Alright, gather 'round, folks! Let's talk about the stock market. I know, I know, usually it's about as exciting as watching paint dry. But trust me, this is like watching paint dry… but the paint is made of money, and sometimes it explodes glitter. We’re diving into the wild world of the Russell 2000 versus the Russell 1000. Think of it as a financial cage match, but instead of oiled-up wrestlers, we have… well, companies.

The Russell Rumble: Small Caps vs. Big Shots

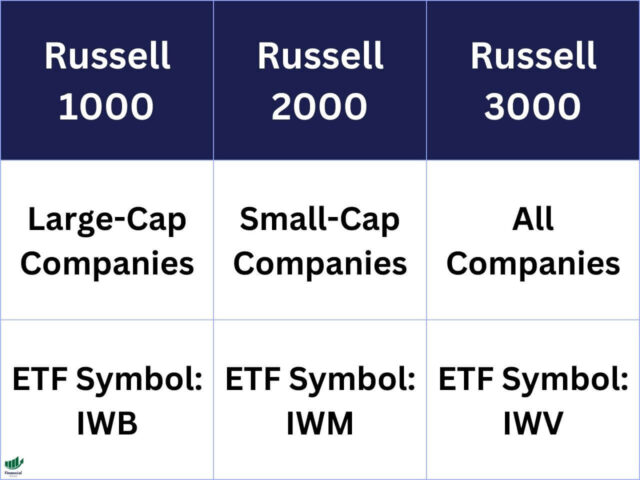

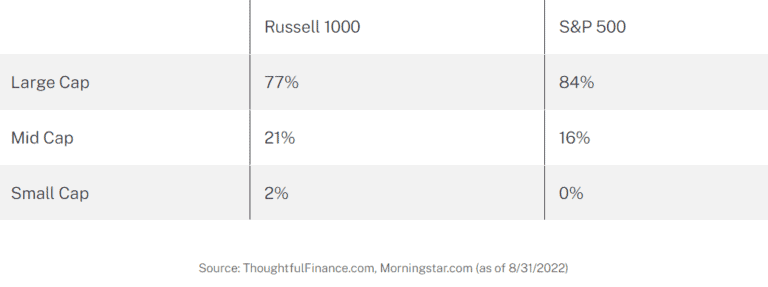

First things first: what are these "Russell" things? The Russell 1000 represents the top 1000 largest publicly traded companies in the U.S. It's basically the cool kids table at the stock market cafeteria. Names you'd recognize, like Apple, Microsoft, and that company you secretly blame for all your online shopping addiction (Amazon!). These are the big hitters, the financial elephants of the world. They generally represent about 93% of the total U.S. stock market.

The Russell 2000? Ah, that's where the fun begins. This index is made up of the next 2000 smaller companies after the Russell 1000. These are the plucky underdogs, the scrappy startups, the potential future giants. Think of them as the minor league baseball team hoping to get called up to the majors. They're often referred to as small-cap stocks.

Why Should I Care About These Indexes?

Great question! (I planted that question, by the way.) These indexes are important because they give us a snapshot of how different segments of the market are performing. They're like thermometers for the economy, except instead of measuring temperature, they measure… well, money-temperature? That's not a real thing, but you get the idea.

