Okay, so you're staring down the barrel of closing out expense accounts. Sounds thrilling, right? Maybe not. But trust me, even accounting can be… kinda interesting. We're talking about money here! And funny money at that – you know, the stuff you spend on "business lunches" that totally sound legit.

Think of closing expense accounts as the grand finale of a financial year. It's like the last episode of your favorite show. You want it to be good! And, more importantly, you want it to tie up all the loose ends. No cliffhangers allowed!

The Magic Words: Closing Entries

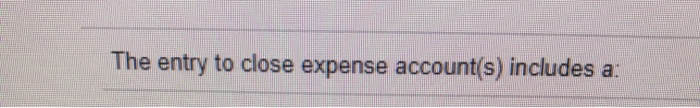

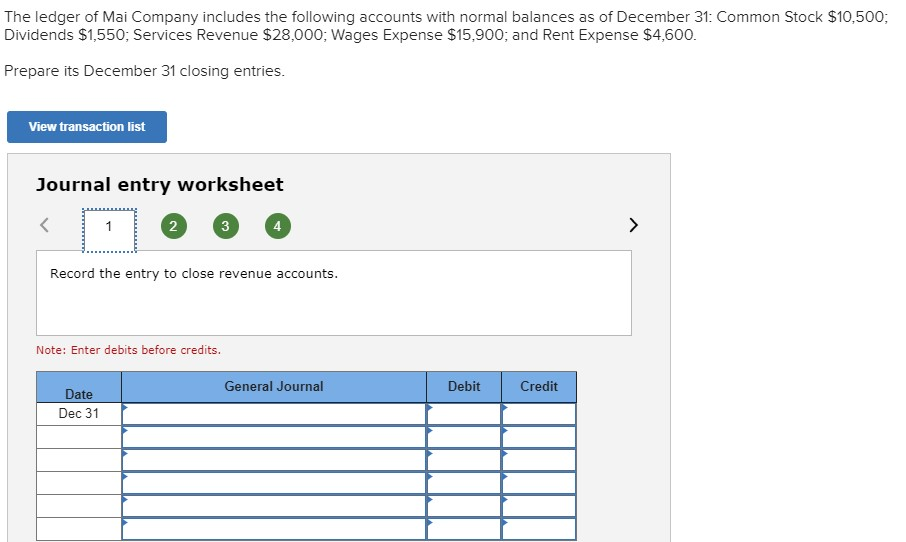

