Hey there! Ever feel like your paycheck vanishes faster than a slice of pizza in Times Square? Yeah, me too. But guess what? New York State has a little secret weapon to help you stash away some cash for the future. It's called the New York State Tax Deferred Compensation Plan, or NYS Deferred Comp for short. Sounds kinda boring, right? Wrong! It's actually kinda… awesome.

Think of it like this: it's your own personal money-saving time machine. You put money in now, and it grows tax-free until you need it later. Like, retirement later. Beach-sipping-margaritas later. You get the idea.

So, What’s the Deal with Deferred Comp?

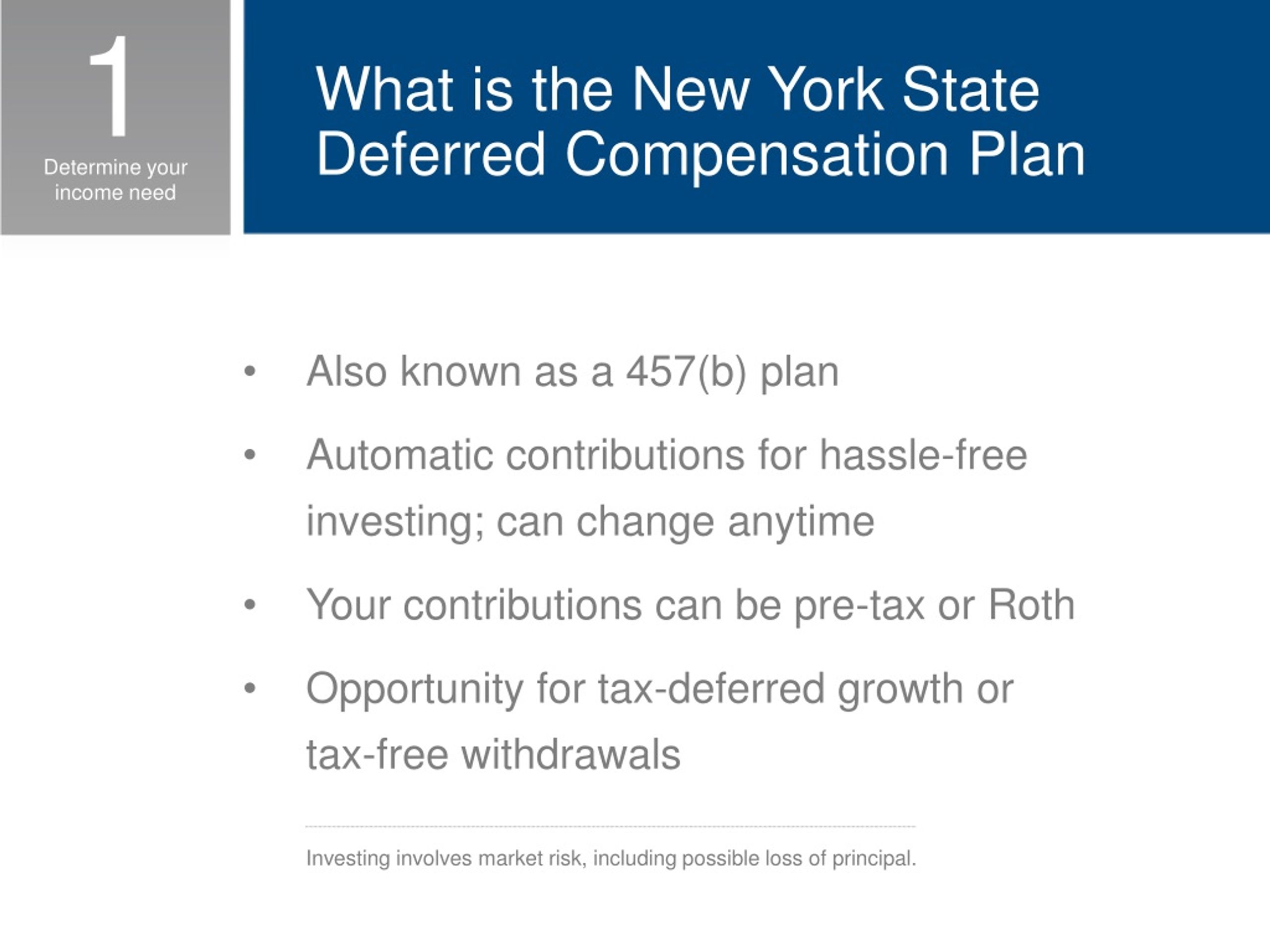

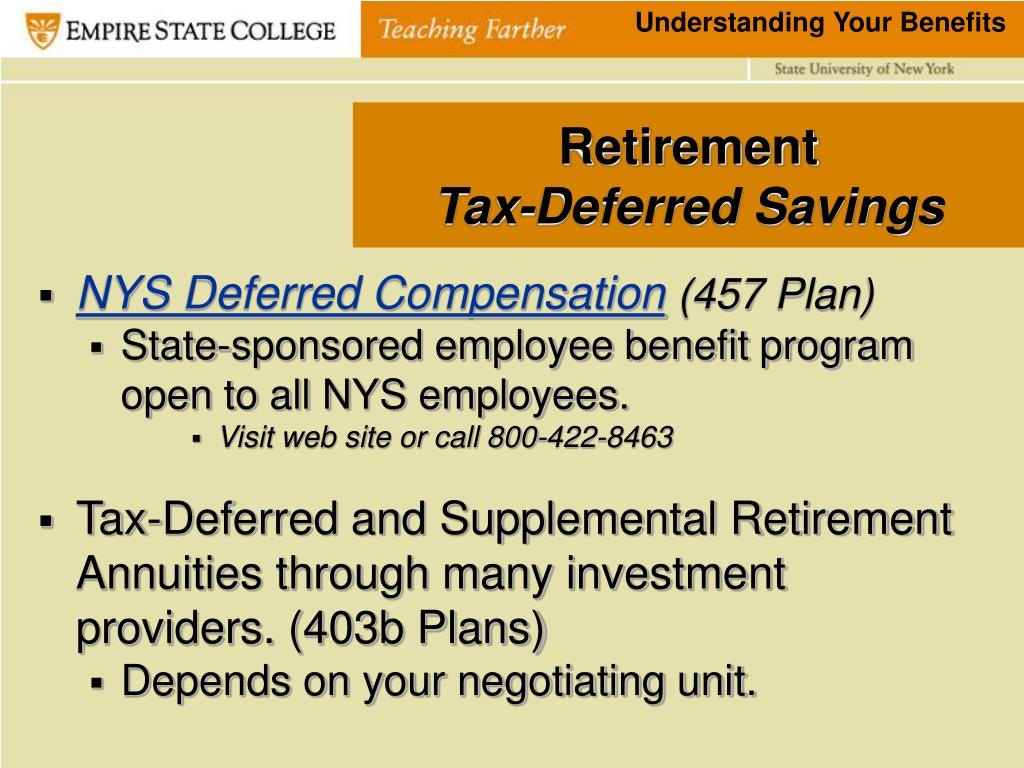

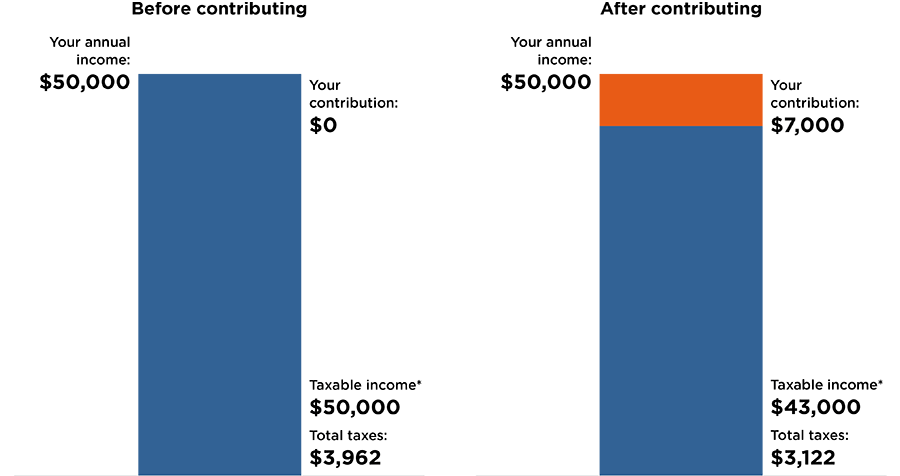

Okay, let’s break it down. The NYS Deferred Comp is basically a retirement savings plan offered to New York State employees. Think of it as a 457(b) plan, which is a cousin to the more famous 401(k). But with a twist! It lets you squirrel away pre-tax dollars, meaning you pay less in taxes now. Boom! More money in your pocket... that you then put away. It's a virtuous cycle, really.

