The availability of placer gold claims for sale in South Dakota presents a multifaceted situation with historical roots and contemporary economic implications. These claims, essentially rights to mine gold within a specific area, represent a confluence of geological potential, economic opportunity, and regulatory frameworks. Analyzing the causes leading to their sale, the effects on local communities and the environment, and the broader implications for the gold market provides a comprehensive understanding of this niche market.

Causes of Placer Gold Claim Sales

Several factors contribute to the decision to sell placer gold claims in South Dakota. A primary driver is often the diminishing returns associated with placer mining. Placer deposits, formed by the erosion and transportation of gold from source rocks, are typically richest in easily accessible areas. As these initial, readily exploited zones are depleted, extracting gold becomes more challenging and costly. The increased effort and investment required, coupled with fluctuating gold prices, can render smaller operations unprofitable, leading claim owners to seek a sale.

Another contributing factor is the age and health of claim owners. Many individuals holding these claims are older and may no longer possess the physical capacity to actively mine. The sale of the claim allows them to realize the potential value of their asset without the burdens of labor and ongoing operational expenses. This is particularly prevalent in regions like the Black Hills, where placer mining has a long history dating back to the gold rush era.

Furthermore, regulatory burdens can influence the decision to sell. Mining regulations, both at the state and federal levels, can be complex and demanding. Compliance with environmental regulations, permitting requirements, and reporting obligations adds to the operational costs. Smaller claim holders may lack the resources or expertise to navigate these complexities effectively, making a sale a more attractive option. The South Dakota Department of Environment and Natural Resources plays a significant role in regulating mining activities, and adherence to their guidelines is crucial for any operation.

Finally, market conditions play a significant role. Fluctuations in the price of gold can impact the profitability of mining operations. While high gold prices incentivize increased production, periods of low prices can force marginal operations to shut down or sell their assets. Moreover, interest from larger mining companies seeking to consolidate claims and expand their operations can also create a market for existing placer claims.

Effects of Placer Gold Claim Sales

The sale of placer gold claims in South Dakota has several effects, both positive and negative, on the environment, local communities, and the mining industry.

