Ever stared at your credit report and thought, "Whoa, what's that?" Don't worry, you're not alone! Credit reports can be a little… cryptic. Today, we're decoding one potentially puzzling entry: Finwise Bank. Buckle up; we're about to make this whole thing a lot less scary and maybe even a little… fun?

Seriously, fun! Okay, maybe not rollercoaster-level fun, but understanding your credit is like having a superpower. It lets you unlock better interest rates, get approved for that dream apartment, and generally feel more in control of your financial life. And that, my friend, is pretty awesome.

So, What IS Finwise Bank?

Let's get down to brass tacks. Finwise Bank is a real bank, headquartered in Utah. They're not some fly-by-night operation. They're an FDIC-insured institution, meaning your deposits are protected. But, and this is a big but, they operate a bit differently than your typical brick-and-mortar bank.

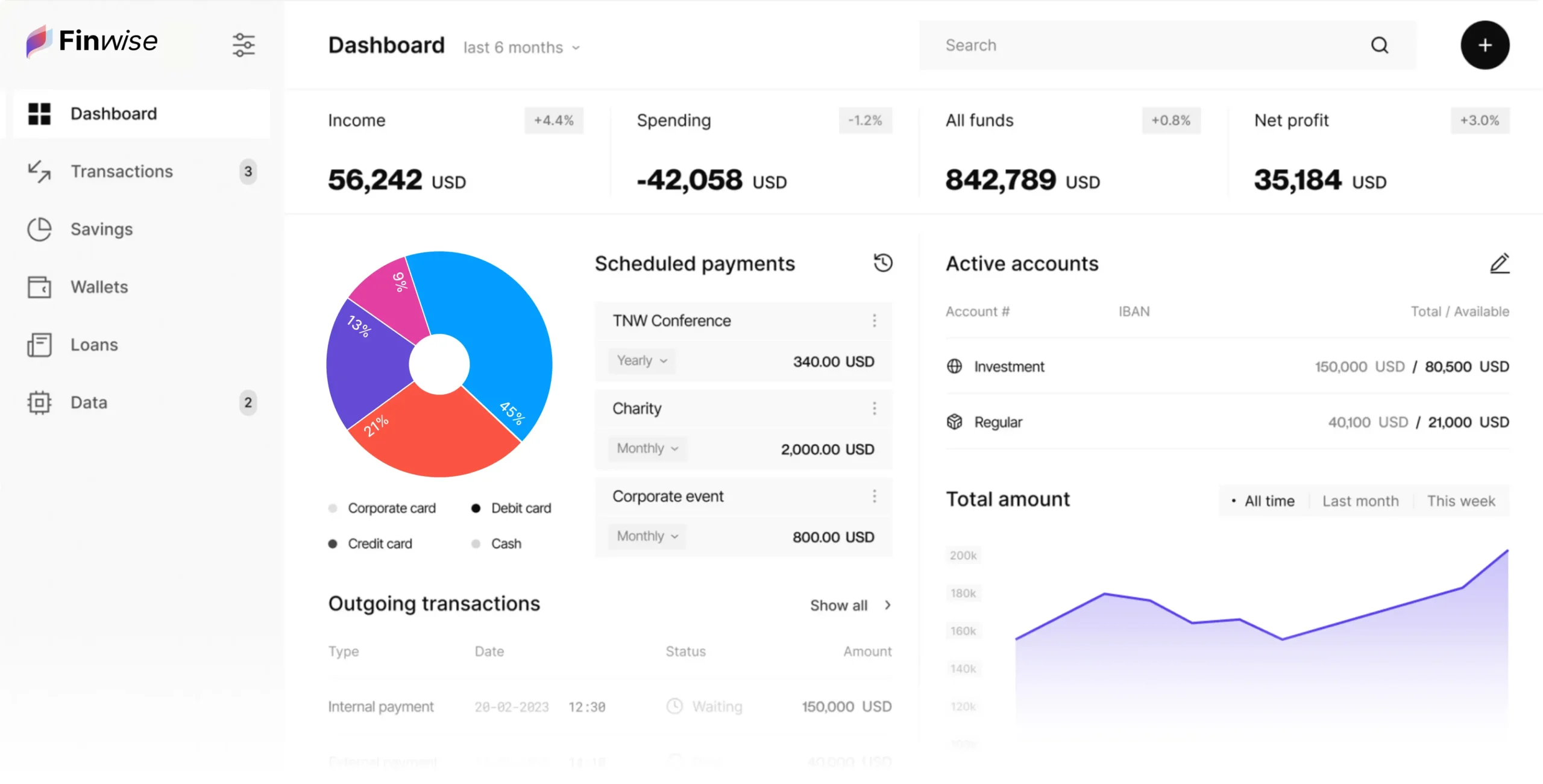

Think of Finwise Bank as a behind-the-scenes player. They primarily work with fintech companies. Fintech (financial technology) companies are those innovative businesses that use technology to deliver financial services – think online lenders, payment platforms, and even some of those cool budgeting apps you've been eyeing.

Finwise Bank provides these fintech companies with banking services. This allows the fintech companies to offer loans and other financial products to you, the consumer. So, if you see "Finwise Bank" on your credit report, it likely means you have a loan or credit product facilitated through one of their fintech partners.

But I Don't Remember Banking Directly With Them!

Exactly! That's the most common source of confusion. You probably didn't walk into a Finwise Bank branch (because, well, they don’t really have them for the public). You likely applied for a loan or credit product through a different company – a company that partners with Finwise Bank.

For example, imagine you took out a personal loan through an online lender that specializes in debt consolidation. That lender might partner with Finwise Bank to originate the loan. When the loan is reported to the credit bureaus, it might show up as "Finwise Bank" because they are the actual legal lender, even though you interacted primarily with the other company. Make sense? It's like the movie industry: you see the actors on screen, but there is a whole production team behind the scenes bringing the movie to life!

Why Is It Showing Up On My Credit Report?

