Hey there! Ever wonder what happens to all the stuff left at the end of the year? I mean, after the holiday rush and those crazy sales? It's all about the "Ending Inventory." Seriously, it's way more interesting than it sounds!

Ending Inventory: The Leftovers We Love (to Track)

So, picture this: your favorite store. It's December 31st. The confetti's settled. The New Year's resolutions are already cracking. What about all the unsold goodies? That, my friend, is ending inventory in a nutshell.

Basically, it’s the value of all the unsold items a business has on hand at the end of an accounting period. Think of it as the "leftovers" after a year-long shopping spree! From quirky gadgets to that sweater no one bought (yet!), it’s all accounted for.

Why Bother Knowing What's Left?

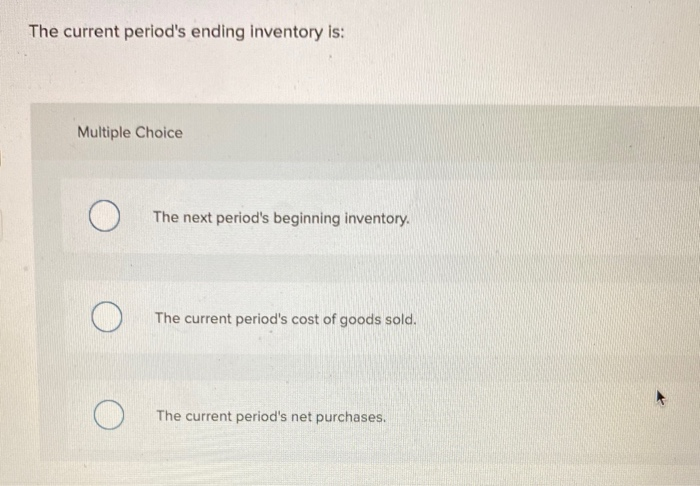

Good question! It's not just about taking stock (pun intended!). Ending inventory is a crucial piece of the financial puzzle. It directly affects a company's:

- Cost of Goods Sold (COGS): Knowing how much inventory is leftover helps determine how much they actually *sold*.

- Gross Profit: More goods sold = more profit, right? Ending inventory helps figure that out.

- Net Income: At the end of the day, that inventory value affects the bottom line!

So, yeah, ending inventory is a big deal for the bean counters. But it’s also super important for understanding a business's overall health. Think of it as giving a company a check-up!

Inventory Accounting: It's a Jungle Out There!