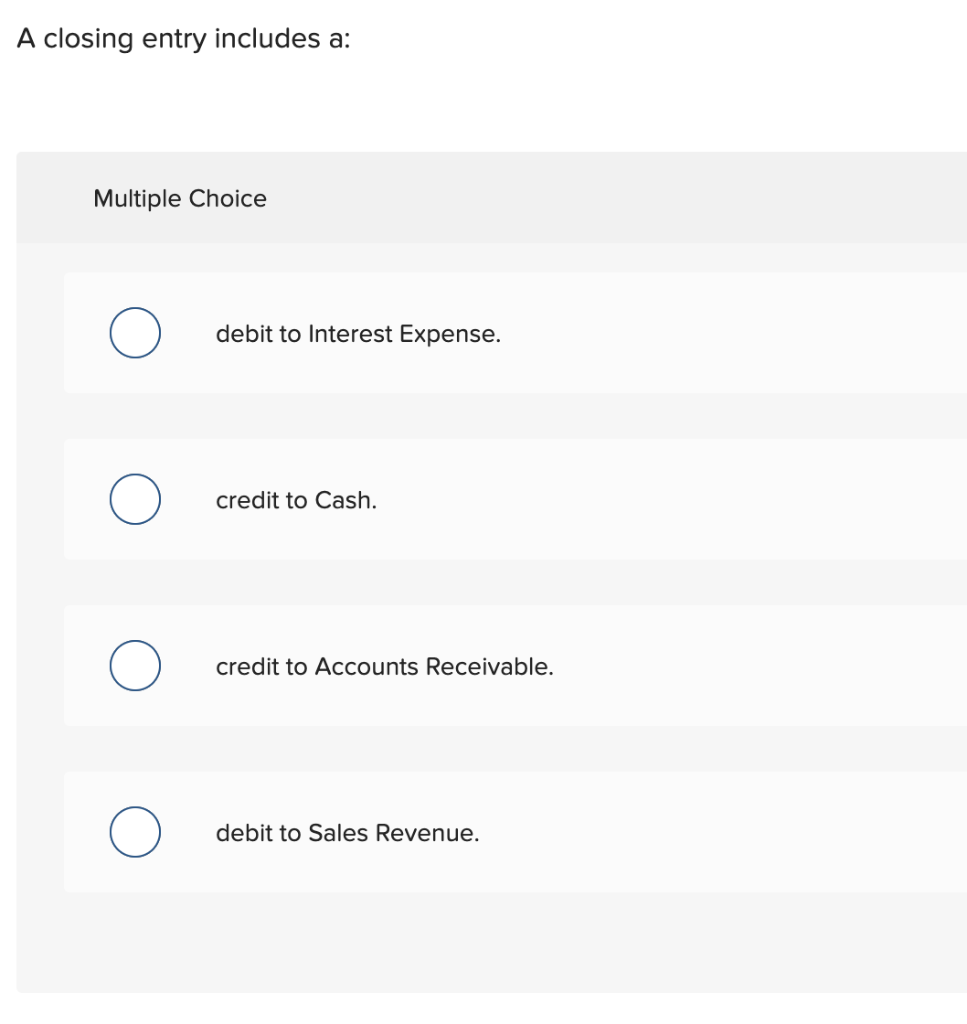

So, what exactly goes into these closing entries? Well, it's not like waving a magic wand and *poof* the accounts are closed. Though, wouldn't that be awesome? Instead, it involves a bit of journal entry wizardry.

Basically, closing entries are designed to zero out all the *temporary* accounts. Think of these as the accounts that track your financial performance over a specific period, like a year. They're temporary because you want to start fresh next year, right? No dragging old baggage around!

What are these temporary accounts? Let's break it down:

Revenue Accounts: Show Me the Money!

