Okay, so picture this: I'm at my favorite coffee shop, the one with the ridiculously overpriced lattes (seriously, are they grinding gold in there?). They suddenly decide to have a "flash sale" – 50% off ALL lattes! The line practically wrapped around the block. People who never order lattes were suddenly ordering two! Even *I* grabbed one, and I usually just stick to my boring black coffee.

It got me thinking, what was *actually* going on there? It wasn't just about cheap coffee. It was about how much people's behavior *changed* when the price changed. And that, my friends, is where the concept of price elasticity of demand swoops in to save the day (or at least explain why you suddenly need a latte at 8 AM).

What IS Price Elasticity of Demand, Anyway?

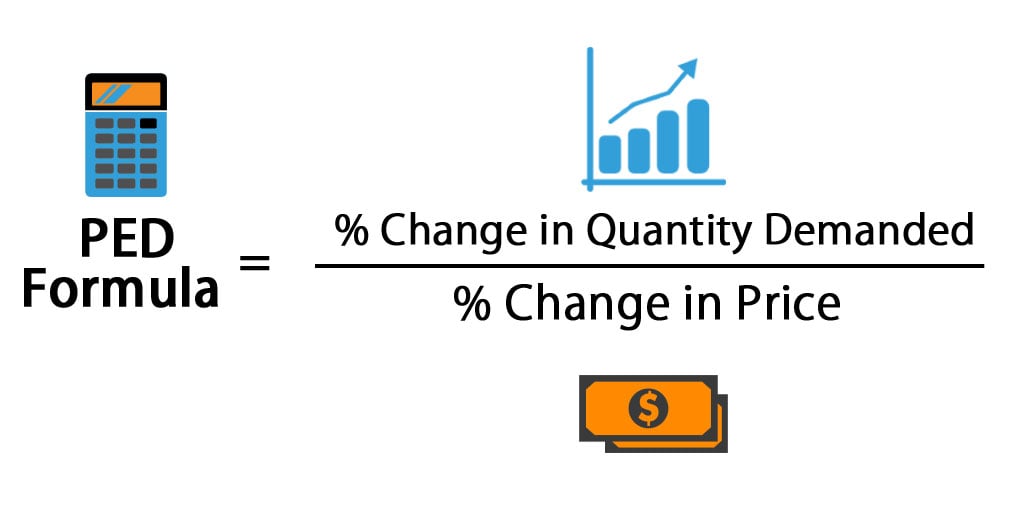

Think of it like this: price elasticity of demand (PED) is a fancy way of saying "How sensitive are people to price changes?" Will a small price change lead to a HUGE change in demand? Or will people barely even notice? PED helps us figure that out. It's like having a superpower that lets you predict consumer behavior (okay, maybe not a *super*power, but still pretty cool).

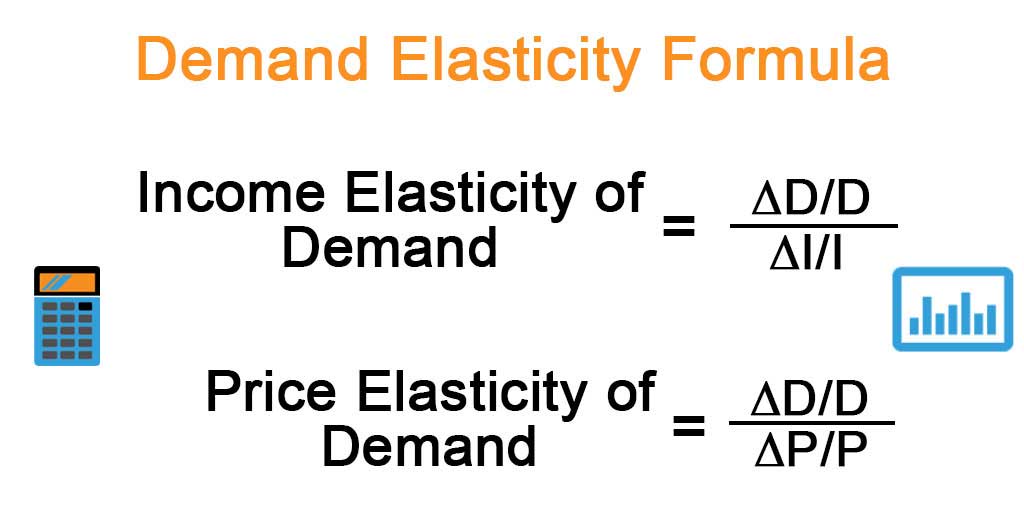

Specifically, PED measures the percentage change in quantity demanded relative to the percentage change in price. In other words, if the price of something goes up by 10%, by what percentage will the demand for that thing go down (or up, though usually down)? That's the core idea. It's all about proportions, baby!

