Securing a personal line of credit can be a valuable tool for managing expenses and navigating financial challenges. However, individuals with bad credit often face significant hurdles in accessing this type of financial product. Understanding the landscape of personal lines of credit for those with poor credit is crucial for making informed financial decisions.

Understanding Personal Lines of Credit

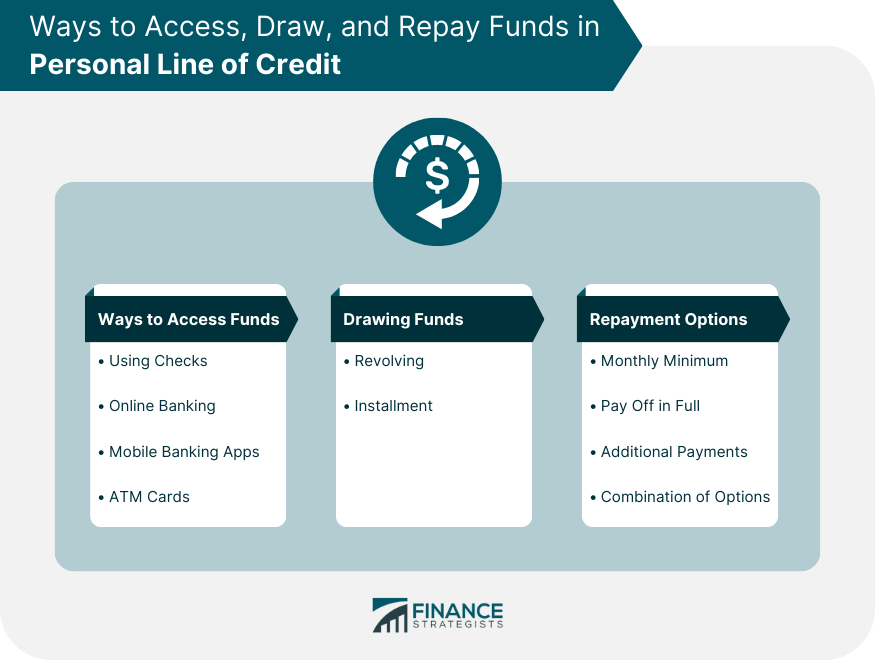

A personal line of credit is a type of revolving credit that provides access to a pre-approved amount of funds. Unlike a loan, where you receive a lump sum, a line of credit allows you to borrow money as needed, up to your credit limit. You only pay interest on the amount you borrow. As you repay the principal, the available credit is replenished, allowing you to borrow again. This flexibility makes it a popular choice for managing irregular expenses or handling unexpected costs.

Key features of a personal line of credit include:

- Revolving Credit: Funds become available again as you repay the outstanding balance.

- Interest Charges: Interest is typically charged only on the outstanding balance.

- Flexibility: Borrow only what you need, when you need it.

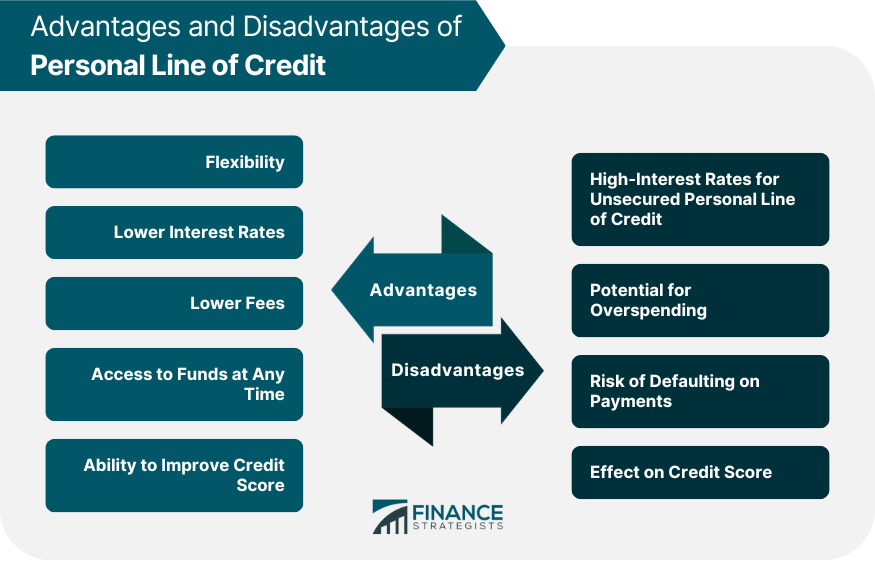

- Fees: Some lines of credit may have annual fees, draw fees, or other charges.

