Understanding the interest earned on a million dollars is a crucial aspect of financial planning and investment strategy. The actual amount of interest generated depends on a confluence of factors, ranging from prevailing interest rates and investment vehicles chosen to tax implications and individual risk tolerance. This article delves into the causes, effects, and implications of interest earned on a substantial sum like one million dollars.

Causes: Determinants of Interest Income

The primary driver of interest income is, undeniably, the prevailing interest rate environment. Interest rates are influenced by macroeconomic factors such as inflation, economic growth, and monetary policy decisions by central banks like the Federal Reserve in the United States or the European Central Bank in Europe. When inflation is high, central banks often raise interest rates to curb spending and control price increases. Conversely, during periods of economic slowdown, interest rates are typically lowered to stimulate borrowing and investment.

The type of investment selected plays a crucial role. Various investment options offer different interest rates and risk profiles. For instance, high-yield savings accounts and certificates of deposit (CDs) typically offer modest interest rates compared to riskier assets like corporate bonds or dividend-paying stocks. Government bonds, considered relatively safe, generally offer lower interest rates than corporate bonds due to their lower default risk. Real estate investments, while not directly generating interest, can produce rental income, which can be considered a form of return on investment.

Another significant factor is the risk associated with the investment. Higher-risk investments generally offer the potential for higher returns, including higher interest rates or dividend yields, to compensate investors for the increased possibility of losing their principal. For example, junk bonds, issued by companies with a lower credit rating, offer significantly higher interest rates than investment-grade bonds to attract investors willing to take on the added risk. However, it is crucial to remember that higher potential returns always come with a greater risk of loss.

