Hey there, curious minds! Ever wondered where all that lovely cash actually *comes* from? It's like asking where the rainbow ends, right? But trust me, understanding the different sources of cash is super useful. Think of it as knowing the secret recipe to your favorite dish, or the cheat codes to a video game – suddenly, things make a whole lot more sense! Let's dive in, shall we?

So, Where Does the Dough Come From?

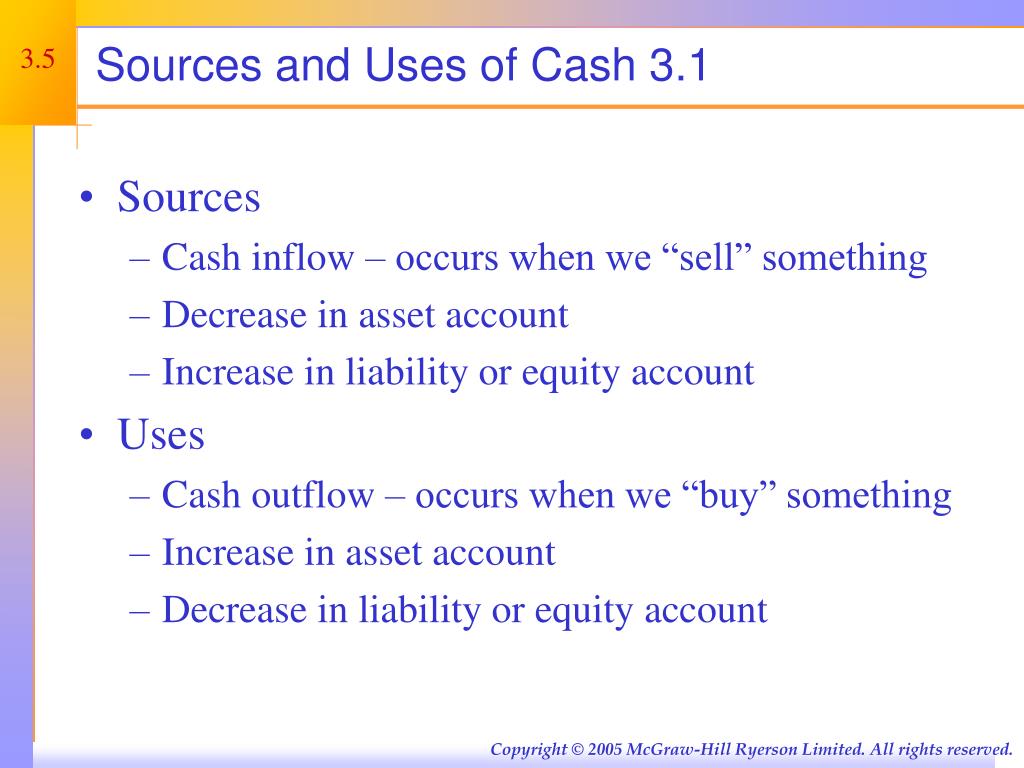

We're not talking about finding a suitcase full of unmarked bills (although, wouldn't that be nice?). We're talking about the real, everyday ways cash flows into businesses and, well, our own pockets too! It’s all about identifying activities that bring money in, not just send it out.

