Personal loans are a common financial tool used to cover various expenses, from consolidating debt to funding home improvements. Typically, lenders heavily weigh an applicant's credit score when assessing their risk. However, "income-based loans," also known as "income-only loans," represent an alternative approach, placing a greater emphasis on an applicant's current earnings and ability to repay, rather than their past credit history. This article explores the nuances of personal loans based on income, differentiating them from traditional loans and outlining their potential benefits and drawbacks.

Understanding Personal Loans Based on Income

Traditional personal loans rely significantly on an applicant's credit score, which is a numerical representation of their creditworthiness based on past borrowing and repayment behavior. A high credit score indicates responsible credit management, making the applicant a less risky borrower in the eyes of lenders. Conversely, a low credit score can result in loan denial or higher interest rates.

Income-based personal loans, on the other hand, prioritize the applicant's current income as the primary indicator of their ability to repay the loan. Lenders offering these loans will still likely review an applicant’s credit history, but the emphasis is shifted towards verifying and analyzing income streams. They assess factors like:

- Employment History: Stability and longevity in the applicant's current and previous jobs.

- Income Verification: Reviewing pay stubs, bank statements, and tax returns to confirm income levels.

- Debt-to-Income Ratio (DTI): Calculating the percentage of monthly income that goes towards debt payments. A lower DTI indicates a greater ability to manage additional debt.

- Cash Flow Analysis: Examining the applicant's overall financial health by looking at income, expenses, and savings habits.

By focusing on these income-related factors, lenders aim to determine if the applicant has sufficient disposable income to comfortably meet their loan repayment obligations.

Benefits of Income-Based Personal Loans

Income-based personal loans offer several advantages, particularly for individuals who may have less-than-perfect credit but a stable income:

- Accessibility for Individuals with Poor Credit: This is perhaps the most significant benefit. Individuals with low credit scores or limited credit history, who might be denied a traditional loan, may qualify for an income-based loan if they demonstrate sufficient income.

- Opportunity to Build Credit: By successfully repaying an income-based loan, borrowers can improve their credit score over time, opening up access to more favorable financial products in the future. This can be a stepping stone for those seeking to rebuild their creditworthiness.

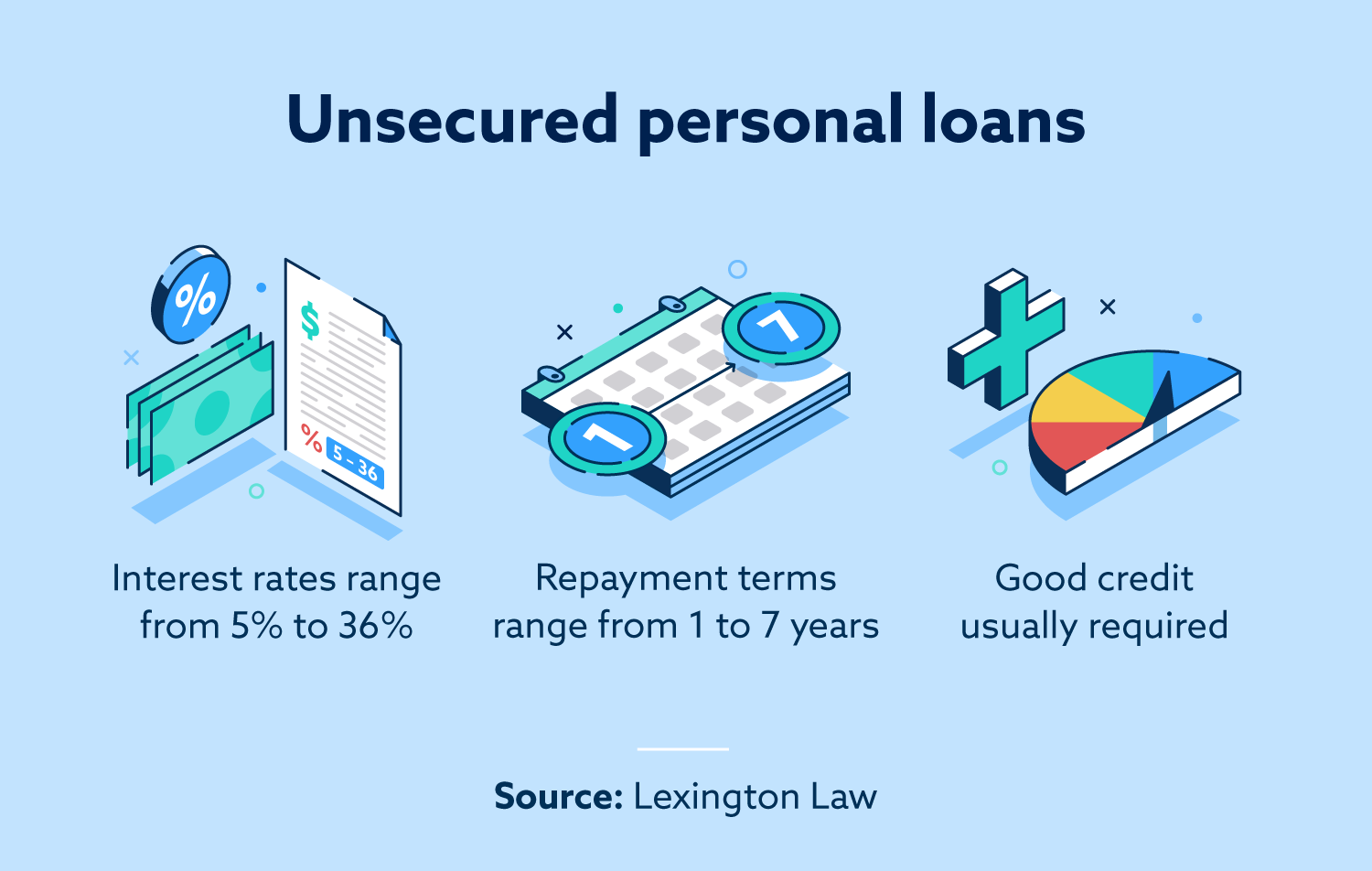

- Potentially Lower Interest Rates Compared to Alternatives: While interest rates on income-based loans may still be higher than those on traditional loans for borrowers with excellent credit, they can be lower than alternatives like payday loans or title loans, which often carry exorbitant interest rates and fees.

