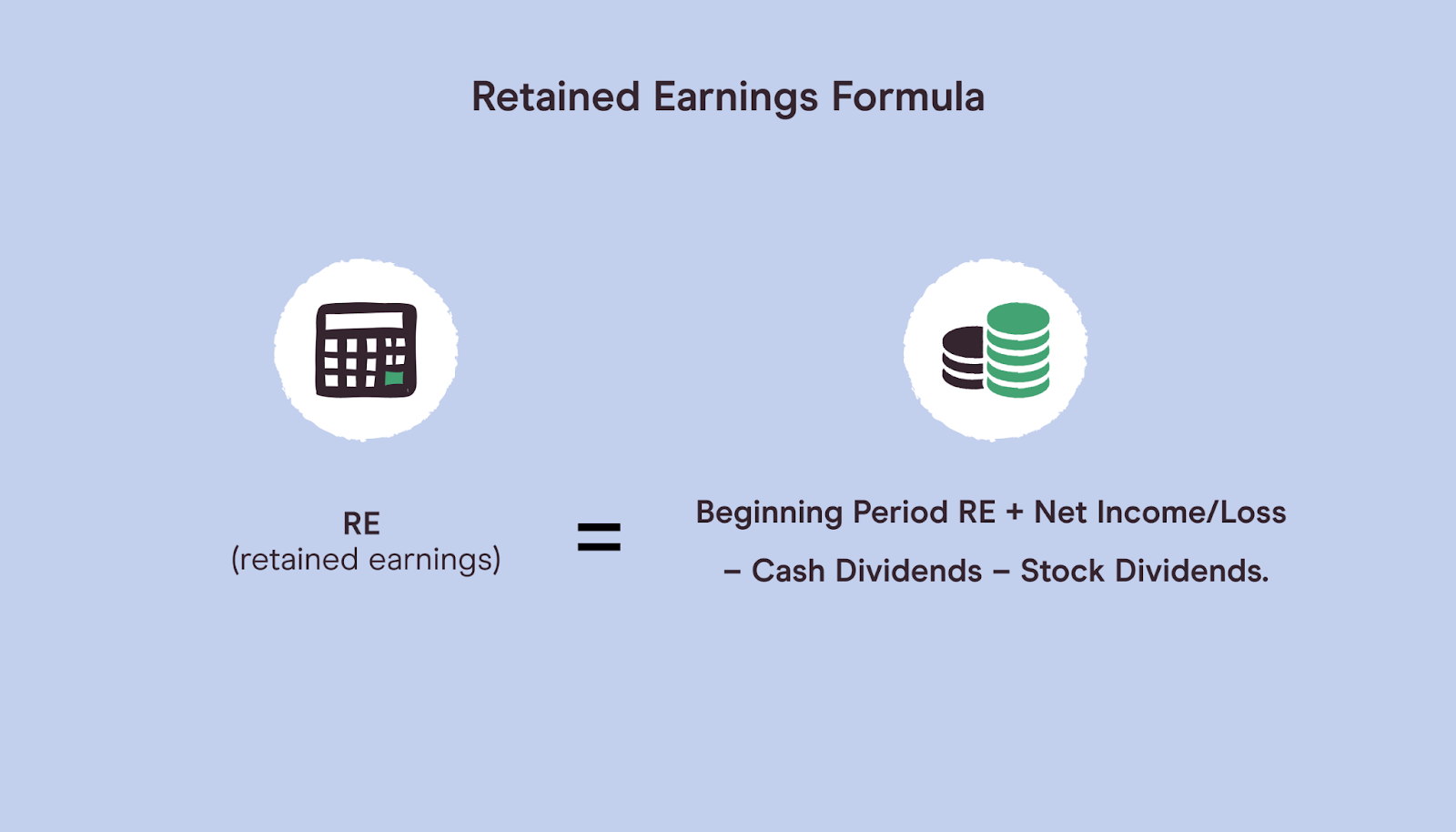

Understanding Retained Earnings

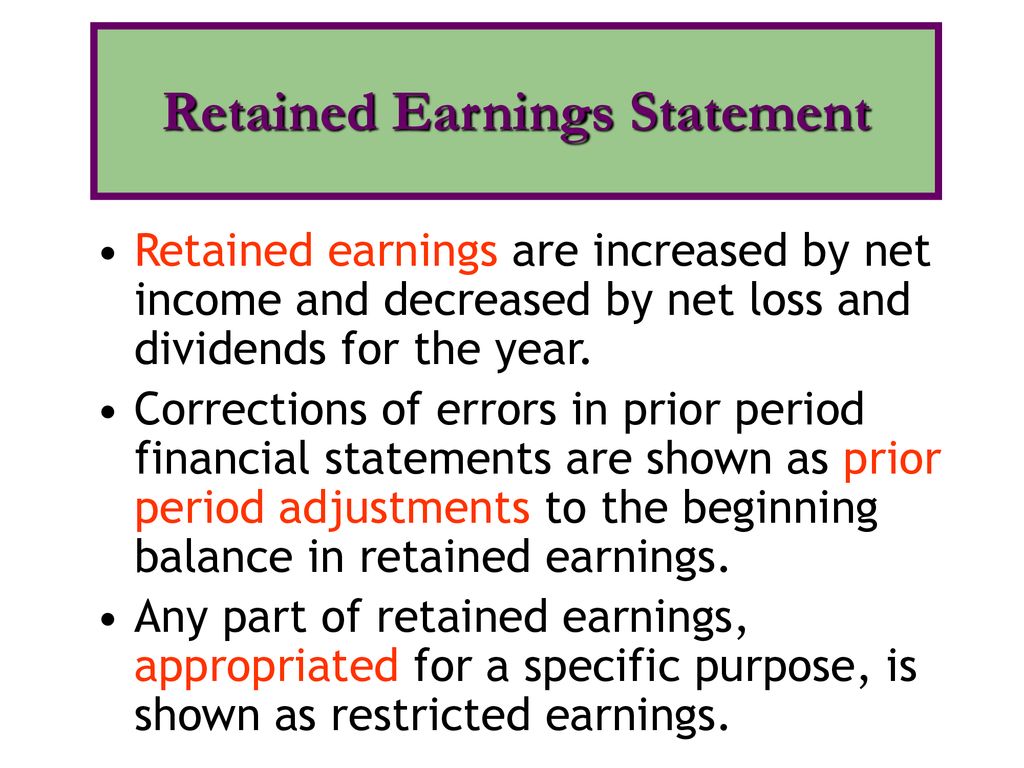

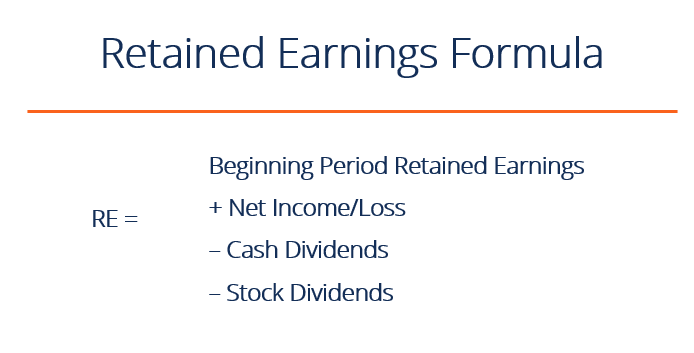

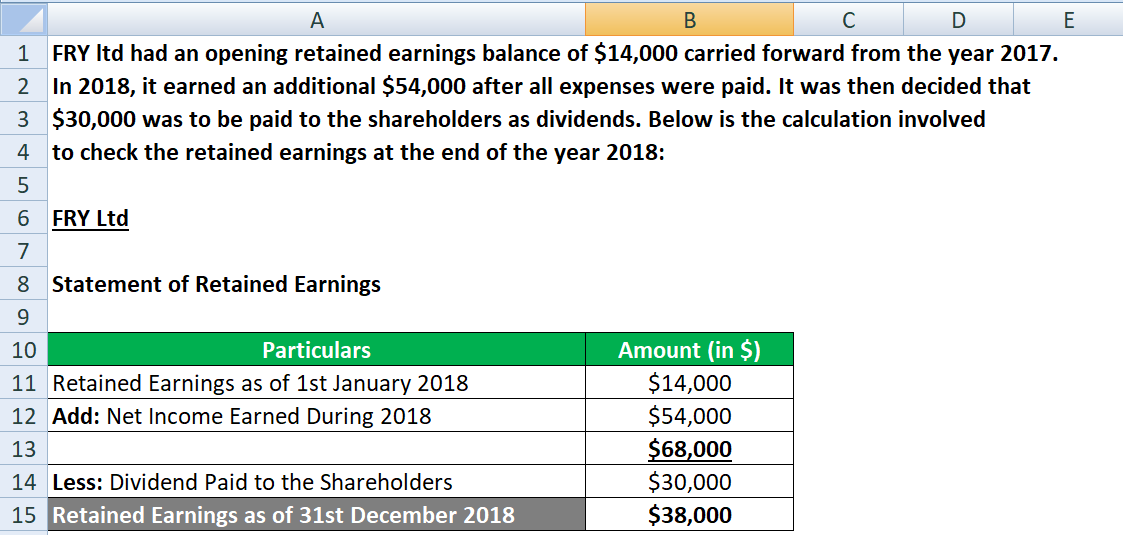

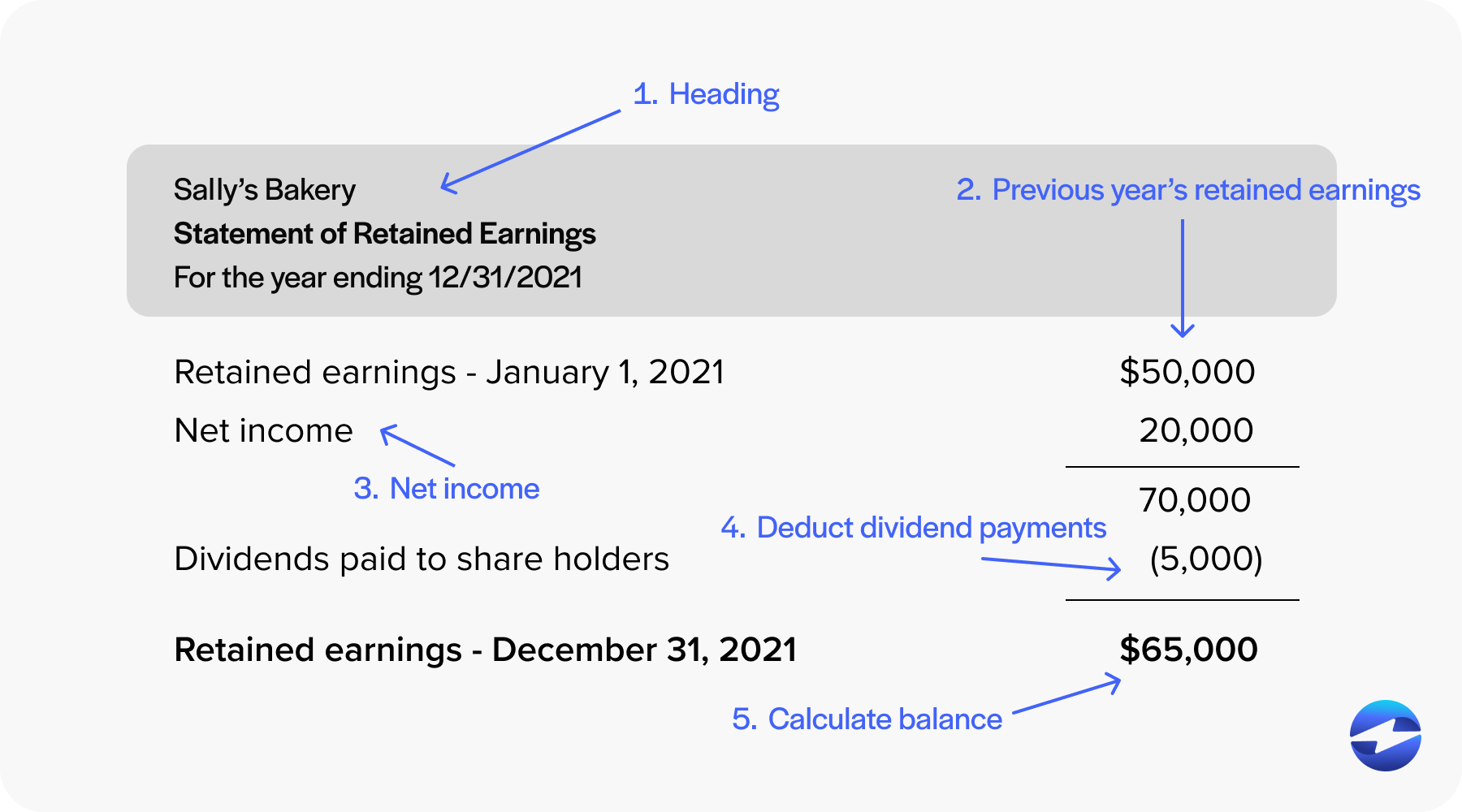

Retained earnings represent the accumulated profits a company has earned over time that have not been distributed to shareholders as dividends. It's a crucial component of a company's equity and provides insight into its financial health and reinvestment capabilities. Analyzing the factors that increase or decrease retained earnings is essential for investors and stakeholders.

Factors Decreasing Retained Earnings

Several key elements can lead to a decrease in retained earnings. Understanding these factors is vital for interpreting financial statements and assessing a company's performance.