Enter the Formula: The Magical Equation

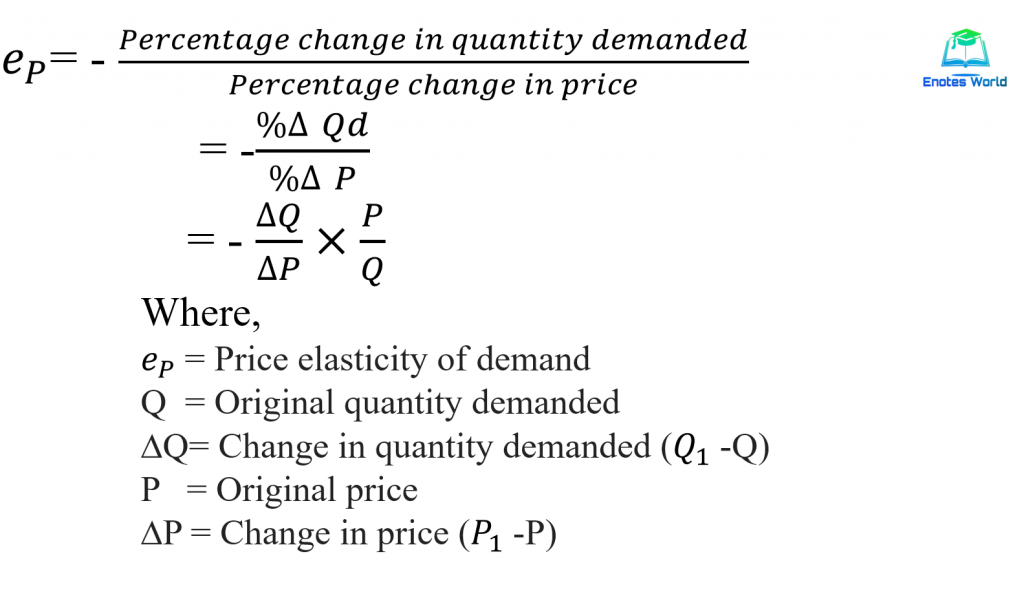

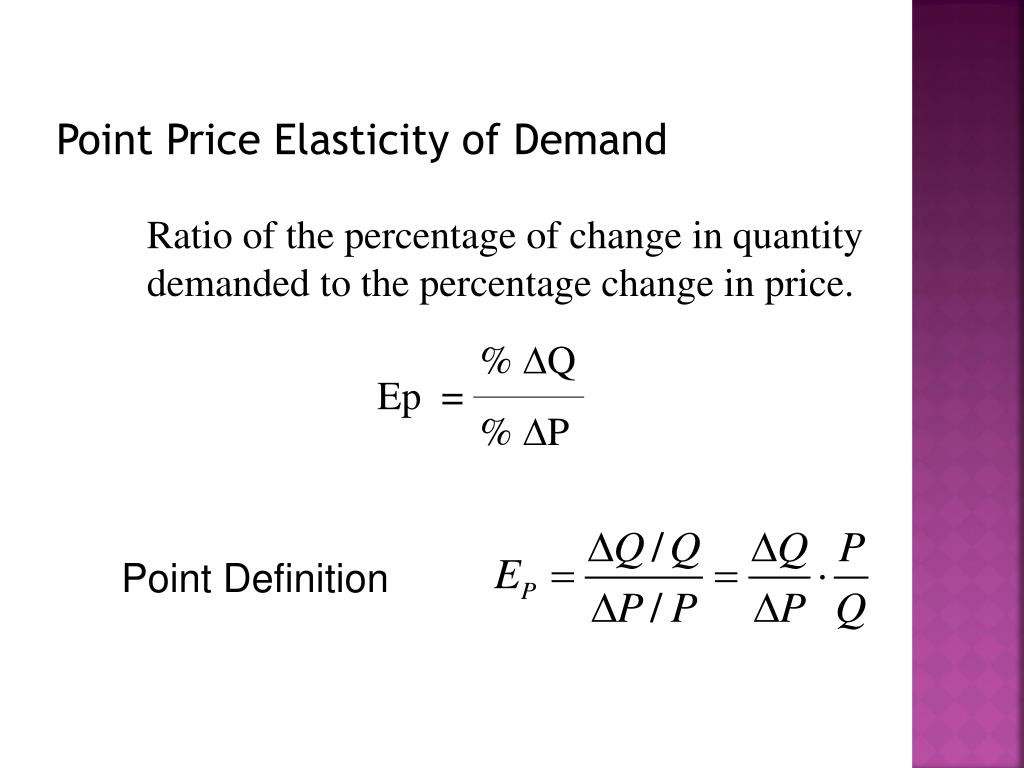

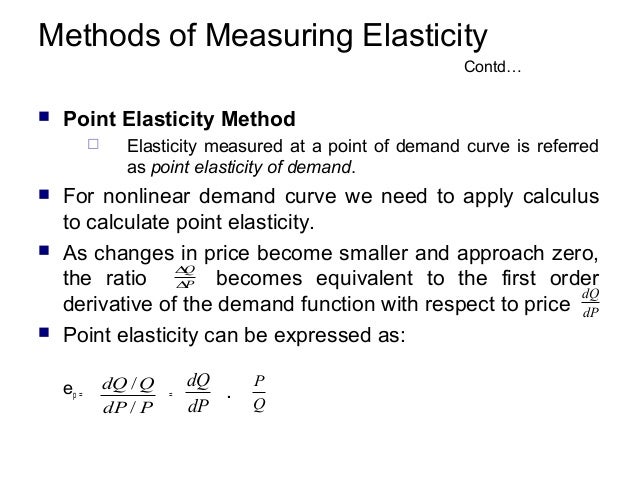

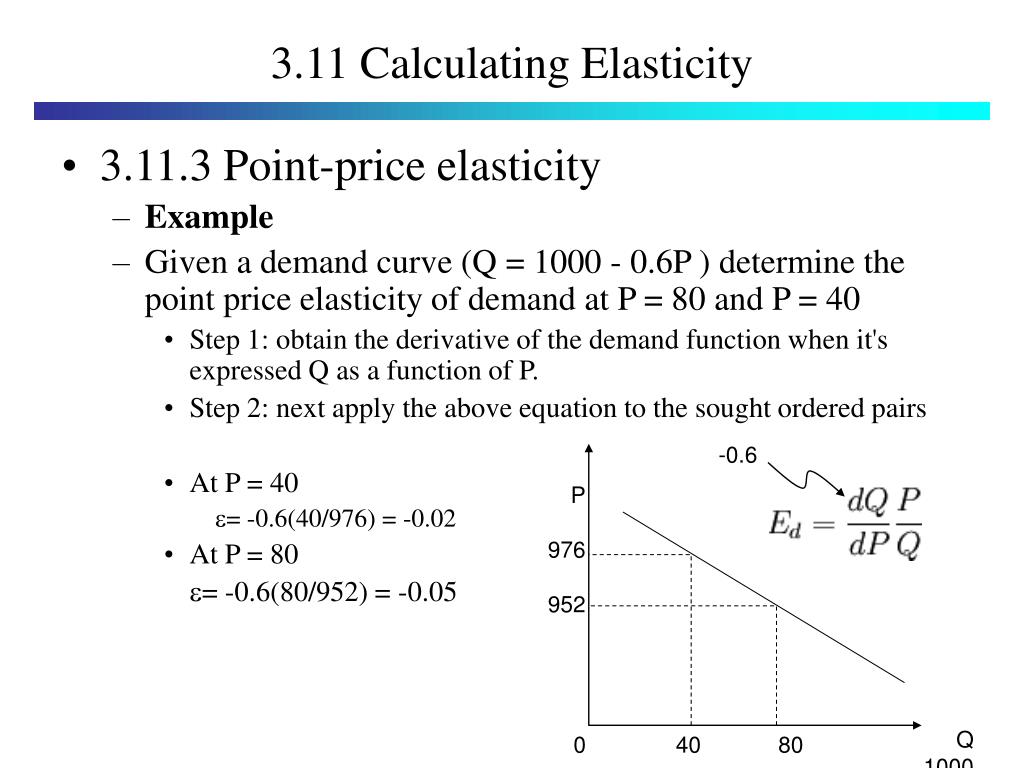

Now for the moment you've all been waiting for (or maybe dreading, if math isn't your jam). The point price elasticity of demand formula. Don't worry, it's not as scary as it sounds. It's actually quite elegant, in its own nerdy way.

