The phrase "packages are looking for funding" signals that entities – often startups or established businesses with distinct projects – are actively seeking capital to support their operational needs, expansion plans, or specific development initiatives. Understanding the nuances of this fundraising process is crucial for both those seeking investment and potential investors evaluating opportunities.

Understanding the Context

When a company or project is described as "looking for funding," it indicates a need for external capital beyond existing revenue streams or internal reserves. This need can arise for various reasons:

- Early-Stage Growth: Startups often require funding to scale their operations, develop their product, or acquire customers.

- Expansion: Established businesses might seek funding to enter new markets, launch new product lines, or increase production capacity.

- Research and Development: Companies involved in innovative technologies or scientific advancements may need funding to support long-term R&D efforts.

- Debt Restructuring: In some cases, funding may be sought to refinance existing debt or improve a company's financial stability.

- Acquisitions: Companies looking to acquire another business may require funding to finance the transaction.

The amount of funding being sought can vary significantly depending on the size and scope of the project. It can range from small seed investments from angel investors or venture capital firms to large-scale funding rounds involving private equity firms or institutional investors.

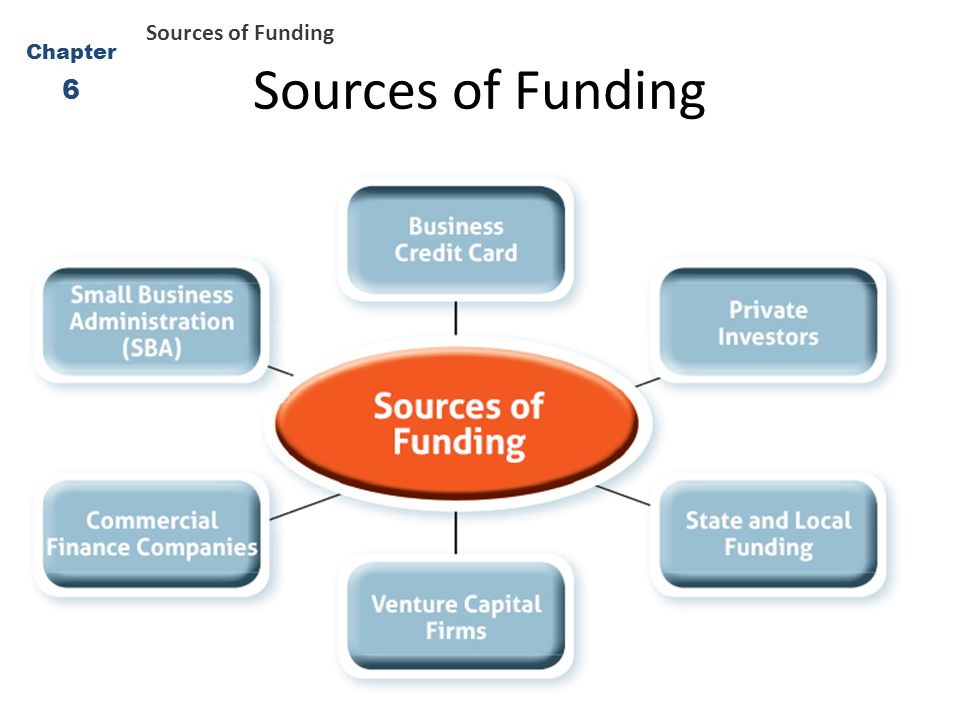

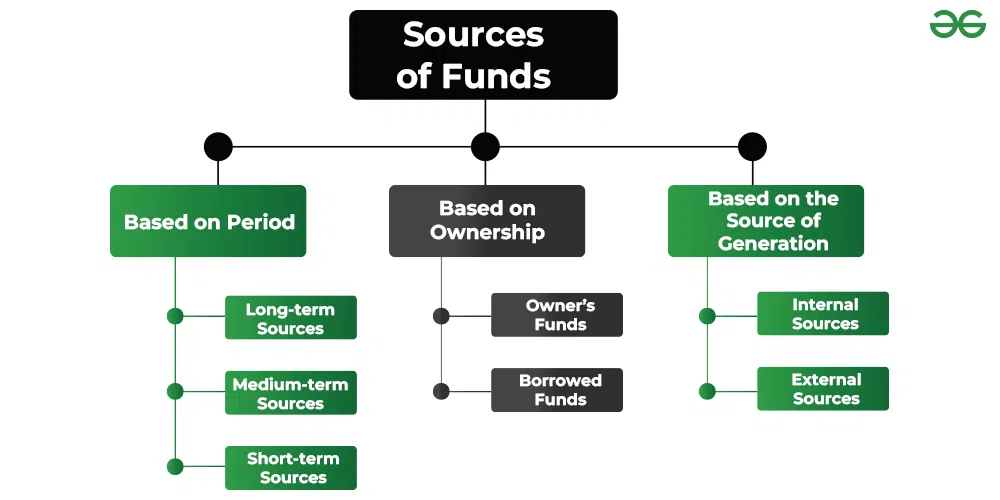

Common Funding Sources

Packages or projects seeking funding have a range of potential sources to explore. These sources differ in terms of the amount of capital they provide, the terms of investment, and the level of involvement they expect in the business.

