Hey everyone, let's talk Farm Credit dividends! You know, that little (or sometimes big!) boost that can make being a part of a cooperative like Farm Credit extra sweet. But, when exactly do these dividends roll around, especially looking ahead to 2025? It's a question a lot of folks have, and honestly, the answer is… it depends!

Think of it like asking when your favorite fruit will be ripe. It's not always the same date every year, right? Weather, growing conditions, and a whole host of other factors play a role. Farm Credit dividends are similar. While there's typically a pattern, the precise timing can vary. So, let’s dig in and explore why that is and what you should be looking out for.

Understanding Farm Credit Dividends: The Basics

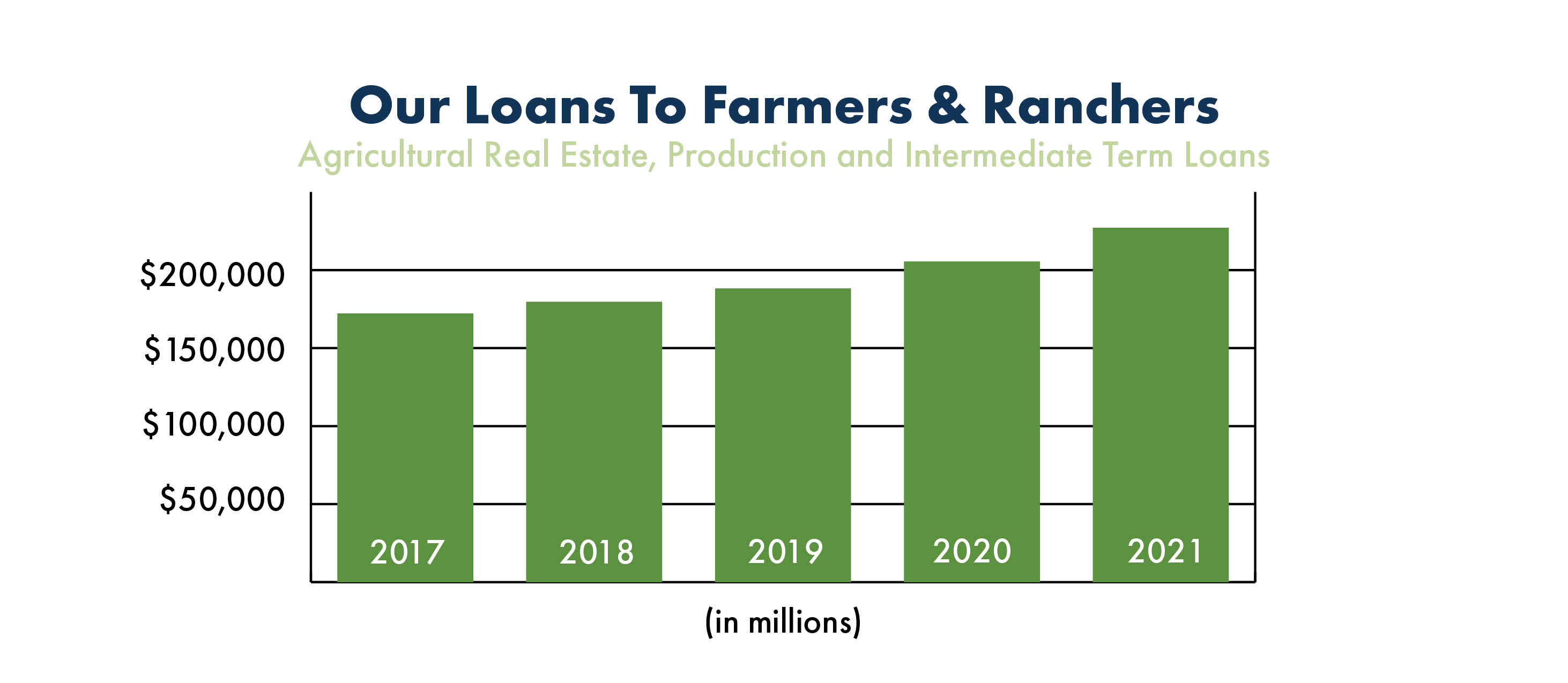

First, a quick refresher. What *are* Farm Credit dividends anyway? Well, Farm Credit institutions are cooperatives. That means they're owned by their borrowers! Unlike a regular bank that's focused solely on maximizing profit for shareholders, Farm Credit institutions operate to serve the needs of their members (that's you!).