Net Losses

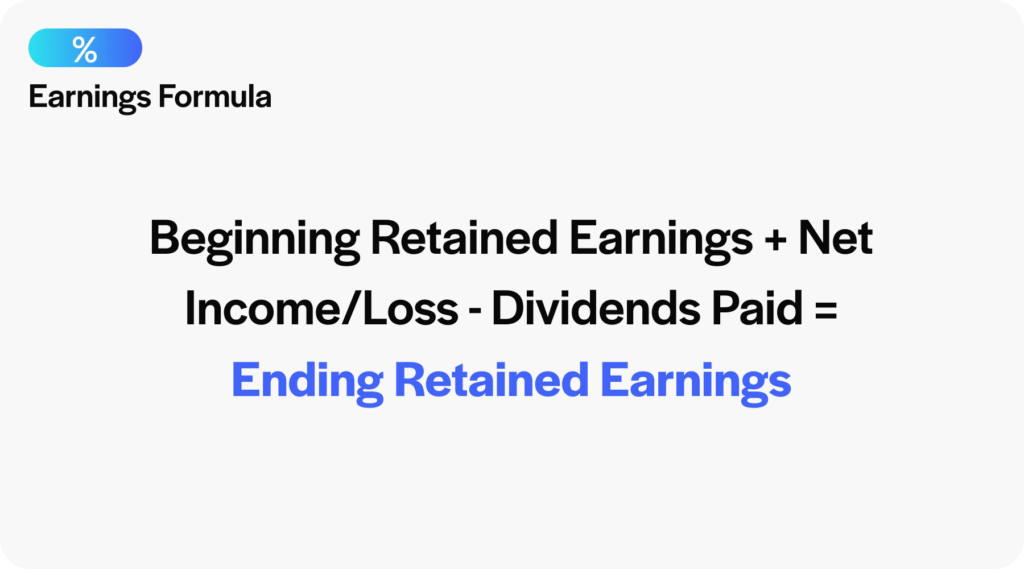

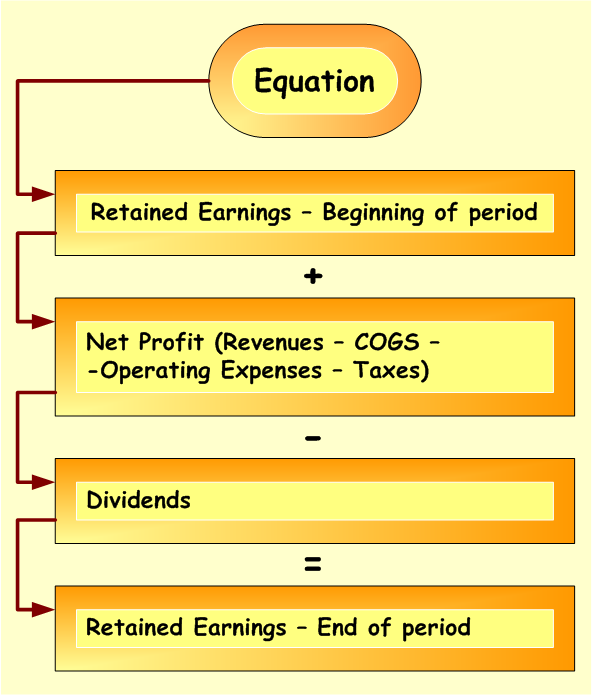

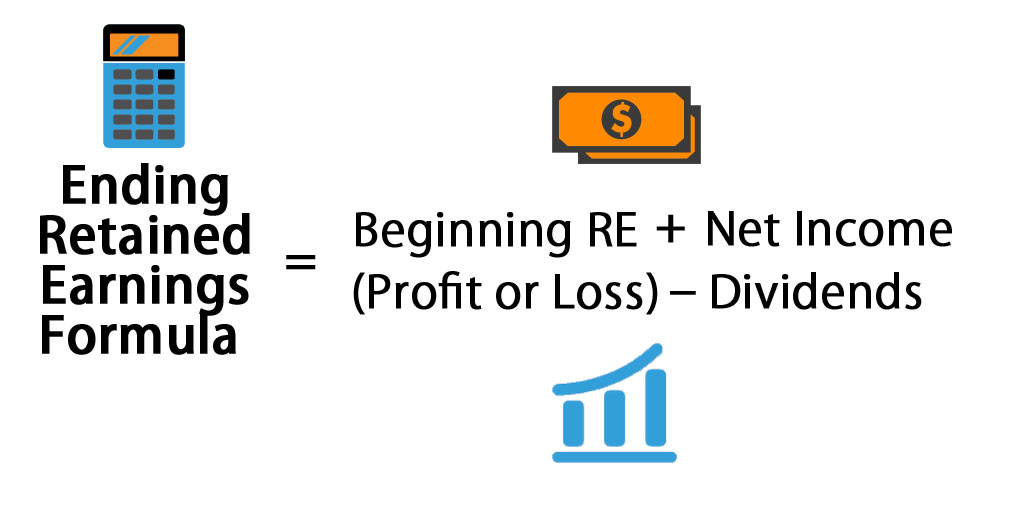

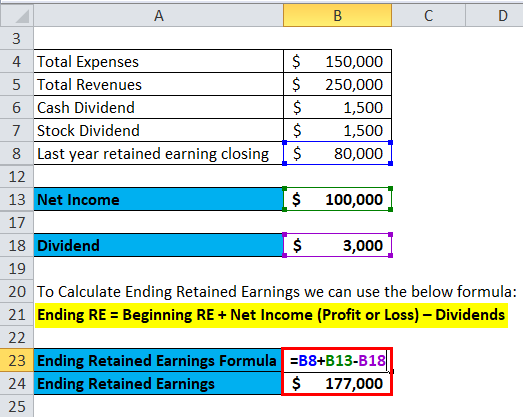

The most direct way retained earnings decrease is through a net loss. When a company's expenses exceed its revenues, the resulting net loss directly reduces the accumulated profit balance. This is reflected in the income statement and subsequently impacts the retained earnings statement. The formulaic relationship is clear: a lower net income (or a net loss) directly translates to a lower addition to (or a subtraction from) retained earnings.

A consistent pattern of net losses signals potential operational inefficiencies or market challenges that a company needs to address.

Dividend Payments

Dividends are distributions of a company's profits to its shareholders. These payments represent a direct outflow of cash and a corresponding reduction in retained earnings. The decision to pay dividends is typically made by the company's board of directors, balancing shareholder expectations with the need for reinvestment in the business. Higher dividend payouts will result in a more significant decrease in retained earnings, impacting the company's ability to fund future growth initiatives internally.

