Delaware Certificate of Amendment: A Comprehensive Overview

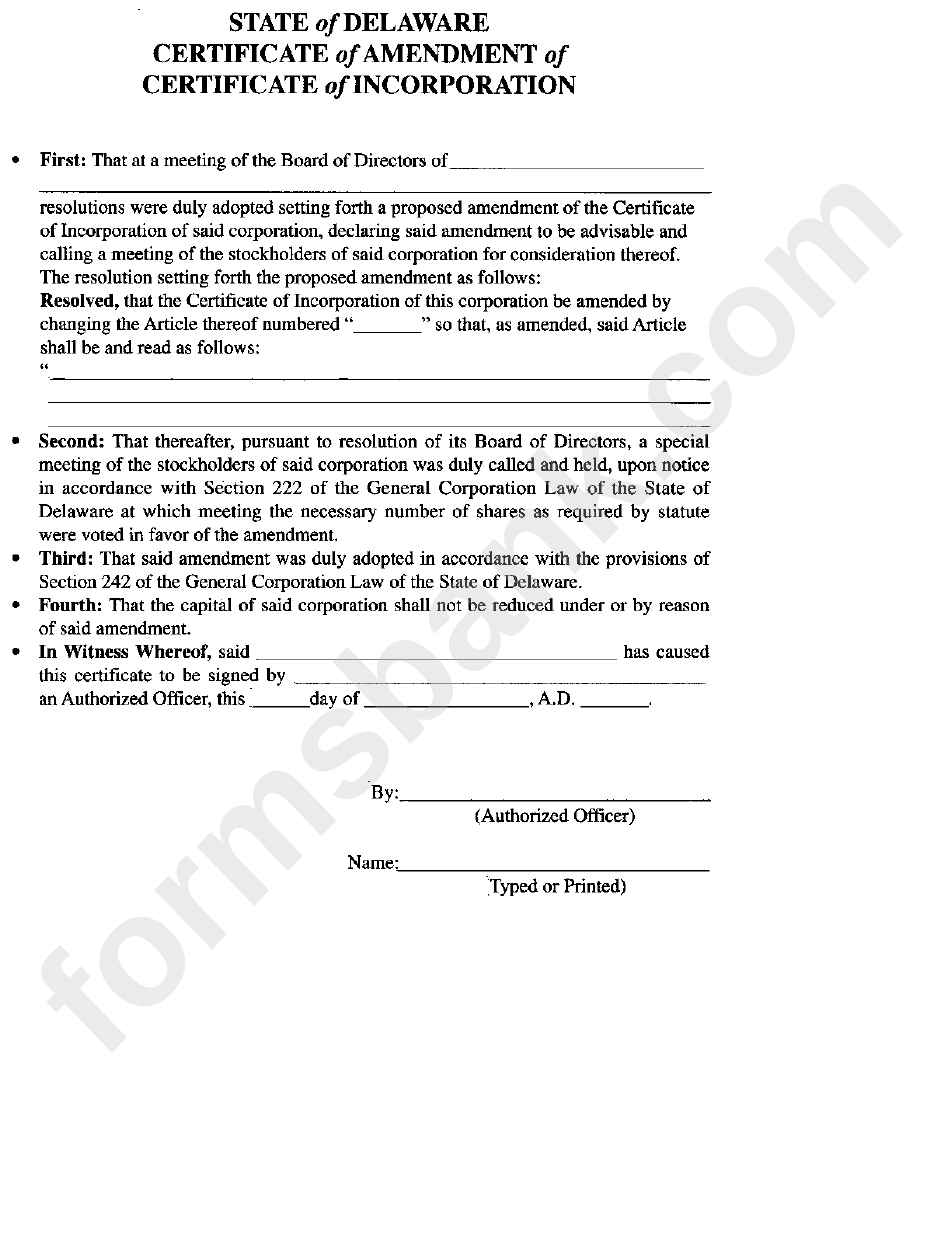

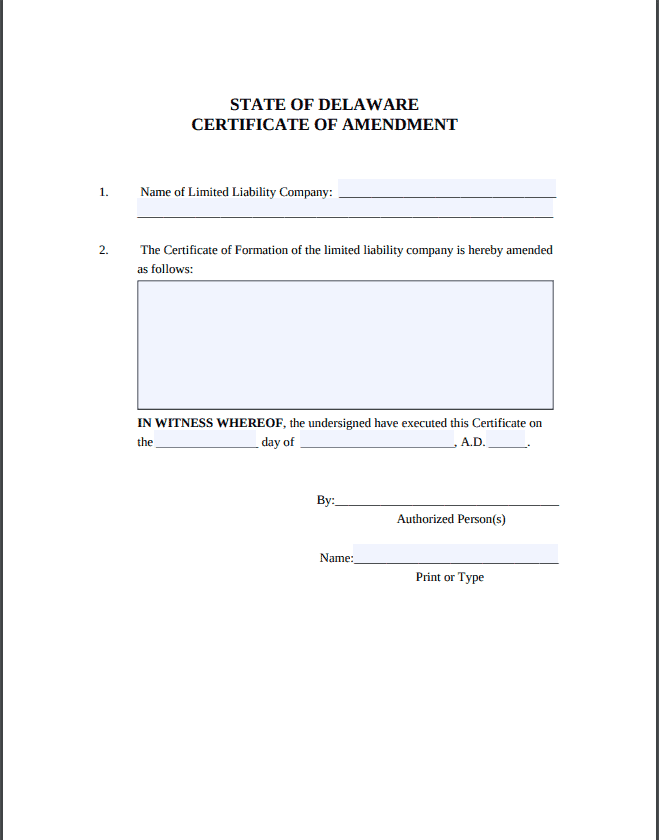

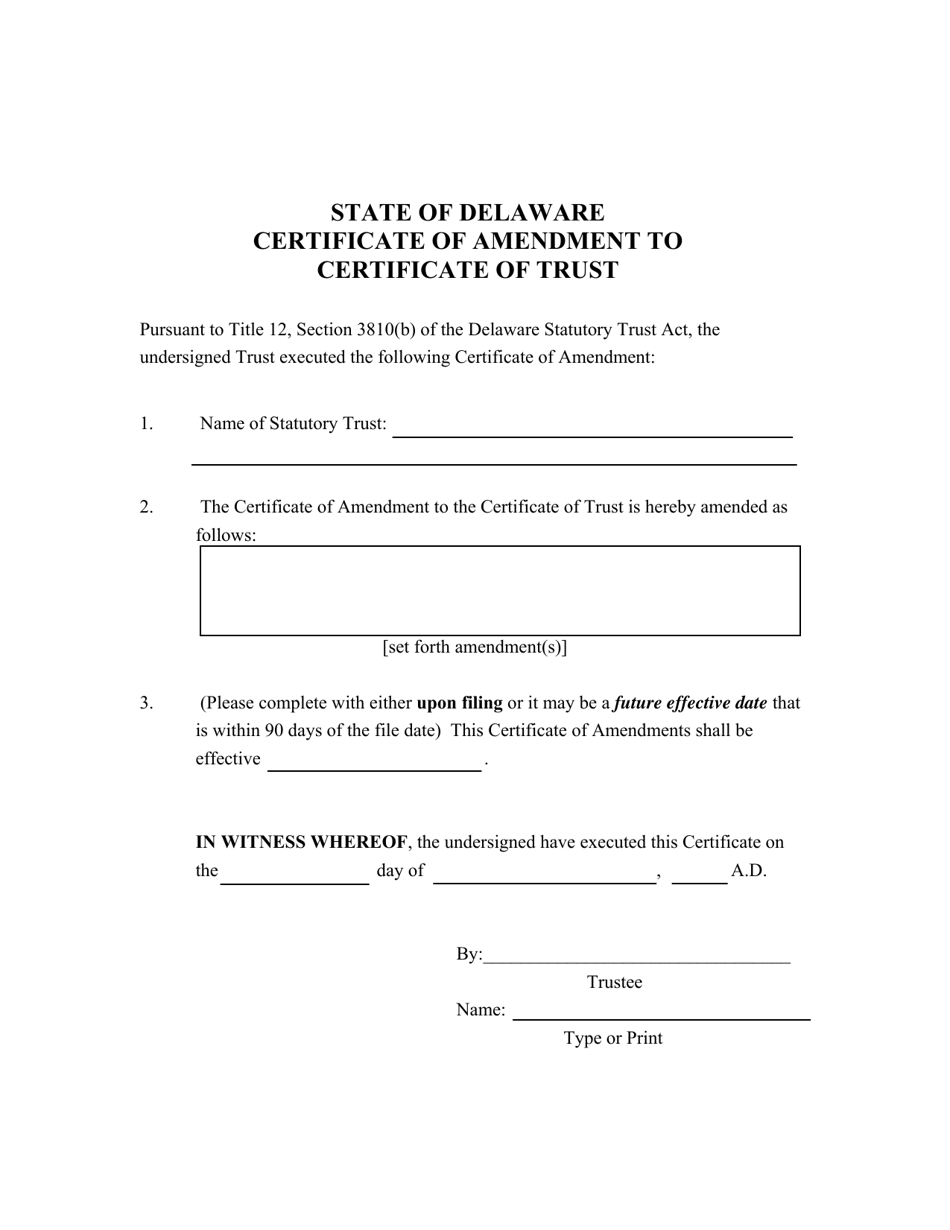

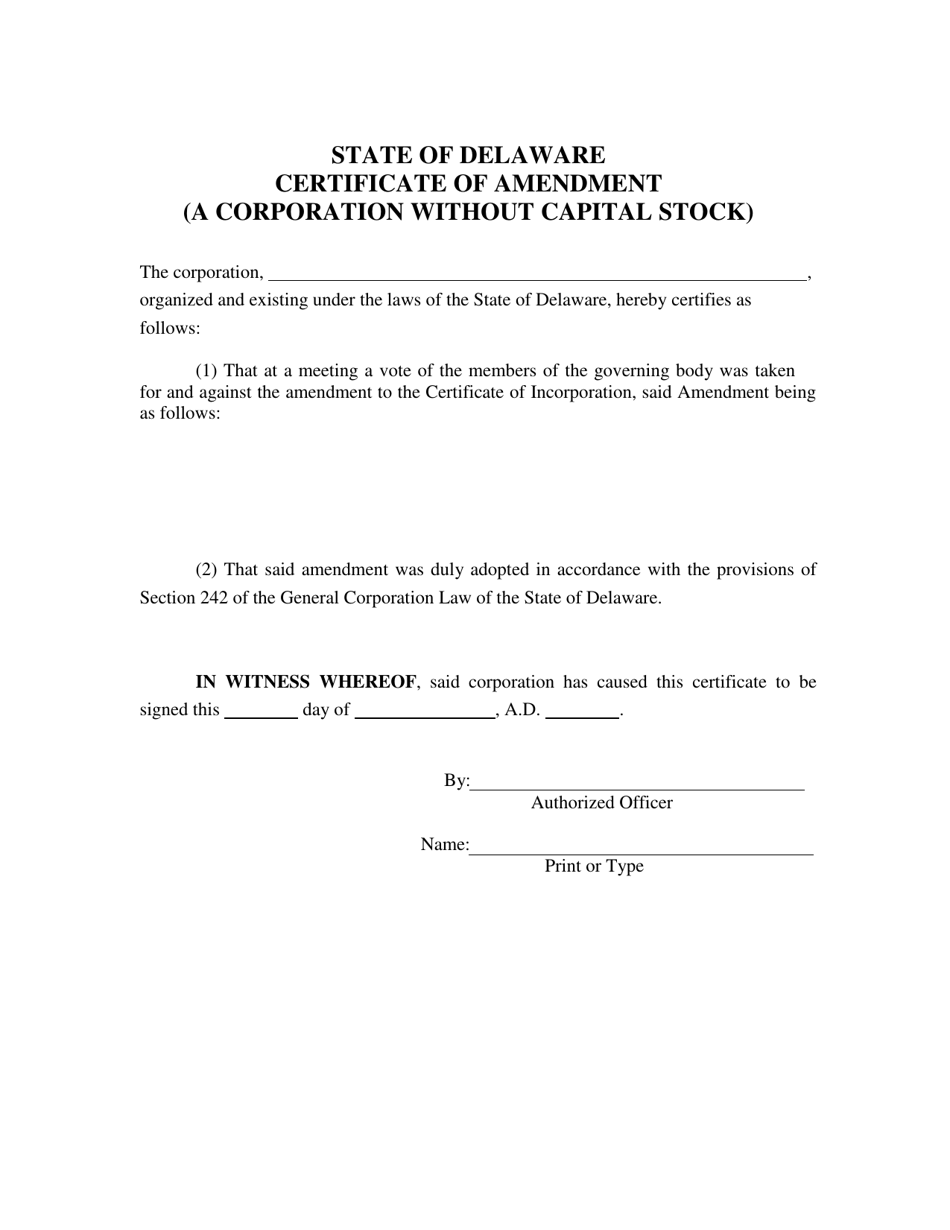

The State of Delaware is a popular jurisdiction for business formation, known for its flexible corporate laws and business-friendly environment. A key component of maintaining a Delaware entity's compliance is the ability to amend its foundational documents. The Certificate of Amendment is the official document used to modify the original Certificate of Incorporation (for corporations) or Certificate of Formation (for LLCs) filed with the Delaware Secretary of State.

Purpose and Scope

A Certificate of Amendment allows a Delaware entity to formally alter information contained in its initial filing. Common reasons for filing a Certificate of Amendment include:

- Changing the corporate name.

- Altering the number of authorized shares of stock.

- Modifying the purpose clause (though this is less common given broad purpose clauses are typical).

