New York Income Allocation for Non-Residents

New York State taxes income earned by both residents and non-residents. However, for non-residents, only income derived from New York sources is subject to New York income tax. This principle, known as income allocation, is crucial for non-residents to understand and properly apply when filing their New York State income tax return (Form IT-203, Nonresident and Part-Year Resident Income Tax Return).

Determining New York Source Income

The core concept for non-residents is identifying what constitutes "New York source income." This generally includes income earned from:

- Services performed in New York State.

- Property located in New York State.

- A business, trade, or profession carried on in New York State.

This means that if a non-resident physically works in New York, rents out property located in New York, or operates a business located in New York, the income generated from those activities is typically considered New York source income.

Specific Income Categories and Allocation Rules

Different types of income are subject to specific allocation rules. Understanding these rules is essential for accurate tax reporting.

Wages, Salaries, and Tips

Wages, salaries, and tips are allocated based on the number of days worked in New York State compared to the total number of days worked everywhere. If a non-resident works both inside and outside of New York, a fraction is calculated representing the portion of workdays spent in New York. This fraction is then applied to the total wages, salaries, and tips to determine the New York source income.

For example, if a non-resident earned $100,000 and worked 100 days in New York and 200 days outside of New York, the New York allocation percentage would be 100/300, or 33.33%. The New York source income would be $33,333 ($100,000 * 0.3333).

Business Income

Income from a business, trade, or profession is allocated based on various factors, often using a business allocation percentage (BAP). The BAP is determined by considering factors such as:

- Property located in New York State compared to property located everywhere.

- Payroll in New York State compared to payroll everywhere.

- Sales in New York State compared to sales everywhere.

The specific formula for calculating the BAP depends on the industry and the nature of the business. New York State Department of Taxation and Finance provides detailed guidance on calculating the BAP in Publication 15, A Guide to Sales Tax in New York State. This publication, while focusing on sales tax, provides insights into the apportionment methodologies that can be relevant for income tax purposes as well, particularly for businesses with substantial sales activities.

Rental Income

Rental income is allocated based on the location of the property. If the rental property is located in New York State, the rental income is considered New York source income.

Capital Gains and Losses

Capital gains and losses are generally allocated based on the location where the property generating the gain or loss is located. For example, gains from the sale of real estate located in New York are allocated to New York.

Interest and Dividends

Interest and dividends are typically not considered New York source income unless they are derived from a business, trade, or profession carried on in New York State. Simple investment income is usually not taxable for non-residents in New York.

Telecommuting and Convenience Rule

A particularly complex area involves telecommuting. New York has a "convenience of the employer" rule, which states that if a non-resident employee works from home outside of New York for their own convenience (rather than because the employer requires it), their days working from home are generally considered New York workdays.

This rule can significantly impact the allocation of income for non-residents who telecommute for New York-based employers. It is crucial to carefully consider whether the telecommuting arrangement is for the employee's convenience or the employer's necessity. Substantiating the employer's requirement is key to avoid unexpected New York tax liabilities.

