Okay, so picture this: I’m on hold. Again. With elevator music that sounds suspiciously like a Casio keyboard demo. And I’m trying to figure out why my escrow account is doing the cha-cha. (Seriously, is it going up? Down? Doing the Macarena?) This time, it's PHH Mortgage. And finding a straight answer – let alone a human being – feels like trying to find a matching sock in the dryer abyss.

And that's when it hit me: other people must be going through this too. Like, a *lot* of people. Hence, this little digital public service announcement dedicated to the noble (and often frustrating) quest of finding the PHH Mortgage Service Center phone number and, perhaps more importantly, getting your actual problem solved. Let's dive in, shall we?

The Great Phone Number Hunt: Why is it so Hard?

Seriously, why *is* it so hard to find a simple phone number these days? It's like companies are actively hiding them, preferring you navigate a labyrinthine website or, even worse, communicate solely through chatbots that clearly have never experienced the joy (or terror) of homeownership. It’s almost as if they are saying “Dear customer, we hear you... but not really”.

Anyway, enough ranting. The most commonly cited PHH Mortgage Service Center phone number (and I've tested this, folks!) is:

1-800-750-2666

But hold your horses (or should I say, hold your mortgage payments?), because that's just the starting point. This isn’t a one-size-fits-all situation, sadly. Calling this number usually leads to automated prompts and menus designed to keep you... well, on hold.

Navigating the Automated System: My Hard-Earned Tips

Okay, listen up, because this is where the real magic (or at least, the semi-magic) happens. Here are some tried-and-true strategies for getting past the robot overlords:

- Be Prepared: Have your loan account number ready. Seriously, dig it out now. Having it handy will save you precious minutes (and sanity). I learned this the hard way.

- Listen Carefully: I know, I know, the robotic voice is soothing as a dentist's drill. But pay attention to the menu options. Often, pressing '0' or saying "agent" repeatedly can (sometimes, maybe, possibly) get you a human.

- Patience is a Virtue (and a Necessity): Prepare for hold times. This isn't a sprint; it's a marathon. Have a book handy, a podcast queued up, or maybe even learn a new language while you wait. (Hey, at least you'll be productive while your life savings are in limbo!)

- Try Different Times of Day: This is anecdotal, but I've found that calling earlier in the morning (like, before 9 am EST) or later in the afternoon can sometimes result in shorter hold times. Everyone else is probably at lunch or already pulling their hair out, respectively.

Beyond the Main Number: Exploring Other Options

Okay, so the 800 number isn't working for you? Don't despair! There are other avenues to explore, though they might require a bit more digging (and possibly a compass). Remember, there's always a way out. *Almost* always.

The Website: A Potential Source of… Information?

PHH Mortgage, now part of Lakeview Loan Servicing, maintains a website (you probably already figured that out). While finding a direct phone number there can be tricky, it's worth exploring for other resources, such as:

- FAQs: Your question might already be answered in their frequently asked questions section. (Though, let's be honest, how "frequently" are they *really* asked if the answers are still buried deep within the site?)

- Contact Forms: Many mortgage companies offer contact forms where you can submit your inquiry. Be as detailed as possible, and be sure to include your loan account number.

