Okay, let's talk about something *super* exciting. Ready? It's all about... *drumroll please*... Premera Blue Cross in-network providers! Bet you didn't see that coming!

I know, I know. Healthcare can sound about as thrilling as watching paint dry. But stick with me. This stuff is actually kinda fascinating, in a “I-understand-how-the-world-works-a-little-better” kind of way.

So, What's the Big Deal?

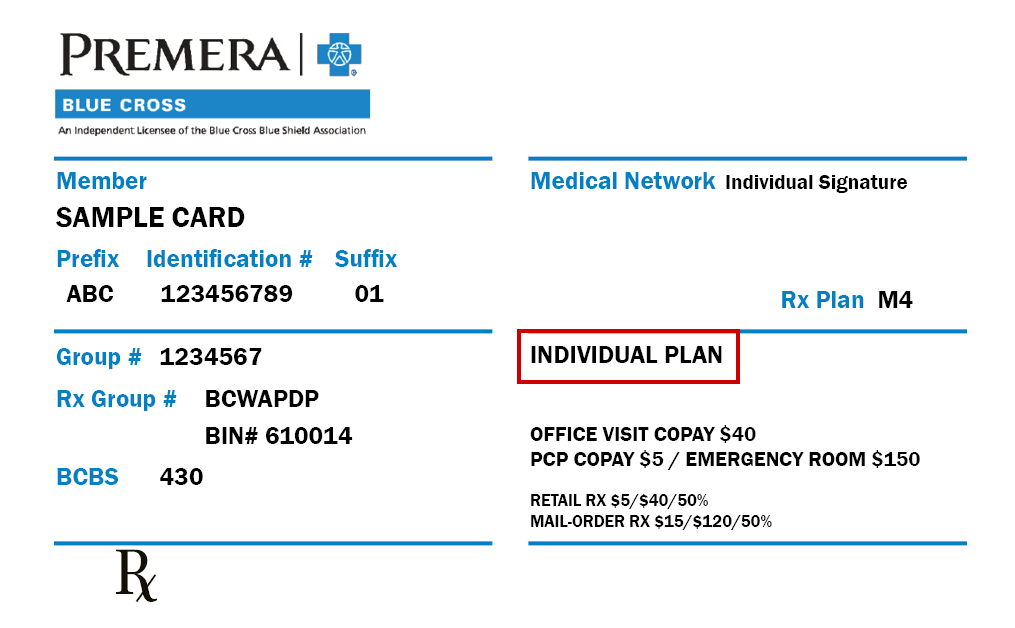

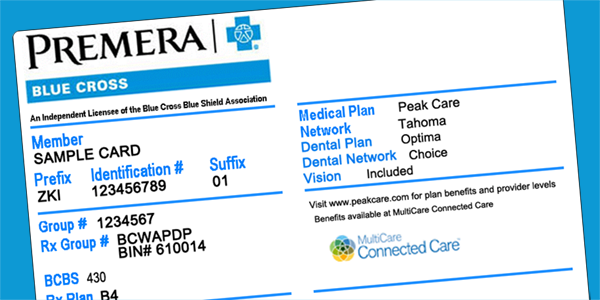

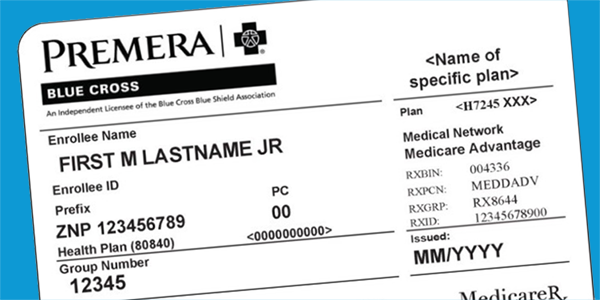

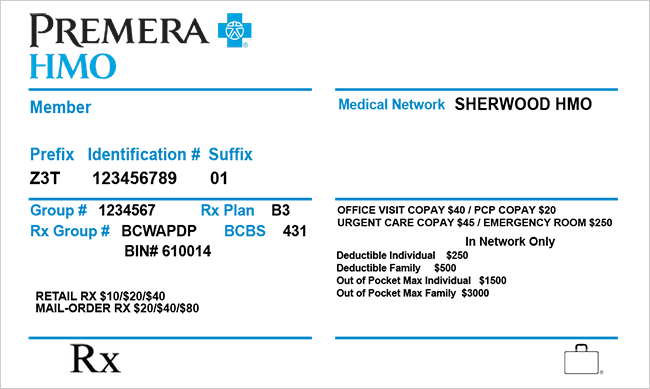

Think of your health insurance like a VIP pass. A *Premera Blue Cross* VIP pass, specifically. But instead of getting you into a concert, it gets you (hopefully) discounted healthcare. And just like some VIP passes only get you into certain areas, your Premera plan works best with certain doctors and hospitals: the *in-network* ones.

Imagine walking into a fancy restaurant and then realizing you only have coupons for the burger joint across the street. That's kinda what it's like going to an out-of-network provider. You *can* do it, but it’s probably gonna cost you more. Sometimes, *a lot* more.

In-network providers are basically the restaurants that accept your VIP pass. They've agreed to a special rate with Premera. This means you pay less out-of-pocket.

Seriously, choosing in-network is like finding a twenty dollar bill in your old jeans. Who doesn't love a little extra cash? Especially when it comes to healthcare bills.