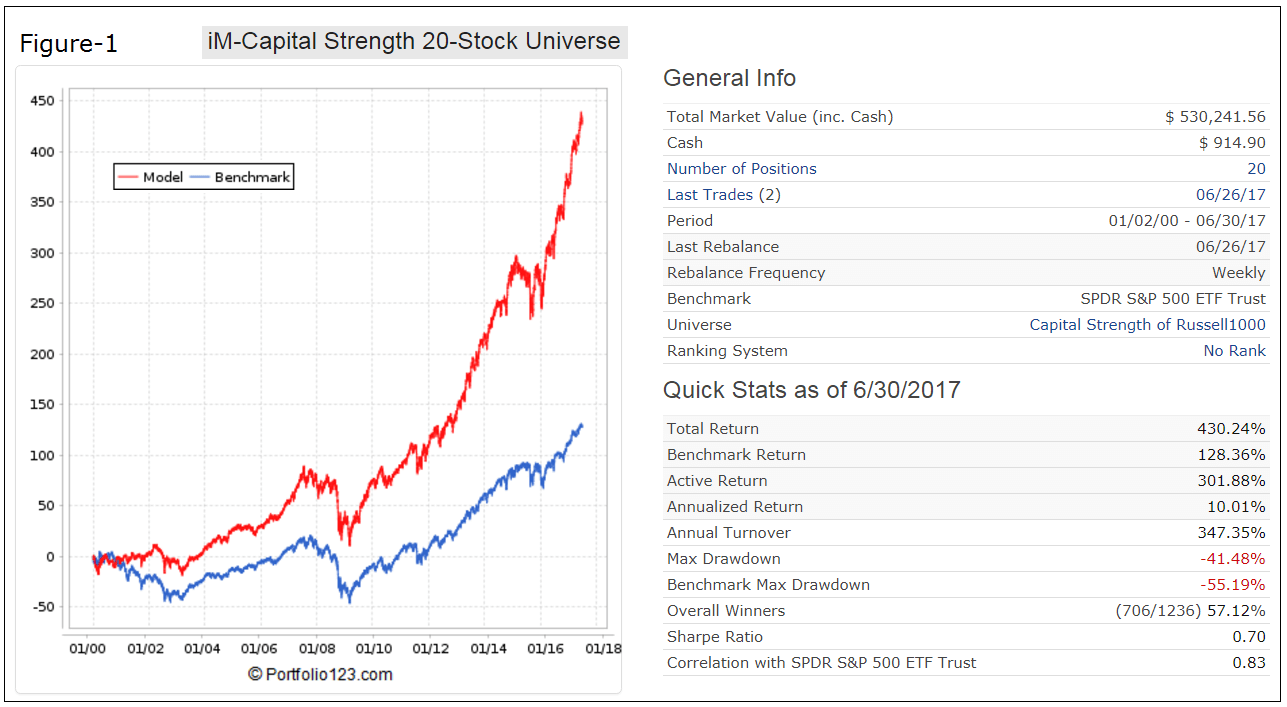

Investors use these indexes as benchmarks. Imagine you're a fund manager, and you're trying to convince people to invest in your small-cap fund. You'll want to show them how you're performing compared to the Russell 2000. If your fund is beating the Russell 2000, you can brag a little. If it's lagging behind, well, maybe you should consider a career change. Like competitive hot-dog eating, or professional napping.

