A Secu Salo cash account, like many financial instruments, often comes with defined withdrawal limits. These limits are implemented for security reasons, regulatory compliance, and to maintain the overall stability of the financial institution. Understanding these limits is crucial for account holders to effectively manage their funds and avoid unexpected inconveniences.

Understanding Withdrawal Limits

Withdrawal limits are restrictions placed on the amount of money that can be withdrawn from an account within a specified period. This period can be daily, weekly, or monthly. The limits can apply to various methods of withdrawal, including:

- ATM withdrawals

- Over-the-counter (teller) withdrawals

- Electronic transfers

- Checks

The rationale behind these limits is multifaceted.

Security Measures

Withdrawal limits act as a safeguard against unauthorized access and fraudulent activities. If an account is compromised, a withdrawal limit restricts the amount of money that can be stolen before the account holder or the financial institution detects the fraudulent activity.

For example, if an account has a daily ATM withdrawal limit of $500, a thief who gains access to the account through a stolen card or phishing scam can only withdraw a maximum of $500 per day. This provides time for the account holder to report the incident and the financial institution to freeze the account.

Regulatory Compliance

Financial institutions are subject to various regulations designed to prevent money laundering and other illicit activities. Withdrawal limits can assist in complying with these regulations by flagging unusually large or frequent withdrawals that may warrant further investigation.

For instance, the Bank Secrecy Act (BSA) in the United States requires financial institutions to report any transactions exceeding a certain threshold (currently $10,000) to the Financial Crimes Enforcement Network (FinCEN). Withdrawal limits can help identify transactions approaching this threshold.

Maintaining Financial Stability

In extreme circumstances, such as a bank run (where a large number of customers withdraw their funds simultaneously), withdrawal limits can help maintain the financial stability of the institution. By limiting the amount of money that can be withdrawn, the institution can prevent a rapid depletion of its reserves.

Types of Withdrawal Limits

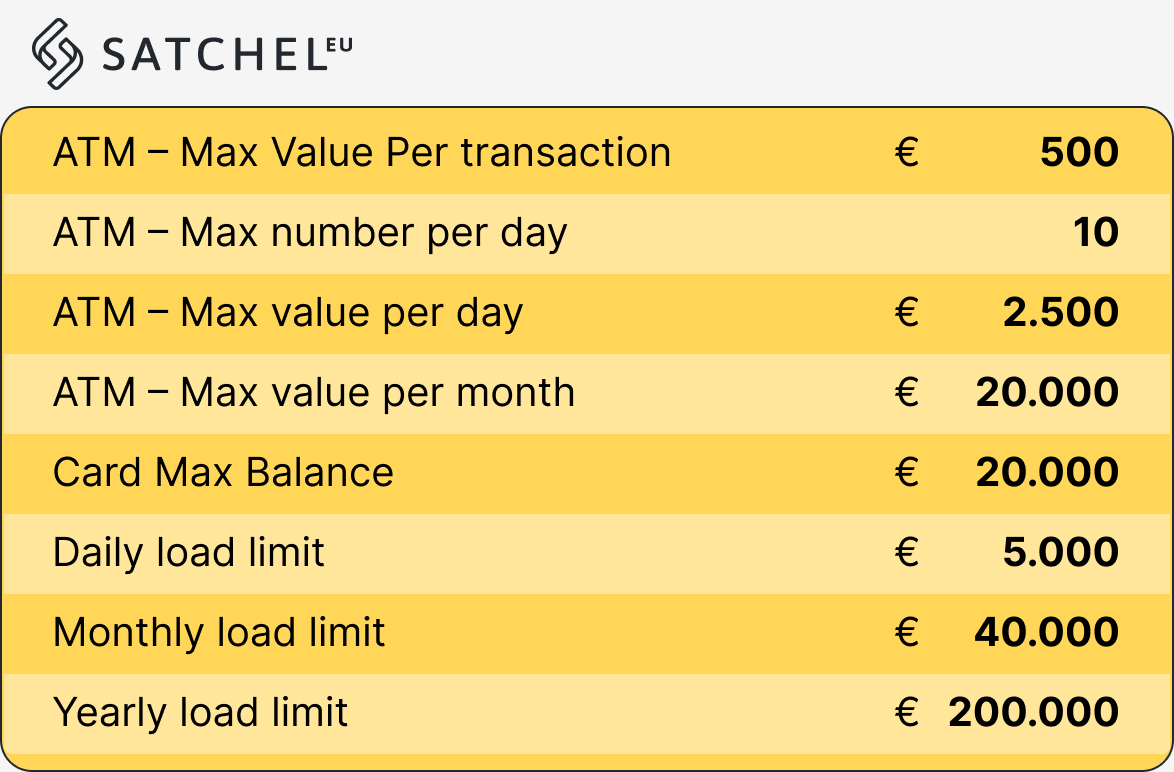

Secu Salo cash accounts, like those offered by other financial institutions, may have several types of withdrawal limits.