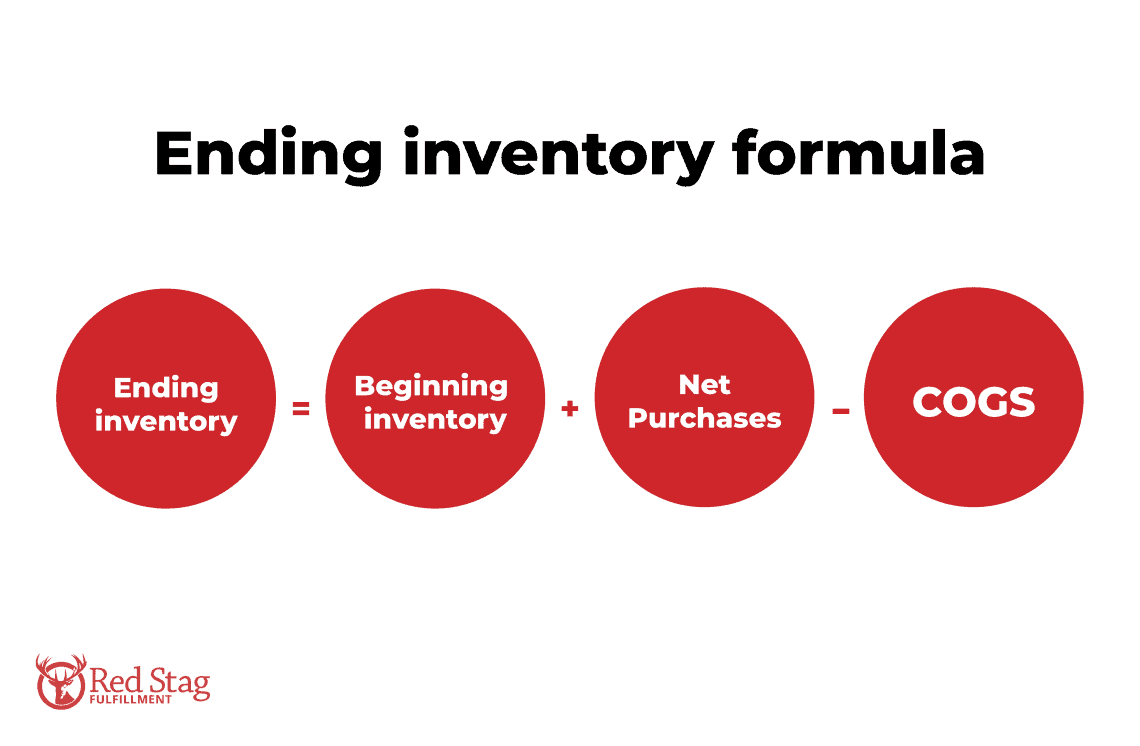

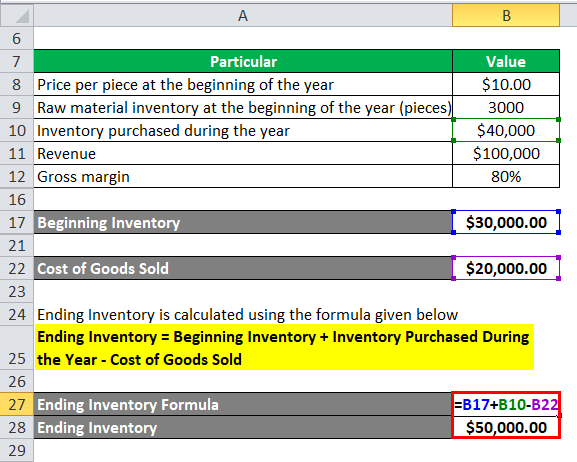

Okay, so how do they actually *calculate* all that leftover stuff? Turns out, there are a few different ways. It's like choosing your favorite ice cream flavor... everyone has a preference (and strong opinions!).