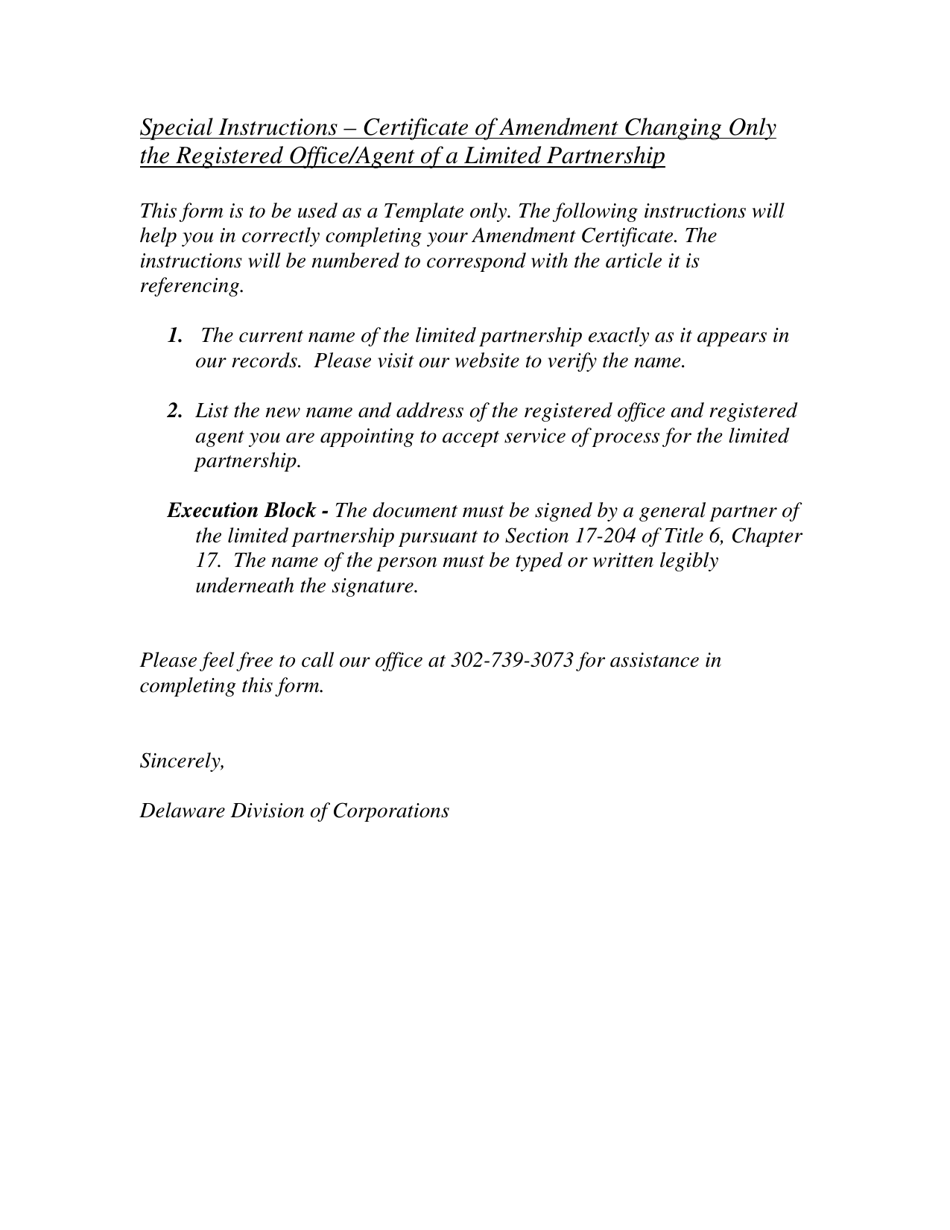

- Making changes to the registered agent information.

- Adding, removing, or modifying provisions in the original certificate.

It is crucial to understand that the Certificate of Amendment only addresses information that is, or should have been, included in the original certificate. Changes to internal governance, such as bylaws (for corporations) or operating agreements (for LLCs), typically do not require a Certificate of Amendment.

Requirements for Filing

The specific requirements for filing a Certificate of Amendment vary depending on the type of entity (corporation vs. LLC) and the nature of the amendment. However, some general requirements apply:

- Authorization: The amendment must be duly authorized by the entity's governing body. For corporations, this typically involves a resolution by the board of directors and, in many cases, approval by the stockholders. For LLCs, the operating agreement will dictate the required procedures for amendment, which often involve a vote of the members.