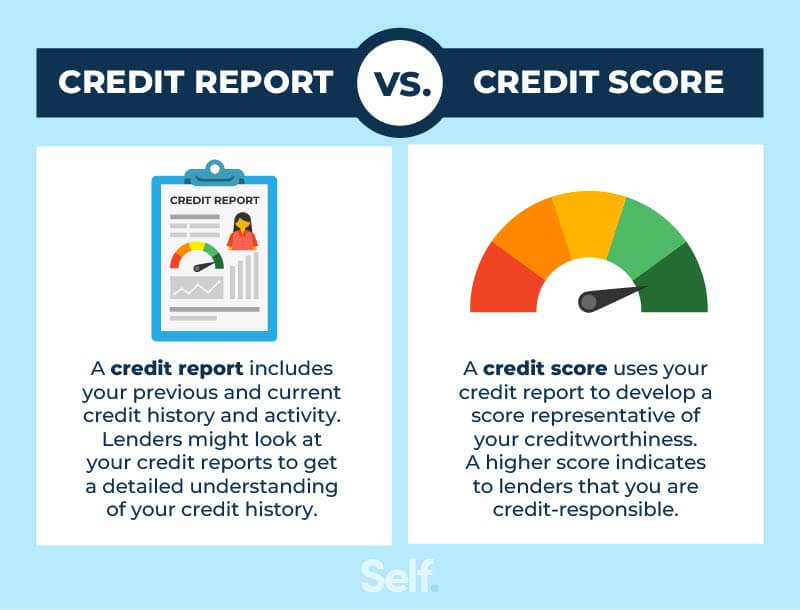

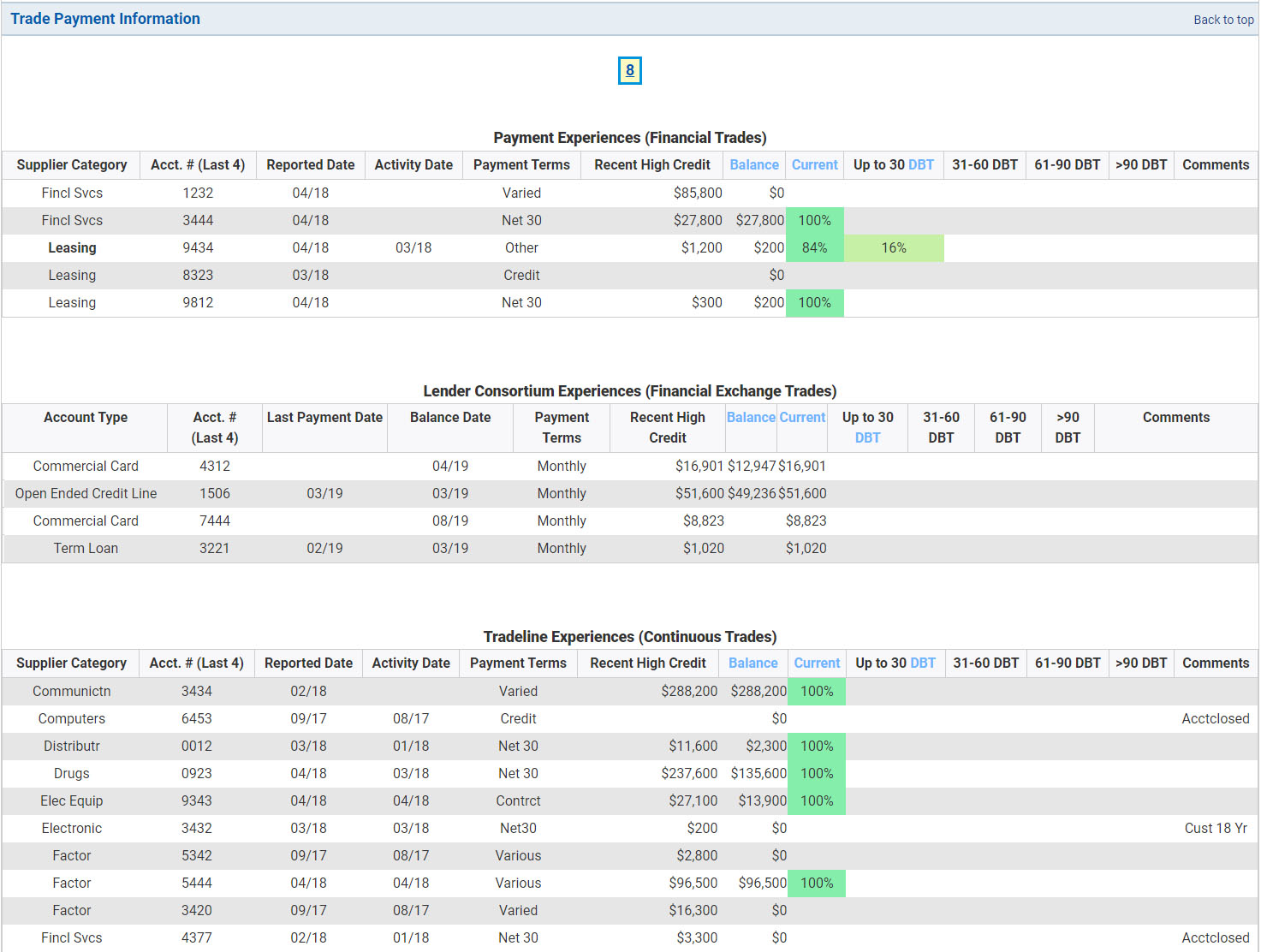

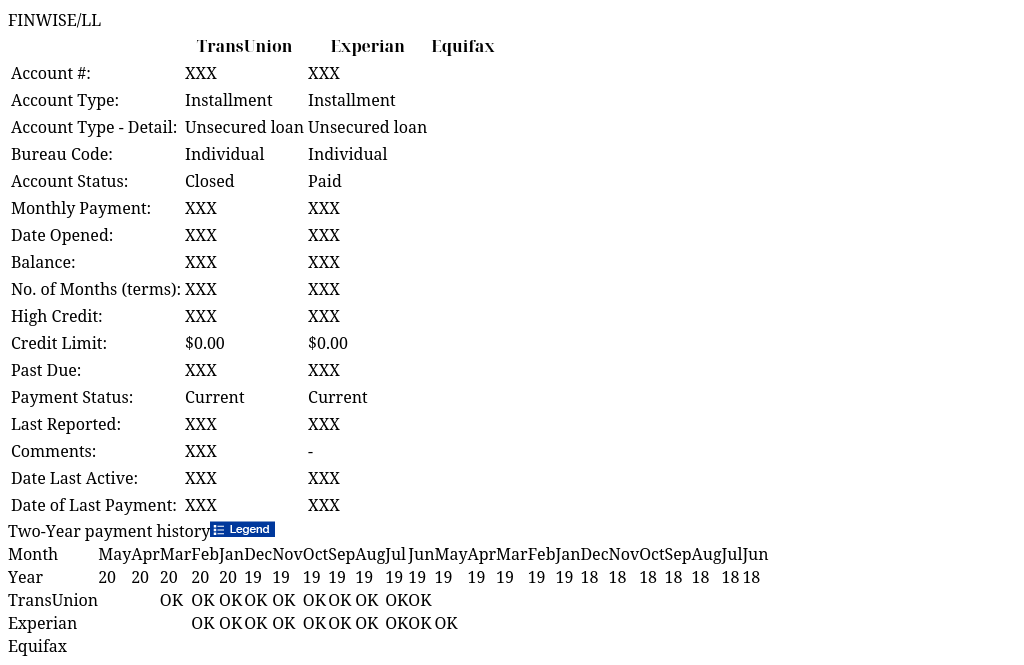

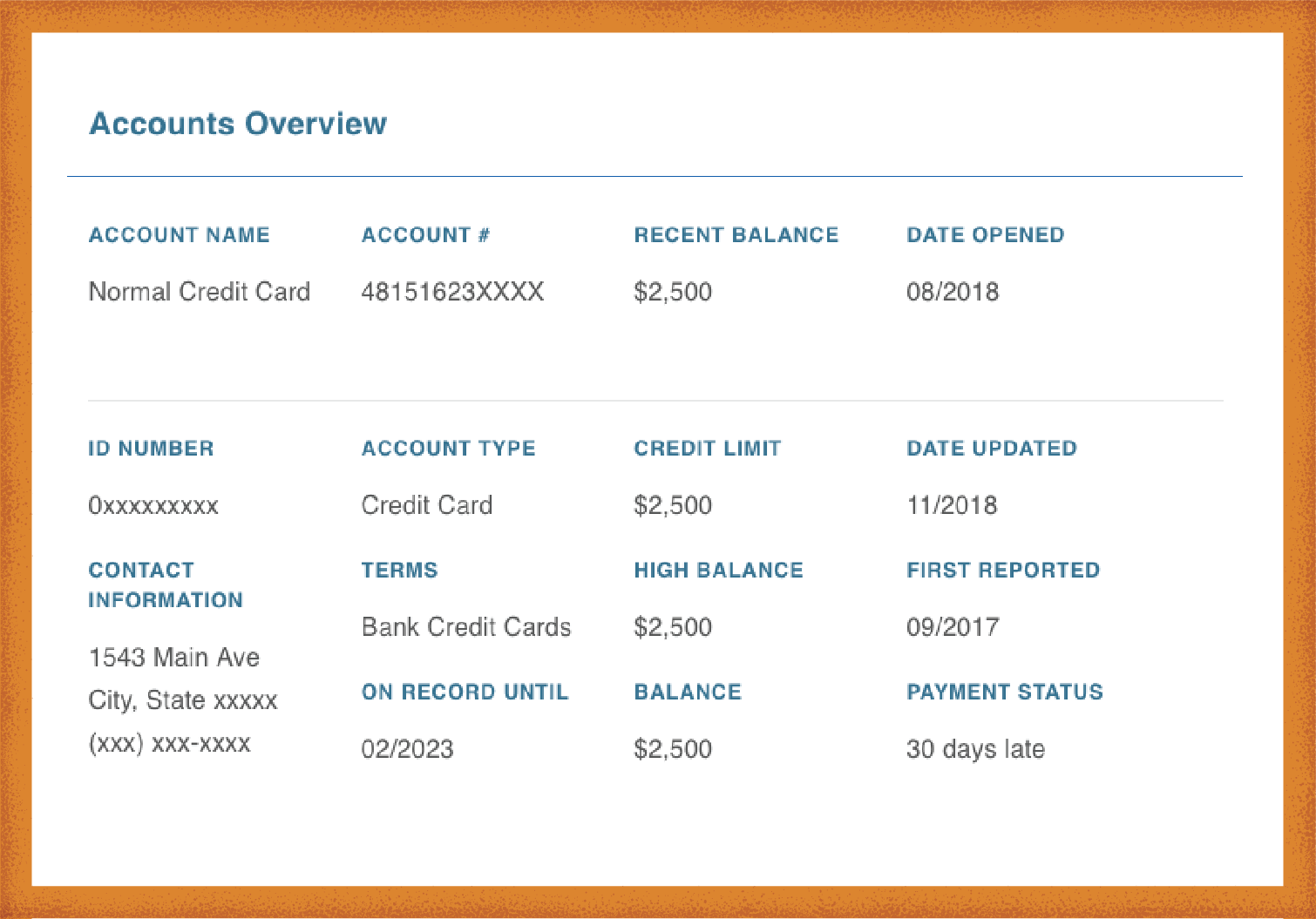

Good question! Any loan or credit product that you have – whether it's a credit card, a mortgage, a student loan, or a personal loan – is typically reported to the major credit bureaus (Equifax, Experian, and TransUnion). This reporting is how your credit score is calculated.

So, if Finwise Bank is involved in the loan, they (or their partner) will report it to the credit bureaus. This is perfectly normal and not necessarily a bad thing. In fact, it shows that you have a credit account in good standing (hopefully!).

However, you'll want to pay close attention to the details of the entry. Make sure the information is accurate. Double-check the loan amount, the opening date, and the payment history. If anything looks off, you'll need to take steps to correct it (more on that later!).

