Okay, so you're curious about Aflac's accident policy, huh? Let's dive in! It's not exactly a laugh riot, but understanding it can be surprisingly… empowering? Think of it as your own personal superhero cape for unexpected ouchies.

Basically, an Aflac accident policy is a type of supplemental insurance. It pays you cash when you have an accident. And who doesn't love cold, hard cash? I mean, come on!

What Kinds of "Oops!" Are We Talking About?

So, what exactly does this thing cover? It's not like they're going to pay you for stubbing your toe (though, wouldn't *that* be amazing?). We're talking about the bigger stuff.

Broken Bones and Fractures

Yep, those are covered. Aflac knows breaking a bone is a big deal (and seriously painful). They’ll help with the bills. Imagine tripping over your dog and ending up with a broken arm. Ouch! But hey, at least you might get some cash to help cover the medical bills and maybe even order some extra-large pizzas while you recover. Because, pizza fixes everything, right?

Did you know that the most commonly broken bone is the clavicle? That's the fancy name for your collarbone. It's like your body's built-in fashion accessory holder... that occasionally snaps.

Dislocations

Popped your shoulder out while attempting that impressive dance move? Dislocated your knee playing pickleball (yes, pickleball injuries are a thing)? Aflac might have your back (or, you know, your shoulder/knee).

Fun fact: Dislocations are often treated by "reducing" the joint. Which sounds way more dramatic than it is. It basically means a doctor puts the bone back where it belongs. Like a puzzle piece that went rogue.

Cuts, Lacerations, and Burns

Sliced your hand while trying to open a coconut with a machete? (Please don't do that.) Got a nasty burn while attempting to deep-fry a turkey indoors? (Seriously, don't.) Aflac can help with those too. They're basically saying, "We understand accidents happen, especially when coconuts and deep fryers are involved."

Here’s a quirky detail: Burns are classified by degrees. First-degree is like a mild sunburn, while third-degree involves damage to deeper tissues. And yes, fourth-degree burns exist, and they are... not fun. (Let's just leave it at that.)

Dental Injuries

Took a rogue baseball to the face and lost a tooth? Chipped a tooth while aggressively eating popcorn? Dental work can be expensive! Aflac recognizes this painful truth and offers coverage for certain dental injuries sustained in accidents. Hopefully, they cover the cost of replacing that precious popcorn-eating incisor.

Another delightful detail: Dentists are basically artists who work with tiny tools inside your mouth. They sculpt, polish, and fill. Who knew your dentist was such a secret Michelangelo?

Eye Injuries

Got poked in the eye during an overly enthusiastic game of charades? Scratched your cornea while battling a dust bunny army under your bed? Eye injuries are no joke, and Aflac often covers them. Protecting your peepers is important!

Did you know your eyes can distinguish about 10 million different colors? That's a lot of rainbows! So, keep those eyes safe and sound.

Concussions

Bumped your head a little too hard? Experiencing that telltale fuzzy feeling after a minor collision? Concussions are surprisingly common, and Aflac can provide benefits for diagnosis and treatment.

Here's a brainy fact: Your brain is basically a big, squishy supercomputer. So, treat it with respect!

Emergency Room Visits and Hospitalizations

Sometimes accidents are serious enough to warrant a trip to the ER or even a hospital stay. The good news is that Aflac accident policies often include benefits for emergency room visits and hospitalizations resulting from a covered accident.

And here's a somewhat morbid, yet fascinating, fact: Hospitals are basically cities within cities. They have their own power grids, security forces, and even laundry services that handle a truly staggering amount of linens. It's a whole world you hope you don't need to spend too much time in.

The Nitty-Gritty: What It *Doesn't* Cover

Okay, so Aflac's accident policy is great, but it's not a magical cure-all. It won't cover everything. Here are a few things to keep in mind:

Pre-existing conditions: If you broke your arm *before* you got the policy, Aflac won't cover a new break on that same arm. Sorry, that's just how it works.

Illness: This policy is for *accidents*, not illnesses. So, if you get the flu, Aflac won't pay out. You'll need a separate health insurance policy for that.

Intentional self-harm: Please, don't hurt yourself intentionally. Aflac (and everyone else) wants you to be healthy and happy.

High-risk activities: Some policies might exclude certain high-risk activities, like skydiving or base jumping. Read the fine print carefully before taking the plunge (literally).

Why Even Bother?