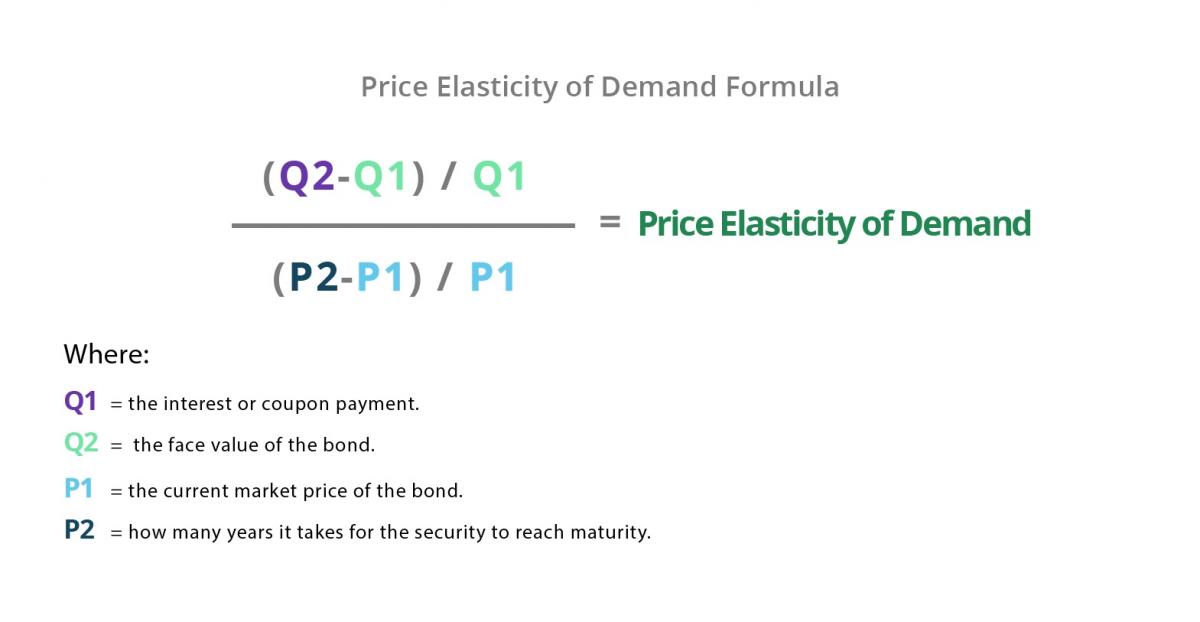

Here it is:

PED = (% Change in Quantity Demanded) / (% Change in Price)

Yep, that's it. That's the whole shebang. But let's break it down even further, because sometimes percentages can be a bit…fussy.

The percentage change in quantity demanded is calculated as:

[(New Quantity - Old Quantity) / Old Quantity] * 100

And the percentage change in price is calculated as:

[(New Price - Old Price) / Old Price] * 100

So, putting it all together, the full formula looks like this:

PED = {[(New Quantity - Old Quantity) / Old Quantity] * 100} / {[(New Price - Old Price) / Old Price] * 100}

Whoa, that looks like a mouthful, right? But don't panic! The "* 100*" parts cancel each other out, so we can simplify it to:

PED = (Change in Quantity / Old Quantity) / (Change in Price / Old Price)

Even better, we can rewrite this as:

PED = (Change in Quantity / Change in Price) * (Old Price / Old Quantity)

Much cleaner, right? This last version is the one I usually use. It's easier to remember and less prone to calculator-induced errors (we've all been there!).

A Quick Example: Let's Get Practical

Okay, let's say the coffee shop used to sell 100 lattes a day at $5 each. After the "flash sale," they sold 200 lattes at $2.50 each. Let's calculate the PED:

- Old Quantity: 100

- New Quantity: 200

- Old Price: $5

- New Price: $2.50

Change in Quantity = 200 - 100 = 100

Change in Price = $2.50 - $5 = -$2.50

Using our simplified formula:

PED = (100 / -2.50) * (5 / 100) = -40 * 0.05 = -2

So the PED is -2. Hold that thought, we'll get to what that actually *means* in a second.

Interpreting the PED: What Does That Number Mean?!

Okay, you've crunched the numbers, you've got a PED value. Now what? The PED value tells you how elastic (or inelastic) the demand is. Here's the breakdown:

- |PED| > 1: Elastic Demand. This means that demand is relatively sensitive to price changes. A small change in price will lead to a relatively large change in quantity demanded. Our latte example above falls into this category. Think of things that are considered luxuries or have readily available substitutes. (Like, if the price of your favorite brand of cereal suddenly doubles, you'll probably switch to a cheaper brand, right?)

- |PED| < 1: Inelastic Demand. This means that demand is relatively insensitive to price changes. A change in price will lead to a relatively small change in quantity demanded. Think of things that are necessities or have few substitutes. (Like, if the price of gasoline goes up, you might complain, but you'll probably still buy gas to get to work, at least in the short run.)

- |PED| = 1: Unit Elastic Demand. This is a special case where the percentage change in quantity demanded is exactly equal to the percentage change in price. It's a perfectly balanced response.

- |PED| = 0: Perfectly Inelastic Demand. This is a theoretical extreme where demand doesn't change at all, no matter the price. Think of something like a life-saving medication – people will pay whatever they have to for it.

- |PED| = ∞: Perfectly Elastic Demand. This is another theoretical extreme where any price increase will cause demand to drop to zero. This is rare in the real world.