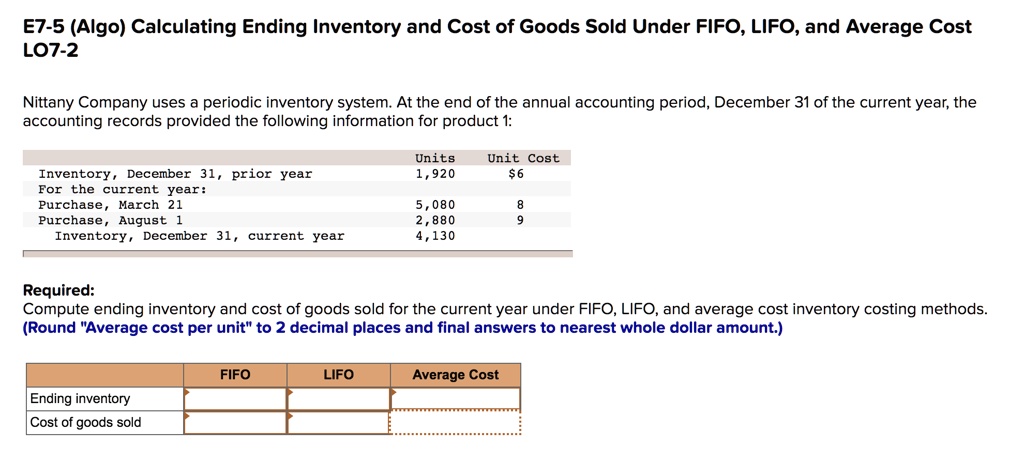

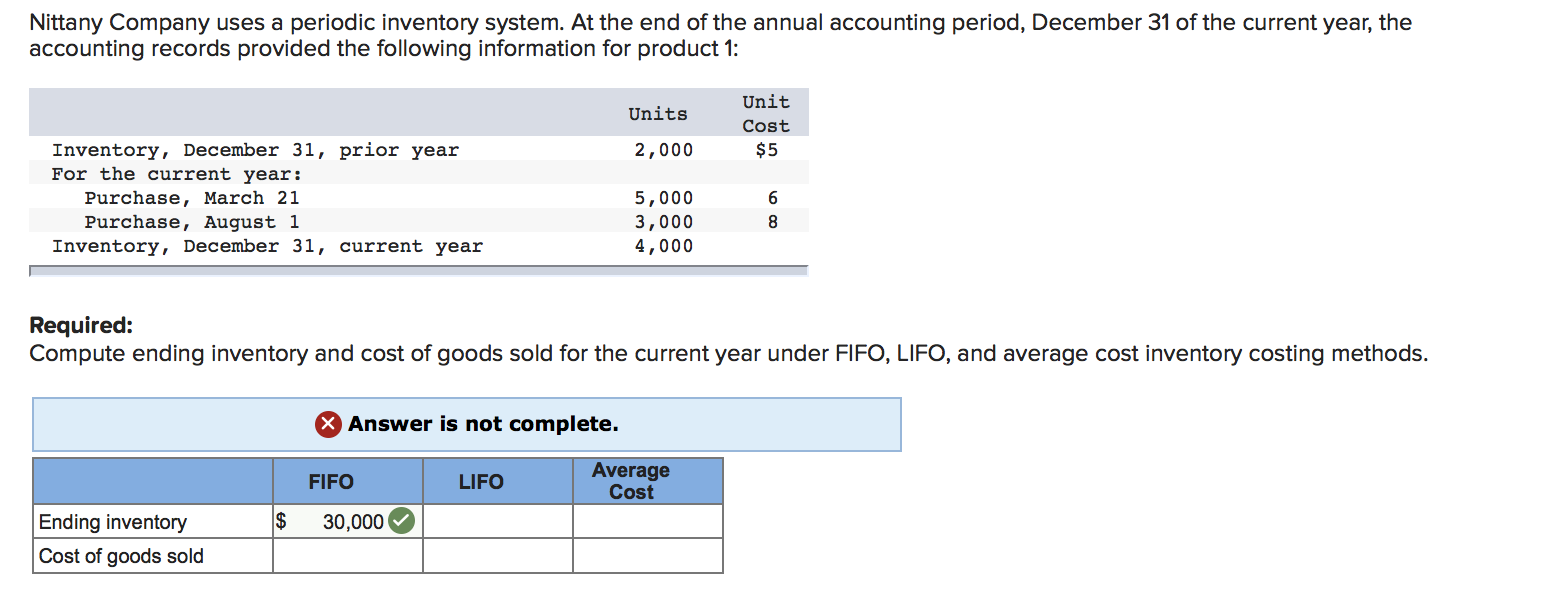

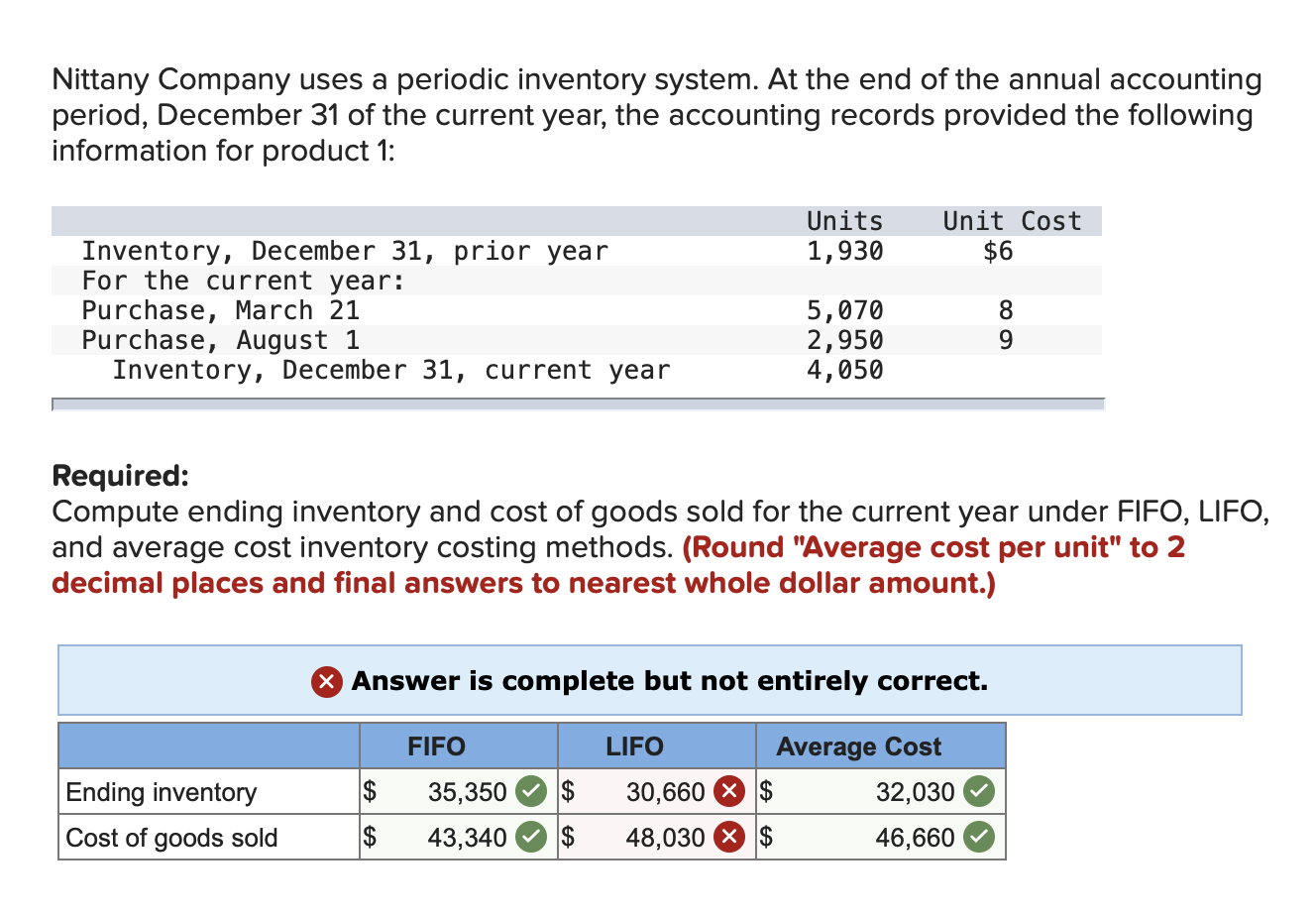

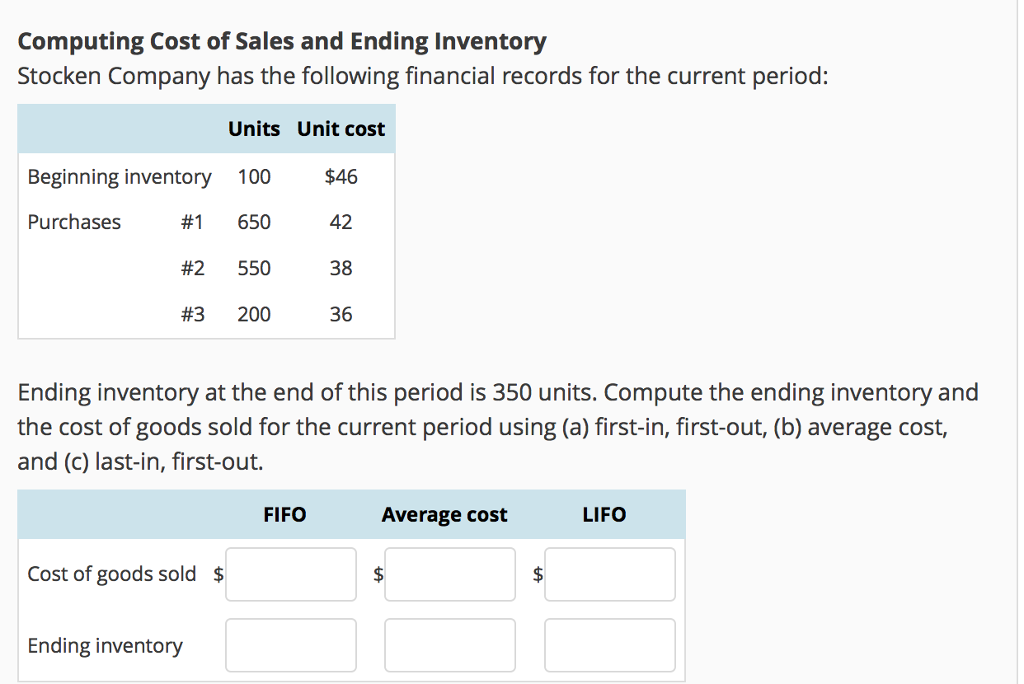

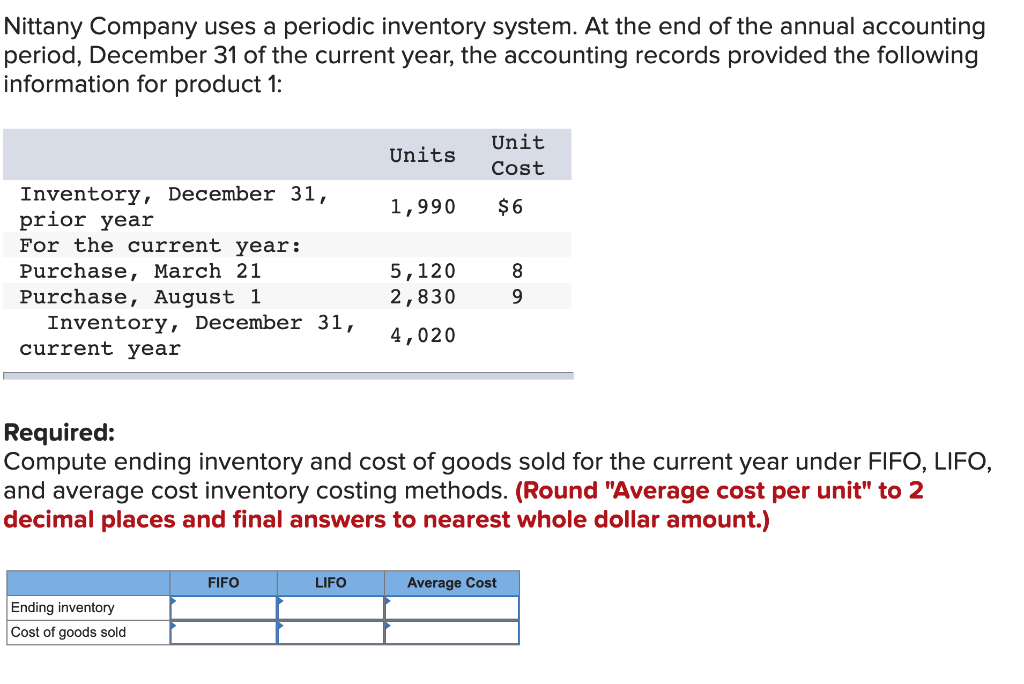

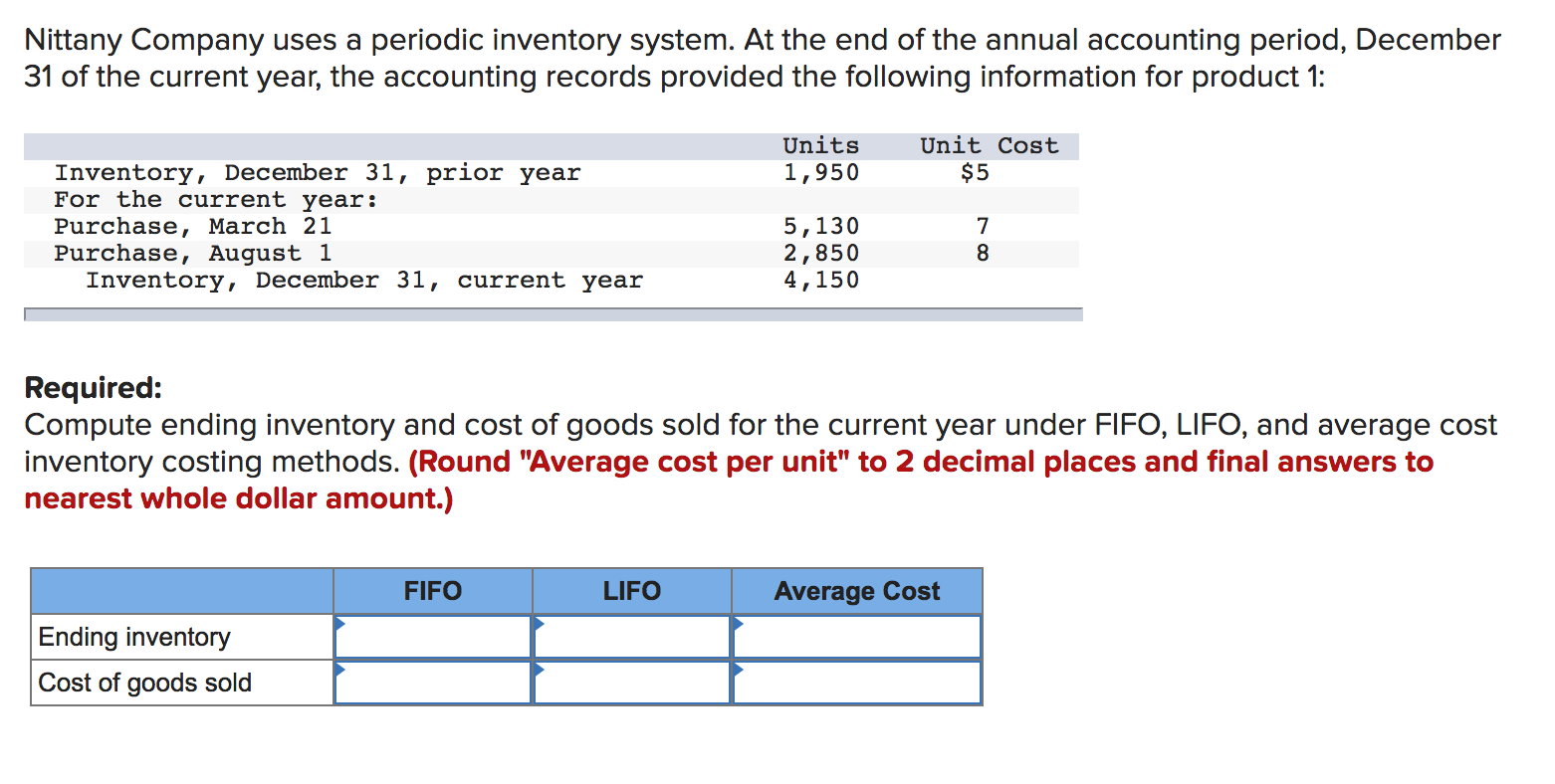

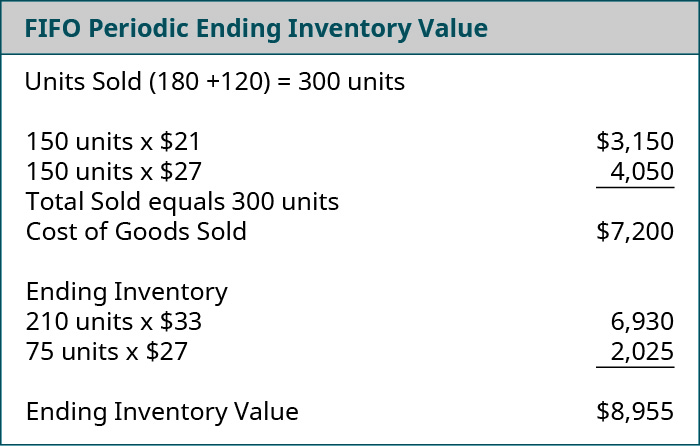

First-In, First-Out (FIFO): The OG

FIFO assumes the oldest items are sold *first*. Makes sense, right? Like, you want to sell that milk carton with the earliest expiration date. This method generally reflects the physical flow of goods.

Fun Fact: In times of rising prices, FIFO usually leads to a higher net income. Because the older, cheaper inventory gets sold first, leaving the newer, more expensive stuff to be recorded as ending inventory.

Last-In, First-Out (LIFO): The Rebel

LIFO assumes the newest items are sold first. A bit counterintuitive, huh? Imagine selling the freshest bread before the day-old stuff. LIFO can be a little weird, but it has its uses (especially when it comes to taxes!).

Quirky Detail: LIFO is not allowed under IFRS (International Financial Reporting Standards). Talk about a rebel without a cause!

