio. Annoying, right? Well, expense ratios in investing can be similar, just slightly less… blatant.

What Exactly *Are* Expense Ratios, Anyway?

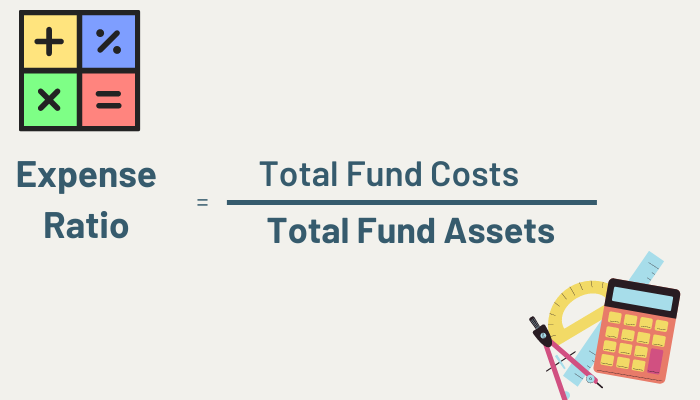

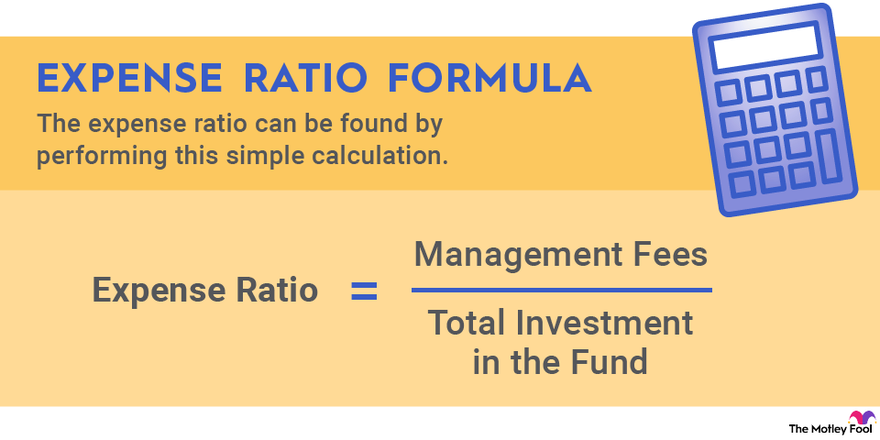

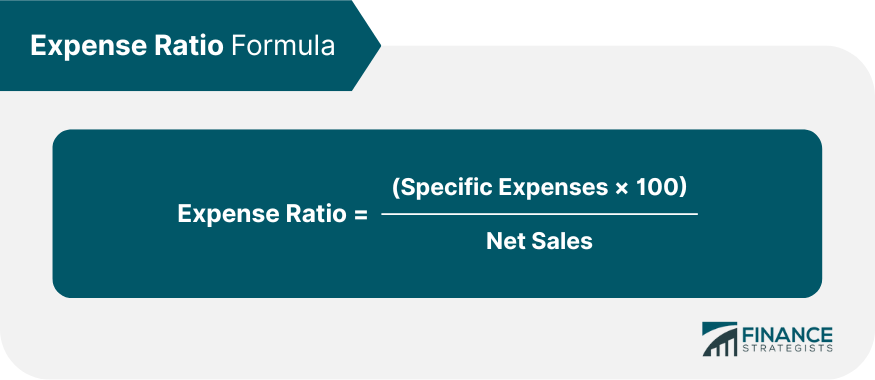

First things first: what are these expense ratio things in the first place? Simply put, it's the percentage of your investment that goes towards covering the fund's operating expenses. Think of it as the cost of keeping the lights on at Fund Central. They need to pay the fund manager, the analysts who pick the stocks (hopefully good ones!), the folks who handle the paperwork (so many forms!), and all the other behind-the-scenes people who make the magic (or sometimes, the not-so-magic) happen.

It's expressed as a percentage. So, an expense ratio of 0.50% means that for every $100 you have invested in the fund, $0.50 goes towards these operating expenses. Seems small, right? But it adds up over time. Think of it like that daily latte you swear you can't live without. Each one is only a few bucks, but by the end of the year, you've spent enough to buy a small island (okay, maybe a really nice inflatable pool, but still!).

Net Expense Ratio: The "On Sale" Price

The net expense ratio is the current expense ratio that investors are actually paying. This is usually lower than the gross expense ratio because it reflects any temporary fee waivers or expense reimbursements that the fund manager is currently offering. Think of it as a limited-time offer, a "buy one, get one half off" deal on fund management. The fund company might temporarily eat some of the costs to attract investors, especially when a fund is new or struggling.

Here's a relatable scenario: You see a sign for "20% off all sweaters!" That's the net expense ratio equivalent. It sounds great! You rush in, grab a pile of sweaters, and head to the checkout, expecting a huge discount. That discounted price you pay at the register is like the net expense ratio – what you *actually* pay in the short term.