The Performance Rollercoaster: Ups and Downs

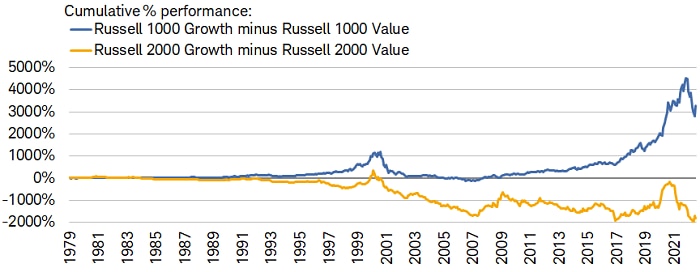

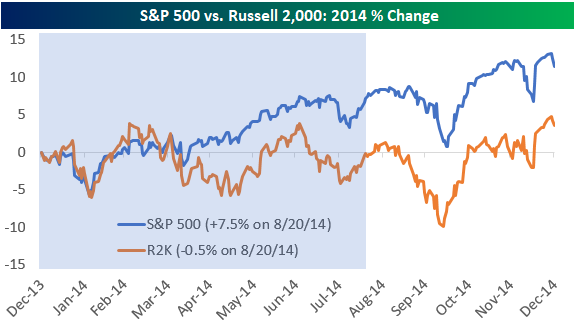

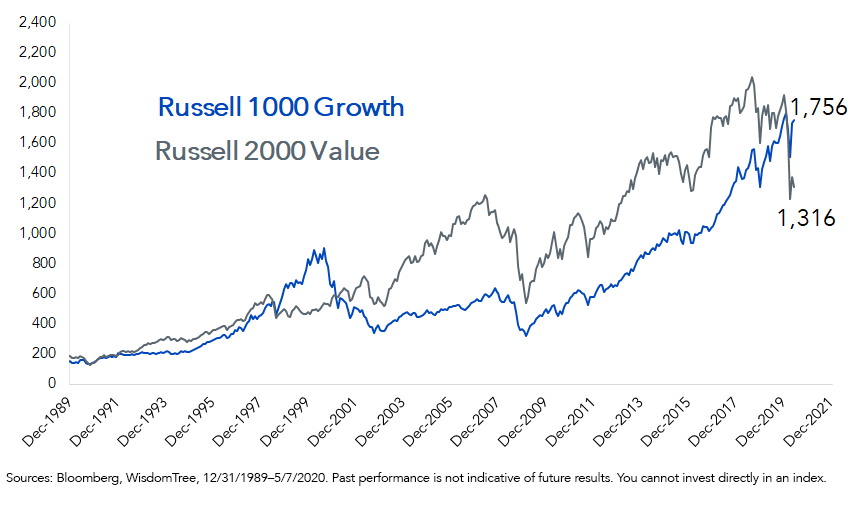

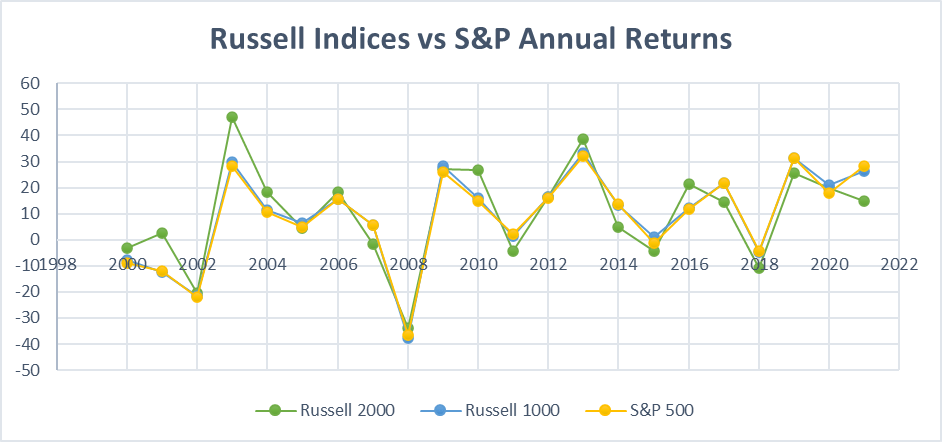

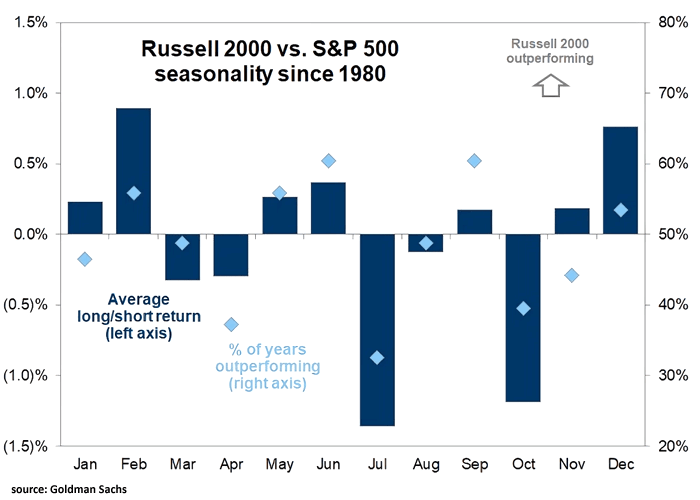

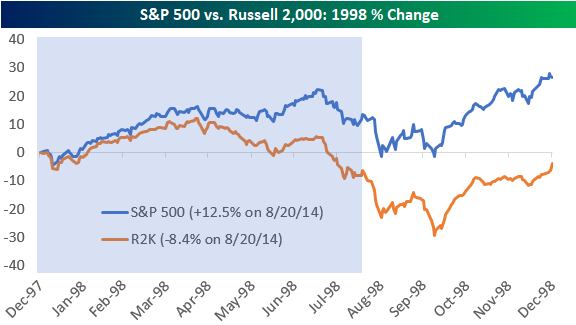

Here's the million-dollar question: who wins this Russell Rumble? The answer, as with most things in life, is: it depends! It's not like one always outperforms the other. It's more like a rollercoaster ride. Sometimes the small caps are soaring, fueled by innovation and high growth potential. Other times, the big boys dominate, offering stability and dividends that make you feel like you're getting paid to… well, exist. I wish that was a real job.