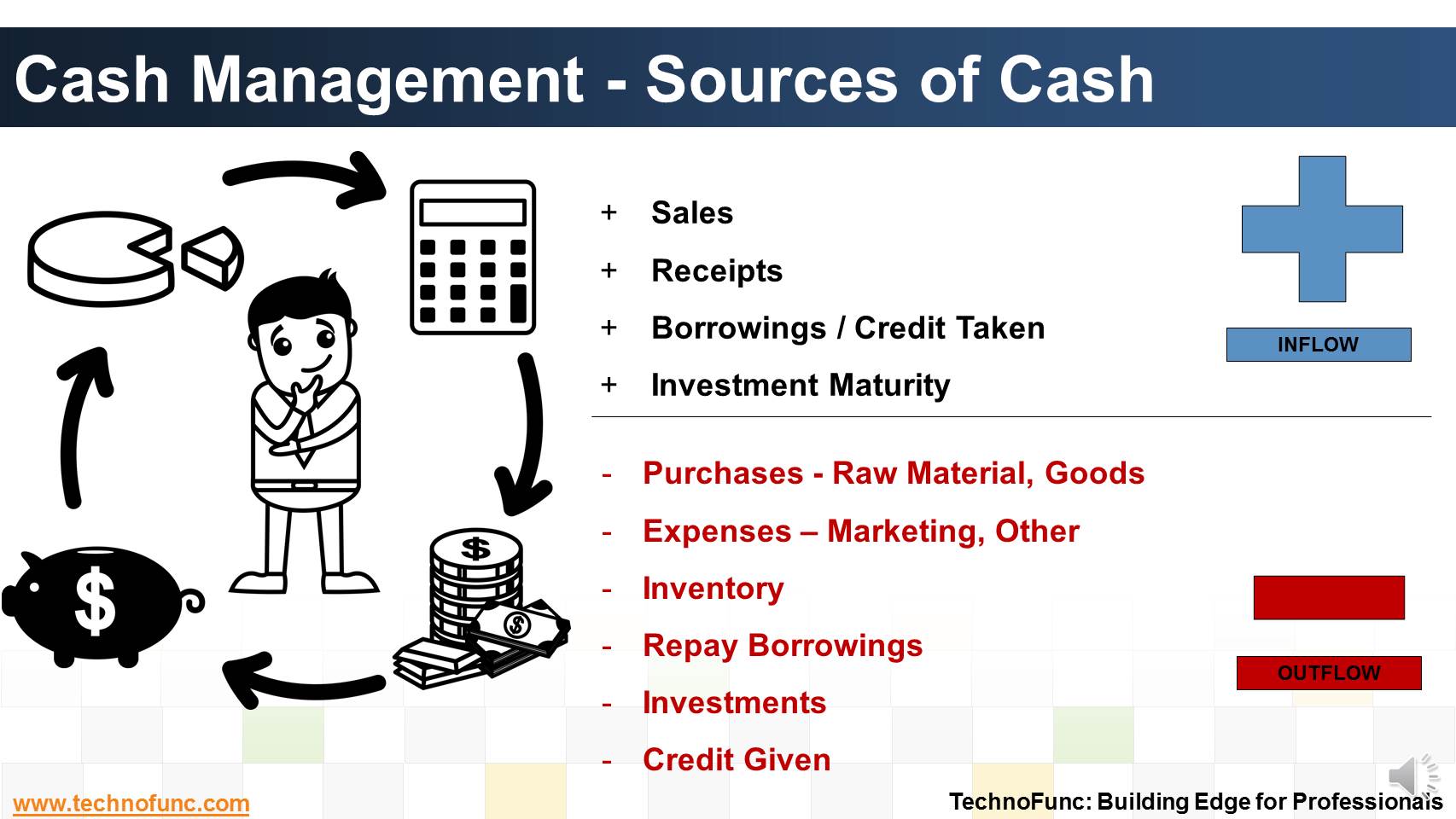

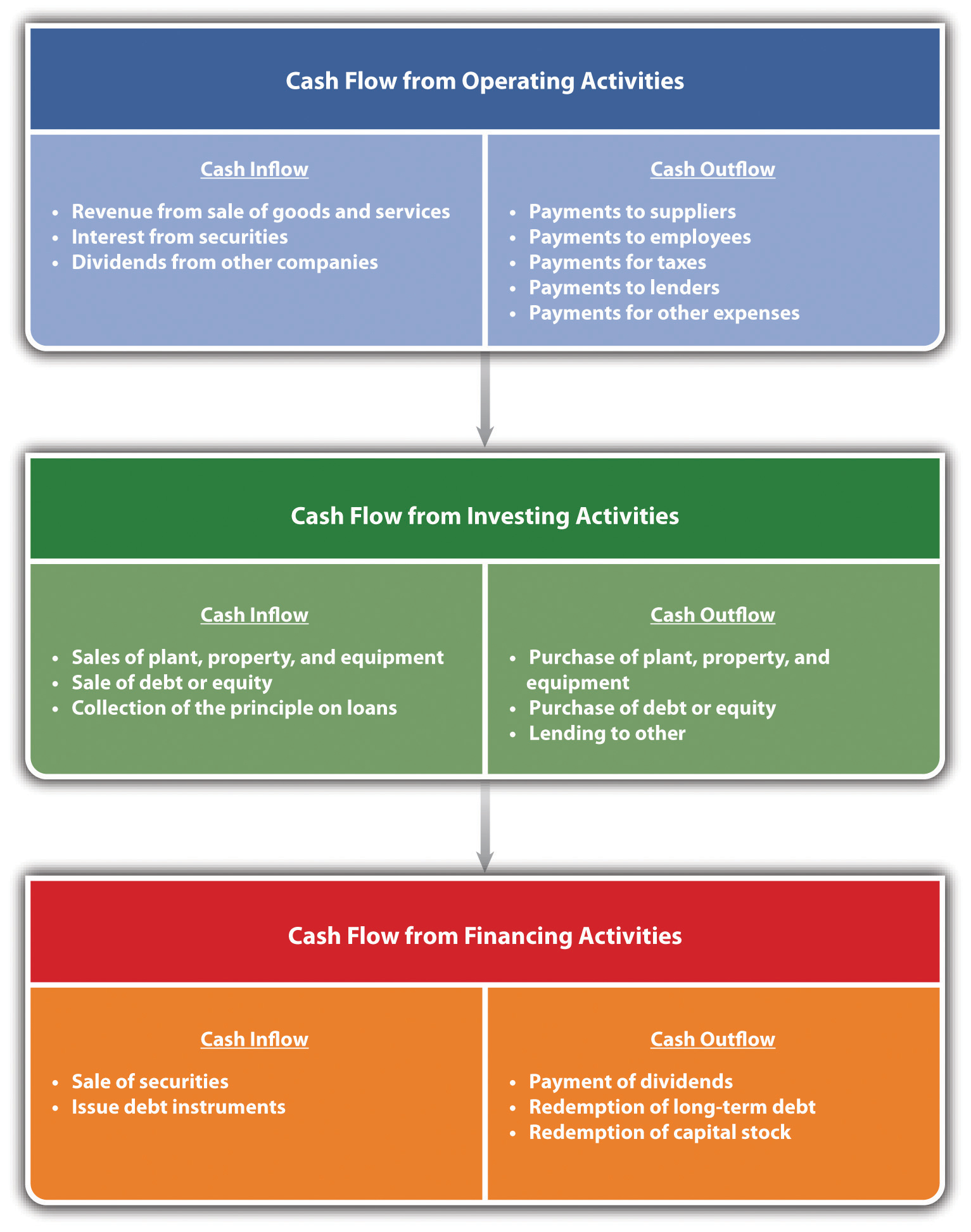

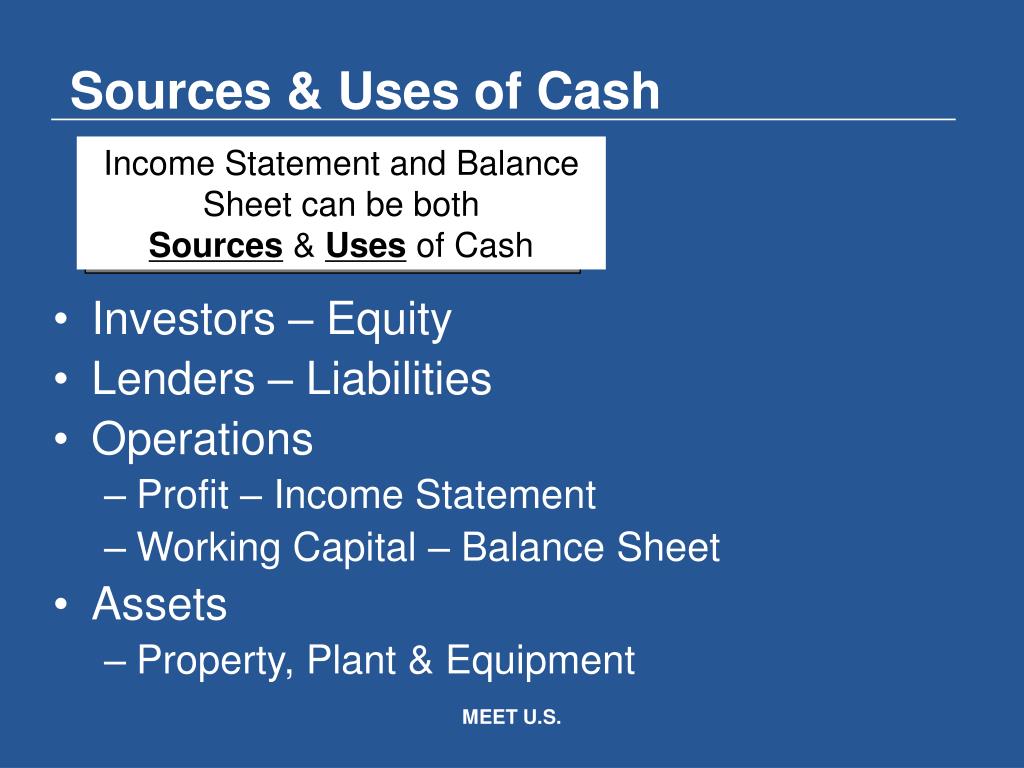

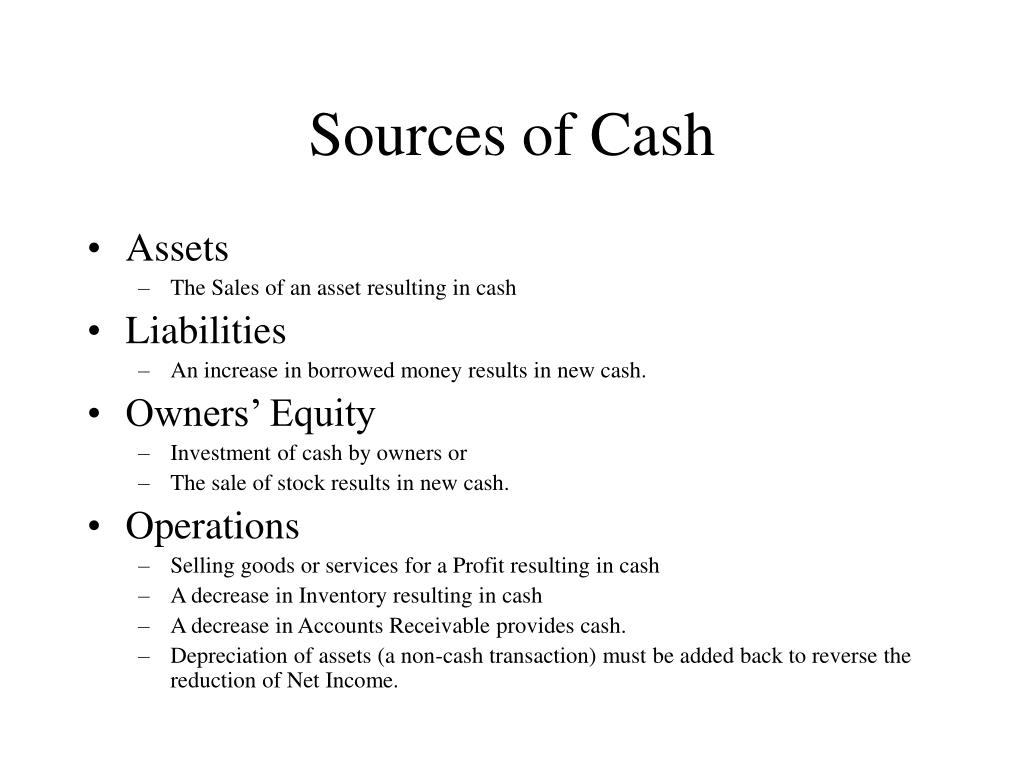

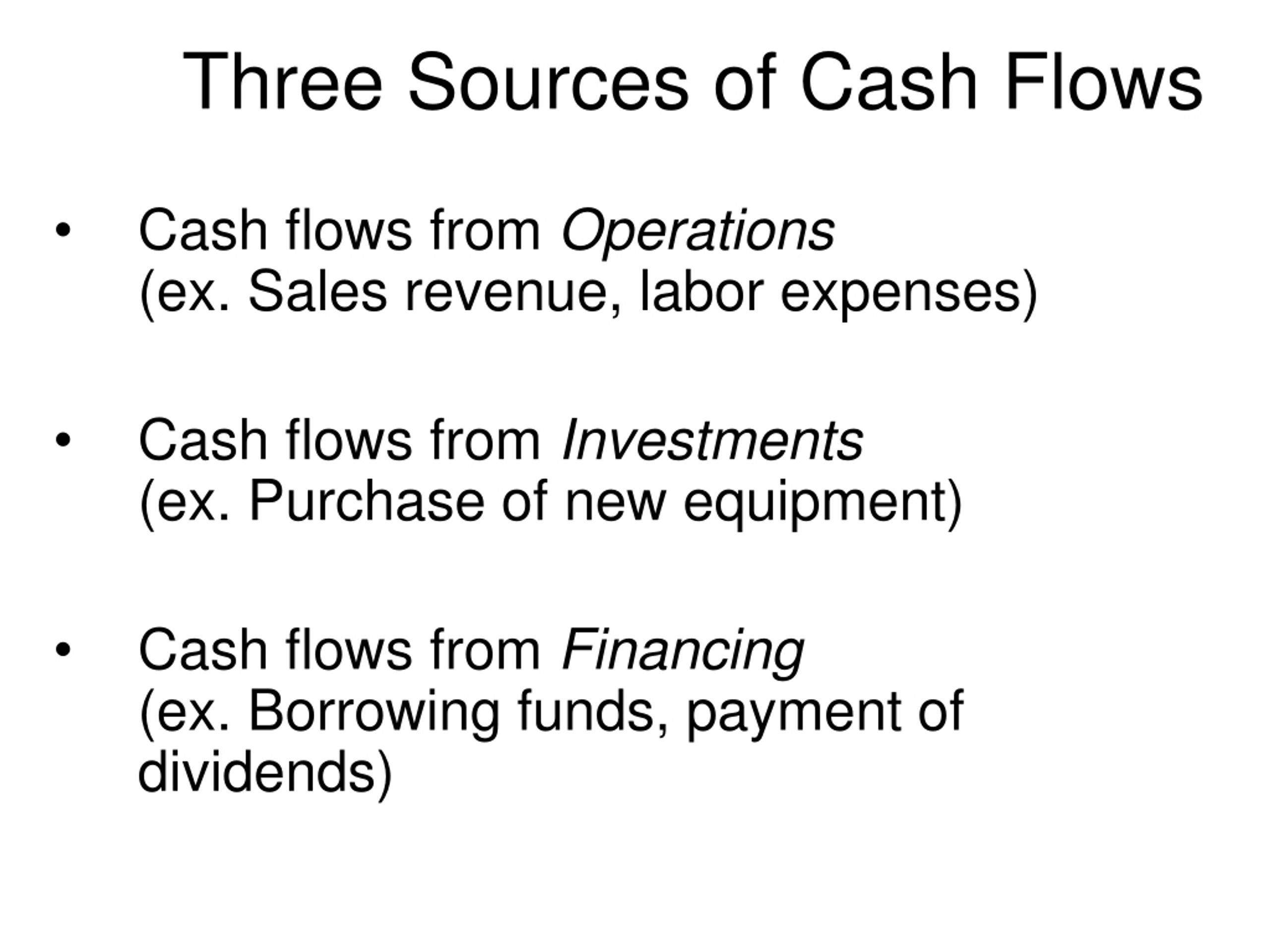

Cash From Operations: The Heartbeat of the Business