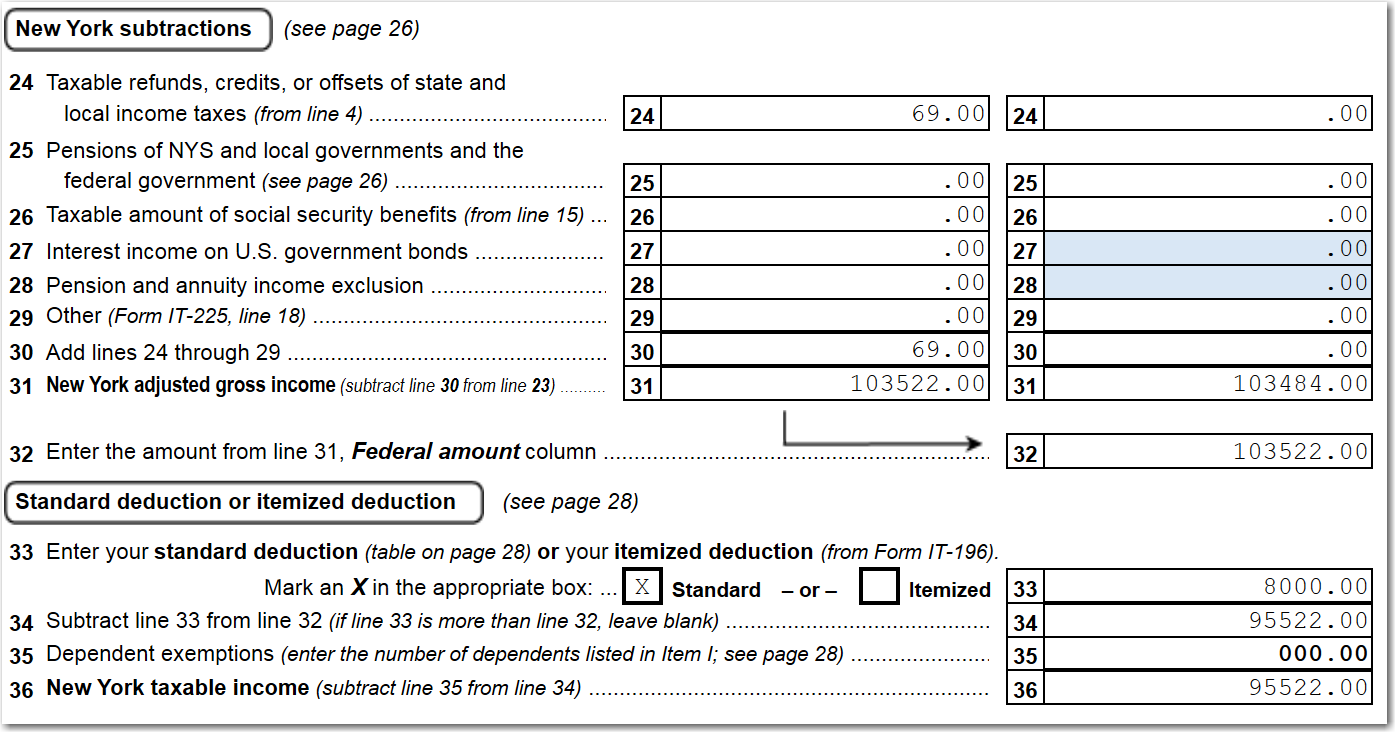

Form IT-203: Nonresident and Part-Year Resident Income Tax Return

Non-residents use Form IT-203 to report their New York source income and calculate their New York income tax liability. The form requires detailed information about the taxpayer's income, deductions, and allocation percentages.

Schedule A of Form IT-203 is where non-residents report and allocate their income. It requires listing each item of income and specifying the amount earned in New York State.

It's important to note that non-residents are only taxed on their New York source income, but they may still be subject to tax in their state of residence. Many states offer a credit for taxes paid to other states to avoid double taxation.

Deductions and Credits

Non-residents are generally allowed to deduct expenses related to their New York source income. These deductions are often subject to allocation, similar to income. For example, if a non-resident incurs business expenses related to their work in New York, they can deduct a portion of those expenses based on the percentage of their business conducted in New York.

Certain New York State tax credits may also be available to non-residents, but eligibility depends on specific criteria and the nature of the credit. Reviewing the instructions for Form IT-203 is essential to identify any applicable credits.

Record Keeping

Maintaining accurate records is crucial for non-residents to support their income allocation calculations. This includes:

- Records of wages, salaries, and tips.

- Documentation of workdays spent in New York State and outside of New York State.

- Financial statements for businesses conducted in New York State.

- Records of rental income and expenses for properties located in New York State.

Adequate documentation can help substantiate the non-resident's tax position in case of an audit.

Seeking Professional Advice

New York income allocation rules for non-residents can be complex, especially when dealing with intricate business structures or telecommuting arrangements. Consulting with a qualified tax professional is highly recommended to ensure accurate tax reporting and compliance with New York tax laws. A tax advisor can help navigate the complexities of income allocation, identify applicable deductions and credits, and minimize potential tax liabilities.

Key Takeaways for New York Non-Resident Income Allocation

Here's a summary of the important points to remember:

- Taxable Income: Only income derived from New York sources is taxable for non-residents.

- Allocation is Key: Correctly allocating income based on specific rules is vital for accurate tax reporting.

- Convenience Rule: The "convenience of the employer" rule can significantly impact telecommuters.

- Form IT-203: Use Form IT-203 to report New York source income.

- Record Keeping: Maintain thorough records to support your allocation calculations.

- Seek Advice: Consider consulting a tax professional for complex situations.

Understanding these points will enable non-residents to better manage their New York State income tax obligations.