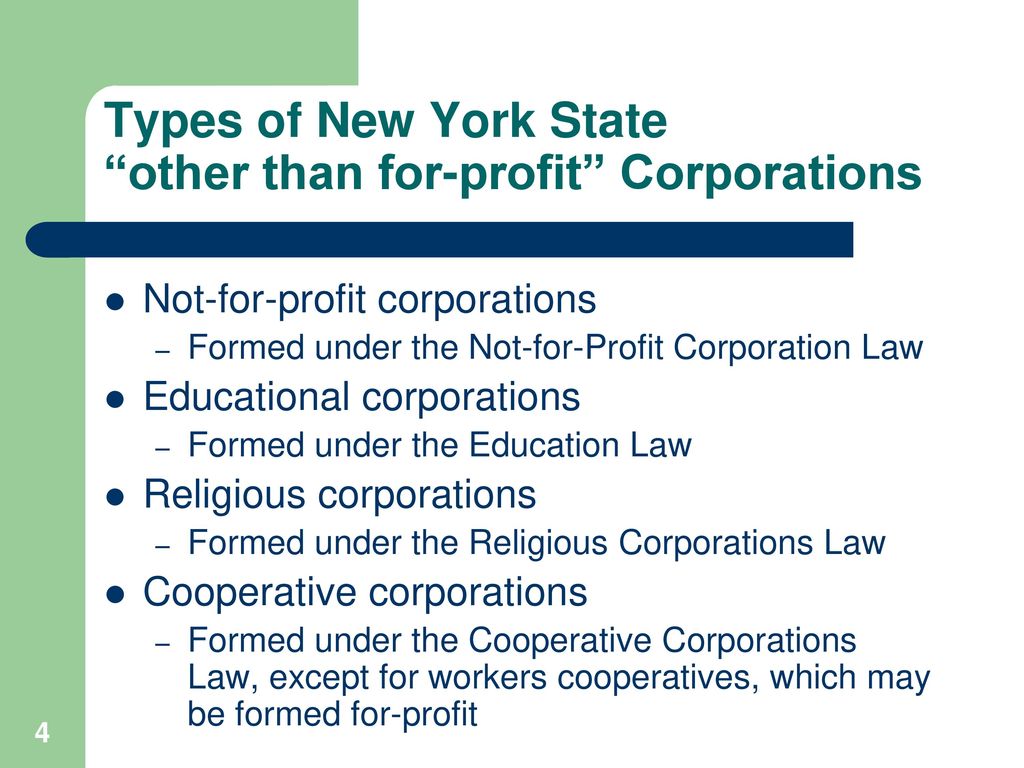

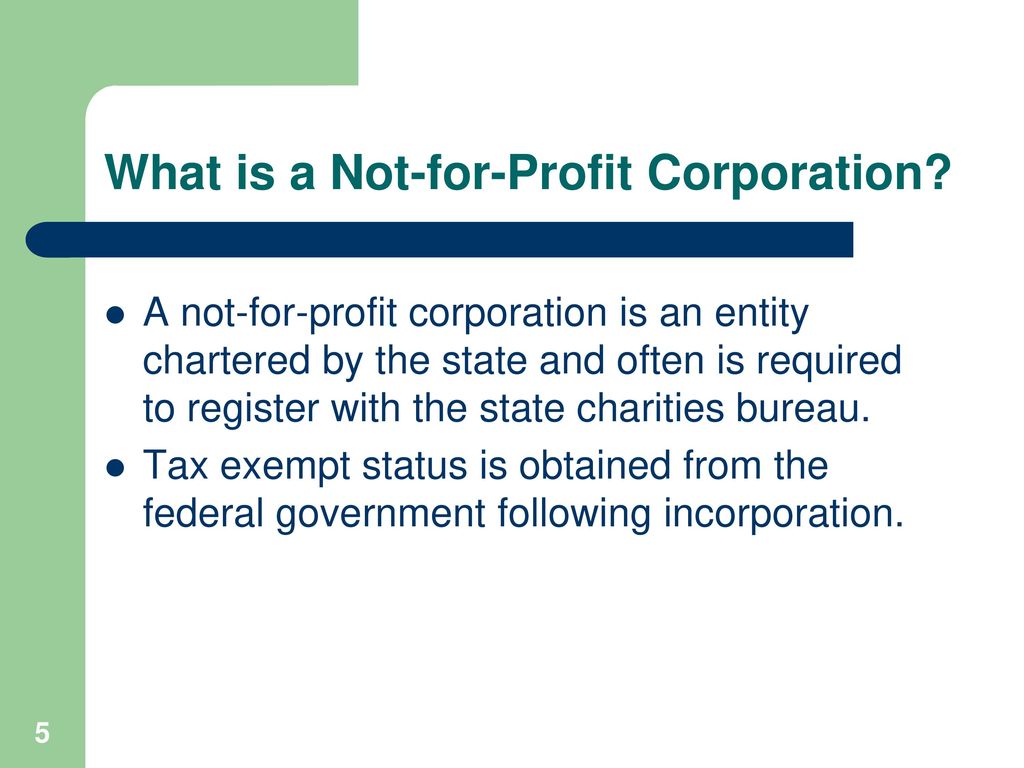

The New York Not-for-Profit Corporation Law (NPCL) governs the formation, operation, and dissolution of not-for-profit corporations within the state of New York. Understanding this law is crucial for individuals and groups seeking to establish and manage organizations dedicated to charitable, educational, religious, scientific, or other non-commercial purposes.

Formation of a Not-for-Profit Corporation

The process of forming a not-for-profit corporation in New York involves several key steps. These steps ensure compliance with state regulations and establish the legal framework for the organization's activities.

1. Choosing a Corporate Name

The first step is selecting a name for the corporation. The NPCL outlines specific requirements for corporate names. The name must be distinguishable from existing corporations, both for-profit and not-for-profit, registered with the New York Department of State. It also cannot contain certain words or phrases that imply a connection with government agencies or regulated industries without proper authorization. A name search can be conducted through the Department of State's website to check for availability. For example, if you're starting a local animal shelter, "Happy Paws Shelter Inc." might be a suitable name, assuming it is not already in use.

2. Drafting the Certificate of Incorporation

The Certificate of Incorporation is the foundational document that officially establishes the not-for-profit corporation. This document must include several key elements:

- Name of the corporation: As selected in the previous step.

- Purpose clause: A clear and concise statement of the corporation's mission and objectives. This clause defines the scope of the organization's activities. For example, a purpose clause might state: "The corporation is organized exclusively for charitable purposes, specifically to provide educational programs and resources to underprivileged children in New York City."

- Type of corporation: The NPCL defines different types of not-for-profit corporations, such as Type A, Type B, Type C, and Type D. The appropriate type depends on the organization's specific purposes. Type B corporations, for instance, are primarily formed for charitable or educational purposes.