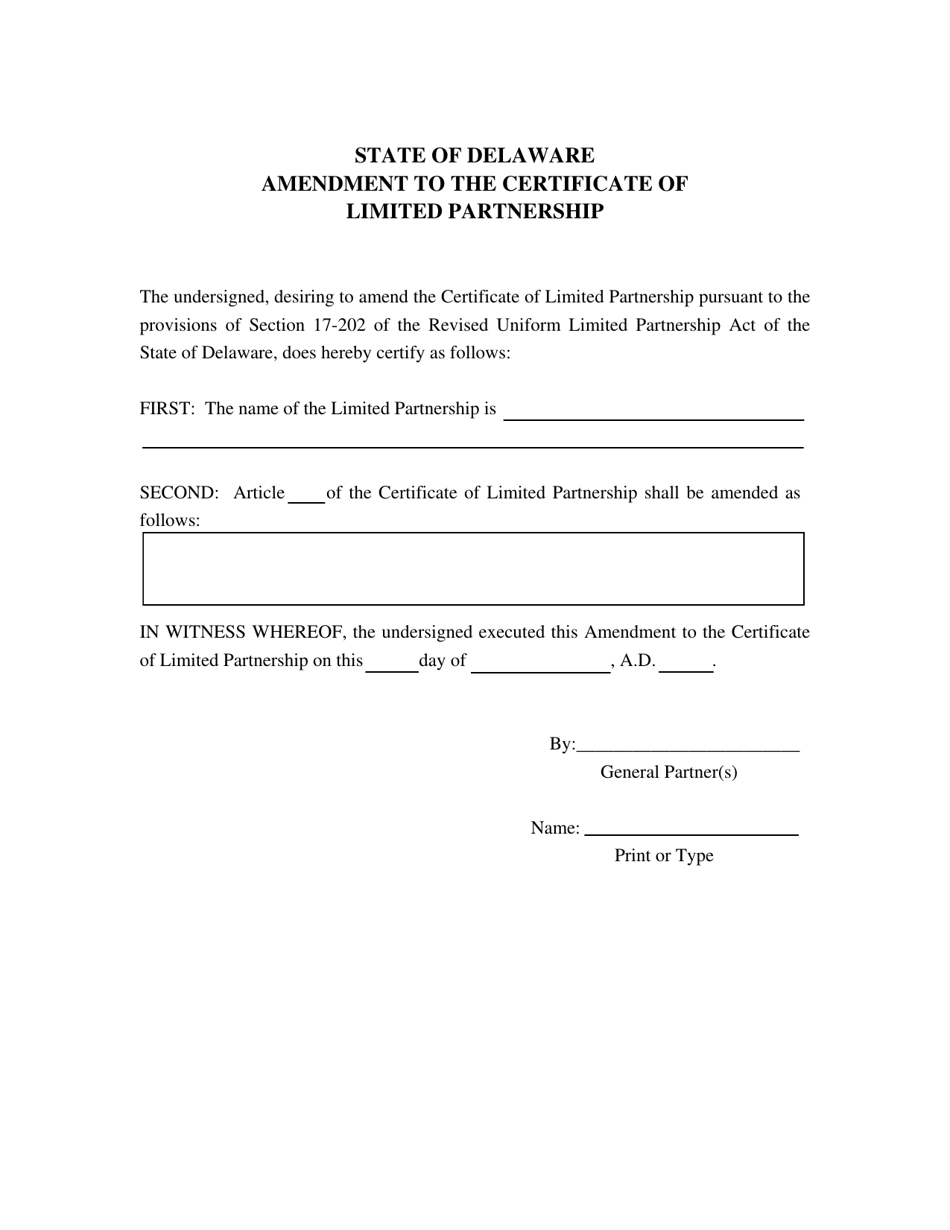

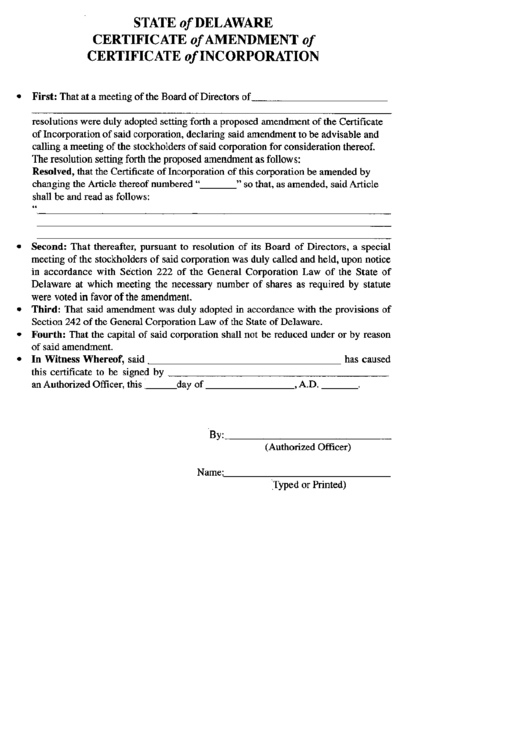

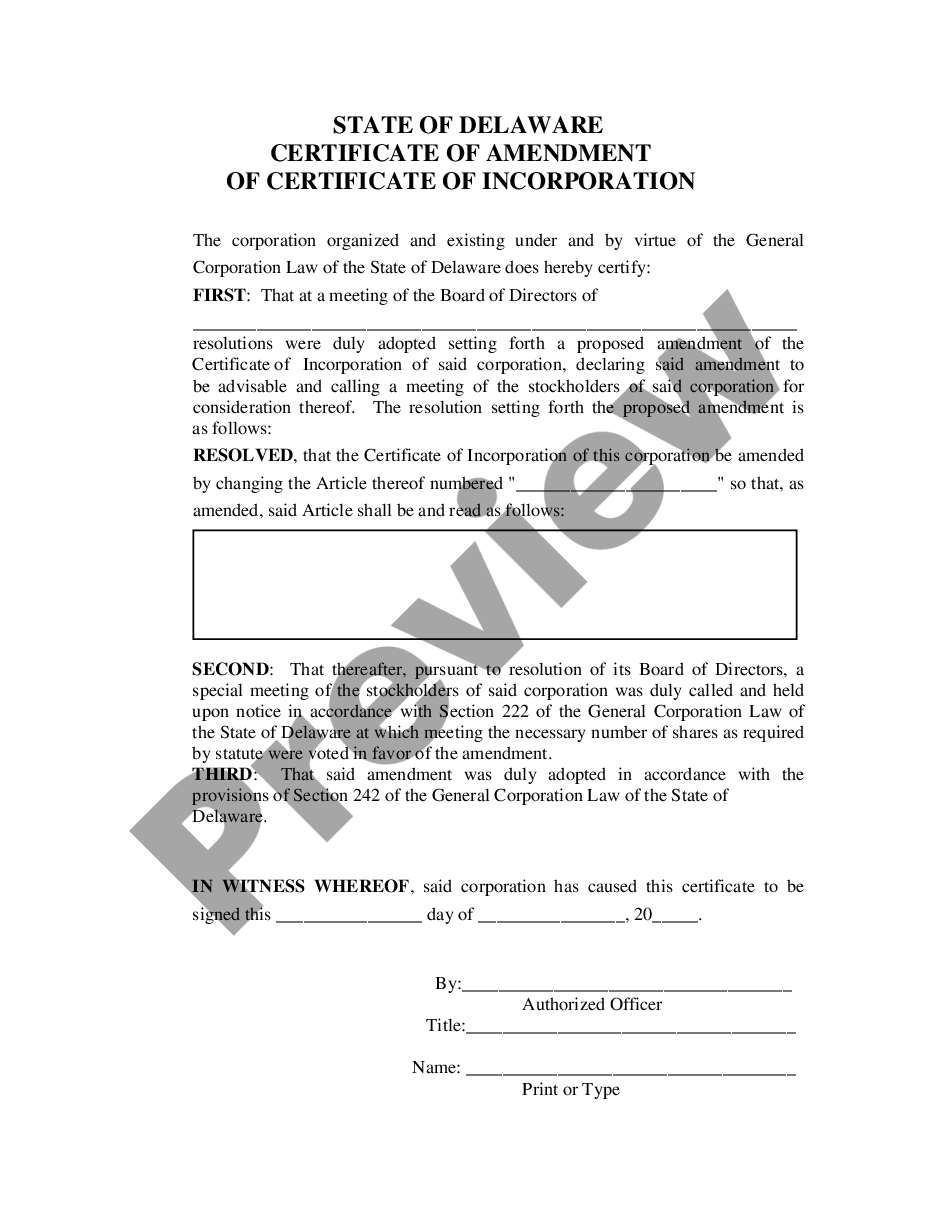

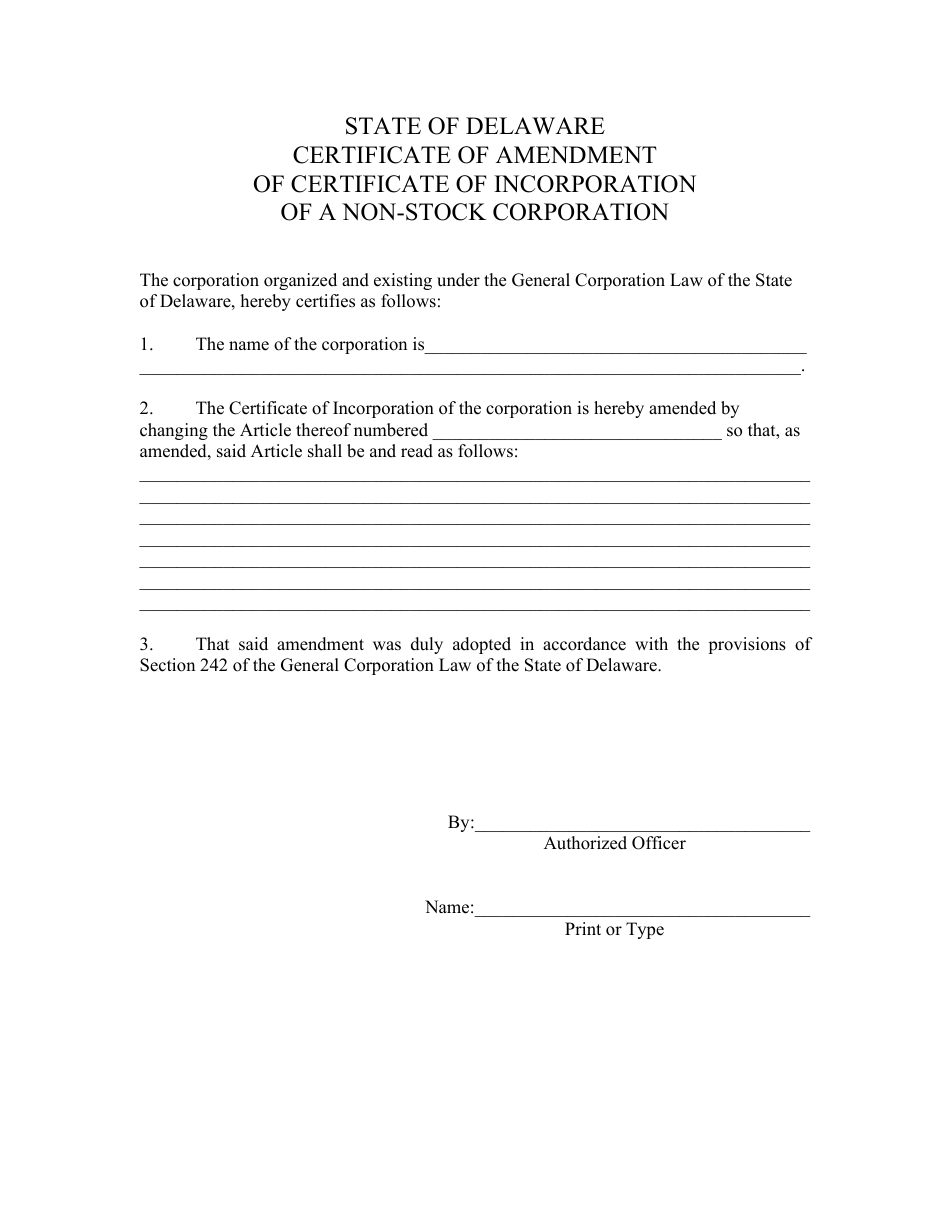

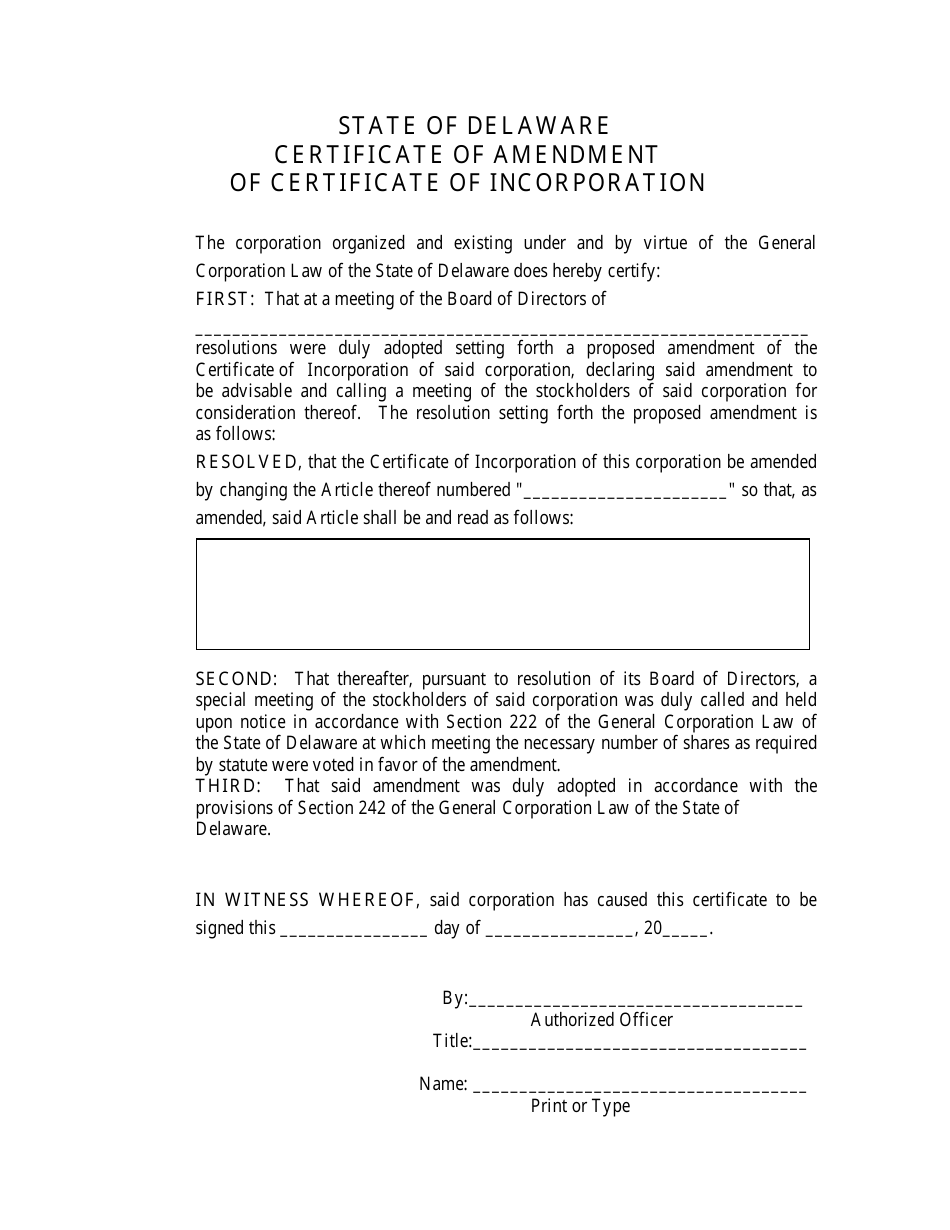

- Form Completion: The Delaware Secretary of State provides standard forms for Certificate of Amendment filings. Using the correct form and accurately completing all required fields is essential. These forms are available on the Secretary of State's website.

- Content Requirements: The Certificate of Amendment must clearly state the specific amendment being made. It should identify the provision of the original certificate being amended and specify the exact language being added, deleted, or modified.

- Execution: The Certificate of Amendment must be executed (signed) by an authorized person. For corporations, this is typically an officer of the corporation. For LLCs, it is often a manager or authorized member. The person signing must have the legal authority to bind the entity.