Finding Your People: How to Locate In-Network Providers

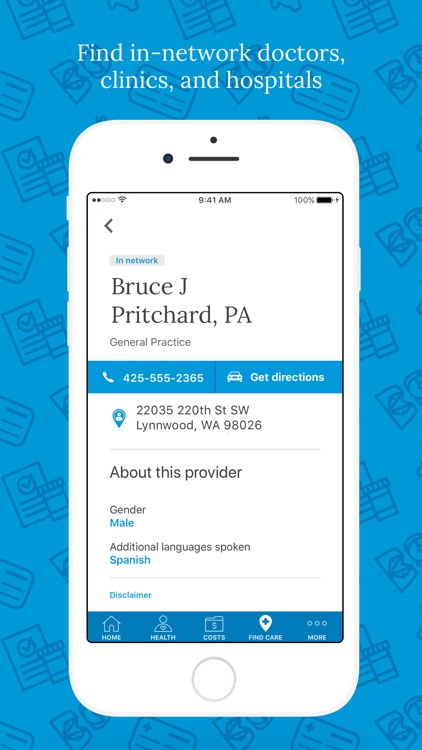

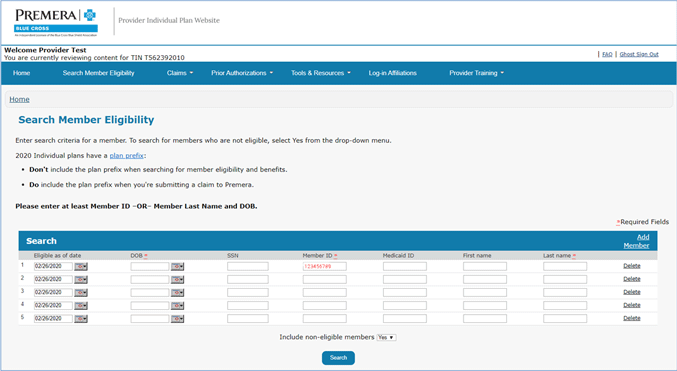

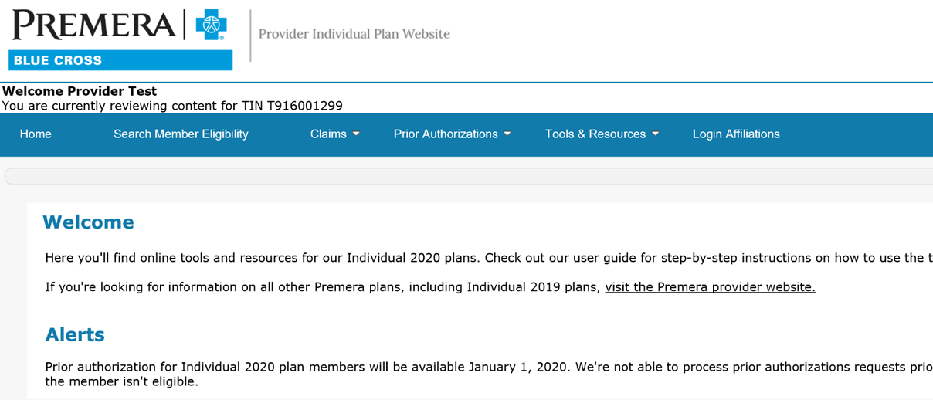

Alright, detective hat time! How do you find these magical in-network providers? Don’t worry, it’s not a scavenger hunt. Usually, Premera has a super handy online directory. It’s basically a Google for doctors.

You can filter by:

- Specialty (need a dermatologist? A podiatrist who specializes in dancing injuries?)

- Location (because nobody wants to drive three hours for a check-up)

- Even language spoken (habla español? Parlez-vous français?)

Think of it as online dating...but for finding a doctor. You want to find someone who's a good fit, right? Someone you *trust* with your precious health.

Also, don't be afraid to call Premera directly! Their customer service folks are (usually) pretty helpful. They can even confirm if a specific doctor is in your network. Think of them as your healthcare concierge. Fancy!

Pro Tip: Double Check Before You Commit!

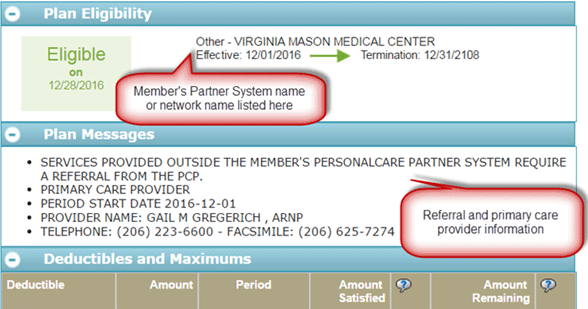

Okay, here's a slightly less fun but *super* important tip: Always, always double-check that a provider is in your network before you receive services. Things can change. Networks shift. Doctors move. It’s like the healthcare version of musical chairs.

Don't just assume because they were in-network last year, they're in-network now. A quick phone call can save you a major headache (and a major bill) down the road.

Why In-Network Matters (Besides Saving Money)

Okay, yeah, saving money is a huge perk. But there’s more to it than just that!

