Hey there, friend! Ever heard the phrase "Income Statement" and felt your eyes glaze over? Yeah, me too. It sounds so… official. But don’t worry! It's not as scary as it seems. Think of it as a story, a financial story, and we're about to uncover its secret identity!

So, what is another term for Income Statement? Drumroll, please… It's also known as the Profit and Loss Statement, or even more casually, the P&L. See? Already less intimidating, right?

Why So Many Names?

Good question! It's like having a bunch of nicknames. Think of it like this: your mom calls you by your full name when you're in trouble, your friends have a silly nickname, and your work colleagues use something professional. Same person, different labels! An Income Statement is just fancy talk. Profit and Loss Statement gets right to the point. P&L? Super casual, like you’re already best buds with the accountants.

The core idea behind all these names is the same: to show how much money a company made (or lost!) over a specific period. Think of it as a financial report card. Did the company ace the semester, or did they need to hit the books harder?

Breaking Down the P&L Fun

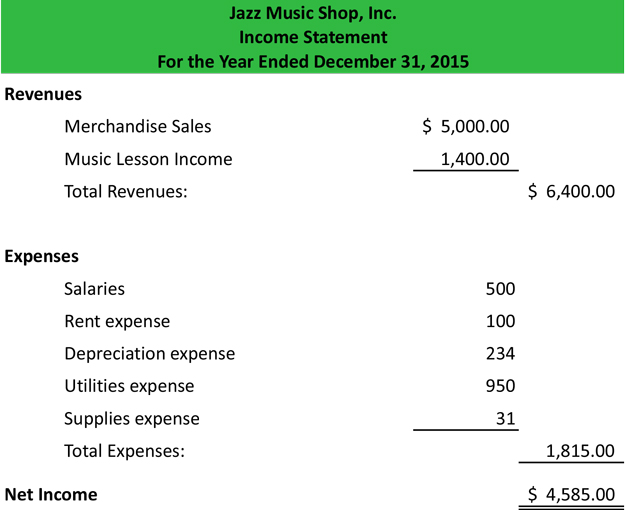

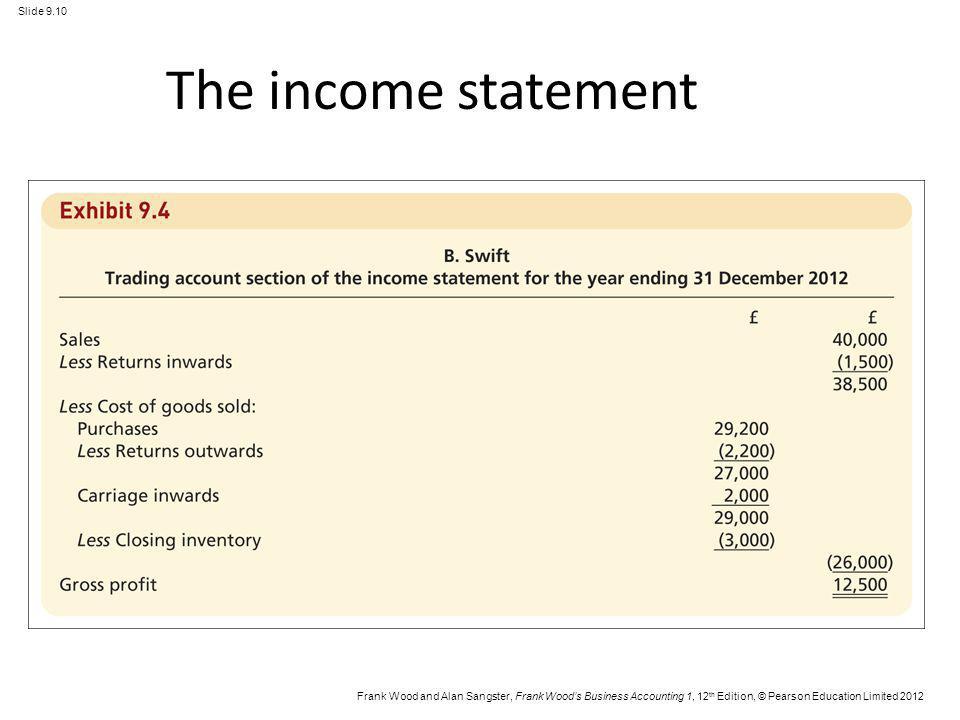

Okay, let's dive a little deeper without getting bogged down in numbers. A P&L statement basically shows you three crucial things: revenue, expenses, and the resulting profit (or loss). Imagine it's a recipe! Revenue is all your ingredients, expenses are the cost of the oven, electricity and your labor, and profit is the delicious cake you get to enjoy (or the burnt offering you have to toss!).

Revenue: This is all the money coming *in*. Sales, services, investments – whatever makes the company money, it all gets tallied here. If you're running a lemonade stand, this is all the money you collected from thirsty customers.

Expenses: This is all the money going *out*. Rent, salaries, supplies, marketing – anything the company has to pay for to keep running. Back to the lemonade stand, this is the cost of lemons, sugar, cups, and maybe even a tiny umbrella for each drink (gotta keep it classy!).