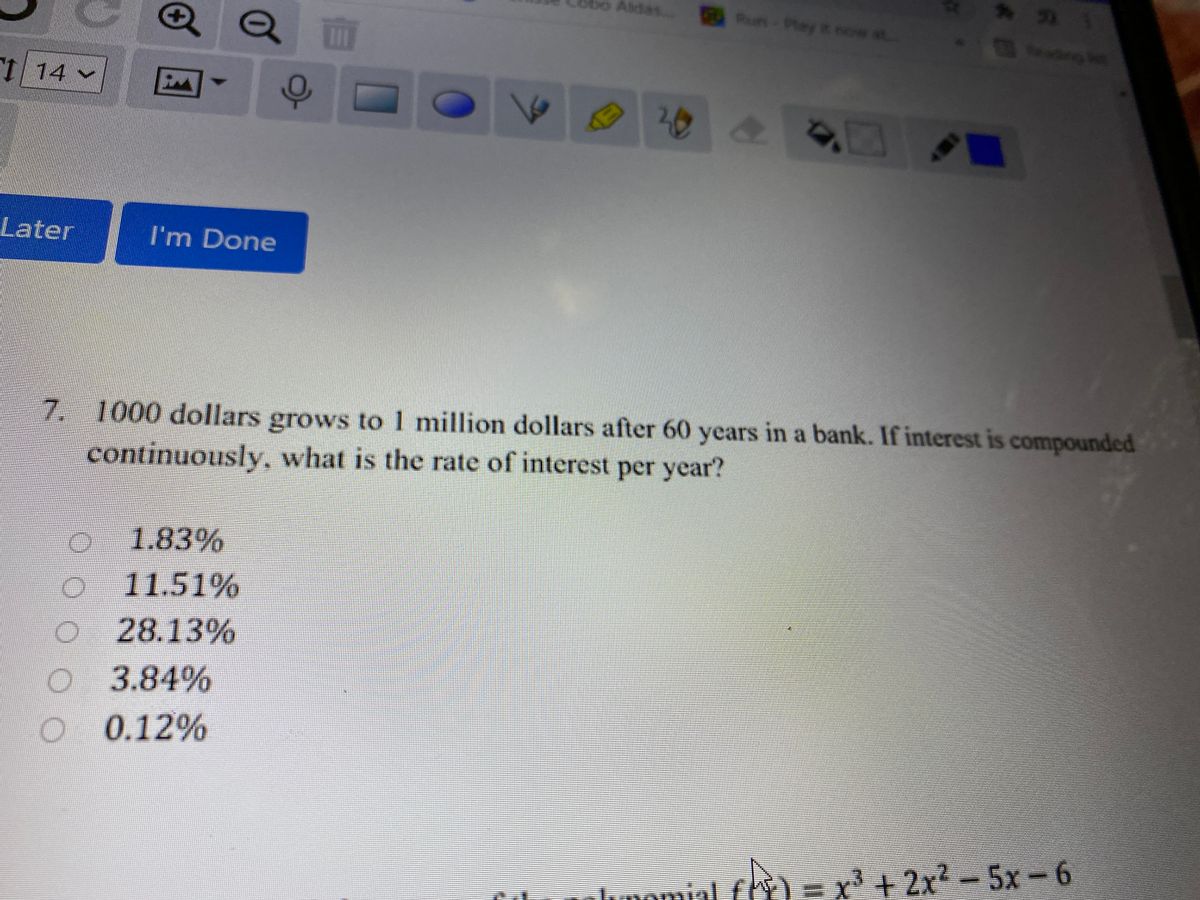

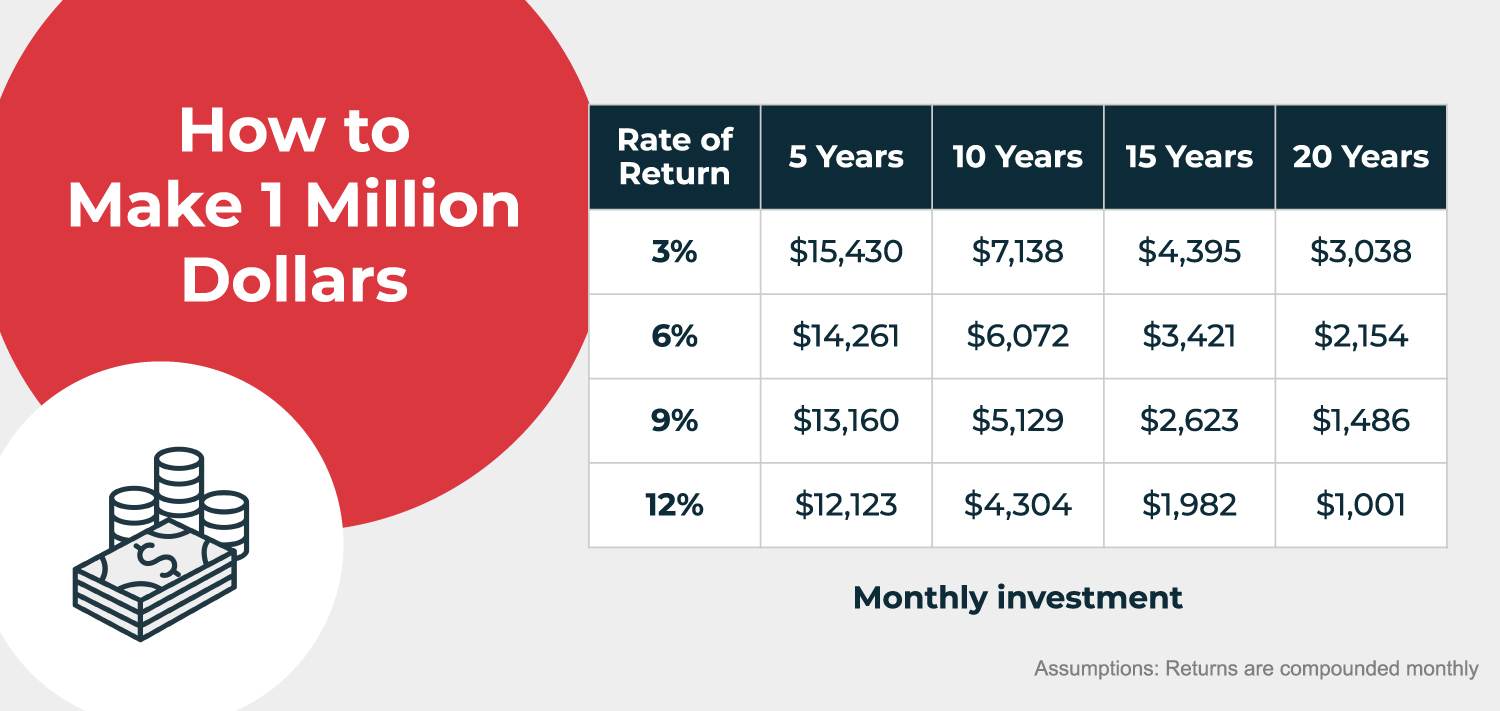

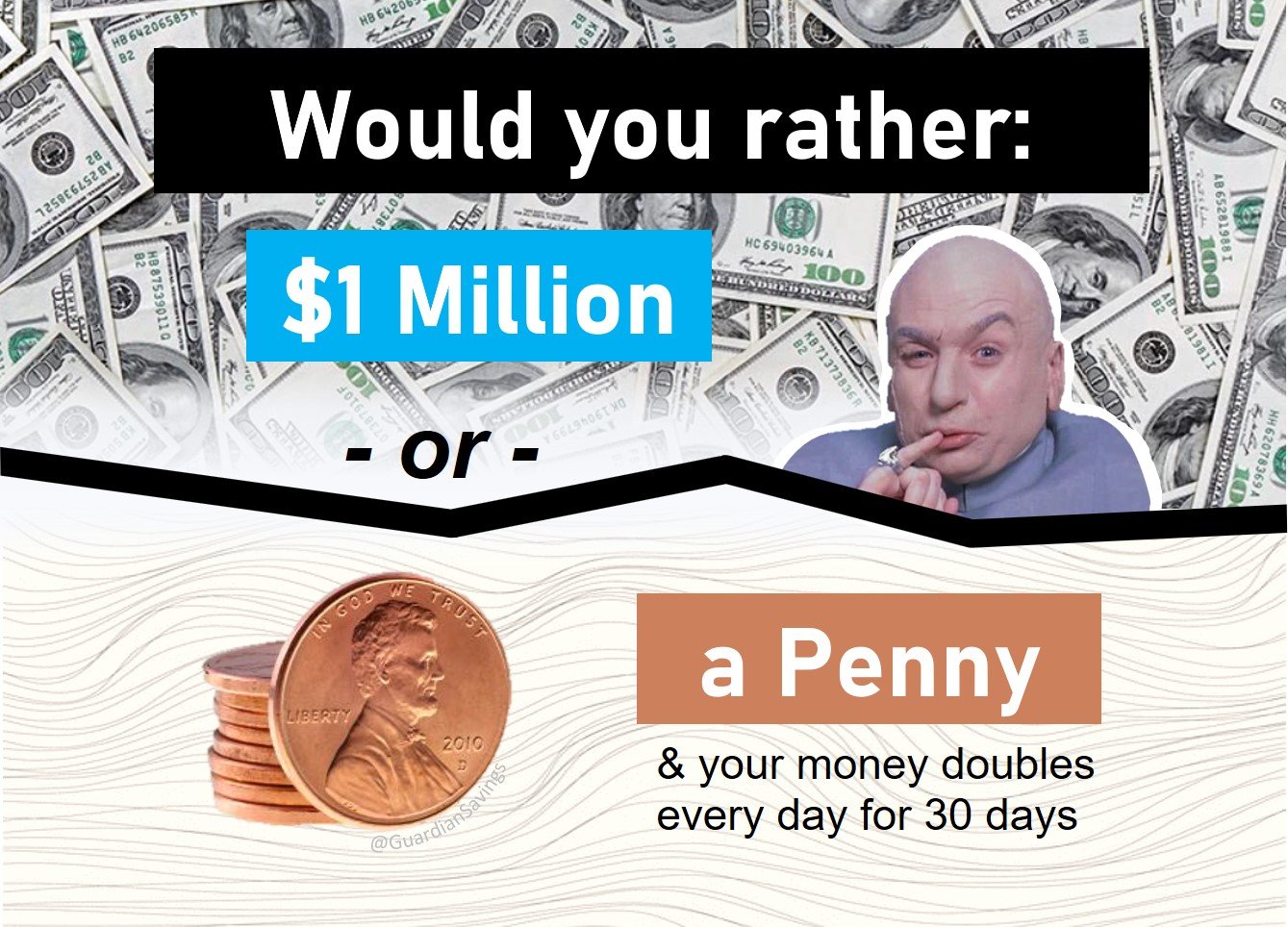

The investment horizon, or the length of time the money is invested, also impacts the total interest earned. Longer investment horizons allow for the accumulation of compound interest, where interest earned on the principal also earns interest over time. This can significantly enhance the overall return, especially in investments like CDs or bonds with fixed interest rates.