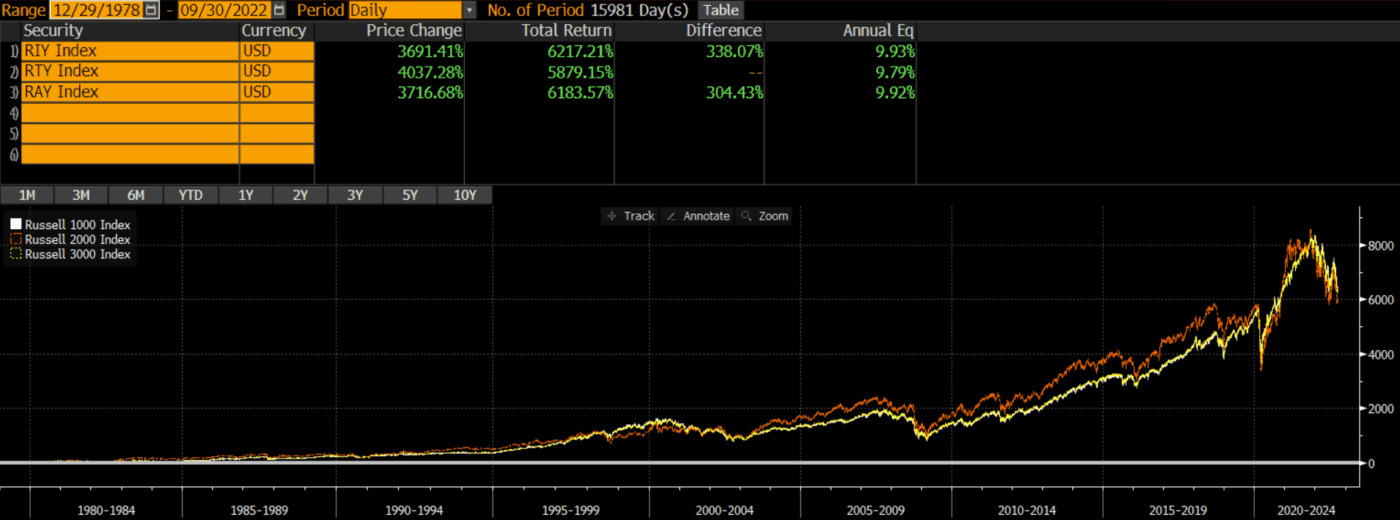

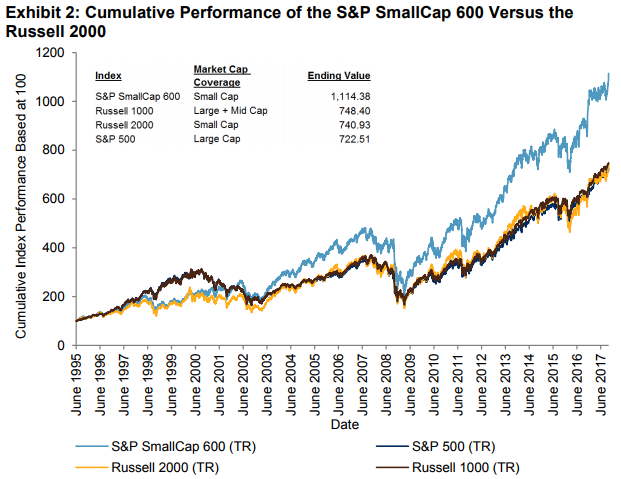

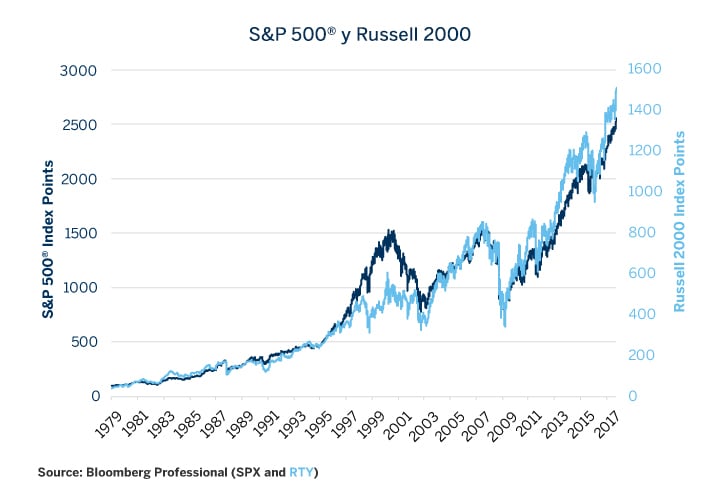

Historically, the Russell 2000 has often outperformed the Russell 1000 over longer periods. But that doesn't mean it's a guaranteed slam dunk. Small-cap stocks are generally riskier than large-cap stocks. They're more volatile, meaning their prices can swing wildly. Think of it as driving a race car versus driving a tank. The race car is faster, but the tank is a lot harder to flip over.