Stock Repurchases (Treasury Stock)

When a company buys back its own shares from the open market, this is known as a stock repurchase or treasury stock. While not an expense in the traditional sense, the cash used for the repurchase reduces the company's assets and, correspondingly, the equity. This reduction in equity is reflected as a decrease in retained earnings. The rationale behind stock repurchases often involves increasing earnings per share (EPS) or returning value to shareholders, but it's crucial to recognize the impact on retained earnings.

Prior Period Adjustments (Specifically, Corrections of Errors that Decrease Net Income)

Prior period adjustments are corrections of errors discovered in previously issued financial statements. If the error resulted in an overstatement of net income in a prior period, the correction will necessitate a reduction in retained earnings. These adjustments are typically made retroactively, affecting the beginning retained earnings balance in the current period. The materiality of these adjustments is crucial, as significant errors can erode investor confidence and trigger regulatory scrutiny.

Certain Accounting Changes

Changes in accounting principles, as mandated by regulatory bodies like the FASB or IASB, can sometimes require retrospective application. If the adoption of a new accounting standard results in a decrease in previously reported net income, the retained earnings balance will be adjusted downwards. These changes ensure comparability and consistency in financial reporting but can significantly impact the perceived financial position of a company.

The Exception: Factors That *Do Not* Decrease Retained Earnings

It is important to identify which events do *not* typically decrease Retained Earnings.

Stock Splits

A stock split is a corporate action where a company increases the number of outstanding shares while simultaneously decreasing the price per share. For example, a 2-for-1 stock split doubles the number of shares and halves the price of each share. Critically, a stock split does not affect the total value of the company or the components of equity, including retained earnings. It is simply a redistribution of ownership represented by more shares at a lower price. The accounting equation (Assets = Liabilities + Equity) remains balanced; no assets are transferred, and no liabilities are created or extinguished.

Stock splits are often undertaken to make shares more affordable to individual investors, increasing liquidity and potentially broadening the shareholder base. However, the underlying financial health and accumulated profits of the company remain unchanged.

Why Stock Splits Don't Affect Retained Earnings: A Closer Look

The key to understanding why stock splits don't affect retained earnings lies in recognizing the difference between equity accounts. While retained earnings is a part of equity, so is common stock (or ordinary shares). In a stock split, the par value of the stock is typically reduced proportionally, and the number of shares is increased. However, the overall equity is not altered.

For example, assume a company has 1 million shares outstanding with a par value of $1 per share and $10 million in retained earnings. The common stock account would be $1 million (1 million shares x $1 par value). After a 2-for-1 stock split, the company would have 2 million shares outstanding with a par value of $0.50 per share. The common stock account remains $1 million (2 million shares x $0.50 par value), and the retained earnings balance remains at $10 million. The split simply reclassifies the equity components without changing the overall value.

Distinguishing Stock Splits from Stock Dividends

It's crucial to distinguish stock splits from stock dividends. While both involve issuing additional shares, their accounting treatment differs. A stock dividend involves transferring a portion of retained earnings to the common stock account, effectively capitalizing a portion of the company's profits. This *does* reduce retained earnings.

Stock splits, on the other hand, do not involve any such transfer. They are purely a proportional increase in shares without any impact on the equity components. The motivation behind stock dividends can be different, often signaling confidence in the company's future prospects without distributing cash dividends.

The Importance of Context

Analyzing changes in retained earnings requires careful consideration of the context. A decrease in retained earnings might not always be negative. For example, a company might strategically increase dividend payouts to reward shareholders, which reduces retained earnings but could be viewed favorably by investors. Conversely, a significant decrease due to net losses or prior period adjustments should raise concerns and warrant further investigation.

Conclusion: Key Takeaways

Understanding the factors that influence retained earnings is critical for evaluating a company's financial health and prospects. Retained earnings are decreased by net losses, dividend payments, stock repurchases, prior period adjustments (correcting past errors that decreased net income), and certain accounting changes that retroactively decrease net income.

However, stock splits do *not* decrease retained earnings. Stock splits are purely a proportional increase in the number of outstanding shares and a corresponding decrease in the price per share, without impacting the overall equity or the retained earnings balance.

By carefully analyzing the reasons behind changes in retained earnings, investors and stakeholders can gain valuable insights into a company's profitability, dividend policy, capital allocation decisions, and overall financial management.

.jpg)