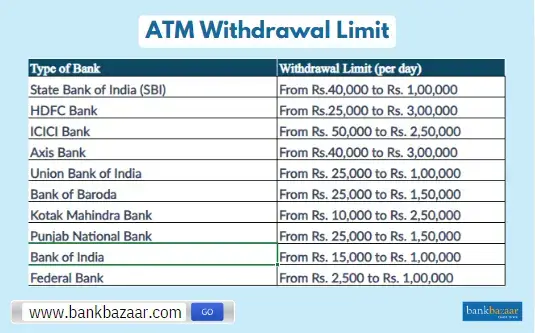

Daily Withdrawal Limits

This is the most common type of withdrawal limit, restricting the amount of money that can be withdrawn within a 24-hour period. The limit typically applies to ATM withdrawals and, in some cases, to over-the-counter withdrawals.

Example: A Secu Salo cash account may have a daily ATM withdrawal limit of $500 and a daily over-the-counter withdrawal limit of $2,000.

Transaction Limits

Some accounts may have limits on the number of transactions that can be made within a given period, regardless of the amount. This is more common with certain types of savings accounts or promotional accounts.

Example: A savings account may allow only six withdrawals per month to comply with federal regulations regarding the definition of a savings account.

Transfer Limits

These limits apply to electronic transfers of funds from the Secu Salo cash account to other accounts, either within the same institution or to external accounts. These limits often vary depending on whether the transfer is initiated online, through a mobile app, or in person.

Example: An account may allow online transfers of up to $5,000 per day, while in-person transfers may have a higher limit of $10,000 per day.

Check Writing Limits

Although less common with basic cash accounts, some accounts may impose limits on the number or value of checks that can be written within a specific period.

Example: A business checking account might have a monthly limit on the total dollar amount of checks that can be processed without incurring additional fees.

Checking Your Withdrawal Limits

It is essential to be aware of the specific withdrawal limits that apply to your Secu Salo cash account. You can typically find this information through several channels:

- Account Agreement: The account agreement you received when opening the account will outline the terms and conditions, including any withdrawal limits.

- Online Banking: Most financial institutions provide online banking platforms where you can view your account details, including withdrawal limits.

- Mobile App: Similar to online banking, mobile apps often provide access to account information, including withdrawal limits.

- Customer Service: You can contact Secu Salo customer service by phone or in person to inquire about your withdrawal limits.

- ATM: Some ATMs may display the withdrawal limit for your account before you initiate a withdrawal.

Exceeding Withdrawal Limits

Attempting to exceed your withdrawal limits can result in several consequences:

- Transaction Denial: The most common outcome is that the transaction will be denied. For example, if you attempt to withdraw $600 from an ATM with a $500 daily limit, the ATM will reject the transaction.

- Fees: Some financial institutions may charge a fee for attempting to exceed a withdrawal limit, even if the transaction is denied.

- Account Review: Repeated attempts to exceed withdrawal limits may trigger a review of your account by the financial institution. This is particularly likely if the attempts appear suspicious or potentially fraudulent.

Strategies for Managing Withdrawal Limits

Here are some strategies for effectively managing withdrawal limits and avoiding inconveniences:

- Plan Ahead: If you anticipate needing a large sum of money, plan ahead and make arrangements to withdraw the funds in advance, potentially over multiple days if necessary.

- Utilize Multiple Withdrawal Methods: If your ATM withdrawal limit is insufficient, consider using other methods, such as over-the-counter withdrawals or electronic transfers.

- Consider a Higher-Tier Account: If your withdrawal needs frequently exceed the limits of your current account, consider upgrading to a higher-tier account that offers higher limits.

- Communicate with the Bank: In exceptional circumstances, such as a large, unexpected expense, you may be able to request a temporary increase in your withdrawal limit by contacting Secu Salo customer service. However, this is not guaranteed and may require providing documentation to support your request.

- Keep Track of Withdrawals: Maintain a record of your withdrawals to ensure that you do not inadvertently exceed your limits. Online banking and mobile apps can be helpful for tracking your account activity.

Conclusion

Understanding and managing withdrawal limits associated with your Secu Salo cash account is crucial for effective financial management. By knowing your limits, planning ahead, and utilizing available withdrawal methods strategically, you can avoid unexpected transaction denials and ensure that you have access to your funds when you need them. Regularly reviewing your account terms and conditions and staying informed about any changes to withdrawal policies is also highly recommended.

Ultimately, withdrawal limits are in place to protect both the account holder and the financial institution. Being aware of these limits and utilizing sound financial planning practices allows individuals to navigate these restrictions effectively and maintain control over their finances.

:max_bytes(150000):strip_icc():format(webp)/faq-what-are-the-withdrawal-limits-for-savings-accounts-4589981-final-8afca50154c641ea9b8b23c4f0c04d19.png)