Finally, tax implications significantly influence the net interest income. Interest income is generally taxable at the federal, and sometimes state, level. Different types of investments may have different tax treatments. For example, interest earned on municipal bonds is often exempt from federal income tax and sometimes state and local taxes, making them attractive to high-income individuals. Investing through tax-advantaged accounts, such as 401(k)s or IRAs, can defer or eliminate taxes on interest earned, maximizing long-term returns.

Effects: Impact of Interest Income

The most obvious effect of earning interest on a million dollars is the increase in wealth. Interest income can provide a steady stream of revenue that can be used to cover living expenses, reinvest for further growth, or fund retirement. The amount of interest earned can significantly impact an individual's financial security and ability to achieve their financial goals.

Interest income can also provide a source of passive income. This income requires minimal effort to generate once the initial investment is made. Passive income can provide financial freedom and allow individuals to pursue other interests or activities without relying solely on earned income from employment.

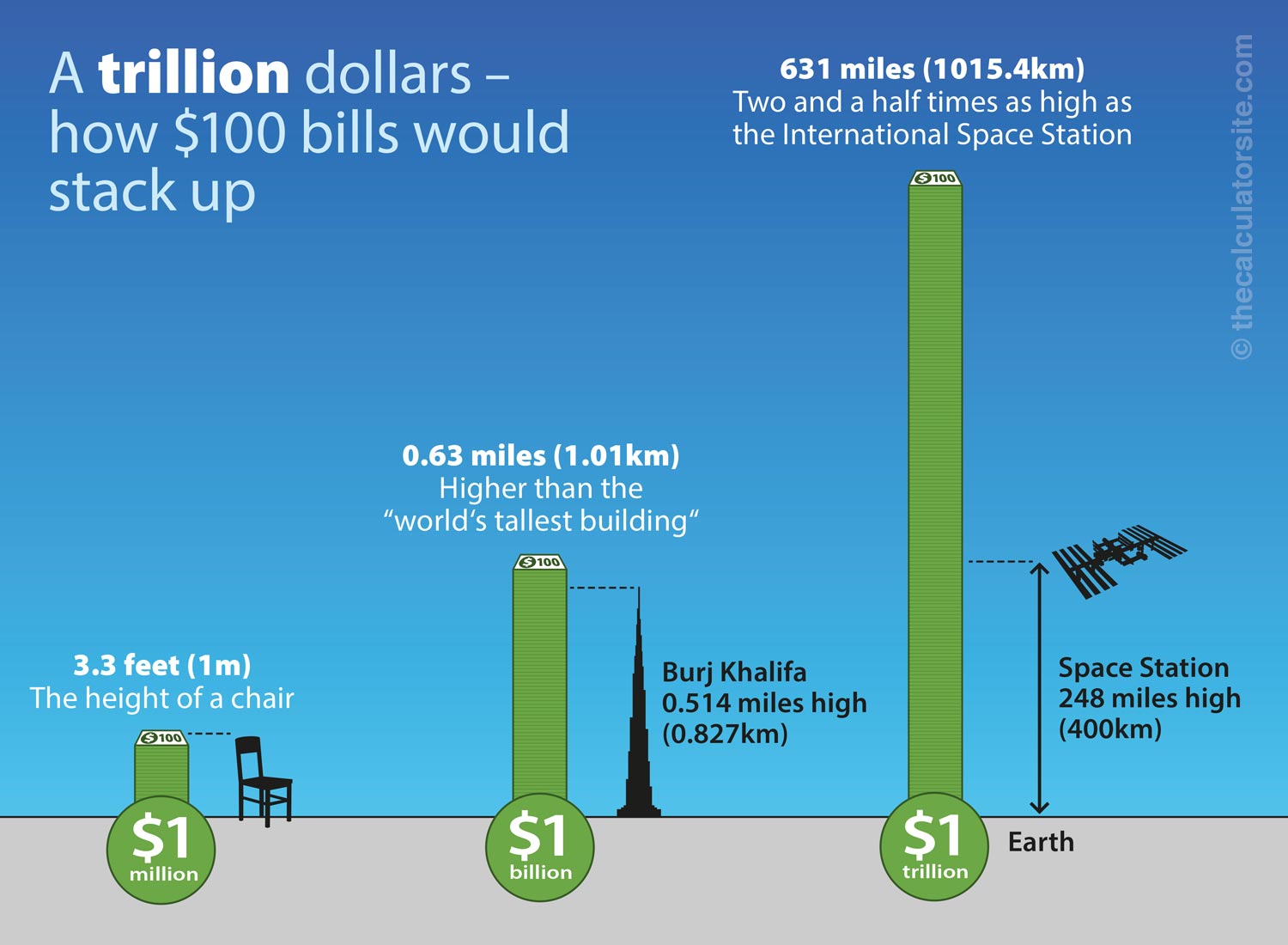

Reinvesting interest income can lead to exponential growth through the power of compounding. As interest is earned and reinvested, the principal grows, leading to even larger interest payments in the future. This compounding effect can significantly accelerate wealth accumulation over time.

The amount of interest earned can also affect an individual's tax burden. Higher interest income can lead to higher taxes, potentially reducing the net return on investment. It is important to consider the tax implications of different investment options and strategies to minimize the tax burden and maximize after-tax returns.

Furthermore, consistent interest income can contribute to financial stability and reduced financial stress. Having a reliable source of income from investments can provide peace of mind and reduce anxiety about financial security, especially during periods of economic uncertainty or unexpected expenses.

Implications: Broader Significance

The ability to generate significant interest income from a substantial sum like one million dollars has several broader implications for individuals, the economy, and society.

For individuals, it highlights the importance of financial literacy and planning. Understanding investment options, risk management, and tax implications is crucial for maximizing returns and achieving financial goals. The ability to effectively manage and invest wealth can significantly improve an individual's quality of life and financial security.

From an economic perspective, interest income contributes to overall economic activity. When individuals earn interest, they are more likely to spend or reinvest that income, stimulating demand and supporting economic growth. Investment income also provides capital for businesses to expand and create jobs.

