Navigating the world of auto insurance can be complex, particularly when attempting to decipher the various discounts available. In New York State, numerous discounts can significantly reduce your premium. This article provides a comprehensive overview of these discounts, offering a structured approach to understanding eligibility and maximizing savings.

Understanding New York State Auto Insurance Discounts

Auto insurance discounts are reductions in your premium offered by insurance companies. These discounts are designed to reward drivers who exhibit responsible behavior, possess specific affiliations, or meet certain criteria. By understanding and qualifying for these discounts, New York State residents can substantially lower their insurance costs.

Defensive Driving Course Discount

One of the most common and accessible discounts is the defensive driving course discount. This discount is available to drivers who complete an approved defensive driving course. Upon completion, drivers are eligible for a mandatory 10% reduction in their auto insurance premium for three years and a four-point reduction on their driving record.

Example: If your annual premium is $1,500, a 10% discount would save you $150 per year.

Eligibility: To be eligible, you must successfully complete a New York State Department of Motor Vehicles (DMV)-approved defensive driving course. These courses are offered both online and in-person. Upon completion, you will receive a certificate that you must provide to your insurance company.

Multi-Car Discount

If you insure more than one vehicle with the same insurance company, you may be eligible for a multi-car discount. This discount recognizes the reduced administrative costs for the insurer associated with managing multiple policies for the same household.

Example: If you insure two cars with the same company, you could save 10-25% on each vehicle's premium.

Eligibility: The requirements vary by insurer, but generally, the vehicles must be registered to individuals residing at the same address. Family members who live in the same household can often combine their policies to qualify.

Multi-Policy Discount (Bundling)

Similar to the multi-car discount, a multi-policy discount, often referred to as bundling, is available when you purchase multiple insurance policies from the same company. This typically involves combining your auto insurance with homeowners, renters, or life insurance policies.

Example: Bundling your auto and homeowners insurance could result in savings of 5-15% on each policy.

Eligibility: To qualify, you must hold at least two different types of insurance policies with the same insurer. The specific savings vary depending on the insurance company and the policies bundled.