A Note on the Negative Sign: You'll notice that the PED value is often negative. This is because, generally, as the price goes up, the quantity demanded goes down (that's the Law of Demand in action!). Economists often ignore the negative sign and focus on the absolute value of the PED, as we did above, to determine elasticity. So, a PED of -2 is considered more elastic than a PED of -0.5.

So, back to our latte example. We calculated a PED of -2. Taking the absolute value, we get 2, which is greater than 1. This means that the demand for lattes at that coffee shop is elastic. A price change significantly impacts the number of lattes sold. That flash sale was a *huge* success because people were very responsive to the lower price.

Why is PED Important? Who Cares?

Okay, so you can calculate PED. Great. But why should you even bother? Well, PED is a powerful tool for a lot of different people:

- Businesses: Businesses use PED to make pricing decisions. If demand for their product is elastic, they might want to avoid price increases, as it could lead to a significant drop in sales. If demand is inelastic, they might be able to raise prices without losing too many customers. (Think airlines charging extra for baggage – they know people will still pay it because flying is often a necessity.)

- Governments: Governments use PED to understand the impact of taxes and subsidies. For example, if the government wants to tax cigarettes, they need to know how much the demand for cigarettes will decrease as a result. If demand is inelastic, the tax will generate a lot of revenue without significantly reducing consumption.

- Economists: Economists use PED to analyze markets and predict consumer behavior. It's a fundamental concept in understanding how markets work.

- YOU (potentially!): Even if you don't run a business or work for the government, understanding PED can help you make better purchasing decisions. Are you really getting a deal on that "50% off" item, or are they just playing with your price sensitivity?