Gross Expense Ratio: The "Regular" Price

The gross expense ratio, on the other hand, is the maximum expense ratio that the fund *could* charge. This is the "sticker price" before any waivers or reimbursements are applied. It represents the total cost of running the fund if the fund company decided to stop offering those temporary discounts. It's like the sweater's original price before the sale – the price you'll potentially pay once the "limited-time offer" expires.

Using our sweater analogy, the gross expense ratio is like the regular price tag on that sweater before the 20% discount. It's what you'd pay if you walked in on a day when there wasn't a sale. It's good to know because it gives you a sense of how much the fund *could* cost you in the future.

Why Does This Even Matter? (The "So What?" Moment)

Okay, so you know the difference. But why should you care? Well, imagine you're choosing between two similar funds. They both invest in the same types of companies and have similar performance histories. But one has a net expense ratio of 0.20% and a gross expense ratio of 0.50%, while the other has a net and gross expense ratio of 0.30%. Which do you choose?

The obvious answer seems to be the one with the 0.20% net expense ratio. But here's the catch: that low rate might not last forever. The fund company could decide to stop waiving fees, and suddenly, you're paying 0.50%. The fund with the 0.30% expense ratio, on the other hand, is more transparent and predictable. You know what you're getting, and you can be reasonably confident that the cost won't suddenly jump up.

Think of it like renting an apartment. One apartment building is offering a "move-in special" with a super low rent for the first six months. That's the net expense ratio equivalent. The other building charges a slightly higher rent from the start, but it's guaranteed for the entire year. Which do you choose? The "deal" might seem tempting, but what happens after those six months are up? Will you be hit with a huge rent increase?

The key takeaway is that the net expense ratio can be deceiving. It's important to look at the gross expense ratio as well to get a realistic picture of the fund's potential costs. A low net expense ratio might be a great short-term benefit, but a higher gross expense ratio could mean higher expenses down the road.

How to Find This Information (The Treasure Hunt)

So, where do you find these expense ratios? Don't worry, you don't need to hire a team of financial detectives. The information is usually readily available in the fund's prospectus. The prospectus is like the fund's official rule book – it contains all the important details about the fund, including its investment objectives, risks, expenses, and past performance.

You can usually find the prospectus on the fund company's website or through your brokerage account. Just look for a link that says "Prospectus" or "Fund Documents." Once you open the prospectus, search for "Expense Ratio" or "Fees and Expenses." You should see both the net and gross expense ratios clearly listed.

Also, many financial websites, like Morningstar or Yahoo Finance, provide expense ratio information for mutual funds and ETFs. Just type in the fund's ticker symbol (the short code that identifies the fund), and you should be able to find the expense ratio information in the fund's profile.

Pro Tip: Don't just look at the expense ratios in isolation. Compare them to the expense ratios of similar funds. Are they higher, lower, or about the same? A higher expense ratio doesn't necessarily mean the fund is bad, but it does mean you need to be sure you're getting your money's worth. Maybe the fund has a superior track record or a unique investment strategy that justifies the higher cost.

Beyond the Ratios: Other Things to Consider (The Fine Print)

While expense ratios are important, they're not the only factor to consider when choosing a fund. You also need to think about:

- The Fund's Investment Strategy: Does the fund's investment strategy align with your own investment goals and risk tolerance? Are you looking for growth, income, or a combination of both?

- The Fund's Past Performance: How has the fund performed in the past? Keep in mind that past performance is not necessarily indicative of future results, but it can give you some idea of the fund's potential.

- The Fund Manager's Experience: How long has the fund manager been managing the fund? Do they have a good track record? A skilled and experienced fund manager can make a big difference in a fund's performance.

- Your Own Investment Timeline: How long do you plan to hold the fund? If you're planning to invest for the long term, you might be more willing to pay a slightly higher expense ratio for a fund with a proven track record.

Think of it like buying a car. The price is important, but you also need to consider the car's features, reliability, fuel efficiency, and your own driving needs. You wouldn't buy a sports car if you need to haul kids and groceries, right?

In Conclusion (The "Aha!" Moment)

Understanding the difference between net expense ratio and gross expense ratio is like knowing the difference between the advertised price and the final price with all the hidden fees. It's all about being informed and making smart decisions. By looking at both ratios, you can get a more realistic picture of the fund's potential costs and avoid any nasty surprises down the road.

So, the next time you're shopping for funds, remember our airline ticket and sweater analogies. Don't be fooled by the low initial price. Dig a little deeper, look at the gross expense ratio, and make sure you're getting a good deal in the long run. Your future self will thank you for it! And who knows, maybe you'll even be able to afford that small island after all. Or at least a really fancy espresso machine to fuel your future investment decisions.

Happy investing!

:max_bytes(150000):strip_icc()/gross-expense-ratio.asp_final-0e312f58767e4c2b864004e72620c88b.png)

:max_bytes(150000):strip_icc()/expenseratio-Final-0ec56abb4fde4c30a850007d090f24d0.jpg)