Orange County Trust: A Pillar of Middletown, NY's Financial Landscape

Orange County Trust Company, headquartered in Middletown, New York, has served as a significant financial institution in the region for over a century. Its history, services, and community involvement demonstrate its commitment to the economic well-being of Orange County and the surrounding areas.

Historical Overview and Evolution

Founded in the early 20th century, Orange County Trust’s origins are rooted in the local community's need for a stable and reliable financial partner. From its initial focus on traditional banking services, the institution has adapted and expanded its offerings to meet the evolving needs of its customer base. This adaptation has included embracing technological advancements in banking, expanding its service portfolio, and strategically growing its physical presence within the region.

Over the decades, Orange County Trust has weathered various economic cycles, maintaining a consistent approach to responsible financial management. This commitment to stability has solidified its reputation as a trustworthy and dependable banking partner for individuals, families, and businesses alike.

Core Banking Services

Orange County Trust provides a comprehensive range of banking services catering to diverse financial needs. These services encompass:

- Personal Banking: Checking and savings accounts, mortgage loans, personal loans, and credit cards.

- Business Banking: Commercial loans, lines of credit, treasury management services, and business checking accounts.

- Wealth Management: Investment advisory services, retirement planning, and estate planning.

The bank differentiates itself through personalized customer service, emphasizing relationship-based banking. This approach involves dedicated account managers who work closely with clients to understand their specific financial goals and provide tailored solutions.

Community Involvement and Corporate Social Responsibility

Orange County Trust actively participates in community development initiatives. This involvement includes:

- Supporting local non-profit organizations through grants and sponsorships.

- Providing financial literacy programs to schools and community groups.

- Encouraging employee volunteerism in local initiatives.

The bank's commitment to corporate social responsibility extends beyond financial contributions. Orange County Trust strives to be a responsible corporate citizen by promoting sustainable business practices and contributing to the overall well-being of the communities it serves. For example, Orange County Trust supported the YMCA of Middletown with a generous donation to the YMCA’s annual campaign.1

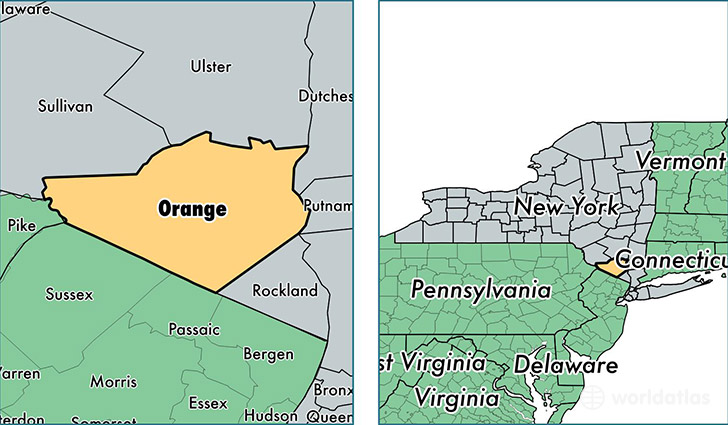

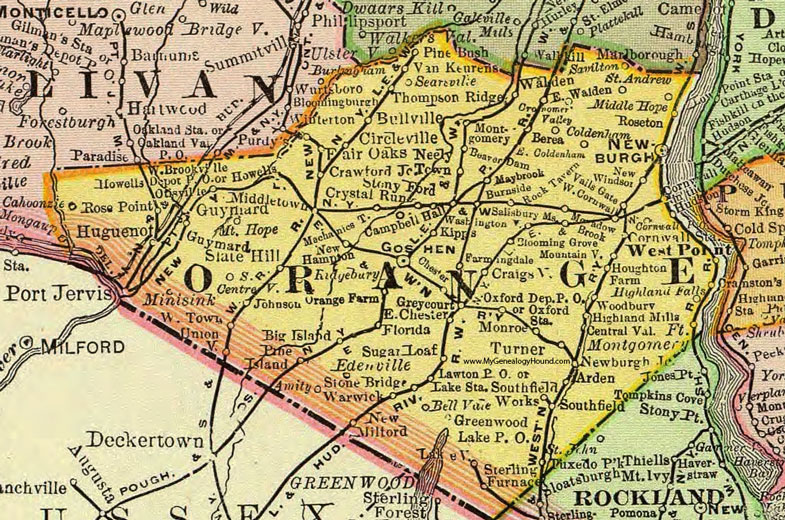

Branch Network and Accessibility

While embracing digital banking solutions, Orange County Trust maintains a network of branch locations throughout Orange County. This physical presence allows customers to access in-person banking services and interact directly with bank representatives. The branches are strategically located to provide convenient access for customers across the region. The bank also invests in online and mobile banking platforms to provide customers with 24/7 access to their accounts and banking services. This multi-channel approach ensures that customers can choose the banking method that best suits their needs.