Profit (or Loss): This is the difference between revenue and expenses. If revenue is greater than expenses, congratulations, you made a profit! If expenses are greater than revenue, oh dear, you have a loss. Hopefully your lemonade stand didn’t go bankrupt!

Here's a quirky fact: Some companies even list the cost of employee snacks under expenses. Imagine! "Cost of office cookies: $5000." That's dedication to morale (and maybe a slight sugar addiction!).

Why Should *You* Care About P&L Statements?

Even if you're not an accountant, understanding the basics of a P&L can be incredibly useful. Thinking of investing in a company? Check out their P&L! It'll give you a good idea of how well they're actually doing. Planning to start your own business? You'll *definitely* need to know how to create and interpret your own P&L!

But it's not just for business owners and investors. Knowing the difference between revenue and profit can help you make smarter financial decisions in your own life. Are you spending more than you're earning? Time to cut back on those fancy coffees (or maybe start selling lemonade!).

Plus, it's just plain fun to understand how the world works. Money makes the world go 'round, and the P&L is a key to understanding how that money flows. It's like learning a secret language that unlocks the mysteries of the business world!

More Fun P&L Facts!

- Did you know that some companies will try to "window dress" their P&L? This means they try to make it look better than it actually is (legally, of course!). It's like putting on your best outfit for a first date, even if you're secretly wearing comfy socks.

- The P&L is often used in conjunction with other financial statements, like the Balance Sheet and the Cash Flow Statement, to get a complete picture of a company's financial health. Think of it as assembling a financial puzzle!

- P&L statements are usually prepared on a monthly, quarterly, or annual basis. It’s like getting regular check-ups from your doctor, but for your business’s financial health!

- Accountants are the rockstars of the P&L world. They're the ones who put all the numbers together and make sense of it all. So, the next time you meet an accountant, give them a high five! They're keeping the financial world turning.

Beyond the Basics: What to Look For

Alright, so you know the basics. But how do you actually *read* a P&L? Here are a few things to keep an eye on:

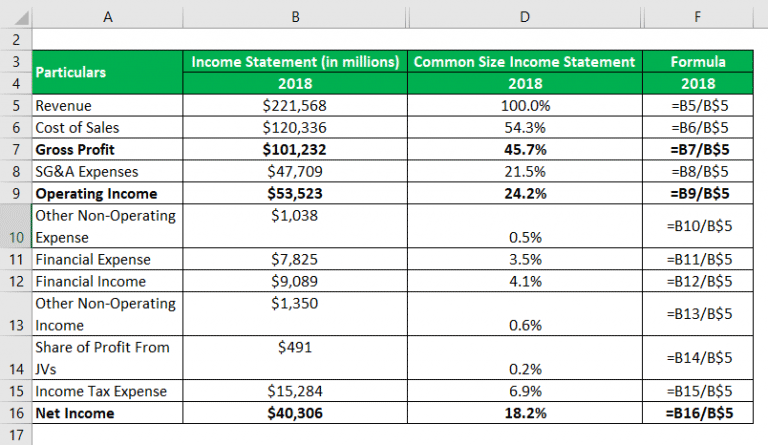

Trends: Is the company's revenue growing over time? Are their expenses increasing faster than their revenue? These trends can tell you a lot about the company's future prospects. Upward trend is good, right? Downward Trend – Danger Will Robinson!

Profit Margins: This is the percentage of revenue that remains after deducting expenses. A higher profit margin means the company is more efficient at generating profits. A lower margin might mean they are bleeding cash somewhere.

Comparison to Competitors: How does the company's P&L compare to those of its competitors? Are they performing better or worse? This can help you understand the company's competitive position. Are they the big dog in the park, or just another pup?

One-Time Events: Be sure to look out for any one-time events that might have skewed the P&L. For example, if a company sold off a major asset, it might have a huge boost in revenue that's not sustainable. It’s like winning the lottery – fun, but not a reliable income stream.

So, Are You a P&L Pro Yet?

Okay, maybe not a "pro" just yet, but hopefully you're feeling a little less intimidated by the Income Statement (aka Profit and Loss Statement, aka P&L!). It's just a story about money coming in and money going out. And like any good story, it can tell you a lot about the characters involved (in this case, the company!).

Remember, the next time you hear someone talking about an Income Statement, you can confidently say, "Oh, you mean the P&L? Yeah, I know all about that!" And then, you can impress them with your newfound knowledge of revenue, expenses, and profit margins. You might even become the most popular person at the party (or at least the most financially savvy!).

The Income Statement is a powerful tool to analyze a company's performance. Knowing this alternate name is just the first step in a financial journey that can empower you personally and professionally. Happy analyzing! And remember, numbers don't lie (but they can be a little tricky sometimes!). Have fun exploring the world of finance!

:max_bytes(150000):strip_icc()/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

![Free Printable Income Statement Templates [Excel, Word, PDF] - What Is Another Term For Income Statement](https://www.typecalendar.com/wp-content/uploads/2023/06/Income-Statement-1-1200x675.jpg)

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)

:max_bytes(150000):strip_icc()/Investopedia11-cc2db67b30a242d5a4d3e4939eb6d212.jpg)