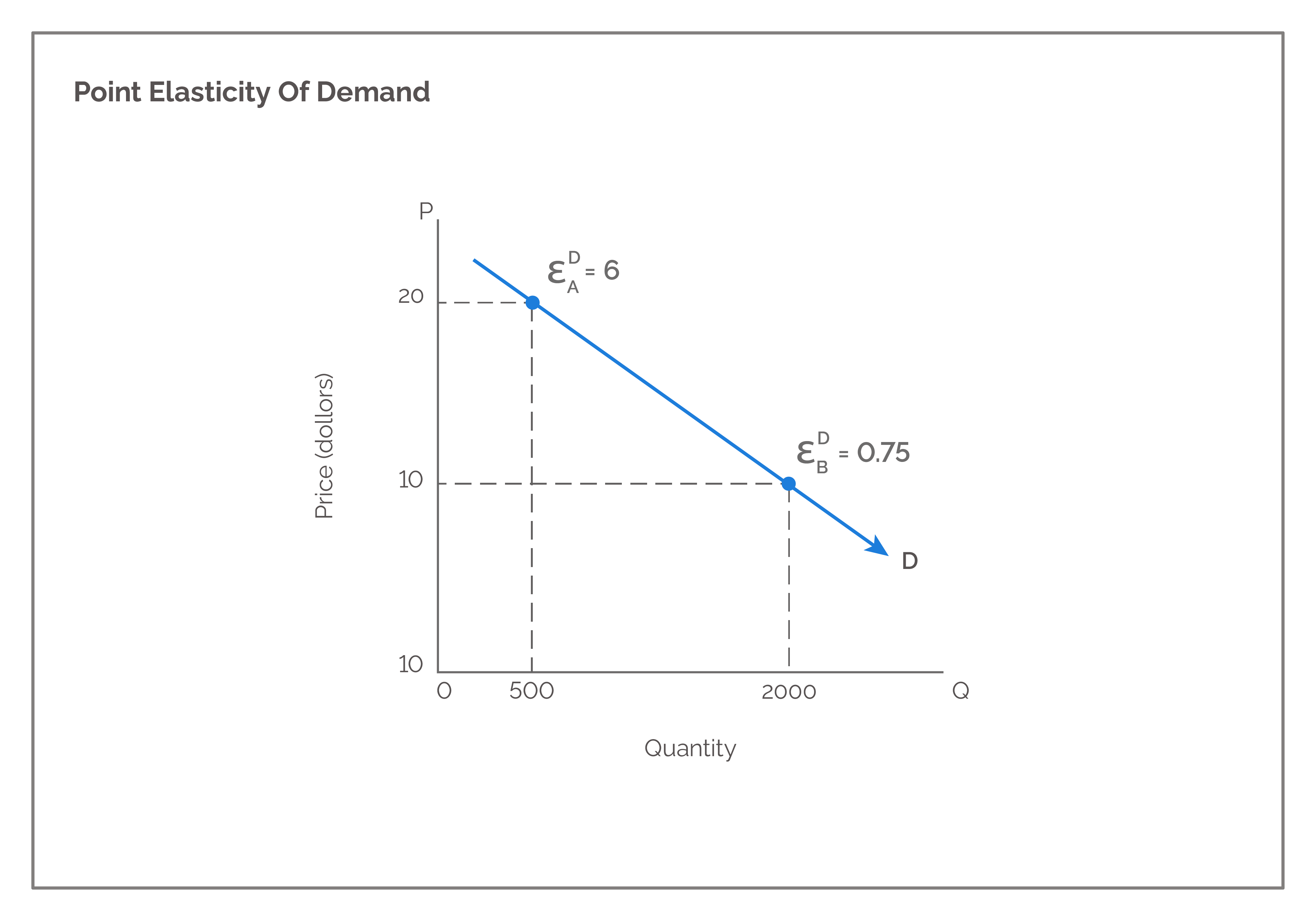

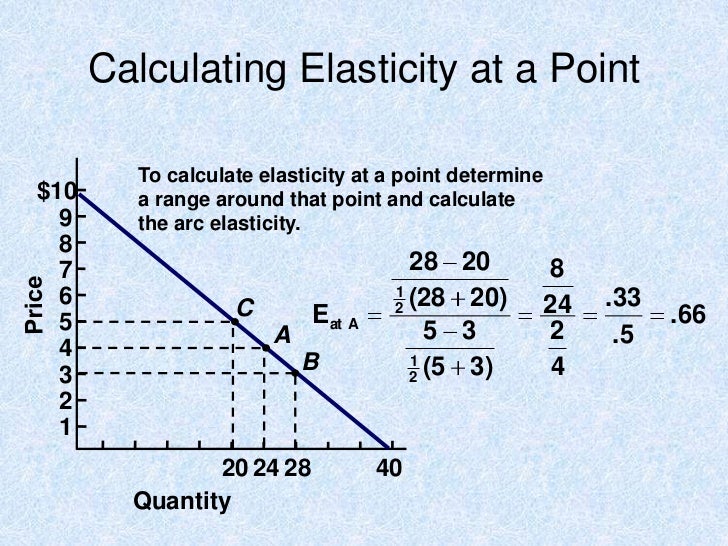

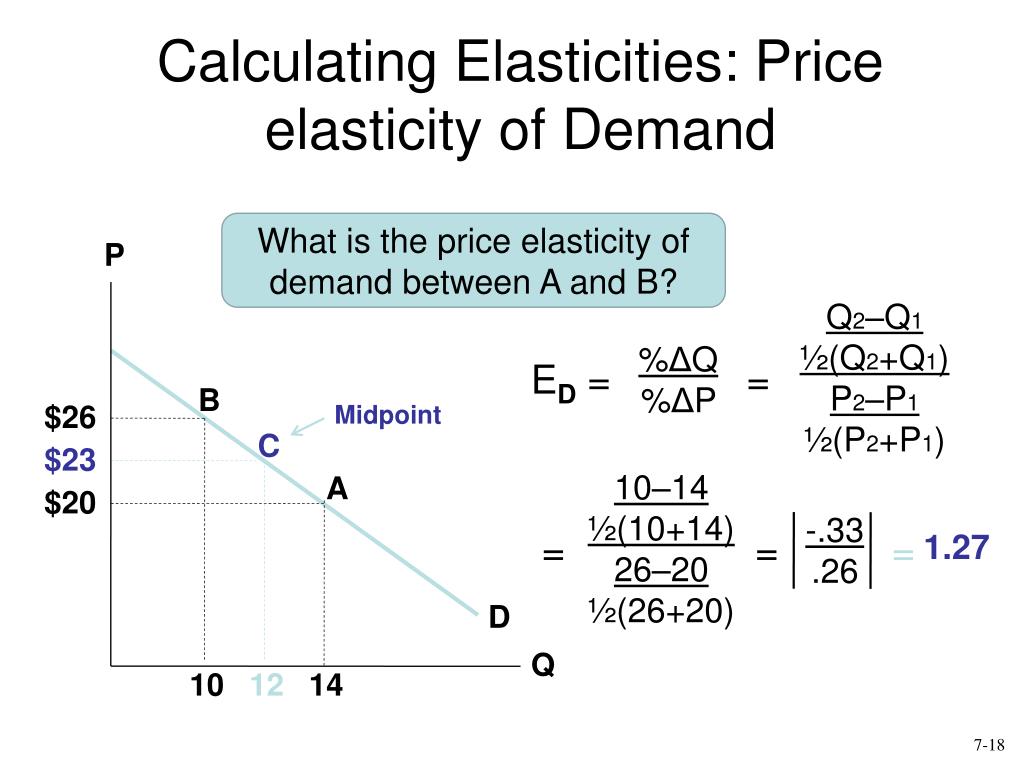

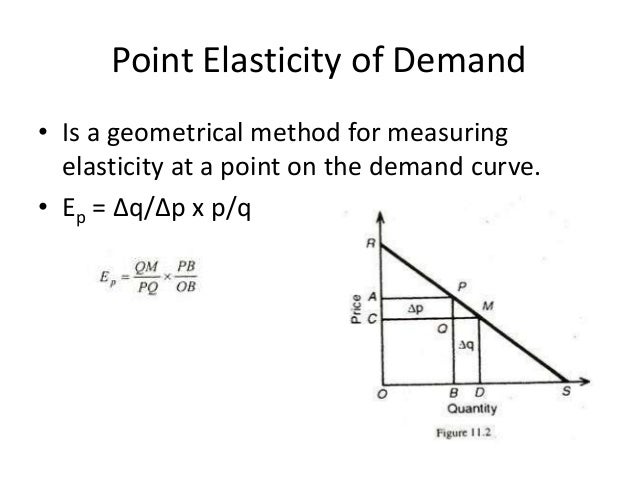

Point Elasticity vs. Arc Elasticity: A Quick Detour

Now, I mentioned point price elasticity of demand. What about arc elasticity? Well, point elasticity calculates elasticity at a *specific point* on the demand curve. It assumes that the price change is very small. Arc elasticity, on the other hand, calculates elasticity over a *range* of prices. It's more accurate when the price change is significant.