Financial Performance and Stability

Orange County Trust consistently demonstrates sound financial performance. Publicly available data, such as annual reports and regulatory filings, indicate a strong capital base, healthy asset quality, and consistent profitability.2 This financial stability is a testament to the bank's prudent risk management practices and its commitment to long-term sustainability. Potential customers are encouraged to review the bank's financial statements for a comprehensive understanding of its financial health.

Leadership and Management

The leadership team at Orange County Trust is composed of experienced banking professionals with a deep understanding of the local market. Their expertise in financial management, risk assessment, and customer service guides the bank's strategic direction and ensures its continued success. The management team fosters a culture of integrity, accountability, and customer focus throughout the organization.

Technological Advancements and Innovation

Orange County Trust recognizes the importance of technology in modern banking. The bank has invested in upgrading its technology infrastructure to provide customers with secure and convenient online and mobile banking services. These services include online bill payment, mobile check deposit, and real-time account monitoring. Orange County Trust continues to explore and implement new technologies to enhance the customer experience and improve operational efficiency. This commitment to innovation ensures that the bank remains competitive in the evolving financial landscape.

Competitive Landscape

Orange County Trust operates in a competitive banking market that includes national banks, regional banks, and credit unions. To differentiate itself, Orange County Trust focuses on providing personalized customer service, building strong relationships with its customers, and offering a comprehensive suite of financial products and services. The bank's local roots and community focus provide a distinct advantage in attracting and retaining customers who value a personal banking experience.

Economic Impact on Middletown and Orange County

Orange County Trust plays a vital role in the economic development of Middletown and Orange County. The bank provides financing to local businesses, supporting job creation and economic growth. Its community involvement and charitable contributions further contribute to the well-being of the region. The bank's presence in the community provides a sense of stability and confidence, encouraging investment and economic activity.

Future Outlook and Strategic Goals

Orange County Trust is committed to maintaining its position as a leading financial institution in the region. Its strategic goals include:

- Expanding its market share by attracting new customers and growing its existing customer base.

- Investing in technology to enhance the customer experience and improve operational efficiency.

- Continuing to support community development initiatives and promote economic growth.

- Maintaining a strong financial position and ensuring long-term sustainability.

The bank's leadership team is confident that Orange County Trust is well-positioned to achieve these goals and continue to serve the financial needs of the community for many years to come.

Legal and Regulatory Compliance

Orange County Trust operates under strict regulatory oversight. The bank adheres to all applicable federal and state banking regulations, ensuring the safety and soundness of its operations. Regular audits and examinations are conducted to verify compliance and identify any potential risks. Orange County Trust is committed to maintaining the highest standards of ethical conduct and regulatory compliance.

Customer Satisfaction and Feedback

Orange County Trust places a high priority on customer satisfaction. The bank actively solicits customer feedback through surveys and other channels to identify areas for improvement. Customer complaints are promptly addressed and resolved. Orange County Trust strives to provide a positive banking experience for all of its customers.

Employee Development and Training

Orange County Trust recognizes that its employees are its greatest asset. The bank invests in employee development and training programs to enhance their skills and knowledge. Employees are encouraged to pursue professional certifications and participate in continuing education opportunities. Orange County Trust fosters a supportive and collaborative work environment, promoting employee engagement and retention.

Conclusion: Key Takeaways

Orange County Trust Company stands as a long-standing financial institution with deep roots in Middletown, NY, and the surrounding Orange County region. Key takeaways include:

- Stability and Longevity: Over a century of service demonstrates a proven track record.

- Comprehensive Services: Offers a wide range of banking and wealth management options for individuals and businesses.

- Community Focus: Actively involved in local initiatives and committed to community development.

- Financial Soundness: Demonstrates consistent financial performance and prudent risk management.

- Commitment to Innovation: Continues to invest in technology to enhance the customer experience.

Potential customers are encouraged to conduct their own due diligence and consider Orange County Trust as a viable financial partner based on their individual needs and preferences.

1 Source: YMCA of Middletown Press Release, 2023.

2 Source: FDIC Data & Reports, Orange County Trust Company.