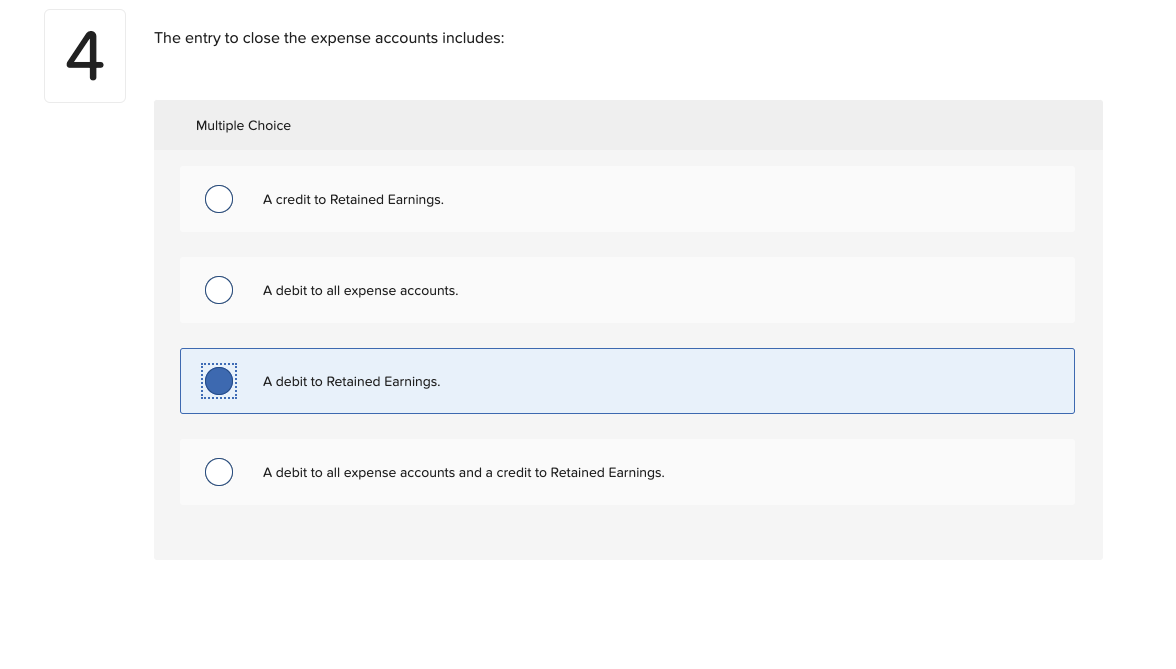

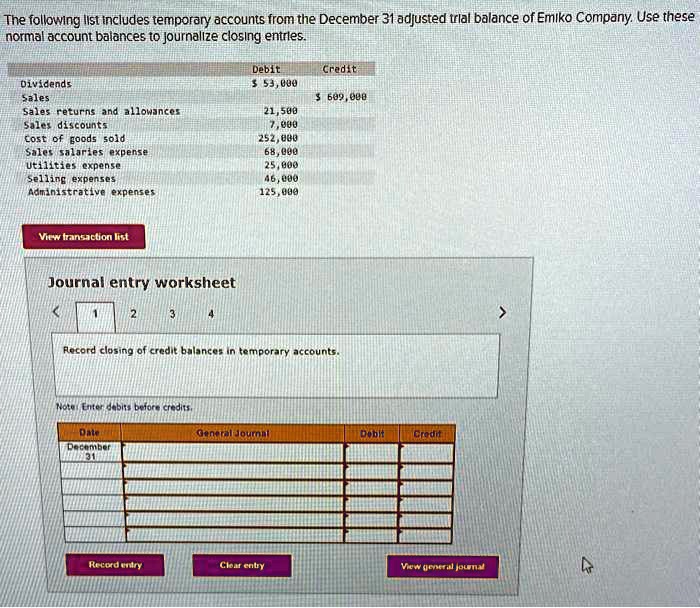

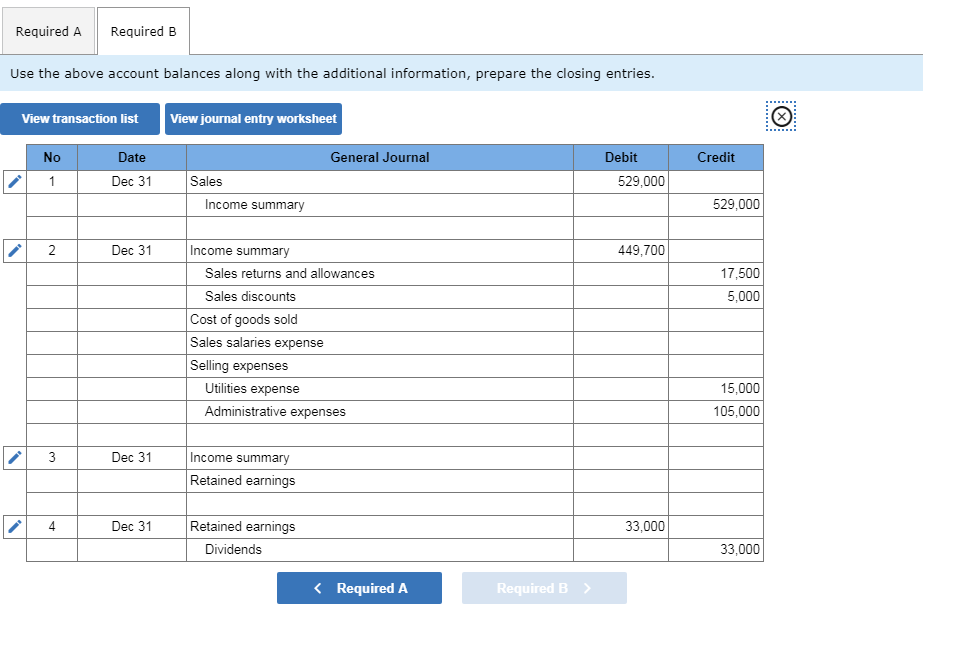

First up, we have revenue accounts. These are all the accounts that track how much money the company brought in. Sales revenue, service revenue, royalty revenue – you name it! It all gets tallied up here.