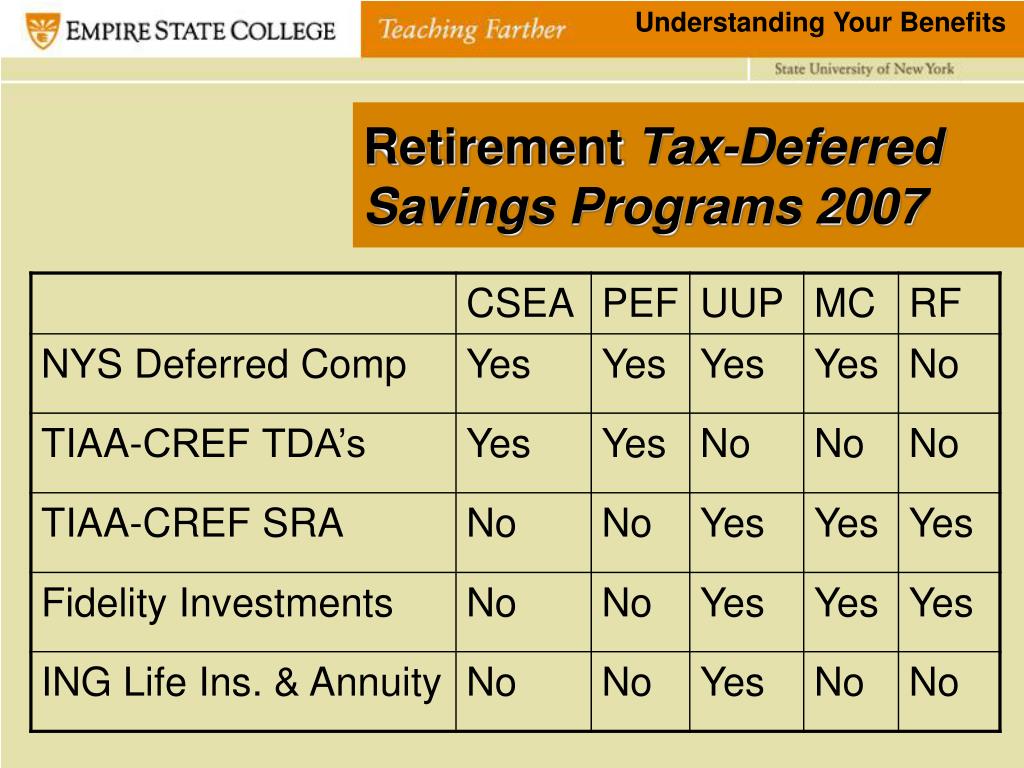

It's not just for state employees though! Many local government and public organizations offer it too. Teachers, firefighters, librarians – you name it. If you work for a public entity in New York, there's a good chance you can participate.

Why is it called "Deferred Compensation?"

Good question! Because you're *deferring* your compensation. You're delaying receiving a portion of your salary until retirement. It's like telling your paycheck, "Hey, I'll see you in 30 years! Don't spend it all at once!" And the best part? The government says, "Okay, we won't tax that money now." Score!

The Nitty-Gritty (But Still Fun!) Details

Alright, let's get down to brass tacks, but we'll keep it light. Trust me.

Contribution Limits: The IRS sets limits on how much you can contribute each year. It changes, so always check the latest guidelines. But generally, it's a pretty generous amount. Think of it as a challenge! Can you max it out? Probably not. But every little bit helps, right?

Investment Options: NYS Deferred Comp offers a variety of investment options, from conservative bond funds to more aggressive stock funds. It’s like a buffet of financial choices! Don’t know where to start? That’s okay! They have resources to help you figure out what’s right for your risk tolerance. Think of it as choosing between vanilla and rocky road – both are ice cream, but they're very different experiences. And remember, past performance is never a guarantee of future success. It’s just a suggestion, really. Like that fortune cookie you got last week.