So, when a Farm Credit association has a good year and generates a profit, a portion of those profits can be returned to the members in the form of dividends. It’s like a thank you for being a part of the cooperative. Pretty cool, huh?

Why is this so important? Because it directly benefits the agricultural community. Those dividends can be reinvested back into farms, used to improve operations, or even just ease some of the financial pressures that come with farming. It's a cyclical system that strengthens the entire agricultural ecosystem.

The Million-Dollar Question: When Will 2025 Dividends Arrive?

Alright, let’s get to the heart of it. When can you realistically expect to see those potential dividends in 2025? As mentioned before, there's no single, definitive date. Each Farm Credit association operates independently, so their dividend schedules can differ. Think of it like different farmers planting different crops at different times – there's a beautiful variety!

However, we can look at some common trends to get a general idea. Here’s what to consider:

Factors Influencing Dividend Timing:

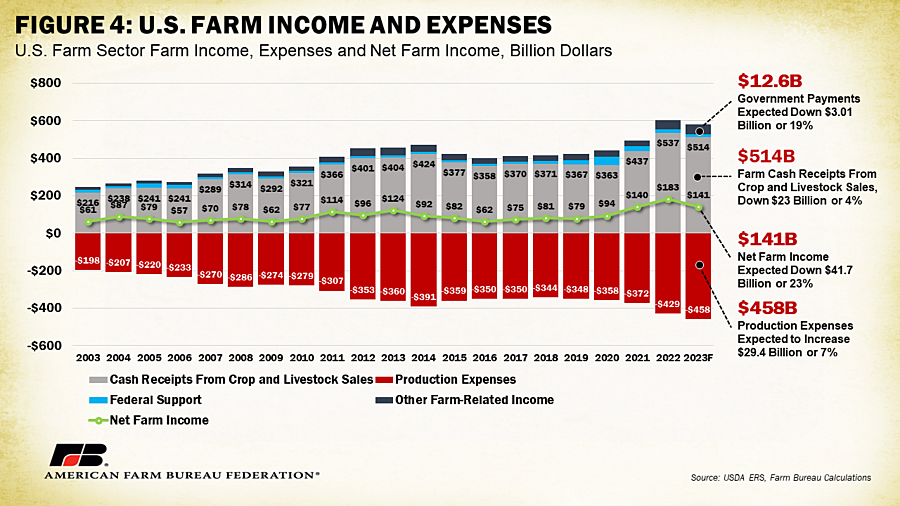

- Association Performance: This is the biggest one. How well did the association perform financially in 2024? A stronger year typically translates to larger dividends and potentially an earlier payout.

- Board Decisions: The Board of Directors of each Farm Credit association has the ultimate say on dividend amounts and timing. They analyze the association's financial position and make decisions that are in the best interest of the members.