- Registered agent: The name and address of the individual or entity designated to receive legal notices on behalf of the corporation.

- Statement regarding distribution of assets upon dissolution: This specifies that upon dissolution, any remaining assets will be distributed to another not-for-profit organization with similar purposes. This clause ensures that the organization's assets continue to serve the public good even after it ceases to exist.

- Signatures of incorporators: The Certificate of Incorporation must be signed by at least one incorporator, who can be an individual or another entity.

3. Filing the Certificate of Incorporation

Once the Certificate of Incorporation is drafted and signed, it must be filed with the New York Department of State, along with the required filing fee. The Department of State reviews the document to ensure compliance with the NPCL. If approved, the Department issues a certificate of incorporation, officially recognizing the existence of the not-for-profit corporation.

4. Obtaining Federal Tax Exemption (Optional but Recommended)

While not required by the NPCL, most not-for-profit corporations seek federal tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This status allows the organization to receive tax-deductible contributions and exempts it from federal income tax. To obtain 501(c)(3) status, the corporation must apply to the Internal Revenue Service (IRS) by filing Form 1023. The IRS reviews the application to ensure that the organization meets the requirements for tax exemption.

5. Establishing Bylaws

Bylaws are the internal rules that govern the operation of the not-for-profit corporation. They outline the roles and responsibilities of the board of directors, the procedures for holding meetings, the voting rights of members (if applicable), and other essential aspects of the organization's governance. The bylaws should be consistent with the Certificate of Incorporation and the NPCL. For example, the bylaws might specify the quorum requirements for board meetings or the process for electing officers.

