Hey there, coffee buddy! Let's spill the beans on Wheeler Real Estate Investment Trust, shall we? Ever heard of 'em? They're a publicly traded company (ticker: WHLR) that, well, used to focus on owning and managing community shopping centers, mostly in the southeastern United States. Used to being the key phrase here, wink wink. But oh boy, what a rollercoaster ride it's been!

Think of Wheeler as that friend who always seems to be "reorganizing" their life. You know the type? New diet, new job, new… well, you get the picture. 😉

The "Before" Times: Shopping Centers and Sunshine

So, back in the day, Wheeler’s whole *thing* was acquiring, developing, leasing, and managing these open-air shopping centers. Picture your typical strip mall: a grocery store, maybe a nail salon, a pizza place... the whole nine yards. They aimed for those everyday needs, the kind of places people frequent all the time. Seemed like a solid plan, right?

The Southeast focus? Smart! Sun, population growth, what could go wrong? (Famous last words, right?) They had a portfolio of properties scattered across several states. Now, building a portfolio is good and well but what happens when things go downhill, you ask? Let's just say that's when the drama started to unfold.

Trouble Brewing: Debt and Delisting

Okay, here's where the plot thickens. Remember that "reorganizing" friend? Well, Wheeler ran into some serious financial headwinds. We're talking debt, folks. A whole lotta debt. And like, who hasn't been there, am I right? Okay, maybe not *that* much debt. But you know...car payments!

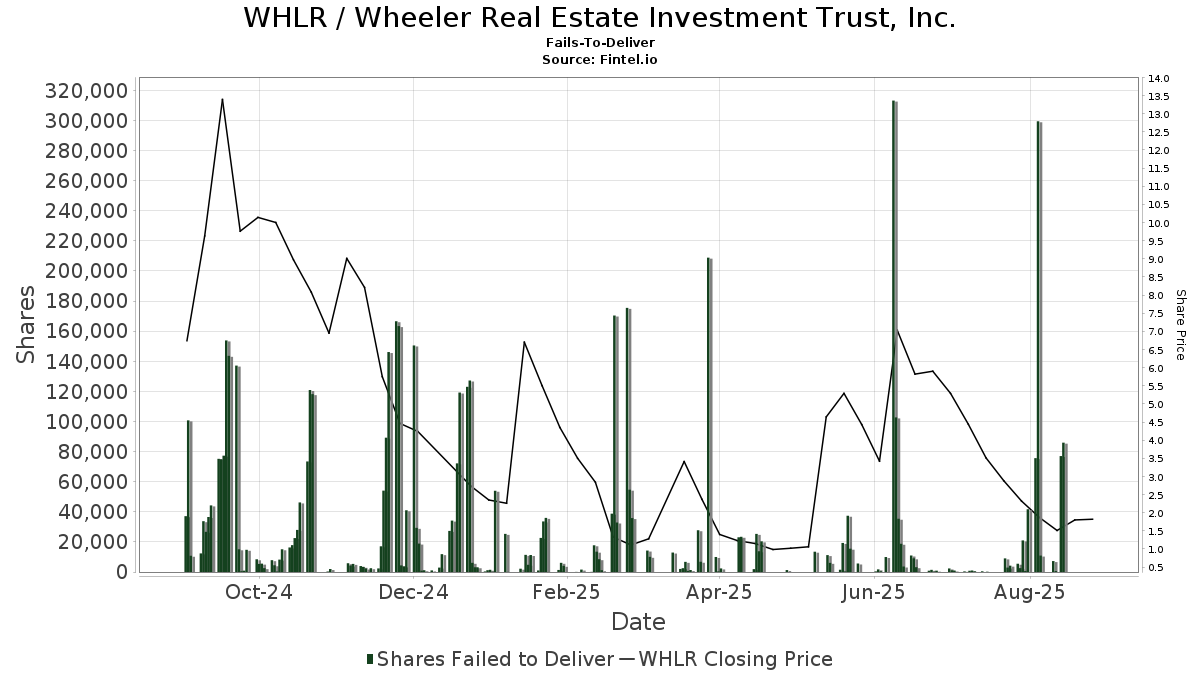

Their stock price started to tumble. And when a stock price tumbles too far, the stock exchanges (like Nasdaq) start to get a little… concerned. And concerned lead to delisting. Ouch! Delisting means they got kicked off the Nasdaq, which is never a good look. Imagine being told you're not cool enough for the popular kids' table anymore. Harsh!

So, what does delisting mean in plain english? It makes it harder for people to buy and sell the stock. Imagine trying to sell lemonade on a street corner that nobody walks down anymore. Tough sell, right?

The Pivot: A New Direction?