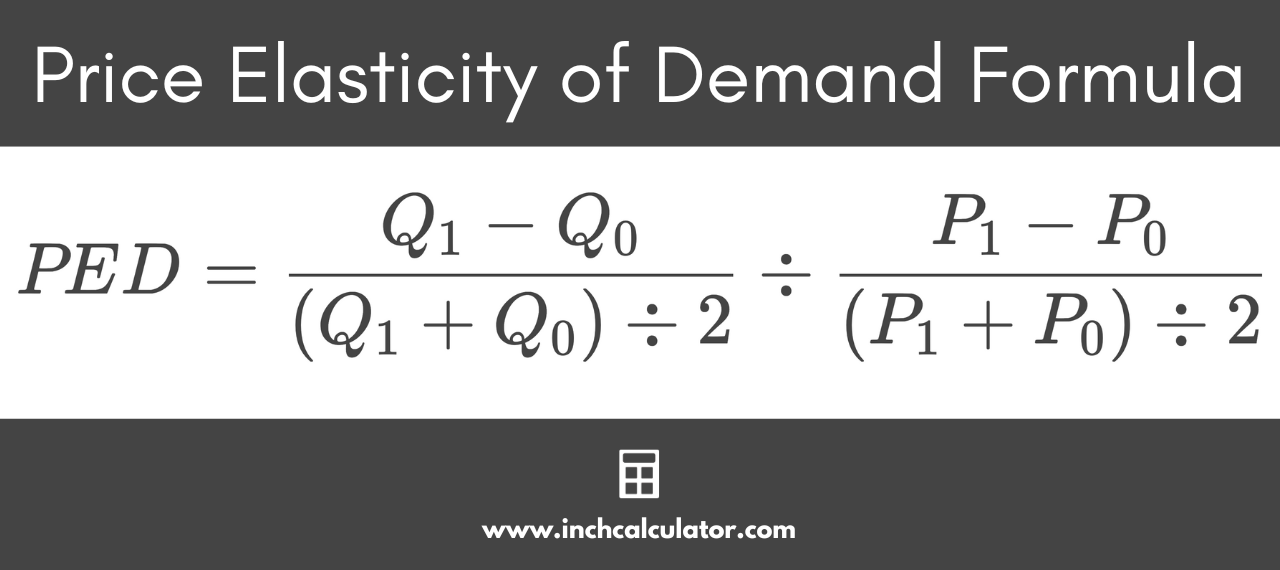

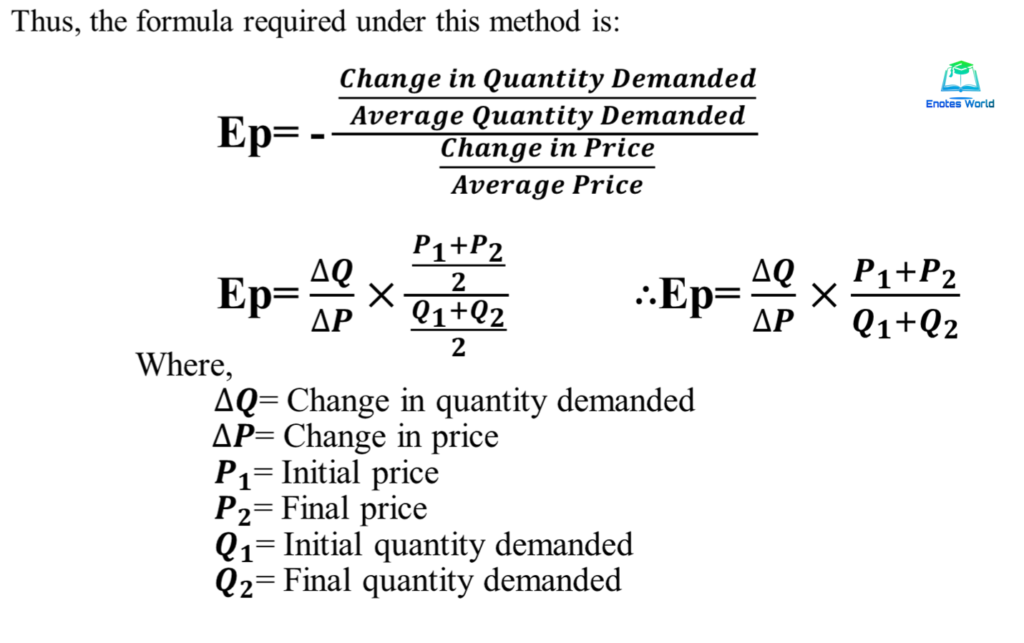

The formula for arc elasticity is slightly different:

Arc PED = [(Q2 - Q1) / ((Q1 + Q2) / 2)] / [(P2 - P1) / ((P1 + P2) / 2)]

Where:

- Q1 = Initial Quantity

- Q2 = Final Quantity

- P1 = Initial Price

- P2 = Final Price

The arc elasticity formula uses the average of the initial and final quantities and prices to calculate the percentage changes. This gives a more accurate estimate of elasticity over a larger price range. In many introductory economics courses, point elasticity is often taught first because it’s conceptually simpler. However, for larger price changes, arc elasticity provides a more accurate measure.

Factors Affecting PED: Why Are Some Things More Elastic Than Others?

So, what makes demand for some things elastic and demand for others inelastic? Several factors play a role:

- Availability of Substitutes: This is probably the most important factor. If there are many substitutes for a product, demand will be more elastic. If there are few or no substitutes, demand will be more inelastic. (Think salt vs. a specific brand of organic, fair-trade, Himalayan pink salt. Regular salt has very few substitutes, so demand is relatively inelastic. The fancy salt has tons of substitutes - other fancy salts! - so demand is more elastic.)

- Necessity vs. Luxury: Necessities tend to have inelastic demand, while luxuries tend to have elastic demand. People *need* food and shelter, so they'll buy them even if the price goes up. People can live without fancy gadgets or designer clothes, so they're more likely to cut back if the price goes up.

- Proportion of Income Spent on the Good: If a good represents a small portion of your income, demand will be more inelastic. If it represents a large portion of your income, demand will be more elastic. (A small price increase on a pack of gum won't affect your behavior much. A large price increase on rent will definitely make you reconsider your housing situation.)

- Time Horizon: Demand tends to be more elastic in the long run than in the short run. People need time to adjust their behavior in response to price changes. (If the price of gasoline suddenly doubles, you might still buy gas in the short run to get to work. But in the long run, you might buy a more fuel-efficient car, move closer to work, or start biking.)

- Brand Loyalty: Strong brand loyalty can make demand more inelastic. People who are loyal to a particular brand are less likely to switch to a substitute, even if the price of their favorite brand goes up. (Think Apple fanatics – they'll often pay a premium for Apple products, even if there are cheaper alternatives.)

Limitations of PED: It's Not a Crystal Ball

While PED is a useful tool, it's important to remember that it's not a perfect predictor of consumer behavior. There are several limitations:

- Assumes Other Factors Remain Constant: PED only measures the impact of price changes on quantity demanded, assuming that all other factors (like income, tastes, and the prices of other goods) remain constant. In the real world, this is rarely the case.

- Difficulty in Obtaining Accurate Data: Calculating PED requires accurate data on prices and quantities demanded. This data can be difficult to obtain, especially for new products or services.

- Can Vary Depending on the Range of Prices: As mentioned earlier, elasticity can vary depending on the range of prices being considered. The PED at a price of $10 might be different from the PED at a price of $20.

- Doesn't Account for Psychological Factors: PED is a purely economic concept. It doesn't take into account psychological factors that can influence consumer behavior, such as framing effects, social norms, and emotional appeals.

Final Thoughts: Go Forth and Calculate!

So, there you have it! The point price elasticity of demand formula, explained in (hopefully) plain English. It's a powerful tool for understanding how consumers respond to price changes, and it can be used by businesses, governments, and even you to make better decisions. Remember to consider the factors that affect PED, and be aware of its limitations. And most importantly, don't be afraid to get your hands dirty and calculate some elasticities yourself! You might be surprised at what you discover. Now, if you'll excuse me, I'm going to go calculate the PED for those overpriced lattes...maybe I can convince them to have another flash sale!