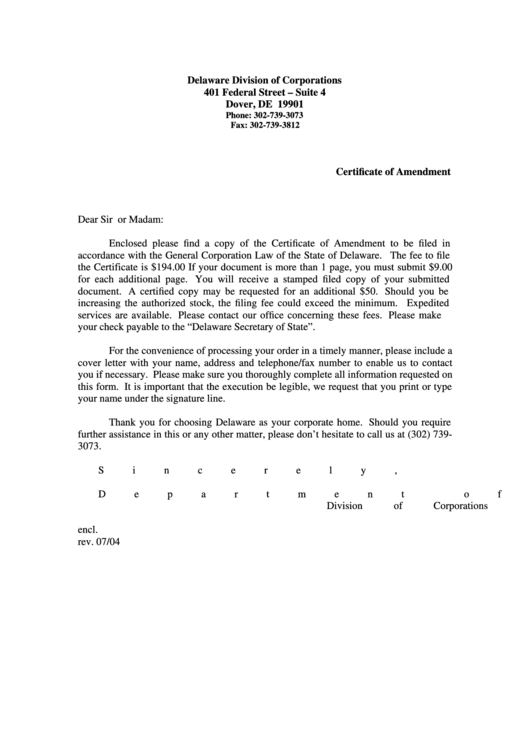

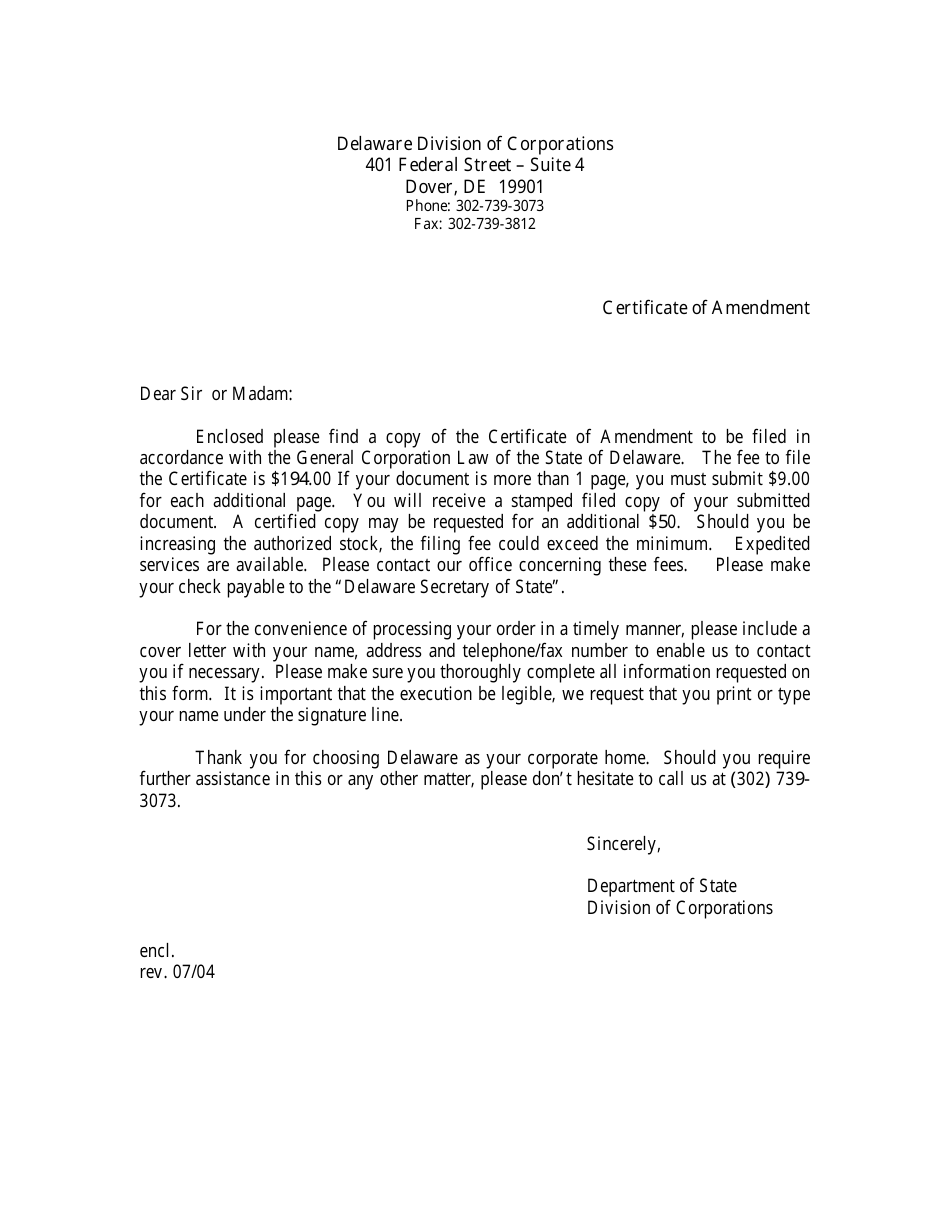

- Filing Fee: The Delaware Secretary of State charges a filing fee for the Certificate of Amendment. The amount of the fee varies depending on the type of entity and the nature of the amendment. Current fee schedules are available on the Secretary of State's website.

Specific Considerations for Corporations

For corporations, amending the Certificate of Incorporation often requires a vote of the stockholders, particularly if the amendment affects stockholder rights or preferences. Delaware law (specifically, the Delaware General Corporation Law, or DGCL) outlines the specific voting requirements for various types of amendments.

For example, an amendment that alters the number of authorized shares of stock typically requires stockholder approval. The DGCL also provides for different classes of stock with different voting rights, which can complicate the amendment process. The Certificate of Amendment must clearly state the vote required and whether that vote was obtained.

Specific Considerations for LLCs

For LLCs, the process for amending the Certificate of Formation is generally governed by the LLC's operating agreement. The operating agreement typically outlines the required vote of the members needed to approve an amendment. If the operating agreement is silent on the amendment process, the Delaware Limited Liability Company Act provides default rules, which generally require the consent of all members.

While LLCs have more flexibility than corporations in their governance structure, it is important to carefully follow the procedures outlined in the operating agreement and the Delaware Limited Liability Company Act when amending the Certificate of Formation. A poorly executed amendment can be challenged in court.

Filing Procedures

The Certificate of Amendment can be filed with the Delaware Secretary of State either electronically or by mail. Electronic filing is generally faster and more efficient. The Secretary of State's website provides instructions for electronic filing.

When filing by mail, the Certificate of Amendment, along with the required filing fee, should be sent to the Division of Corporations in Dover, Delaware. It's recommended to send the documents by certified mail with return receipt requested to ensure proof of delivery.

Effective Date

The amendment becomes effective upon filing with the Delaware Secretary of State, unless a later effective date is specified in the Certificate of Amendment. It's possible to specify a future effective date, but this date must be within a certain timeframe (typically no more than 90 days) from the filing date.

Importance of Legal Counsel