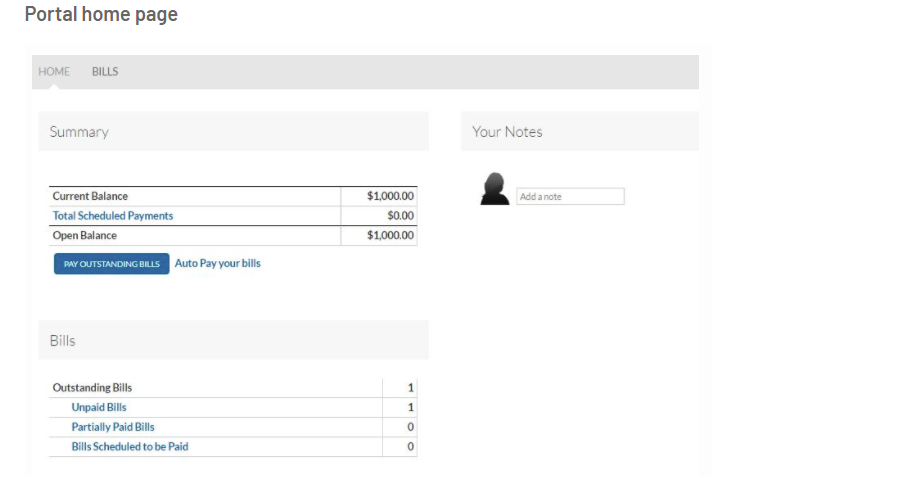

- Online Account Access: If you haven't already, create an online account. You may be able to view your loan information, make payments, and even send secure messages through the portal.

Other Numbers: Specialized Departments

Depending on your specific issue, there might be other specialized departments within PHH Mortgage (or Lakeview) that you can contact directly. Finding these numbers can be like searching for buried treasure, but here are some possibilities to consider:

- Loss Mitigation: If you're having trouble making your mortgage payments, contact their loss mitigation department. They may be able to offer assistance programs or alternative payment plans.

- Escrow Department: For questions about your escrow account (the source of my initial frustration!), try to find the direct line. Good luck with that!

- Customer Service Escalation: If you've already tried the general customer service number and haven't gotten anywhere, ask to speak to a supervisor or escalate your issue to a higher level of support. Be polite, but firm. (And maybe channel your inner Karen – just a little. No need to go full-blown Karen, though!).

The Power of the Written Word: Snail Mail

Yes, I know, snail mail sounds positively archaic in this digital age. But sometimes, a well-written letter can be surprisingly effective. It forces the company to document your complaint and respond in writing. Be sure to include your loan account number, a detailed explanation of your issue, and copies of any relevant documents. And yes, make sure to keep a copy for yourself. Send it via certified mail with return receipt requested so you have proof that it was received.

And here is the address, as you guessed it, hidden in the website:

PHH Mortgage Corporation

PO Box 5490

Mount Laurel, NJ 08054-5490

Lakeview Loan Servicing: The New Sheriff in Town

As I mentioned earlier, PHH Mortgage is now part of Lakeview Loan Servicing. This means that some of the contact information and processes may have changed. So, keep this in mind while you are searching for solution.

The Lakeview Loan Servicing website is your friend (or at least, a potential source of information). Here are some Lakeview's phone numbers:

- Customer service: 1-855-206-8440

- Payment related: 1-800-256-6495

Escalation Tactics: When All Else Fails

Okay, so you've called, emailed, and written letters, and you're still getting nowhere. What do you do? It's time to bring out the big guns (metaphorically speaking, of course!).

The Consumer Financial Protection Bureau (CFPB)

The CFPB is a government agency that protects consumers in the financial marketplace. You can file a complaint with the CFPB online or by phone. The CFPB will then forward your complaint to the mortgage company and require them to respond. This can often be a very effective way to get your issue resolved.

Your State Attorney General

Your state attorney general's office may also be able to assist you with your mortgage issue. Contact their office to see if they have any resources available.

Legal Action: The Last Resort

If you've exhausted all other options, you may need to consider taking legal action. This should be a last resort, as it can be expensive and time-consuming. But if you believe that the mortgage company has violated the law or breached their contract with you, it may be necessary to protect your rights.

Final Thoughts: Stay Strong, Mortgage Warrior!

Dealing with mortgage companies can be incredibly frustrating. It often feels like you're fighting a losing battle against a faceless bureaucracy. But don't give up! Be persistent, be organized, and be prepared to advocate for yourself. Remember, you have rights as a borrower. Now go forth and conquer. And maybe invest in some noise-canceling headphones for those inevitable hold times.

And if you find a secret, super-secret phone number that bypasses all the automated systems, please, for the love of all that is holy, share it with the rest of us. We're all in this together!

Disclaimer: This article is for informational purposes only and does not constitute financial or legal advice. Always consult with a qualified professional before making any financial decisions. And remember, I'm just a person on the internet who's also struggling with mortgage madness.

.png)

.png)