Imagine your body. Your heart pumps blood, right? In a business, cash from operations is like the heartbeat. It's the money generated from your day-to-day activities – selling your products, providing services, the bread and butter of what you do. If your heart stops, things get bad. If your cash from operations dries up... well, you get the idea!

Think about it this way: you run a bakery. Selling cupcakes and croissants brings in cash. That's your operations at work! It’s the fundamental source of cash for any successful business. Are you covering your costs *and* making a profit? That’s the question!

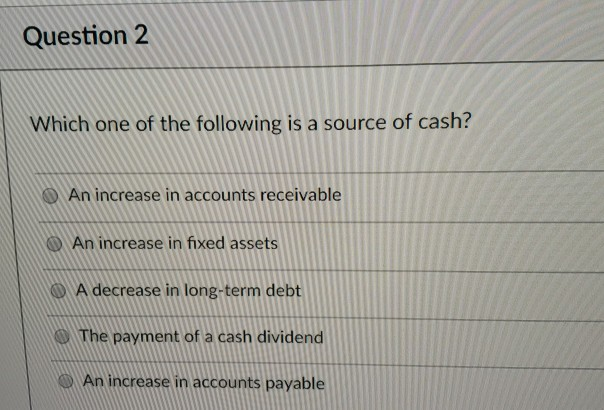

Here's a breakdown:

- Sales Revenue: The obvious one! Money coming in from selling goods or services.

