The year 2023 witnessed a notable event in the Las Vegas business landscape: the bankruptcy filings associated with entities related to Terra Firma Development Corporation. These filings, while complex, highlight the inherent risks within the real estate development sector and raise important questions about market stability and investor confidence.

Understanding Terra Firma and its Las Vegas Projects

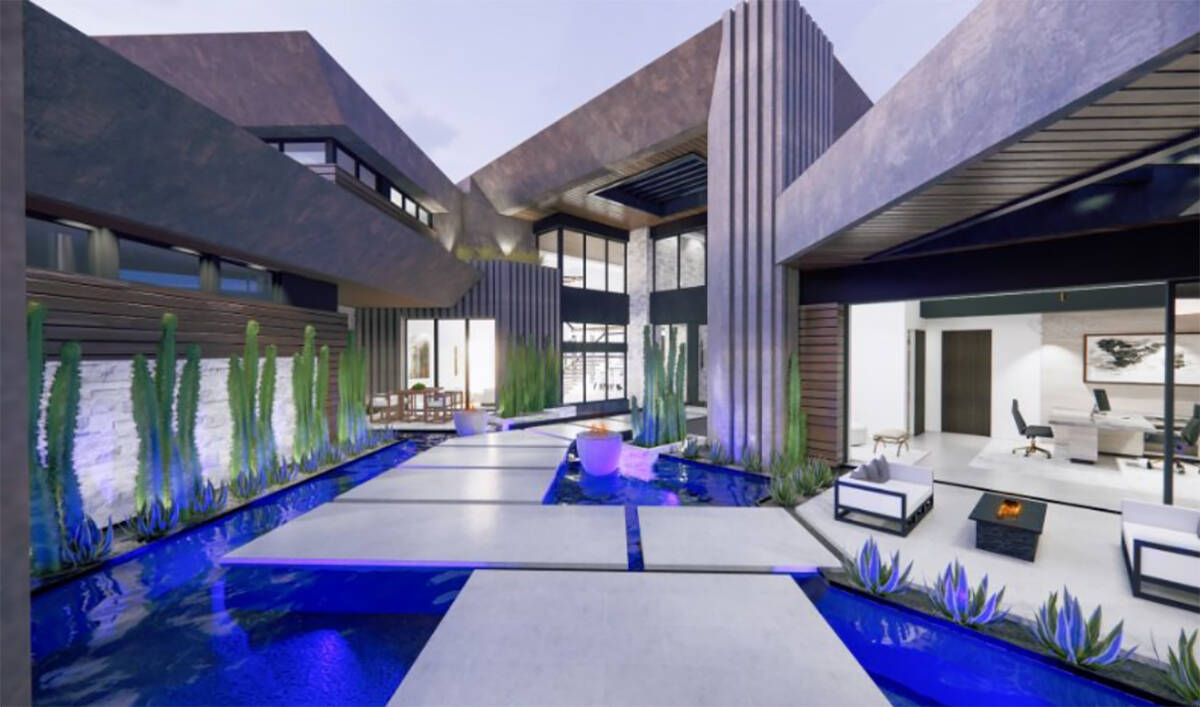

Terra Firma Development Corporation, while not a household name, engaged in significant real estate projects, particularly in the Las Vegas metropolitan area. Their involvement often centered on large-scale residential developments and commercial ventures aimed at capitalizing on the region's growth potential. Understanding the scope and nature of these projects is crucial to grasping the implications of the subsequent bankruptcy filings.

Terra Firma's approach typically involved acquiring land, securing necessary permits, and overseeing the construction and marketing phases of their developments. They frequently partnered with investors and lenders to finance these capital-intensive endeavors. The projects themselves varied in size and type, ranging from single-family home communities to mixed-use commercial spaces.

Several key factors contributed to Terra Firma's initial success. The Las Vegas real estate market, prior to 2023, experienced a period of relative stability and growth. This environment provided fertile ground for developers willing to undertake ambitious projects. Furthermore, the company likely benefited from a network of relationships with local government officials, contractors, and financial institutions.

The Bankruptcy Filings: A Timeline and Overview

The bankruptcy filings associated with Terra Firma and its related entities unfolded throughout 2023, revealing a cascading effect of financial distress. While the specific details of each filing differed, they collectively pointed to underlying problems with debt management, project performance, and overall financial viability.

The initial filings often involved subsidiary companies or special purpose vehicles (SPVs) created to manage individual development projects. These entities, burdened with substantial debt and facing challenges in selling or leasing properties, sought Chapter 11 bankruptcy protection. This allowed them to temporarily halt creditor actions and attempt to reorganize their debts.

As the year progressed, the scope of the bankruptcy proceedings widened, encompassing more entities directly linked to Terra Firma. This indicated that the financial difficulties were not isolated to specific projects but rather reflected systemic issues within the overall organization. The filings typically included detailed schedules of assets and liabilities, providing insights into the extent of the company's financial obligations and its ability to meet them.

"The bankruptcy filings highlight the precarious nature of real estate development, where large capital outlays are contingent on future market conditions," commented a local real estate analyst.

Key Factors Contributing to the Bankruptcies

Several factors contributed to the financial distress experienced by Terra Firma and its related entities. These factors, which are common in the real estate industry, were amplified by specific circumstances in the Las Vegas market.

Market Fluctuations

Real estate markets are inherently cyclical, and Las Vegas is no exception. Changes in interest rates, consumer confidence, and overall economic activity can significantly impact property values and sales velocity. A downturn in the market can make it difficult for developers to sell or lease properties at prices that cover their costs and debt obligations.