Operation of a Not-for-Profit Corporation

After formation, the not-for-profit corporation must comply with ongoing requirements under the NPCL to maintain its legal standing.

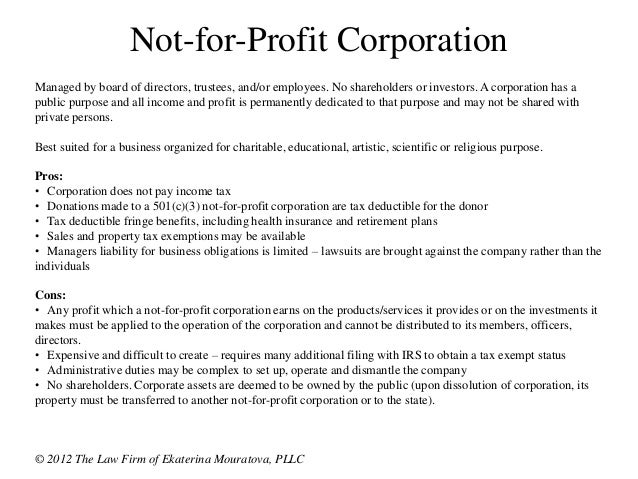

1. Board of Directors

The board of directors is responsible for overseeing the management and activities of the corporation. Directors have a fiduciary duty to act in the best interests of the organization. This duty includes exercising reasonable care, loyalty, and obedience. The NPCL specifies the minimum number of directors required for different types of not-for-profit corporations. The board is responsible for setting policies, approving budgets, and ensuring compliance with applicable laws and regulations. They should meet regularly and keep minutes of their meetings.

2. Membership (If Applicable)

Some not-for-profit corporations have members who have certain rights and responsibilities, such as voting for directors. The NPCL outlines the requirements for membership, including eligibility criteria, voting rights, and procedures for admitting and removing members. If the corporation has members, it must hold regular meetings and provide members with notice of these meetings.

3. Financial Reporting

Not-for-profit corporations are required to maintain accurate financial records and file annual reports with the New York Attorney General's Charities Bureau. These reports provide transparency about the organization's finances and activities. The specific reporting requirements depend on the organization's size and revenue. Larger organizations may be required to undergo an independent audit.

4. Compliance with Laws and Regulations

Not-for-profit corporations must comply with all applicable federal, state, and local laws and regulations. This includes laws relating to fundraising, employment, and contracts. Failure to comply with these laws can result in penalties, including fines and the loss of tax-exempt status.

Dissolution of a Not-for-Profit Corporation

When a not-for-profit corporation ceases to operate, it must be formally dissolved in accordance with the NPCL. The dissolution process involves several steps:

1. Board Approval

The board of directors must approve a plan of dissolution. This plan outlines the procedures for winding up the corporation's affairs, including paying debts and distributing assets.

2. Filing a Certificate of Dissolution

A Certificate of Dissolution must be filed with the New York Department of State. This certificate provides notice that the corporation is dissolving and includes information about the distribution of assets.

3. Distribution of Assets

The NPCL requires that the assets of a dissolving not-for-profit corporation be distributed to another not-for-profit organization with similar purposes. This ensures that the assets continue to serve the public good.

4. Final Reporting

The corporation must file a final report with the New York Attorney General's Charities Bureau, providing details about the dissolution process and the distribution of assets.

Practical Advice and Insights

Navigating the New York Not-for-Profit Corporation Law can be complex. Here are some practical tips:

- Seek Legal Counsel: It is advisable to consult with an attorney experienced in not-for-profit law to ensure compliance with the NPCL and other applicable laws.

- Maintain Accurate Records: Keeping accurate financial records and minutes of board meetings is crucial for demonstrating compliance and transparency.

- Stay Informed: Stay up-to-date on changes to the NPCL and other relevant laws and regulations.

- Transparency and Accountability: Operate with transparency and accountability to build trust with donors, members, and the public.

- Understand Fiduciary Duties: Board members should be aware of their fiduciary duties and act in the best interests of the organization.

By understanding and complying with the New York Not-for-Profit Corporation Law, individuals and groups can effectively establish and manage organizations that serve the public good and contribute to the well-being of their communities. This knowledge empowers individuals to participate meaningfully in the not-for-profit sector and ensures that these vital organizations operate with integrity and accountability.