The closing entry basically takes all that revenue and *transfers* it somewhere else. Where? To the Income Summary account. Think of the Income Summary as a temporary holding pen for all the gains and losses before they get moved to the big boss account: Retained Earnings.

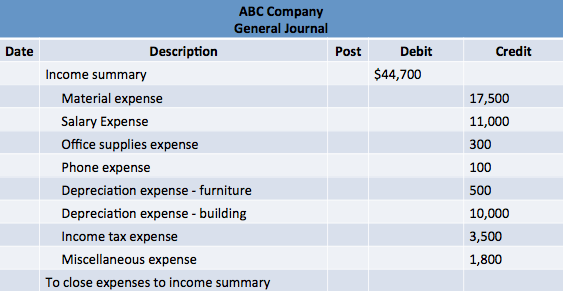

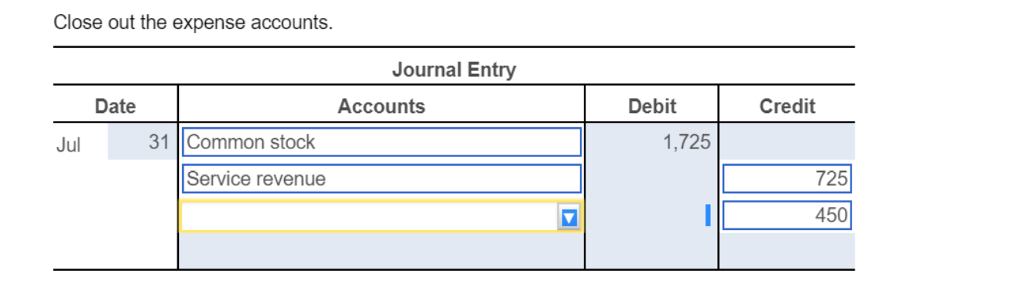

Expense Accounts: Where Did It All Go?!