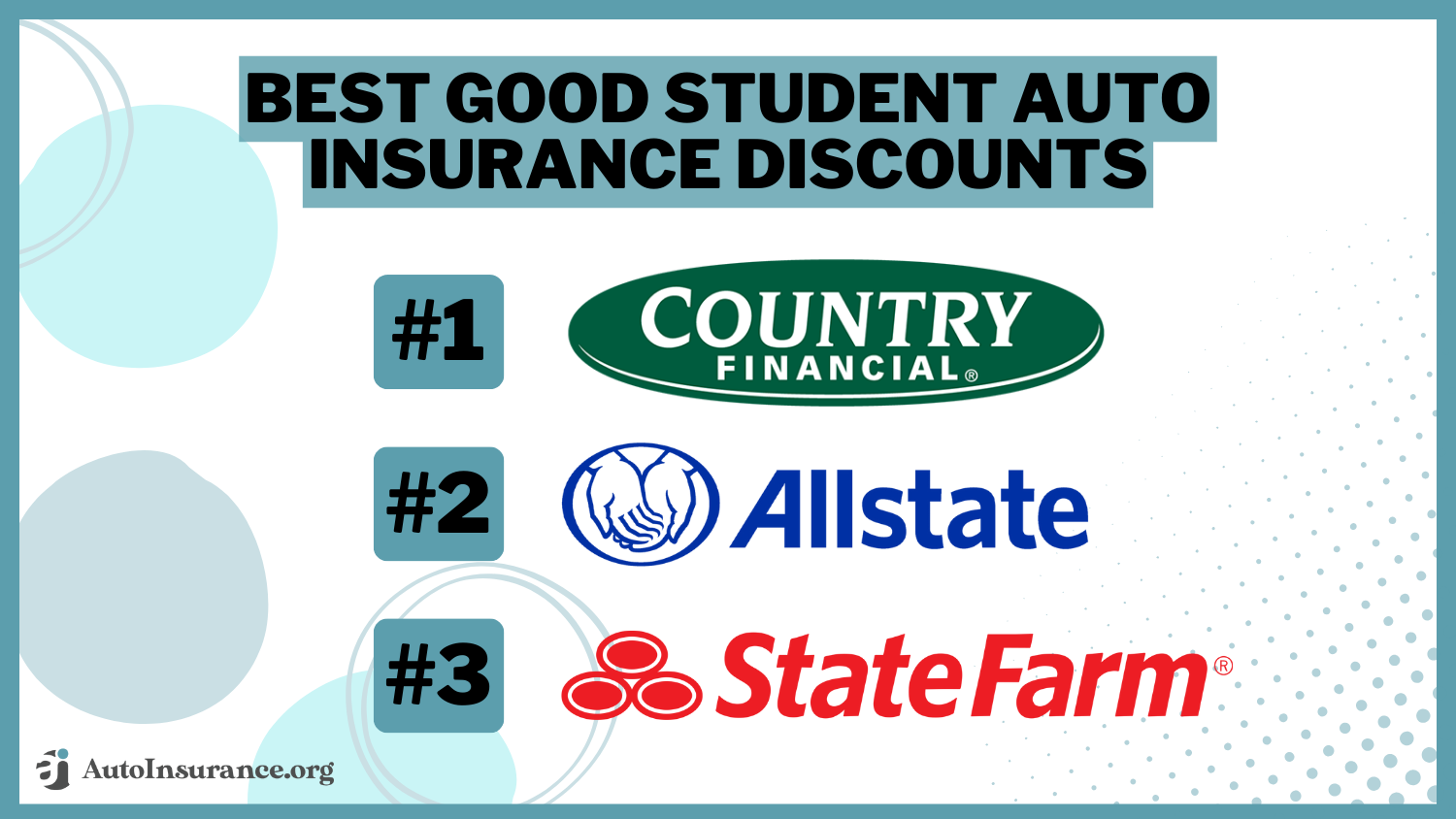

Good Student Discount

Young drivers often face higher insurance rates due to their relative inexperience. However, many insurers offer a good student discount to incentivize academic excellence. This discount recognizes that students who perform well academically are often more responsible and less likely to be involved in accidents.

Example: A student maintaining a "B" average or higher may qualify for a 10-25% discount on their auto insurance premium.

Eligibility: The specific criteria vary, but generally, students must be enrolled full-time in high school or college and maintain a minimum GPA of 3.0 (or equivalent). Proof of academic performance, such as a transcript, is usually required.

Anti-Theft Device Discount

Vehicles equipped with anti-theft devices are less likely to be stolen, which reduces the insurer's risk. As a result, many insurance companies offer discounts for vehicles equipped with approved anti-theft systems.

Example: Installing a car alarm or a GPS tracking system could lead to a 5-10% discount on your comprehensive coverage.

Eligibility: The type of anti-theft device required to qualify for the discount varies by insurer. Common examples include car alarms, LoJack systems, and VIN etching. Documentation of the device's installation may be required.

Low Mileage Discount

Drivers who drive fewer miles annually are statistically less likely to be involved in accidents. To reflect this lower risk, some insurers offer a low mileage discount. This discount is particularly beneficial for individuals who work from home, use public transportation, or only drive occasionally.

Example: Driving less than 7,500 miles per year could qualify you for a 5-15% discount.

Eligibility: To qualify, you will typically need to provide an estimate of your annual mileage to your insurer. They may require periodic odometer readings to verify your mileage.

Affiliation Discounts

Some insurance companies offer discounts to members of specific organizations, such as professional associations, alumni groups, or employers. These affiliation discounts are often negotiated between the insurance company and the organization to provide preferential rates to its members.

Example: Members of a specific professional association might receive a 5-10% discount on their auto insurance.

Eligibility: You must be a current member in good standing of the eligible organization. Proof of membership is usually required.

Payment Method Discount

Some insurers offer discounts for setting up automatic payments or paying your premium in full. Automatic payments reduce the insurer's administrative costs associated with billing and collections, while paying in full reduces the risk of policy cancellation due to non-payment.

Example: Setting up automatic payments could result in a small discount, such as 1-3% on your premium.

Eligibility: To qualify, you must enroll in automatic payments through your bank account or credit card or pay your annual premium in full at the beginning of the policy period.

Advanced Safety Features Discount

Vehicles equipped with advanced safety features, such as automatic emergency braking, lane departure warning, and blind-spot monitoring, are less likely to be involved in accidents. Insurance companies recognize this reduced risk and offer discounts for vehicles with these features.

Example: Owning a vehicle with automatic emergency braking could earn you a 5-10% discount.

Eligibility: The specific safety features required to qualify vary by insurer. You may need to provide documentation demonstrating that your vehicle is equipped with the qualifying features.

Senior Citizen Discount

Many insurance companies offer discounts to senior citizens, recognizing their typically safer driving habits and lower accident rates. The eligibility criteria and discount amounts vary by insurer.

Example: Drivers over the age of 65 may be eligible for a 5-10% discount.

Eligibility: The age requirement typically ranges from 55 to 65, depending on the insurer. A valid driver's license and proof of age are usually required.

Practical Advice and Insights

To maximize your auto insurance savings in New York State, consider the following:

- Shop Around: Obtain quotes from multiple insurance companies to compare rates and discounts.

- Ask Questions: Inquire about all available discounts and the specific eligibility requirements.

- Maintain a Clean Driving Record: Avoid accidents and traffic violations to keep your rates low.