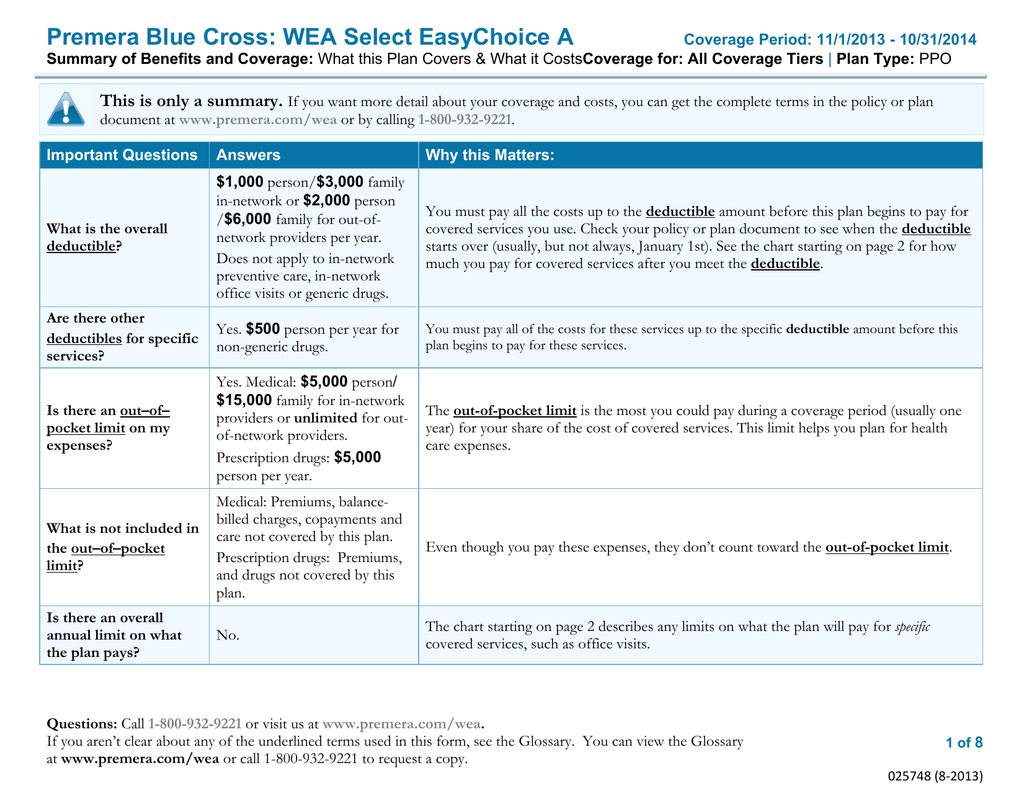

Predictability: When you use in-network providers, you know what to expect. Premera has already negotiated rates, so you're less likely to get a surprise bill that makes you want to faint.

Simplicity: In-network providers usually handle the billing directly with Premera. Less paperwork for you! Who doesn't love less paperwork? It's like getting out of jury duty.

Peace of Mind: Knowing you're getting the best possible care at the best possible price? That’s priceless. It’s like knowing you aced that exam you totally winged.

Out-of-Network: When It Makes Sense (Maybe)

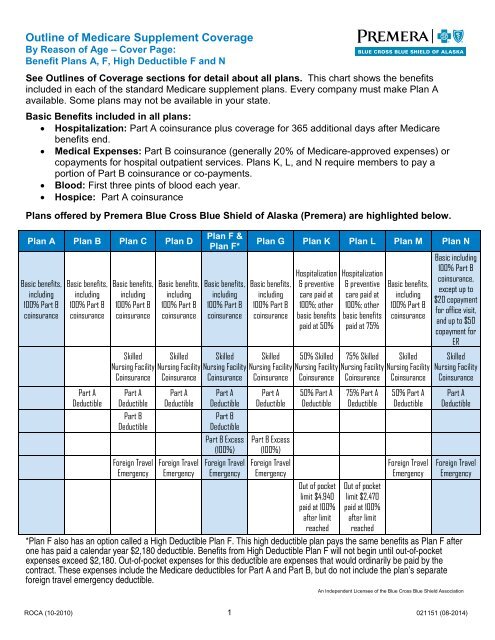

Okay, so in-network is usually the way to go. But sometimes, going out-of-network might be necessary. Maybe you need a specialist who's not in your network. Or maybe you're traveling and need urgent care.

Just be prepared for potentially higher costs. And make sure to understand your plan's out-of-network benefits. Read the fine print! (Okay, maybe *ask* someone to read the fine print for you. Fine print is the enemy.)

Always check with Premera before seeking out-of-network care if possible. They might be able to help you find an in-network alternative, or at least give you an idea of what your costs will be.

Fun Facts (Because Why Not?)

Did you know that the term "blue cross" originally referred to plans that covered hospital care? And "blue shield" covered doctor's services? Now you know! You’re practically a healthcare historian!

Imagine a world where you had to barter for healthcare. "I'll trade you three chickens for a root canal!" Thankfully, we have health insurance (and dentists who prefer cash or credit).

And here's a real kicker: navigating health insurance can feel like learning a new language. Deductibles, co-pays, co-insurance...it's a whole new world of jargon! But hey, you're learning it one article at a time!

In Conclusion: Be a Smart Shopper!

Think of healthcare like shopping for anything else. You compare prices, you look for deals, and you try to get the best value for your money. Using Premera Blue Cross in-network providers is like using a coupon code at your favorite online store. It's a simple way to save money and get the care you need.

So, the next time you need to see a doctor, remember your in-network VIP pass! It's your ticket to a healthier wallet and (hopefully) a healthier you.

Don't be afraid to ask questions, do your research, and be an active participant in your healthcare decisions. You've got this!

Now go forth and conquer the world of in-network providers! You are armed with knowledge. Use it wisely!