Angel Investors

Angel investors are high-net-worth individuals who invest their own money in early-stage companies. They often provide seed funding or bridge financing to help companies get off the ground. Angel investors typically have expertise in specific industries and can offer valuable mentorship and guidance to entrepreneurs.

Key Characteristics: Personal investment, early-stage focus, mentorship potential, smaller investment amounts.

Venture Capital

Venture capital (VC) firms invest in high-growth companies with the potential for significant returns. VCs typically invest larger amounts of capital than angel investors and take a more active role in managing the companies they invest in. VC funding is often used to scale operations, expand into new markets, or develop new products.

Key Characteristics: Institutional investment, growth-stage focus, active management involvement, larger investment amounts.

Private Equity

Private equity (PE) firms invest in established businesses with the aim of improving their performance and increasing their value. PE firms often acquire controlling stakes in companies and implement operational improvements, strategic changes, or financial restructuring. PE funding is typically used for acquisitions, leveraged buyouts, or recapitalizations.

Key Characteristics: Institutional investment, established business focus, operational improvements, large investment amounts.

Crowdfunding

Crowdfunding involves raising small amounts of money from a large number of individuals, typically through online platforms. Crowdfunding can be used to fund a variety of projects, from startups to creative endeavors. There are different types of crowdfunding, including donation-based, reward-based, and equity-based crowdfunding.

Key Characteristics: Collective investment, diverse project types, online platforms, varying investment models.

Grants and Government Funding

Certain projects, particularly those focused on research and development or social impact, may be eligible for grants or government funding. These sources typically provide non-dilutive funding, meaning the company does not have to give up equity in exchange for the funding. Grants and government funding can be highly competitive to obtain.

Key Characteristics: Non-dilutive funding, project-specific focus, competitive application process, often sector-specific.

Debt Financing

Debt financing involves borrowing money from a bank or other financial institution. Debt financing can be used to fund a variety of purposes, such as working capital, capital expenditures, or acquisitions. Debt financing typically requires the company to repay the loan with interest over a specified period.

Key Characteristics: Loan-based funding, interest payments, repayment schedule, collateral requirements.

Evaluating Investment Opportunities

For potential investors, understanding that "packages are looking for funding" is just the initial signal. Thorough due diligence is essential to assess the viability and potential return on investment.

Business Plan Analysis

A comprehensive business plan is crucial. It should outline the company's mission, vision, and strategy, including a detailed market analysis, competitive landscape assessment, and financial projections. Investors should carefully review the business plan to understand the company's potential for growth and profitability.

Financial Due Diligence

Financial due diligence involves examining the company's financial statements, including income statements, balance sheets, and cash flow statements. Investors should assess the company's revenue growth, profitability, and financial stability. They should also review the company's capital structure, debt levels, and cash burn rate.

Market Analysis

Understanding the market in which the company operates is crucial. Investors should assess the size of the market, its growth potential, and the competitive landscape. They should also evaluate the company's market share, customer acquisition costs, and customer retention rates.

Management Team Assessment

The quality of the management team is a critical factor in the success of any company. Investors should assess the experience, expertise, and track record of the management team. They should also evaluate the team's ability to execute the company's strategy and adapt to changing market conditions.

Legal and Regulatory Compliance

Investors should ensure that the company is in compliance with all applicable laws and regulations. This includes reviewing the company's legal documents, such as articles of incorporation, contracts, and intellectual property rights. They should also assess the company's exposure to legal risks and regulatory changes.

Key Takeaways

When you hear "packages are looking for funding," remember these essential points:

- It signifies a need for external capital to support growth, expansion, or specific projects.

- Multiple funding sources exist, each with different investment terms and expectations. Carefully consider the options.

- Due diligence is paramount for potential investors to assess risk and potential return.

- A solid business plan and strong management team are crucial for attracting investment.

- Understanding the market and competitive landscape is essential for evaluating the company's potential for success.

In conclusion, the phrase "packages are looking for funding" represents a dynamic interplay between those seeking capital and those providing it. Successful navigation of this landscape requires a clear understanding of the funding options, rigorous due diligence, and a focus on long-term value creation.