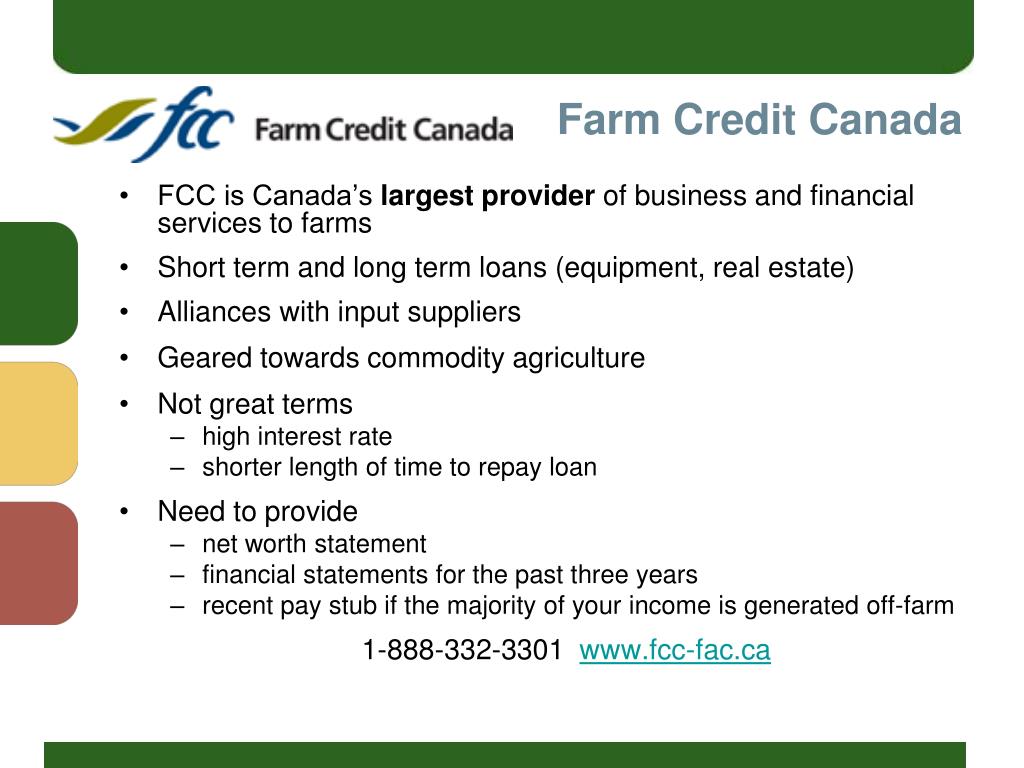

- Regulatory Requirements: Farm Credit institutions are regulated by the Farm Credit Administration (FCA). The FCA sets guidelines that associations must follow regarding capital reserves and dividend payouts.

- Historical Trends: Looking at past dividend payment dates can give you a clue. Has your association historically paid out dividends in the first quarter of the year, or later in the spring or summer?

Common Dividend Payment Periods:

While each association is unique, here are some typical timeframes when Farm Credit dividends are often distributed:

- Late Winter/Early Spring (February - April): This is a common period, as associations often finalize their financial results from the previous year in January and February.

- Spring/Early Summer (May - June): Some associations may take a little longer to finalize their calculations and get the necessary approvals, resulting in a spring or early summer payout.

It's like waiting for your favorite TV show to come back on. You know it's *eventually* going to happen, you just need to be patient and keep an eye out for updates!

Finding the Exact Date for *Your* Association

Okay, enough generalizations! How do you find the *specific* dividend payment date for *your* Farm Credit association? Here are a few reliable methods:

- Check Your Association's Website: This is usually the easiest and most direct approach. Look for a section on "Patronage" or "Dividends." Many associations will announce dividend information on their homepage or news section.

- Contact Your Loan Officer: Your loan officer is a great resource for any questions you have about your Farm Credit association, including dividend information. They can provide you with the most up-to-date details.

- Read Association Publications: Farm Credit associations often publish newsletters or annual reports that contain information about dividends and other important news.

- Attend Annual Meetings: Annual meetings are a great way to stay informed about your association's performance and dividend plans. Plus, you get to meet other members and learn more about the cooperative!

Think of it like searching for hidden treasure. The information is out there, you just need to know where to look!

Why This Matters: More Than Just a Check

Understanding Farm Credit dividends is about more than just knowing when you'll get a check (although that's certainly a nice perk!). It's about understanding how the cooperative model works and how it benefits you, the farmer.

The fact that Farm Credit institutions are owned by their borrowers means that they're directly invested in the success of agriculture. When you're a member of a Farm Credit association, you're not just a customer; you're an owner. And those dividends? They're a tangible reminder of that ownership and the shared prosperity that comes with it.

It’s like being part of a community garden. Everyone contributes, and everyone benefits from the fruits (or vegetables!) of their labor.

Looking Ahead: The Future of Farm Credit Dividends

What does the future hold for Farm Credit dividends? It's tough to say for sure, but a few things are likely to continue to be important:

- Sound Financial Management: Farm Credit associations will need to continue to be financially sound to generate profits and pay dividends.

- Adaptation to Change: The agricultural industry is constantly evolving, so Farm Credit associations will need to adapt to changing conditions and needs of their members.

- Commitment to the Cooperative Model: The cooperative model is the foundation of Farm Credit, and it will continue to be essential to the success of the system.

So, while we can't predict the exact date of your 2025 Farm Credit dividends right now, keep an eye on your association's website, talk to your loan officer, and stay engaged with your cooperative. Knowing when those dividends are coming is important, but understanding why they exist and how they benefit you is even more so. Here's to a prosperous year for agriculture!

Happy farming, and happy dividend-watching!