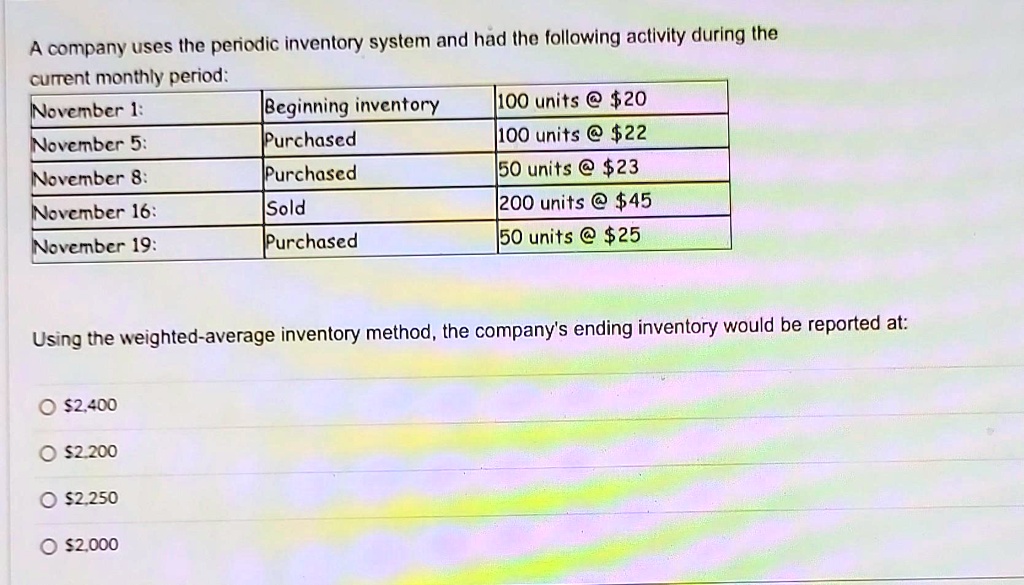

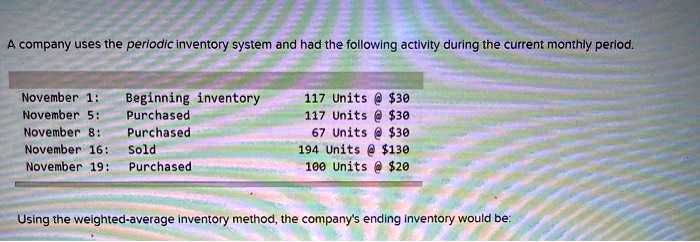

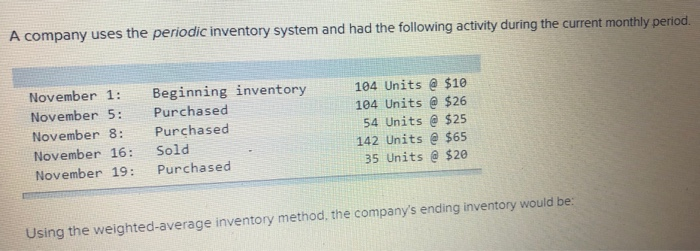

Weighted-Average Cost: The Peacemaker

This method calculates a weighted-average cost for all inventory items. It’s like blending all the flavors into one smooth, middle-of-the-road smoothie. Then, everything sold and everything left uses that average cost.

Why it's popular: The weighted-average method is simple to calculate and easy to use, especially when dealing with large quantities of similar items. It basically smoothes out all the fluctuations in prices.

Ending Inventory Errors: Uh Oh!