- Flexible Loan Amounts: Depending on the lender and the applicant's income level, income-based loans can offer a range of loan amounts to suit different financial needs.

Drawbacks and Considerations

While income-based personal loans can be beneficial, it's essential to be aware of their potential drawbacks:

- Potentially Higher Interest Rates: Lenders may charge higher interest rates on income-based loans to compensate for the increased risk associated with lending to borrowers with less-than-perfect credit.

- Stricter Income Verification Requirements: Lenders offering these loans typically have rigorous income verification processes. Applicants will need to provide detailed documentation to prove their income stability and consistency.

- Limited Loan Amounts: Depending on income and DTI, the amount offered might be less than a traditional loan, especially for those with limited income.

- Risk of Debt Cycle: If borrowers are not careful and overextend themselves with debt, income-based loans can contribute to a cycle of debt, especially if the interest rates are high.

Who Are Income-Based Personal Loans Suitable For?

Income-based personal loans can be a suitable option for individuals who:

- Have a stable income but a low or limited credit score.

- Need access to funds for specific expenses like debt consolidation, medical bills, or home repairs.

- Are committed to making timely repayments to improve their credit score.

- Have carefully assessed their ability to repay the loan without financial strain.

These loans are not a good fit for individuals who:

- Have unstable income or difficulty managing their finances.

- Are already burdened with significant debt.

- Are seeking a loan for non-essential or frivolous expenses.

Finding and Evaluating Income-Based Loan Options

If you're considering an income-based personal loan, it's crucial to research and compare different lenders. Here's how:

- Online Research: Use online search engines and comparison websites to find lenders offering income-based personal loans. Look for lenders that specialize in serving borrowers with less-than-perfect credit.

- Read Reviews: Check online reviews and ratings from previous borrowers to get an idea of the lender's reputation and customer service quality.

- Compare Interest Rates and Fees: Obtain quotes from multiple lenders and compare their interest rates, fees, and repayment terms. Pay close attention to the APR (Annual Percentage Rate), which reflects the total cost of the loan.

- Assess Loan Terms: Consider the loan term and repayment schedule. Choose a loan term that allows you to comfortably afford the monthly payments without stretching your budget too thin.

- Check Eligibility Requirements: Review the lender's eligibility requirements to ensure you meet their income and employment criteria.

- Understand the Fine Print: Carefully read the loan agreement before signing it, paying attention to any penalties for late payments or early repayment.

Example Scenario: Consider John, who has a steady job earning $50,000 per year but has a credit score of 600 due to past financial difficulties. He needs a $5,000 loan to consolidate some high-interest credit card debt. A traditional lender might deny his application or offer a very high interest rate. However, with an income-based loan, he might be approved based on his stable income, even with his lower credit score. He should compare offers from several lenders to find the most favorable interest rate and repayment terms.

Alternatives to Income-Based Personal Loans

Before opting for an income-based personal loan, explore other potential options:

- Secured Loans: If you have assets like a car or home, you could consider a secured loan, where the asset serves as collateral. Secured loans often have lower interest rates than unsecured loans.

- Credit Union Loans: Credit unions are non-profit financial institutions that often offer more favorable loan terms to their members than traditional banks.

- Personal Loan from Family or Friends: If possible, borrowing from family or friends can be a lower-cost alternative to a traditional loan.

- Credit Counseling: Seek advice from a credit counselor to explore options for managing debt and improving your credit score. They may suggest debt management plans or other strategies.

The Importance of Responsible Borrowing

Regardless of the type of loan you choose, responsible borrowing is essential. This includes:

- Borrowing Only What You Need: Avoid borrowing more than you can comfortably afford to repay.

- Creating a Budget: Develop a budget to track your income and expenses, ensuring you can allocate sufficient funds for loan repayments.

- Making Timely Payments: Always make your loan payments on time to avoid late fees and damage to your credit score.

- Avoiding Overextension: Don't take on more debt than you can handle. Monitor your debt-to-income ratio and avoid accumulating excessive debt.

Conclusion

Personal loans based on income offer a potential pathway to financial assistance for individuals with stable earnings but less-than-perfect credit histories. By shifting the emphasis from credit scores to income verification, these loans can provide access to funds that might otherwise be unavailable. However, it's crucial to weigh the potential benefits against the risks, including potentially higher interest rates and the importance of responsible borrowing. By carefully researching and comparing options, individuals can determine if an income-based personal loan is the right solution for their specific financial needs and circumstances. The significance of these loans lies in their ability to provide financial opportunities to a broader range of individuals, promoting greater financial inclusion and enabling them to address important financial needs.

:max_bytes(150000):strip_icc()/Personal-loans-111715-final-3c39d6d214e44604bdc1efca2525d37d.png)