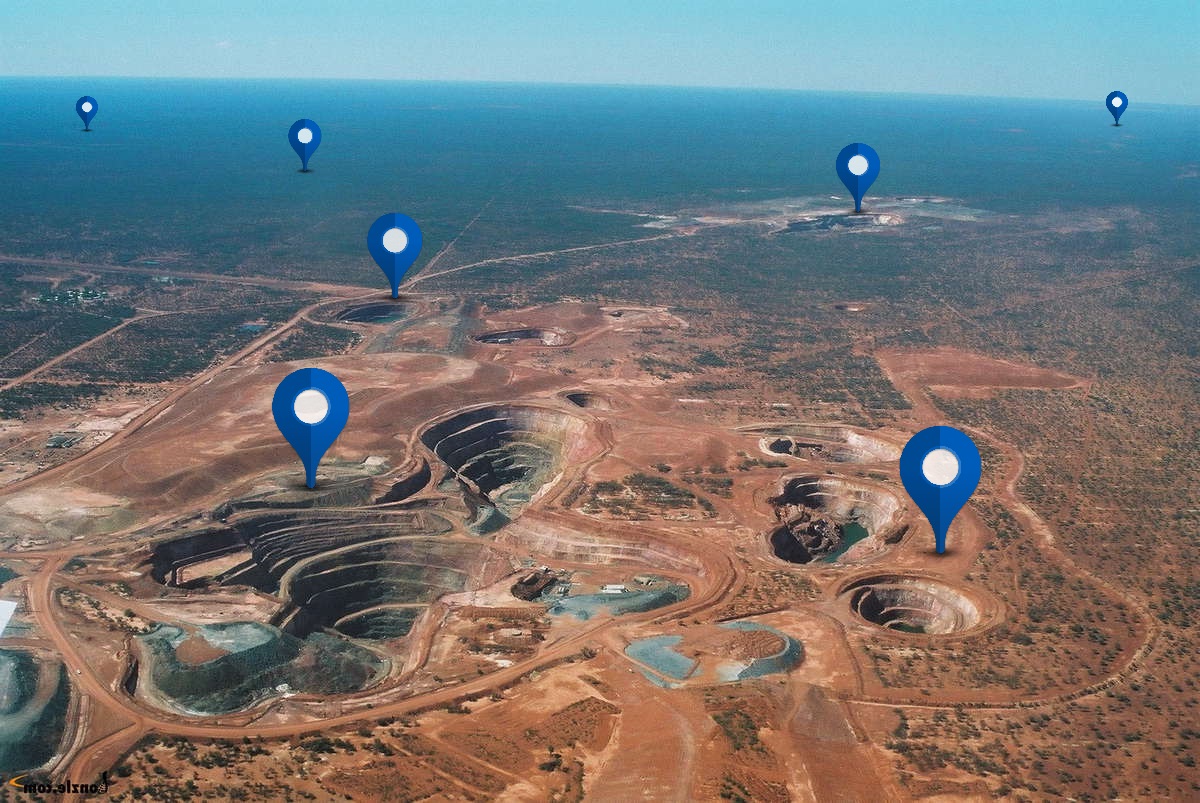

Environmental impacts are a significant concern. Placer mining, even on a small scale, can disrupt ecosystems, alter stream flows, and contribute to sedimentation. Improperly managed mining activities can lead to water pollution and habitat degradation. The transfer of a claim to a new owner raises questions about their commitment to responsible mining practices and their capacity to mitigate environmental risks. While regulations are in place, enforcement can be challenging, especially with numerous small-scale operations.

The economic effects on local communities are complex. The sale of a claim can bring an influx of capital to the seller, benefiting them directly. However, the impact on the local economy depends on the buyer's intentions and operations. If the new owner invests in more efficient mining techniques and expands production, it could create jobs and stimulate economic activity. Conversely, if the buyer simply holds the claim for speculation or implements unsustainable mining practices, the long-term economic benefits may be limited.

The sale can also impact the social fabric of mining communities. In regions where placer mining has a long history, claims are often passed down through generations. The sale of a family claim can represent a loss of heritage and tradition. It can also lead to conflicts between long-time residents and new owners, especially if the latter are perceived as being insensitive to local values or environmental concerns.

From an industry perspective, claim sales can contribute to consolidation within the mining sector. Larger companies may acquire smaller claims to expand their land holdings and increase their reserves. This consolidation can lead to economies of scale and more efficient mining practices. However, it can also reduce competition and potentially lead to higher gold prices.

Implications for the Gold Market

The sale of placer gold claims in South Dakota has several implications for the broader gold market. While the production from these claims represents a relatively small fraction of global gold supply, it can still influence local market dynamics and investor sentiment.

The availability of claims for sale can provide opportunities for entrepreneurs and small-scale miners to enter the market. These individuals may lack the capital to acquire larger mining operations but can still participate in gold production by purchasing and working smaller placer claims. This can contribute to a more diverse and competitive mining landscape.

The sales also contribute to the overall transparency and liquidity of the gold market. By providing a mechanism for transferring ownership of gold resources, these transactions facilitate price discovery and allow investors to assess the value of gold-bearing properties. The price at which claims are sold can serve as an indicator of market sentiment and future expectations for gold prices.

However, the sale of claims can also be subject to speculation and fraud. Some individuals may purchase claims with the intention of reselling them at a higher price without ever engaging in actual mining. This type of speculative activity can inflate claim prices and create a bubble in the market. It is important for potential buyers to conduct thorough due diligence and verify the validity of claims before making a purchase.

Furthermore, the environmental and social consequences of placer mining, regardless of claim ownership, can impact the reputation of the gold industry as a whole. Negative publicity surrounding irresponsible mining practices can damage consumer confidence and lead to increased scrutiny from regulatory agencies.

For example, the Homestake Mine, once the largest gold mine in North America located in South Dakota, provides a historical context. While it was a large-scale operation, its closure highlighted the eventual depletion of resources and the need for responsible environmental management. Similarly, smaller placer mining operations must operate sustainably to avoid long-term negative impacts.

Broader Significance

The market for placer gold claims in South Dakota is a microcosm of larger issues related to resource extraction, environmental sustainability, and economic development. It highlights the challenges of balancing the economic benefits of mining with the need to protect natural resources and preserve local communities.

The story of these claims is also a reflection of the enduring allure of gold. Throughout history, gold has held a special place in human imagination, representing wealth, power, and security. The prospect of striking it rich continues to attract individuals to mining regions like the Black Hills, even as the realities of placer mining become increasingly challenging.

Ultimately, the responsible management of placer gold claims requires a collaborative approach involving claim owners, regulatory agencies, and local communities. By promoting sustainable mining practices, enforcing environmental regulations, and fostering open communication, it is possible to mitigate the negative impacts of mining and ensure that the benefits are shared equitably. The fate of these claims, and the future of placer mining in South Dakota, will depend on the choices made by these stakeholders.