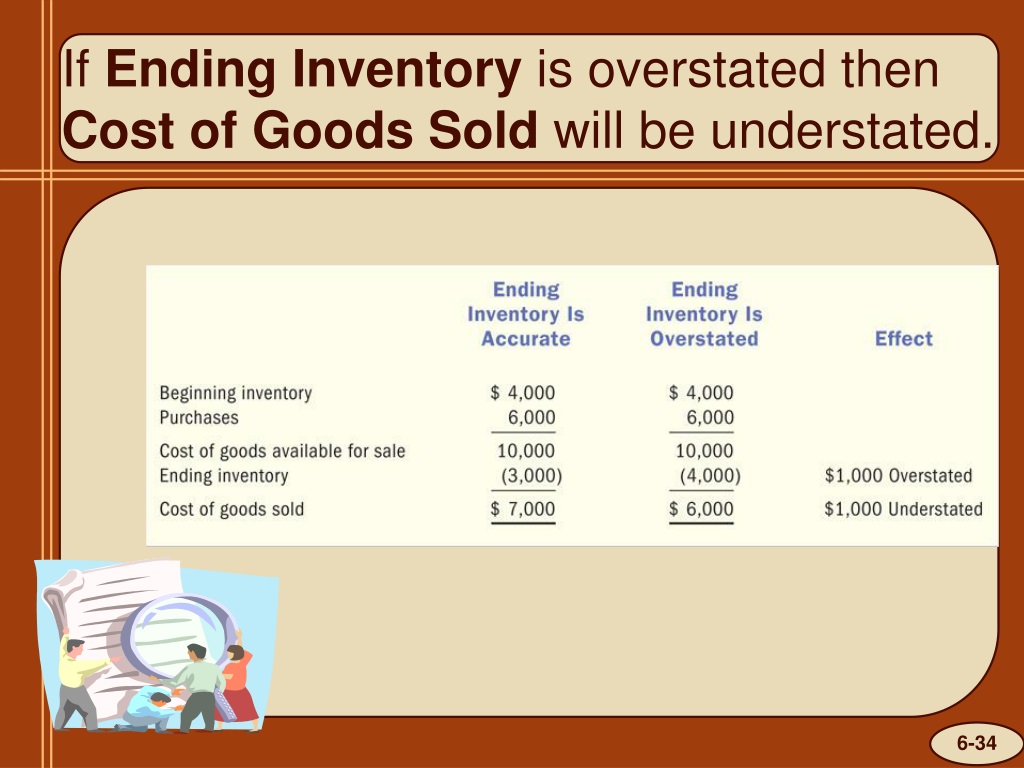

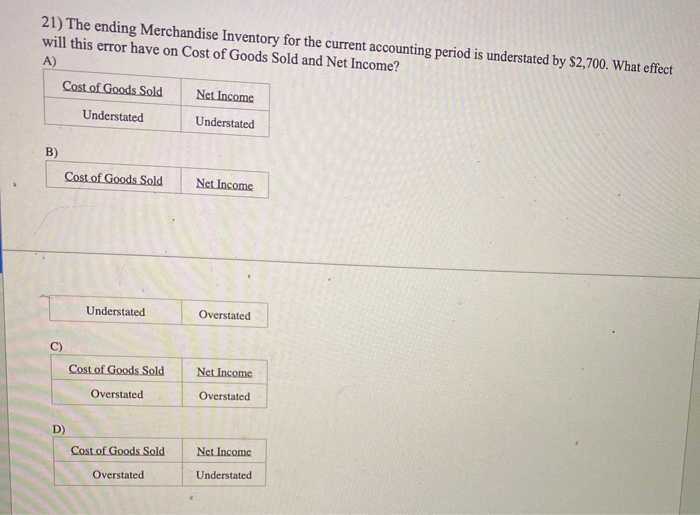

Mistakes happen. Even when counting leftover sweaters! And guess what? Errors in ending inventory can have a ripple effect on financial statements. It's like a domino effect of wrong numbers!

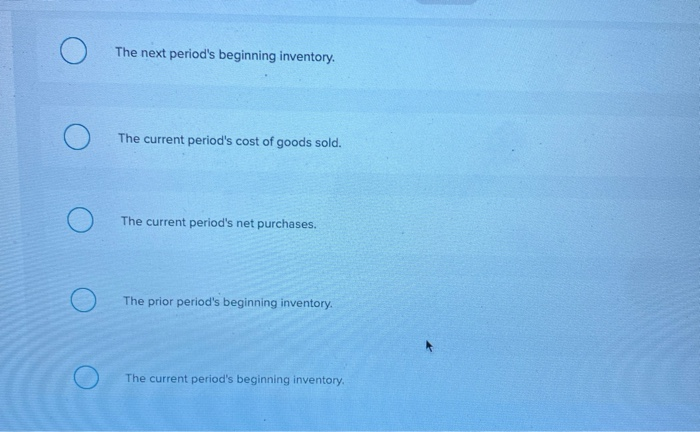

What's the Impact? An overstated ending inventory in one year leads to an understated cost of goods sold that year. This, in turn, creates an overstated net income. The next year, things will be reversed!

Think of it this way: Counting too many sweaters one year means you think you made more profit than you did. The next year, you'll be playing catch-up!

Ending Inventory: More Than Just Numbers

While it might seem like a dry accounting term, ending inventory is a peek into a company's soul. It tells you about:

- Inventory Management: Are they good at predicting demand? Do they have too much or too little stock?

- Sales Performance: What are people actually buying? What's gathering dust on the shelves?

- Overall Efficiency: Is the company running like a well-oiled machine, or are there some kinks in the system?

Here's a Thought: Next time you're shopping, take a look around. Think about the ending inventory implications of every product on the shelves. It's a fun way to appreciate the behind-the-scenes magic of business!

The Curious Case of Obsolete Inventory

Ah, yes. The dreaded obsolete inventory. These are the items that are no longer usable or sellable. Think of those outdated tech gadgets or the fashion trends that completely missed the mark. What happens to those poor things?

The Write-Down: Companies usually have to "write down" the value of obsolete inventory. This means reducing its value on the balance sheet. It's like admitting defeat and saying, "Okay, this item is basically worthless now."

Fun Fact: Proper inventory management is key to minimizing obsolete inventory. You don't want to be stuck with a warehouse full of Betamax players in a Netflix world!

In Conclusion: Embrace the Leftovers!

So, there you have it! Ending inventory: not just a bunch of unsold stuff, but a vital piece of the financial puzzle. It’s about tracking goods, understanding costs, and even predicting a company’s future.

Next time you hear someone mention ending inventory, don't zone out! Remember this article and impress them with your newfound knowledge. Tell them about FIFO, LIFO, and the woes of obsolete inventory. They'll be amazed!

And remember: every business has an ending inventory. From the smallest mom-and-pop shop to the biggest multinational corporation. It's a universal concept that connects us all... in a weird, accounting kind of way.

Keep exploring, stay curious, and happy calculating! Now, go forth and conquer the world... or at least understand your favorite store’s year-end numbers!