The Challenges of Securing a Personal Line of Credit with Bad Credit

A poor credit score, generally considered to be below 630, significantly limits your options for obtaining a personal line of credit. Lenders view individuals with bad credit as higher-risk borrowers, increasing the likelihood of default. Consequently, they may be hesitant to offer lines of credit, or they may impose stricter terms and conditions.

The primary challenges include:

- Limited Availability: Fewer lenders are willing to offer lines of credit to individuals with poor credit.

- Higher Interest Rates: Lenders compensate for the increased risk by charging significantly higher interest rates.

- Lower Credit Limits: Even if approved, the credit limit may be considerably lower than what someone with good credit could obtain.

- Stricter Terms: Lenders may impose stricter repayment terms, such as shorter repayment periods or more frequent payments.

- Collateral Requirements: Some lenders may require collateral to secure the line of credit, transforming it into a secured line of credit.

Options for Individuals with Bad Credit Seeking a Personal Line of Credit

While securing a traditional personal line of credit with bad credit can be difficult, several alternative options may be available:

Secured Personal Line of Credit

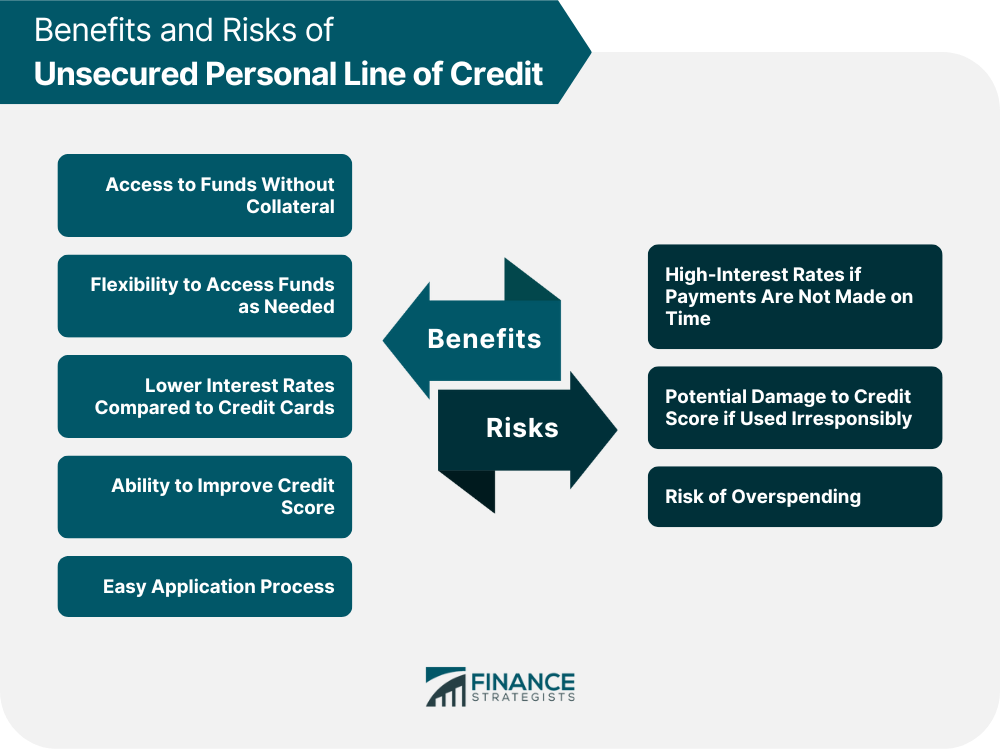

A secured personal line of credit requires you to provide collateral, such as a savings account, certificate of deposit (CD), or other assets, to secure the line of credit. This reduces the lender's risk, making them more willing to approve your application despite your bad credit. If you fail to repay the borrowed funds, the lender can seize the collateral to cover the debt.

Pros:

- Easier to obtain with bad credit.

- Potentially lower interest rates compared to unsecured options.

Cons:

- Requires pledging an asset as collateral.

- Risk of losing the collateral if you default on the loan.

Credit Builder Loan

A credit builder loan is specifically designed to help individuals with poor or no credit history improve their credit scores. With this type of loan, the borrowed funds are held in a secured account while you make regular payments. Once the loan is repaid, the funds are released to you. The lender reports your payment history to the credit bureaus, which can help improve your credit score over time.

Pros:

- Helps improve credit score.

- Relatively easy to qualify for.

Cons:

- You don't have immediate access to the borrowed funds.

- May have fees and interest charges.