Is It a Scam? Should I Be Worried?

As mentioned earlier, Finwise Bank is a legitimate bank. Seeing their name on your credit report doesn't automatically mean you're a victim of fraud or a scam. However, it's always a good idea to be vigilant and take precautions to protect your identity and financial information.

Here's what to do if you're concerned:

- Review the Account Details Carefully: Make sure the loan amount and other information are consistent with what you remember borrowing.

- Contact Finwise Bank Directly: If you have questions or concerns about the account, reach out to Finwise Bank's customer service department. Their contact information should be readily available online.

- Contact the Fintech Company: If you remember taking out a loan with a particular fintech company, contact them as well. They can provide additional details about the loan and its connection to Finwise Bank.

- Check Your Credit Report Regularly: Monitoring your credit report regularly is crucial for detecting any signs of fraud or identity theft. You can get a free copy of your credit report from each of the major credit bureaus once a year at AnnualCreditReport.com.

- Consider a Credit Monitoring Service: These services can alert you to any changes in your credit report, such as new accounts being opened or changes in your credit score.

If you suspect fraud, immediately contact the credit bureaus and file a police report. Don't delay! The sooner you take action, the better.

Okay, So What Happens Now?

Now that you know what Finwise Bank is and why it might be on your credit report, you can take a more informed approach to managing your credit. Here are a few tips:

- Pay Your Bills On Time: This is the single most important thing you can do to improve your credit score. Late payments can have a significant negative impact.