Over-Leveraging

Real estate development often involves substantial debt financing. While leveraging can amplify returns during periods of growth, it also increases the risk of financial distress during downturns. If a company takes on too much debt relative to its assets and income, it becomes vulnerable to even modest declines in market conditions.

Project Delays and Cost Overruns

Construction projects are inherently complex and prone to delays and cost overruns. Unexpected issues such as permitting challenges, material shortages, and labor disputes can push project costs above budget and delay completion dates. These delays can reduce revenue and increase expenses, further straining a company's finances.

Mismanagement and Poor Planning

Internal factors such as mismanagement, poor planning, and inadequate risk assessment can also contribute to financial distress. A lack of effective oversight, unrealistic projections, and failure to adapt to changing market conditions can lead to costly mistakes and ultimately undermine a company's financial viability.

Impact on Stakeholders

The Terra Firma bankruptcies had a ripple effect, impacting various stakeholders including investors, lenders, contractors, and homebuyers.

Investors

Investors who provided equity financing for Terra Firma's projects faced the prospect of significant losses. Depending on the terms of their investments, they may have been last in line to receive any remaining assets after creditors are paid.

Lenders

Banks and other financial institutions that provided debt financing also faced potential losses. The extent of their losses depended on the value of the collateral securing their loans and the priority of their claims in the bankruptcy proceedings.

Contractors and Suppliers

Contractors and suppliers who provided goods and services to Terra Firma's projects may have been left with unpaid invoices. These businesses often rely on timely payments to maintain their own operations, and delays or defaults can have a significant impact on their financial stability.

Homebuyers

In some cases, homebuyers who had entered into contracts to purchase properties in Terra Firma's developments faced uncertainty. The bankruptcy proceedings could delay or even prevent the completion of these projects, leaving buyers in a difficult situation.

Lessons Learned and Implications for the Future

The Terra Firma bankruptcies serve as a cautionary tale for the real estate industry. They underscore the importance of prudent financial management, realistic risk assessment, and adaptability to changing market conditions. These events also highlight the need for greater transparency and accountability in real estate development projects.

One key lesson is the importance of avoiding over-leveraging. Companies should carefully assess their debt capacity and ensure that they have sufficient financial flexibility to weather potential downturns. They should also stress-test their financial models to evaluate the impact of adverse scenarios such as rising interest rates or declining property values.

Another important lesson is the need for effective risk management. Developers should carefully assess the risks associated with each project and develop mitigation strategies to address potential problems. This includes conducting thorough due diligence, securing appropriate insurance coverage, and establishing contingency plans for unexpected delays or cost overruns.

Furthermore, the Terra Firma case highlights the importance of transparency and accountability. Investors and lenders should demand clear and accurate information about the financial health of development companies and the progress of their projects. They should also exercise due diligence to ensure that management teams have the experience and expertise necessary to successfully execute their business plans.

The implications of the Terra Firma bankruptcies extend beyond the specific companies involved. They may lead to increased scrutiny of real estate development projects in Las Vegas and other markets. Lenders may become more cautious about providing financing, and investors may demand higher returns to compensate for the increased risk. These changes could potentially slow down the pace of development and impact the overall growth of the real estate sector.

Ultimately, the Terra Firma bankruptcies serve as a reminder that real estate development is a high-risk, high-reward endeavor. Success requires not only vision and ambition but also sound financial management, diligent risk assessment, and the ability to adapt to changing market conditions.

The Broader Economic Context

It's essential to understand the Terra Firma bankruptcies within the broader economic context of 2023. Rising interest rates, driven by the Federal Reserve's efforts to combat inflation, played a significant role. These higher rates increased borrowing costs for developers and made it more difficult for potential homebuyers to qualify for mortgages. This combination squeezed the real estate market and exposed vulnerabilities in highly leveraged projects.

Furthermore, concerns about a potential recession loomed throughout the year. While the U.S. economy proved more resilient than many predicted, the uncertainty surrounding economic growth dampened investor confidence and contributed to a more cautious lending environment. This environment made it harder for developers to refinance existing debt or secure new funding for projects.

Current Status and Future Outlook

As of late 2023 and early 2024, the bankruptcy proceedings involving Terra Firma and its related entities are ongoing. The courts are overseeing the liquidation of assets and the resolution of claims from creditors. It remains to be seen how much creditors will ultimately recover and what the long-term impact will be on the affected projects.

The future of the abandoned or partially completed projects is uncertain. Some may be acquired by other developers and completed, while others may remain stalled for an extended period. The ultimate outcome will depend on market conditions, the availability of financing, and the willingness of other developers to take on the risks involved.

The Terra Firma bankruptcies serve as a microcosm of the challenges and risks inherent in the real estate industry, particularly during periods of economic uncertainty. They underscore the need for careful planning, prudent financial management, and adaptability to changing market conditions.

In summary, the Terra Firma Las Vegas bankruptcies of 2023 matter because they illustrate the financial vulnerabilities inherent in large-scale real estate development, highlight the risks associated with over-leveraging, and serve as a cautionary tale for investors, lenders, and developers alike. These events underscore the interconnectedness of the real estate market and the broader economy, demonstrating how changes in interest rates, consumer confidence, and overall economic activity can have a significant impact on individual projects and companies. The outcome of these bankruptcies will continue to shape the Las Vegas real estate landscape in the years to come.