Okay, let's talk about something that might not sound super exciting at first glance, but trust me, it's worth a chat: Short Term Disability (STD) insurance. Think of it like this – it's like having a superpower for your paycheck when life throws you a curveball. Ever wondered what would happen if you suddenly couldn't work for a few weeks or months? That’s where this little gem comes in.

What Exactly IS Short Term Disability?

Simply put, STD insurance is designed to replace a portion of your income if you're temporarily unable to work due to an illness or injury that isn't work-related. We’re talking about stuff like:

- Recovering from surgery (the non-elective kind!)

- Dealing with a serious illness (think flu with complications or pneumonia)

- Welcoming a new baby (maternity leave!)

- Mental health challenges that require time off work (anxiety, depression)

It's like a safety net for your wallet during tough times. Imagine it as a temporary stand-in for your regular paycheck, ensuring you can still cover your bills while you focus on getting better. Think of it like this: If your car suddenly broke down, you wouldn't want to be stranded without a way to get around, right? STD is the same idea, but for your income.

So, Why Should I Care? (Is it *really* worth it?)

That's the million-dollar question, isn't it? Here's where we get into the 'cool' and 'interesting' part. We all like to think we're invincible. We're healthy, we're energetic, and nothing bad will *ever* happen to us. But, unfortunately, life has a funny way of proving us wrong. Have you ever heard the phrase, "Hope for the best, prepare for the worst"? That's basically the motto of responsible adults, and STD insurance definitely falls under the 'preparation' category.

Think of it as your financial first-aid kit. You might not need it every day, but when you *do* need it, you'll be incredibly grateful it's there. It's like having a spare tire – you hope you never get a flat, but you'd be pretty stuck without one if you did!

The Financial Reality Check

Let’s be real: going without a paycheck for even a short amount of time can be devastating for many people. Rent or mortgage, groceries, utilities, car payments… the bills keep coming, even when you’re not working. STD insurance can help bridge that gap, preventing you from having to raid your savings, take out a loan, or rely on credit cards (which, let's face it, can lead to a whole other set of problems).

Consider this: could you comfortably cover your essential expenses for, say, 6 weeks without your usual income? If the answer is a hesitant "maybe" or a definite "no," then STD insurance should be seriously considered.

Peace of Mind: Priceless

Beyond the financial aspect, STD insurance offers something even more valuable: peace of mind. Knowing that you have a safety net in place can significantly reduce stress and anxiety during an already difficult time. When you're focusing on recovering, the last thing you need is the added worry of how you're going to pay the bills.

It allows you to focus on what truly matters – getting better and returning to work healthy and strong. Isn't that worth something? It's like having a personal cheerleader for your recovery, whispering, "Don't worry about the money, just focus on getting back on your feet!"

How Does it Work, Exactly?

Okay, let's get into the nitty-gritty. Here’s the basic rundown:

- Eligibility: Typically, you need to be employed and working a certain number of hours per week to qualify.

- Waiting Period: Most policies have a waiting period (also known as an elimination period) before benefits kick in. This can range from a few days to a couple of weeks. Think of it as the deductible for your income.

- Benefit Amount: STD usually covers a percentage of your pre-disability income, typically around 60-70%. So, you won't be getting your full salary, but it's a significant portion that can make a big difference.

- Benefit Duration: The length of time you can receive benefits varies, but it's usually between 3 to 6 months.

- Premiums: You'll pay a regular premium, either deducted from your paycheck (if it’s offered through your employer) or paid directly to the insurance company (if you purchase an individual policy).

The specifics of each policy can vary, so it's crucial to read the fine print and understand the details before enrolling. Don't be afraid to ask questions! Your HR department or insurance agent should be able to provide you with all the information you need.