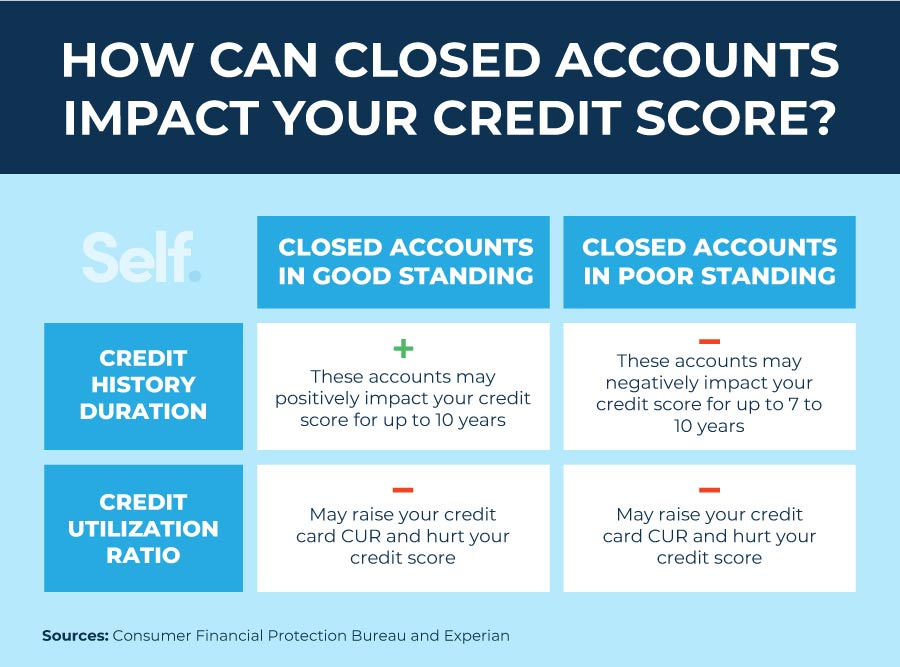

- Keep Your Credit Utilization Low: Credit utilization is the amount of credit you're using compared to your total available credit. Aim to keep it below 30%. For example, if you have a credit card with a $1,000 limit, try to keep your balance below $300.

- Don't Open Too Many Accounts at Once: Opening several new accounts in a short period of time can lower your credit score. Be selective about the accounts you open.

- Regularly Review Your Credit Report: As mentioned earlier, checking your credit report regularly is essential for detecting errors and signs of fraud. Make it a habit!

- Be Patient: Building good credit takes time. Don't get discouraged if you don't see results overnight. Just keep making smart financial choices, and your credit score will gradually improve.

Correcting Errors on Your Credit Report

Let's say you spot an error related to a Finwise Bank account on your credit report. Maybe the loan amount is wrong, or the payment history is inaccurate. What do you do? Don't panic! You have the right to dispute any inaccurate information on your credit report. Here's how:

- Contact the Credit Bureau: You'll need to file a dispute with the credit bureau that's reporting the incorrect information. You can do this online, by mail, or by phone.

- Provide Documentation: Include any documentation that supports your claim, such as copies of loan agreements, payment statements, or bank records.

- Be Clear and Concise: Clearly explain the error and why you believe it's inaccurate.

- Follow Up: The credit bureau has 30 days to investigate your dispute. Follow up with them to check on the status of your claim.

If the credit bureau finds that the information is indeed inaccurate, they will correct it. They'll also notify the other credit bureaus so they can update their records as well. The process can take a little time, but it's worth it to ensure that your credit report is accurate.

Finwise Bank and The Future of Lending

The rise of fintech and partnerships with banks like Finwise is shaping the future of lending. You may see more and more unfamiliar names on your credit report as online lending becomes even more prevalent. Don't let it intimidate you!

Knowing that these banks are frequently working behind the scenes can help you feel more confident as you make financial decisions. Be diligent. Compare rates. Read the fine print. You've got this!

The world of finance is constantly evolving, but with a little knowledge and effort, you can stay on top of things and make smart choices that will benefit you in the long run. And who knows, maybe you'll even find yourself enjoying the process! (Okay, maybe "enjoying" is a strong word, but at least you'll feel more empowered!)

The Takeaway: Empowerment Through Knowledge

So, the next time you see "Finwise Bank" on your credit report, don't freak out! You now have the knowledge to understand what it means and how to address any concerns. This isn't just about deciphering a name on a document; it's about taking control of your financial life and building a brighter future.

Understanding your credit report is like having a map to your financial destination. It shows you where you are, where you've been, and how to get where you want to go. It empowers you to make informed decisions, negotiate better rates, and achieve your financial goals.

And remember, learning about finance doesn't have to be a chore. Embrace the challenge, ask questions, and celebrate your progress along the way. Every little bit of knowledge you gain is a step toward a more secure and prosperous future. Now go out there and conquer your credit report!

Ready to learn more? Dive deeper into understanding your credit score, explore the world of fintech lending, and discover the tools and resources available to help you manage your finances. The journey to financial empowerment starts with a single step. Take that step today!

/CreditReport_SpiffyJ_E--56a1deaa5f9b58b7d0c4000c.jpg)