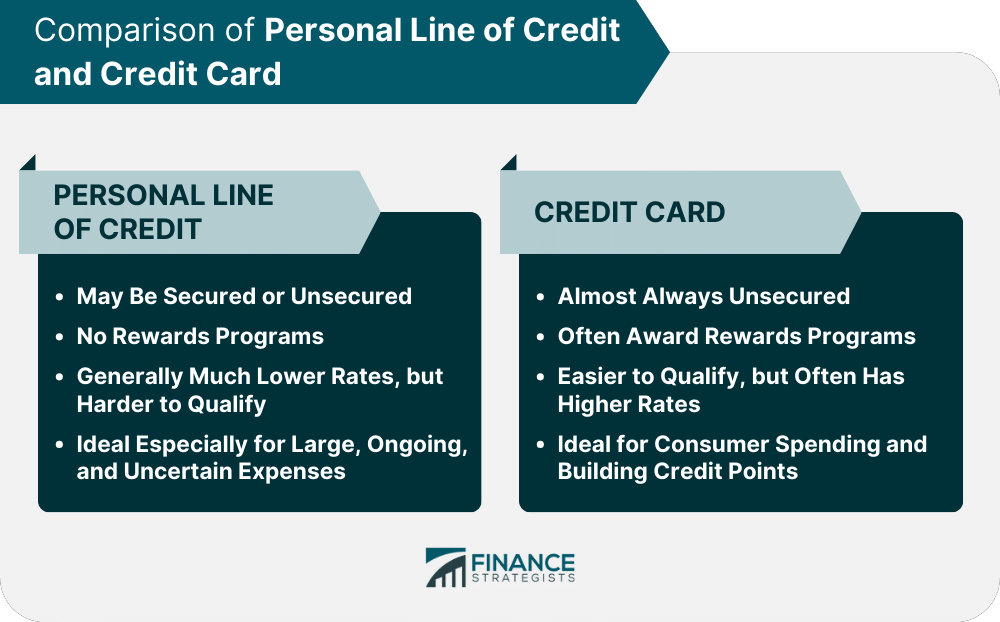

Credit Cards for Bad Credit

While not technically a line of credit, credit cards designed for individuals with bad credit function similarly, offering a revolving line of credit. These cards typically have high interest rates and low credit limits, but they can be a stepping stone to rebuilding your credit. Responsible use, including making timely payments and keeping your credit utilization low, can help improve your credit score.

Pros:

- Relatively easy to obtain.

- Can help improve credit score with responsible use.

Cons:

- High interest rates.

- Low credit limits.

- Potential for fees.

Personal Loans for Bad Credit

Some lenders specialize in offering personal loans to individuals with bad credit. These loans typically have higher interest rates and fees compared to loans for borrowers with good credit. However, they can provide access to needed funds, and responsible repayment can help improve your credit score. It is important to carefully evaluate the terms and conditions before accepting a personal loan for bad credit.

Pros:

- More readily available than traditional lines of credit.

- Can help improve credit score with responsible repayment.

Cons:

- High interest rates and fees.

- May have unfavorable terms and conditions.

Strategies for Improving Your Credit Score

The best long-term solution for accessing more favorable credit terms is to improve your credit score. This can be achieved through several strategies:

- Pay Bills on Time: Payment history is the most significant factor in your credit score.

- Reduce Credit Card Debt: Aim to keep your credit utilization ratio (the amount of credit you're using compared to your total available credit) below 30%.

- Dispute Errors on Your Credit Report: Regularly review your credit report for inaccuracies and dispute any errors you find.

- Avoid Opening Too Many New Accounts: Opening multiple new accounts in a short period can negatively impact your credit score.

- Become an Authorized User: If you have a trusted friend or family member with good credit, ask if they will add you as an authorized user on their credit card.

Important Considerations

Before applying for any type of credit, especially if you have bad credit, it is crucial to consider the following:

- Interest Rates: Compare interest rates from multiple lenders to find the lowest possible rate.

- Fees: Be aware of any fees associated with the line of credit or loan, such as annual fees, origination fees, or late payment fees.

- Repayment Terms: Understand the repayment schedule and ensure that you can comfortably afford the monthly payments.

- Financial Stability: Assess your financial situation and ensure that you can responsibly manage the debt.

Avoid predatory lenders. Be wary of lenders who offer guaranteed approval or require upfront fees. These lenders often charge exorbitant interest rates and fees, trapping borrowers in a cycle of debt.

Seeking advice from a qualified financial advisor can provide personalized guidance and help you make informed decisions about your finances.

Conclusion

Obtaining a personal line of credit with bad credit is challenging but not impossible. Exploring alternative options like secured lines of credit, credit builder loans, and credit cards for bad credit can provide access to needed funds. However, it is essential to prioritize improving your credit score through responsible financial habits. By diligently managing your finances and making timely payments, you can gradually improve your creditworthiness and access more favorable credit terms in the future. Remember to compare offers carefully, understand the associated costs, and seek professional advice when needed. Taking steps to improve your credit score will provide more options and better terms in the long run.