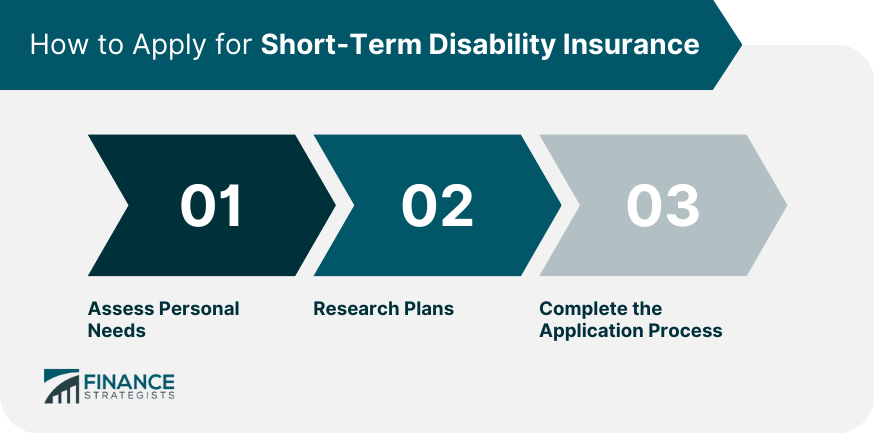

Where Can I Get Short Term Disability Insurance?

You generally have two main options:

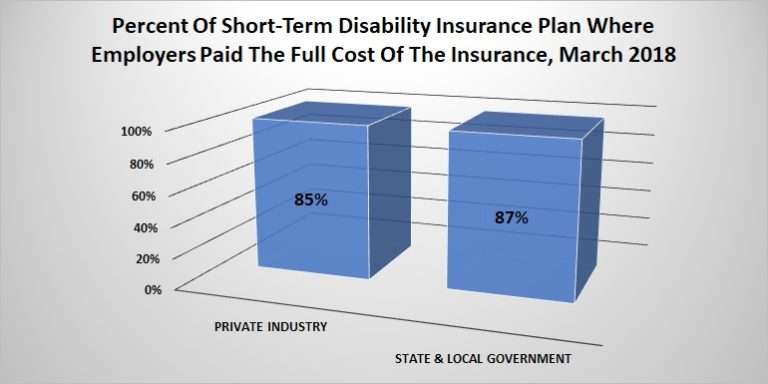

- Through your employer: Many employers offer STD insurance as part of their benefits package. This is often the most affordable option, as employers may subsidize the premiums.

- Individual policy: You can also purchase STD insurance directly from an insurance company. This might be a good option if your employer doesn't offer it, or if you're self-employed.

Comparing options and getting quotes from different providers is always a good idea. Just like you wouldn't buy the first car you see without doing some research, you should shop around for the best STD insurance policy for your needs and budget.

Is It Worth It? The Bottom Line

So, back to the original question: is short-term disability insurance worth it? The answer, as with most things in life, is: it depends.

If you have a substantial emergency fund that could easily cover several months of living expenses, and you're relatively confident in your health, you might decide that STD insurance isn't necessary for you. However, for most people, the peace of mind and financial protection it offers is well worth the cost.

Think about your personal situation, your financial obligations, and your risk tolerance. Consider the potential cost of not having STD insurance – what would happen if you were unable to work for an extended period? Could you handle the financial strain? Would it impact your family? Would you have to borrow money or dip into your retirement savings?

STD insurance might not be the most glamorous topic, but it's a smart and responsible way to protect yourself and your loved ones. It's an investment in your financial well-being and a safety net that can help you weather unexpected storms. It's like having a reliable friend who's always there to lend a helping hand when you need it most. And who wouldn't want a friend like that?

Ultimately, the decision is yours. But hopefully, this has given you a better understanding of what STD insurance is, how it works, and why it might be a valuable addition to your overall financial plan. Now go forth and research – be informed, be prepared, and be financially empowered!

.jpg)

:max_bytes(150000):strip_icc()/short-term-disability-basics-1177839_V2-5bbd0f8146e0fb0051d0c4cf.png)