But hold on! Our "reorganizing" friend isn’t down for the count just yet! Wheeler started talking about a strategic shift. (Cue dramatic music!) What does that even mean? Well, in their case, it seems to involve cleaning up their balance sheet (read: paying down that debt) and exploring new avenues.

Did they wave a magic wand and suddenly become debt-free overnight? Sadly, no. But they did start taking steps, like selling off assets (aka, some of those shopping centers). Think of it as having a massive garage sale to get rid of stuff you don't need (or can't afford) anymore.

So, what *is* this new direction? This is where things get a little...murky. It's like when your friend says they're going to "find themselves" and you're not entirely sure what that entails. Wheeler has talked about... well, various things. I'd imagine they'd rather take a less public route now!

The Curious Case of Wheeler Today

Okay, so where does that leave us today? Honestly? It’s complicated. Wheeler is still around, but they're definitely in a different place than they were a few years ago. Their website is still up, but it looks fairly dated (It's like a time capsule from the early 2000s). It also provides limited information, but you can still see how things are shaking out in the market!

Are they going to make a triumphant comeback and become a real estate powerhouse again? That's the million-dollar question (or maybe the million-debt-dollar question, haha!). The real estate market is ever changing, and honestly, anyone's guess is as good as mine!

What Can We Learn from Wheeler's Story?

Okay, so maybe investing in a struggling REIT isn't everyone's cup of tea (or coffee!). So let’s see what we can learn from the Wheeler story?

Lesson #1: Debt is a Double-Edged Sword. A little debt can be good, helping you grow and expand. But too much debt? That can sink you faster than you can say "bankruptcy." It's like eating cake. A slice is delicious. An entire cake? Probably not a good idea.

Lesson #2: Diversification is Key. Don't put all your eggs in one basket, as they say! If Wheeler's shopping centers all tanked at the same time (or faced similar challenges), that's a problem. Spreading your investments around can help cushion the blow if one area struggles.

Lesson #3: Management Matters. Who's steering the ship? Do they have a clear vision? Are they making smart decisions? Good management can make all the difference between success and failure. It's like having a GPS that actually works, instead of one that keeps telling you to drive into a lake.

Lesson #4: Due Diligence is Your Best Friend. Before you invest in anything, do your homework! Read the financial reports, understand the risks, and don't just rely on what some random person on the internet tells you (even me!). Think of it as researching a restaurant before you go there. You want to make sure it's not going to give you food poisoning, right?

Lesson #5: Never Stop Learning. The world of finance is constantly evolving. New technologies, new regulations, new trends… it can be overwhelming! But the more you learn, the better equipped you'll be to make smart decisions. It's like learning a new language. The more you practice, the more fluent you become.

Disclaimer Time (Because We Have To!)

Okay, before anyone runs off and makes any crazy investment decisions based on our little chat, let me throw in a quick disclaimer: I'm just a random internet person (with a passion for coffee and financial gossip!). I'm not a financial advisor, and this is not investment advice. Do your own research, talk to a professional, and don't blame me if you lose all your money. Got it? Good! 😉

The Future of Wheeler: A Cliffhanger!

So, what's next for Wheeler Real Estate Investment Trust? That remains to be seen. Will they pull off a miraculous turnaround? Will they fade into obscurity? Only time will tell. But one thing's for sure: their story is a fascinating reminder of the risks and rewards of the real estate world. It's a drama that is still unfolding!

It's also a lesson on the power of adaptation. Even in the face of adversity, businesses can pivot and try to find new ways to survive. Whether Wheeler's pivot will ultimately be successful remains to be seen but the spirit of change is always something to watch out for!

Think of it like a TV show. We're at the end of the season, and there's a huge cliffhanger. We don't know what's going to happen next! Will the hero prevail? Will the villain win? We'll just have to wait until next season to find out!

Final Thoughts (Over Coffee, Of Course!)

So, there you have it! The (somewhat) condensed, (slightly) sarcastic, and (hopefully) informative story of Wheeler Real Estate Investment Trust. It's a tale of ambition, debt, delisting, and strategic shifts. It's a story that reminds us that even the most promising investments can face unexpected challenges.

But it's also a story about resilience, adaptation, and the unwavering human (or corporate) spirit to keep going, even when the odds are stacked against you.

Now, if you'll excuse me, I need another cup of coffee. All this financial talk has made me thirsty! And maybe I'll do some more digging into other REITs. Who knows what other fascinating stories are out there? Cheers!

Until next time, keep your investments safe, your coffee strong, and your sense of humor intact! 😉

PS - Let me know in the comments if you have any thoughts or opinions on Wheeler! I'd love to hear what you think!