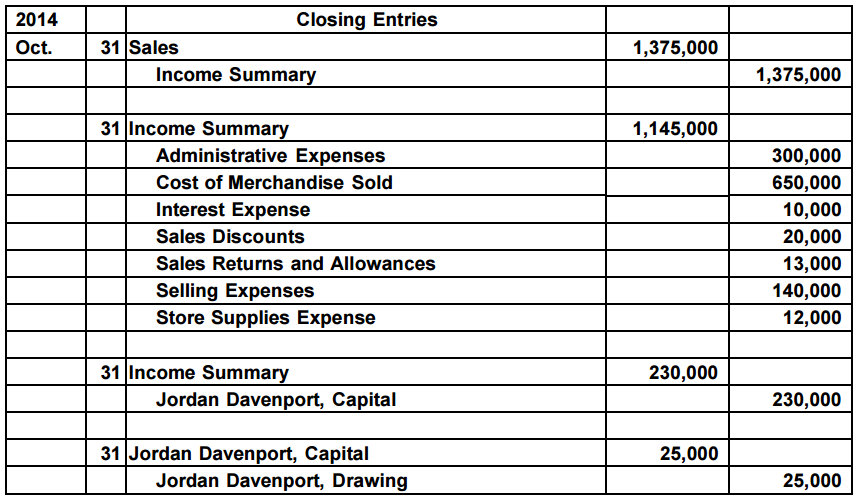

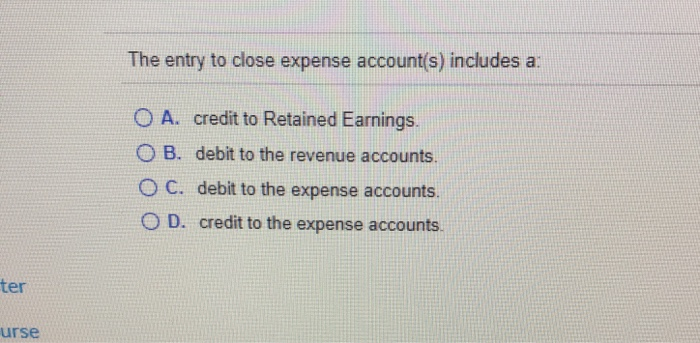

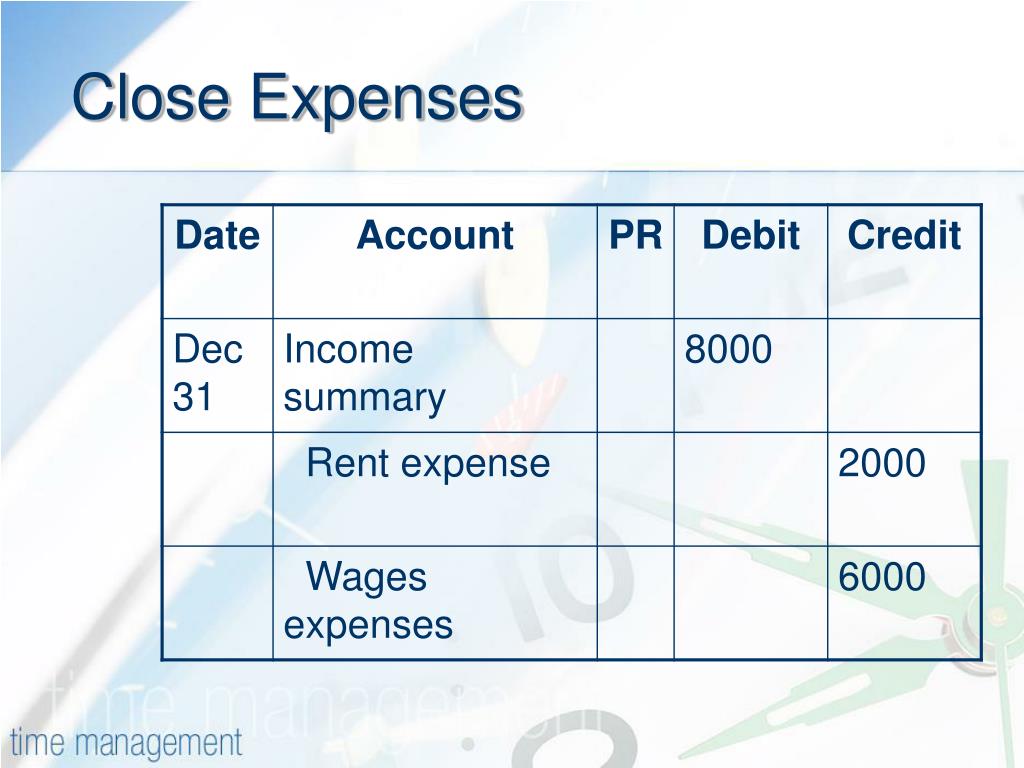

Next, we have the expense accounts. These are the accounts that track all the money the company spent. Salaries, rent, utilities, marketing – all those necessary evils that keep the business running.

Just like revenue, we need to zero out these expense accounts. So, guess where all the expenses go? You guessed it! To the Income Summary account. The Income Summary is starting to look like a pretty busy place, isn't it?