The availability of interest-bearing investments and the ability to earn passive income can also promote entrepreneurship and innovation. Individuals who have a financial safety net from investment income may be more willing to take risks and pursue new business ventures, contributing to economic dynamism and technological advancements.

However, there are also potential social implications. The concentration of wealth and the ability to generate significant income from investments can exacerbate income inequality. Individuals with substantial capital have a significant advantage in accumulating wealth compared to those who rely solely on earned income. This can lead to disparities in economic opportunity and social mobility.

Finally, the pursuit of higher interest rates can sometimes lead to excessive risk-taking and financial instability. When investors chase high yields without adequately assessing the associated risks, it can lead to misallocation of capital and financial bubbles. This can have detrimental consequences for the overall economy, as seen in past financial crises.

Consider, for example, an individual who invests $1 million in a high-yield bond fund promising a 7% annual return. This translates to $70,000 in annual interest income. While this sounds appealing, the high yield likely reflects a higher level of risk. If the underlying bonds default, the investor could lose a significant portion of their principal, negating the benefits of the high interest income. Alternatively, investing in a more conservative portfolio of government bonds yielding 2% would generate $20,000 annually, a lower return but with significantly less risk.

The historical context is also relevant. During periods of low interest rates, such as the years following the 2008 financial crisis, investors struggled to generate meaningful income from traditional fixed-income investments. This led to a search for yield, often pushing investors into riskier assets and contributing to asset bubbles in areas like real estate and high-growth technology stocks.

Broader Significance

In conclusion, the interest earned on a million dollars is not a fixed sum but rather a dynamic outcome shaped by a complex interplay of factors. Understanding these causes, effects, and implications is essential for responsible financial planning and investment management. While generating substantial interest income can significantly enhance wealth and financial security, it is crucial to carefully consider the associated risks and tax implications. Moreover, the broader economic and social consequences of investment income, including its impact on economic activity, income inequality, and financial stability, should be carefully considered to ensure a more equitable and sustainable financial system. Ultimately, the ability to harness the power of interest income responsibly requires a combination of financial literacy, prudent risk management, and a long-term perspective.