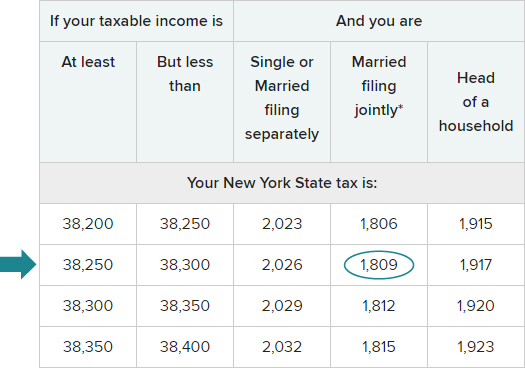

Taxes, Taxes, Taxes: Here's where it gets really cool. You don’t pay taxes on the money you contribute, or on the earnings it generates, until you withdraw it in retirement. It's like a magical tax-free bubble. The downside? When you *do* take the money out, it's taxed as ordinary income. But hey, hopefully, you'll be in a lower tax bracket by then, relaxing on that beach, and it won't sting so much.

Catch-Up Contributions

Feeling like you’re behind? Don’t sweat it! If you're nearing retirement age, NYS Deferred Comp offers catch-up contributions. These allow you to contribute even more than the regular limit for a few years. It's like a financial power-up to help you reach your retirement goals faster. Think of it as extra credit in the game of life.

Also, the last three years before the eligible retirement age, you might be able to defer even *more*. It's like saying to your younger self, "Thanks for slacking! I got this!"

Why Bother? (Seriously, Why?)

Okay, let’s be real. Retirement seems like a million years away. Why worry about it now? Well, here’s the thing: time is your best friend when it comes to investing. The sooner you start, the more time your money has to grow. It’s the magic of compound interest. It's like planting a tiny seed and watching it grow into a giant money tree (metaphorically, of course. Don't try planting dollar bills). Plus, there are other perks:

- Tax Benefits: Who doesn’t love saving on taxes? Deferring taxes now means more money in your pocket today and more money growing for your future.

- Portability: If you leave your job, you can usually roll your Deferred Comp account into another retirement account, like an IRA or another employer’s plan. It’s like taking your financial baggage with you.

- Convenience: Contributions are automatically deducted from your paycheck, so you don’t even have to think about it. It’s like setting up automatic bill pay, but for your future self.

Is it Right for You?

Only you can answer that. But here are a few things to consider:

- Are you eligible? Check with your employer to see if they offer NYS Deferred Comp.

- Can you afford it? Even a small contribution can make a big difference over time. Start small and increase your contributions as you can.

- Are you comfortable with investing? Do your research and choose investment options that align with your risk tolerance and financial goals.

Important Disclaimer: I am *not* a financial advisor. This is just a fun chat about a financial topic. Always consult with a qualified professional before making any investment decisions. They can help you create a personalized plan that’s right for you.

Fun Facts (Because Why Not?)

Okay, here are some random, potentially useless, but hopefully amusing facts:

- Did you know that the idea of deferred compensation has been around for centuries? Ancient Romans used to defer payments to soldiers until after they retired from service. Talk about a long-term investment!

- The first modern 457(b) plans (the cousins of NYS Deferred Comp) were created in the 1970s. They were designed to help public sector employees save for retirement.

- There are people whose job it is to literally manage billions of dollars in deferred compensation funds. Imagine the pressure! They're probably really good at Jenga.

In Conclusion (and Yes, We’re Almost Done!)

NYS Deferred Comp might not be the most exciting topic in the world, but it’s a powerful tool that can help you build a more secure financial future. So, do some research, talk to a financial advisor, and see if it’s right for you. And remember, even if retirement seems far away, it’s never too early to start planning. Who knows? Maybe one day you'll be sipping those margaritas on that beach, all thanks to your savvy savings habits. And you can tell all your friends how much fun deferred comp is. They'll love it! (Maybe...)

So there you have it! Now go forth and conquer your financial future! Or, you know, just think about it a little. That's a good start too.