Here's a fun fact: Ever wonder if someone's "expense account" is really just a free-for-all? Yeah, auditors wonder that too. That's why detailed expense reports are so important! (And why you should probably keep those receipts.)

The Dreaded Income Summary: The Balancing Act

Okay, so the Income Summary account now holds all the revenue and all the expenses. It's time for a showdown! We need to figure out the *net income* or *net loss*. This is basically the difference between the revenue and the expenses.

If revenue is greater than expenses, then congratulations! You have a net income! High fives all around!

If expenses are greater than revenue, then… well, you have a net loss. Maybe cut back on the fancy office coffee next year?

Either way, that net income or net loss gets transferred to the *Retained Earnings* account. Retained Earnings is basically the accumulated profits (or losses) of the company over its entire history. It's like the company's bank account for profits.

Dividends: Sharing the Wealth (or Not)

Finally, we have dividends. Dividends are the payments made to shareholders. It's like the company sharing its profits with the people who own it.

Dividends are also considered a temporary account because they relate to a specific period. So, you guessed it, we need to close them out too! Dividends are transferred directly to the Retained Earnings account. Paying dividends reduces the amount of retained earnings.

The Grand Finale: Retained Earnings

So, after all that transferring and summarizing, where do we end up? With the Retained Earnings account. This account now reflects all the revenue, expenses, and dividends for the year. It's the ultimate summary of the company's financial performance.

The beauty of closing entries is that they prepare the accounts for the next accounting period. It's like hitting the reset button on all the temporary accounts so you can start fresh. No more lingering revenue or expenses from last year!

Closing entries make it easier to compare financial performance from one period to the next. You're comparing apples to apples, not apples to oranges. This is super important for making informed business decisions.

Why Bother? (The Importance of Closing Entries)

You might be thinking, "Okay, this sounds like a lot of work. Why do we even bother with closing entries?"

Well, first of all, it's generally *required* by accounting standards. So, if you want to keep the accountants happy (and out of jail), you need to do it. But beyond that, closing entries serve a really important purpose. It's about accuracy and transparency.

Here's the thing: If you didn't close out the temporary accounts, they would just keep accumulating year after year. This would make it impossible to track financial performance accurately. Imagine trying to figure out your net income if your revenue account included sales from the past 10 years! Talk about a headache!

Closing entries also ensure that the financial statements are accurate and reliable. Investors, creditors, and other stakeholders rely on these statements to make informed decisions about the company. If the statements are inaccurate, those decisions could be based on faulty information.

Plus, properly closed accounts help with things like budgeting and forecasting. You need a clear and accurate picture of the past to make informed predictions about the future. No one wants to base their budget on a bunch of outdated numbers!

Making It Fun (Or At Least Less Painful)

Okay, let's be real: Closing expense accounts might not be the most thrilling task in the world. But it doesn't have to be a complete drag. Here are a few tips for making it a little more fun (or at least less painful):

- Turn it into a game: Set a timer and see how quickly you can complete the closing entries. Offer a small reward to the person who finishes first (and accurately!).

- Listen to music: Put on your favorite tunes to help you stay focused and motivated.

- Take breaks: Don't try to do it all at once. Take frequent breaks to stretch, walk around, and clear your head.

- Teamwork makes the dream work: Collaborate with your colleagues to divide the workload and provide support.

- Celebrate when you're done: Treat yourself to something special when you've finished the closing entries. You deserve it!

And remember, it's all about the details. Accuracy counts! So, double-check your work and make sure everything is in order. After all, a little attention to detail can go a long way in the world of accounting.

So, there you have it! The entry to close the expense accounts, demystified. It's not as scary as it sounds, right? Now go forth and conquer those closing entries! You got this!

![[Solved] ? ?? Journalize the closing entries. Incl | SolutionInn - The Entry To Close The Expense Accounts Includes](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2021/02/602e0170d42cd_1613627759196.jpg)