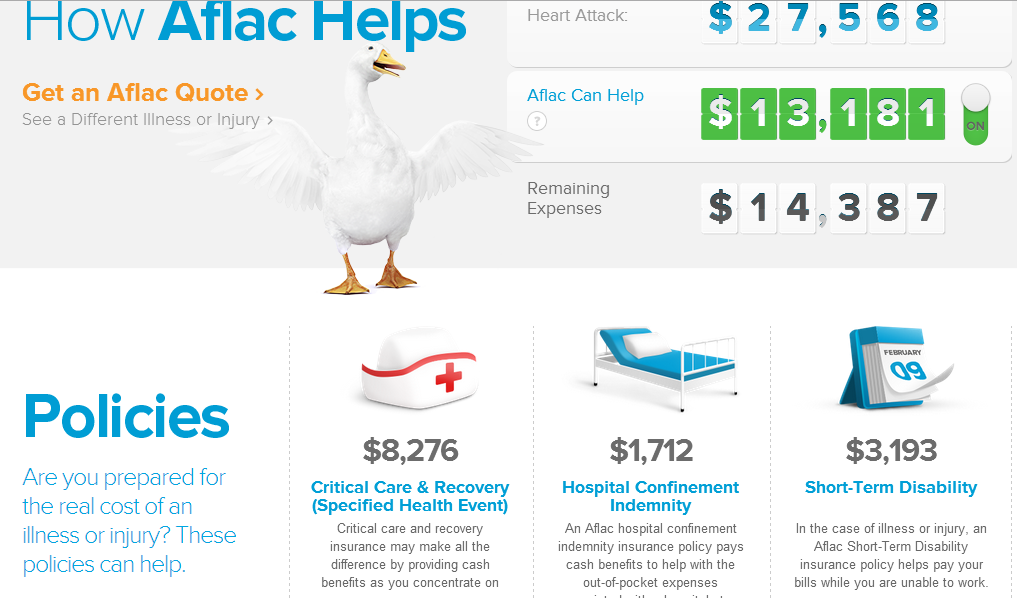

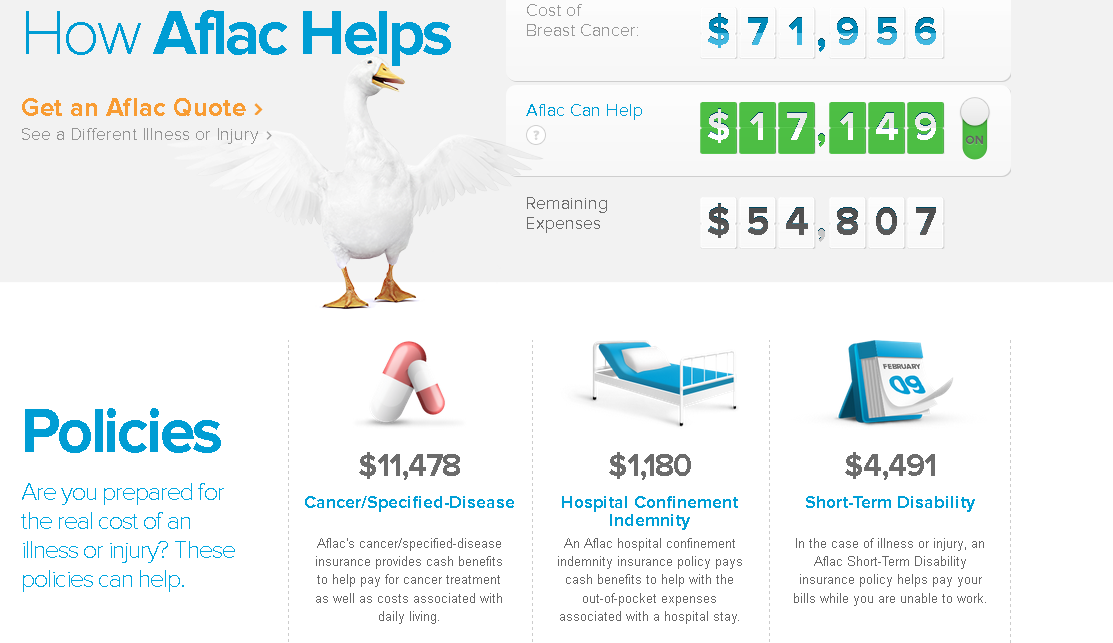

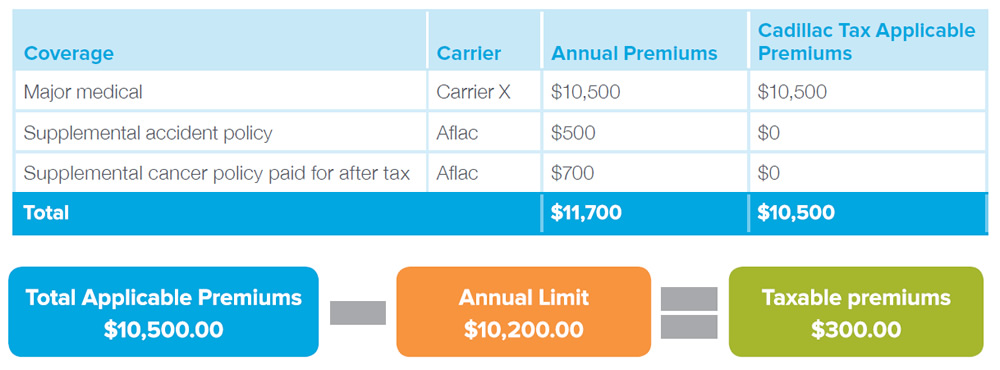

So, why should you even consider an Aflac accident policy? Well, think of it as a financial cushion. It can help you pay for things that your regular health insurance might not cover, like deductibles, co-pays, and out-of-pocket expenses. Plus, the cash you receive can be used for anything you want: groceries, rent, childcare, or even a celebratory pizza party after your recovery. It's your money, spend it as you see fit!

Ultimately, it's about peace of mind. Knowing you have a little extra protection in case of an accident can make life a little less stressful. And who doesn't need less stress these days?

Read the Fine Print!

This isn’t a substitute for reading the actual policy. Seriously, read the policy!. Every policy is different. Coverage varies. Understand the details of *your* specific Aflac accident policy before you need to use it. It's the grown-up thing to do. Plus, you might uncover some surprisingly quirky clauses hidden in the fine print.

So, there you have it! A (hopefully) fun and informative look at Aflac's accident policy. Now go forth and be accident-prone… just kidding! Stay safe, be smart, and maybe avoid the coconuts and deep fryers.