Amending a Certificate of Incorporation or Certificate of Formation can have significant legal and financial implications. It is highly recommended to consult with legal counsel before filing a Certificate of Amendment. An attorney can advise on the specific requirements for the amendment, ensure compliance with Delaware law, and help avoid potential legal challenges.

For example, if an amendment affects the rights of stockholders or members, it is crucial to ensure that those rights are properly protected and that the amendment is properly authorized. An attorney can also help draft the language of the amendment to ensure that it is clear, unambiguous, and legally sound.

"Seeking professional legal advice is paramount when considering any changes to your company's governing documents. A Delaware attorney experienced in corporate law can guide you through the process, ensuring compliance and protecting your business interests."

Consequences of Non-Compliance

Failure to properly file a Certificate of Amendment can have serious consequences. For example, if a corporation changes its name but fails to file a Certificate of Amendment, the corporation may not be able to enforce contracts entered into under the new name. Similarly, if an LLC fails to properly amend its Certificate of Formation to reflect a change in its registered agent, it may not receive important legal notices.

In addition, a defective Certificate of Amendment can be challenged in court, potentially leading to costly litigation and uncertainty about the validity of the amendment. Furthermore, knowingly filing a false or misleading Certificate of Amendment can result in civil and criminal penalties. Delaware law takes corporate governance seriously, and adherence to the rules is crucial for maintaining good standing.

Key Takeaways

- The Delaware Certificate of Amendment is the official document used to modify a company's foundational documents (Certificate of Incorporation or Certificate of Formation).

- The amendment must be properly authorized by the entity's governing body (board of directors and stockholders for corporations; members for LLCs).

- Specific content requirements must be met, including clearly stating the amendment and identifying the provision being amended.

- Filing fees are required, and the amendment becomes effective upon filing (unless a later effective date is specified).

- Consulting with legal counsel is highly recommended to ensure compliance with Delaware law and avoid potential legal challenges.

- Failure to properly file a Certificate of Amendment can have serious consequences, including legal challenges, inability to enforce contracts, and potential penalties.