- Improve Your Credit Score: In New York, insurers can use your credit score to determine your rates, so improving your credit can lead to savings.

- Review Your Policy Annually: Re-evaluate your coverage needs and update your information to ensure you are receiving all eligible discounts.

- Consider a Higher Deductible: Increasing your deductible can lower your premium, but ensure you can afford the out-of-pocket expense in the event of an accident.

By understanding the various auto insurance discounts available in New York State and proactively seeking out those for which you are eligible, you can significantly reduce your insurance costs and ensure you are getting the best possible value for your money. Regularly reviewing your policy and exploring different options can lead to substantial long-term savings.

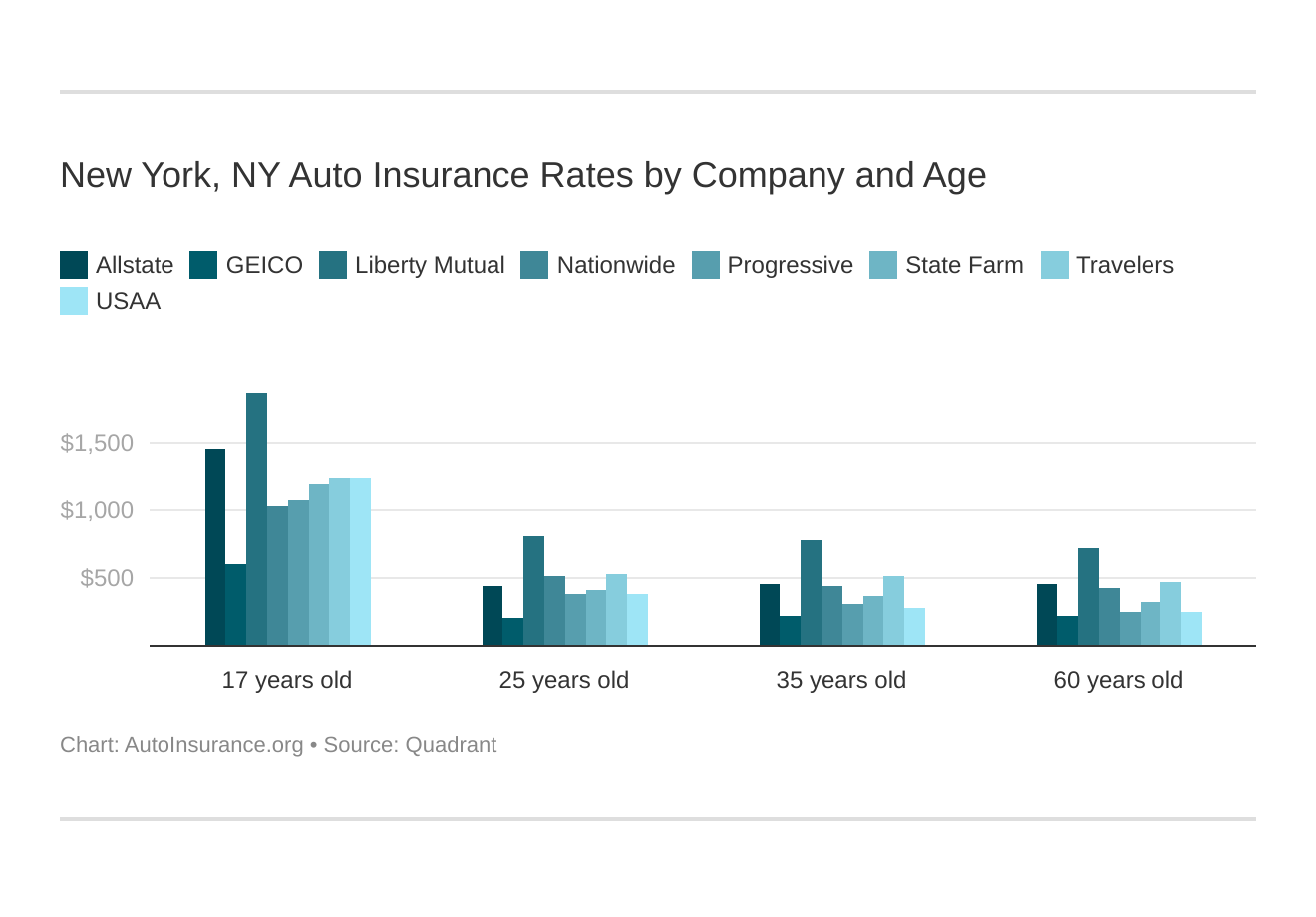

![New York Auto Insurance [Rates + Cheap Coverage Guide] | AutoInsurance.org - New York State Auto Insurance Discounts](https://www.autoinsurance.org/wp-content/uploads/dw/new-york-auto-insurance-rates-by-company-vs-state-average-nQLAH.png)