Factors Affecting Performance

So, what makes these indexes dance to different tunes? A few key factors:

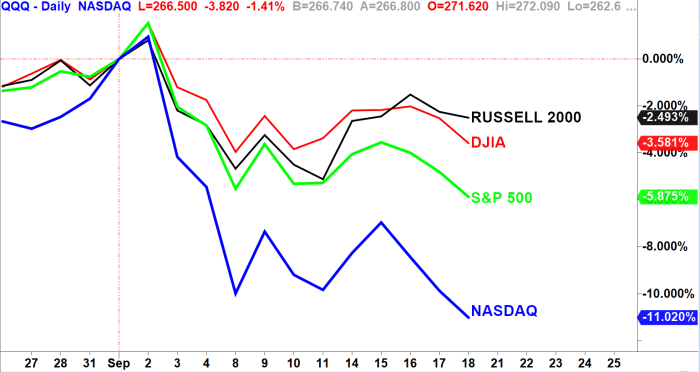

- Economic Growth: Small-cap companies are often more sensitive to economic changes. If the economy is booming, they can thrive. But if the economy tanks, they can get hit hard. Think of them as the canaries in the coal mine of the stock market. (Except, hopefully, they don't actually die.)

- Interest Rates: Higher interest rates can hurt small-cap companies more because they often rely on borrowing money to grow. It's like trying to run a marathon with lead shoes.

- Investor Sentiment: When investors are feeling optimistic, they're more likely to take a chance on small-cap stocks. But when fear creeps in, they tend to flock to the perceived safety of large-cap stocks. This is known as the “flight to safety.” It’s like when a zombie apocalypse happens, you're going to hide in the biggest, sturdiest building you can find, not that quirky little coffee shop.

- Sector Composition: The Russell 2000 has a different mix of industries than the Russell 1000. This can impact performance depending on which sectors are in favor. For example, if healthcare is booming, and the Russell 2000 has a lot of healthcare companies, it might outperform.

The Investor's Dilemma: To Small-Cap or Not to Small-Cap?

Okay, so you’re thinking, "Should I invest in the Russell 2000 or the Russell 1000?" Well, that depends on your investment goals, risk tolerance, and how much time you want to spend glued to your computer screen watching stock prices. (Spoiler alert: probably too much.)

Here are a few things to consider:

- Long-Term Growth: If you're looking for long-term growth potential, the Russell 2000 could be a good option. But remember, it comes with more risk. It's like planting a seed that could grow into a giant redwood or… well, just a really enthusiastic weed.

- Stability and Dividends: If you prefer stability and income, the Russell 1000 might be a better fit. These companies are generally more established and often pay dividends, which are like little cash bonuses for being a shareholder. It’s like finding a twenty dollar bill in your old jeans – a pleasant, unexpected surprise!

- Diversification: Diversifying your portfolio is always a good idea. You don’t want to put all your eggs in one basket, unless that basket is made of reinforced steel and guarded by trained attack squirrels. Consider investing in both the Russell 2000 and the Russell 1000 to get a balance of growth and stability.

How to Invest: The Lazy Person's Guide

Alright, let's be honest. Most of us don't have the time or the inclination to pick individual stocks. So, how do you invest in these indexes without losing your mind (or all your money)? The easiest way is through Exchange Traded Funds (ETFs). These are like baskets of stocks that track the performance of an index. Just buy a Russell 2000 ETF or a Russell 1000 ETF, and you're good to go! It's like ordering pizza instead of making it from scratch. Less effort, same delicious (financial) outcome.

There are tons of ETFs out there that track these indexes. Just do a little research, compare the fees, and pick one that suits your needs. And remember, past performance is not indicative of future results. In other words, just because the Russell 2000 did well last year doesn't mean it will do well this year. The stock market is a fickle beast.

The Bottom Line: It's a Marathon, Not a Sprint

Investing in the Russell 2000 or the Russell 1000 is not a get-rich-quick scheme. It's a long-term game. It's like running a marathon, not a sprint. You need to be patient, disciplined, and prepared for ups and downs. Don't panic when the market dips (it will). Don't get too cocky when it soars (it might not last). Just stay the course, and you might just end up with a comfortable retirement. Or at least enough money to buy a decent used RV and drive off into the sunset.

And that, my friends, is the story of the Russell 2000 versus the Russell 1000. Now go forth and invest… responsibly! And maybe buy me a coffee while you're at it. After all, I just saved you from making some potentially disastrous financial decisions. (Or at least entertained you for a few minutes. Which, let's be honest, is a valuable service in itself.)