- Collections from Customers: Maybe you sell on credit? Getting paid for those past sales is crucial.

- Other Operating Income: This could be anything from royalties to commissions – those little extra streams of income.

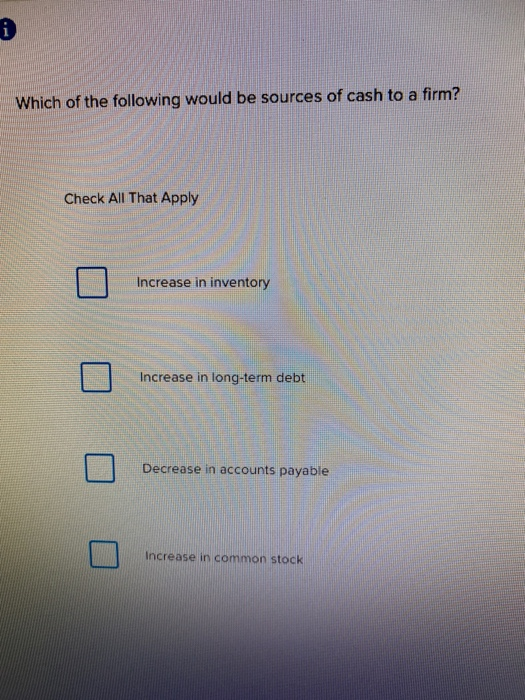

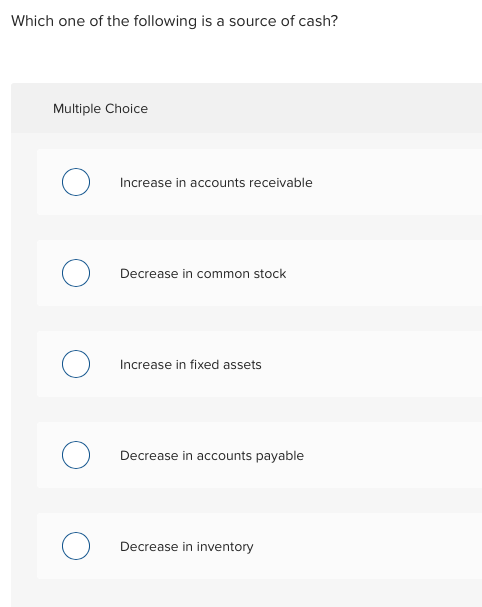

Cash From Investing Activities: Planting Seeds for the Future

Investing activities are all about the future. It's like planting seeds now to harvest later. We're talking about buying or selling long-term assets – things that will benefit the business for years to come. Think of it like this: cash from investing activities is about buying the tools you need to be *even better* at your job tomorrow.

For example:

- Selling Property, Plant, and Equipment (PP&E): Old equipment, buildings, land – selling them brings in cash. Did you upgrade your oven at the bakery? Selling the old one is an investing activity.

- Selling Investments: Stocks, bonds, or other securities. Cashing them out is a source of cash.

- Collecting Loan Principal: If you've lent money to someone else, getting repaid the principal is an inflow of cash.

It's important to note that *buying* these things *uses* cash, but *selling* them *generates* cash. It’s all about perspective!

Cash From Financing Activities: Borrowing and Ownership

Financing activities are about how a business funds its operations and investments. It's like deciding how to pay for your house – mortgage, savings, or winning the lottery (lucky you!). This often involves dealing with lenders (banks) or investors (shareholders).

Here are some common examples:

- Borrowing Money: Taking out a loan from a bank is a major source of cash. This is where debt comes into play.

- Issuing Stock: Selling shares of your company to investors brings in cash. It’s like giving away a piece of the pie in exchange for money to bake more pies!

- Issuing Bonds: Similar to borrowing, but usually from a wider range of investors.

- Grants and Subsidies: Receiving financial assistance from the government or other organizations. This is like finding free money (almost)!

On the flip side, repaying loans, buying back stock (treasury stock), and paying dividends *use* cash. Remember, it’s about the flow.

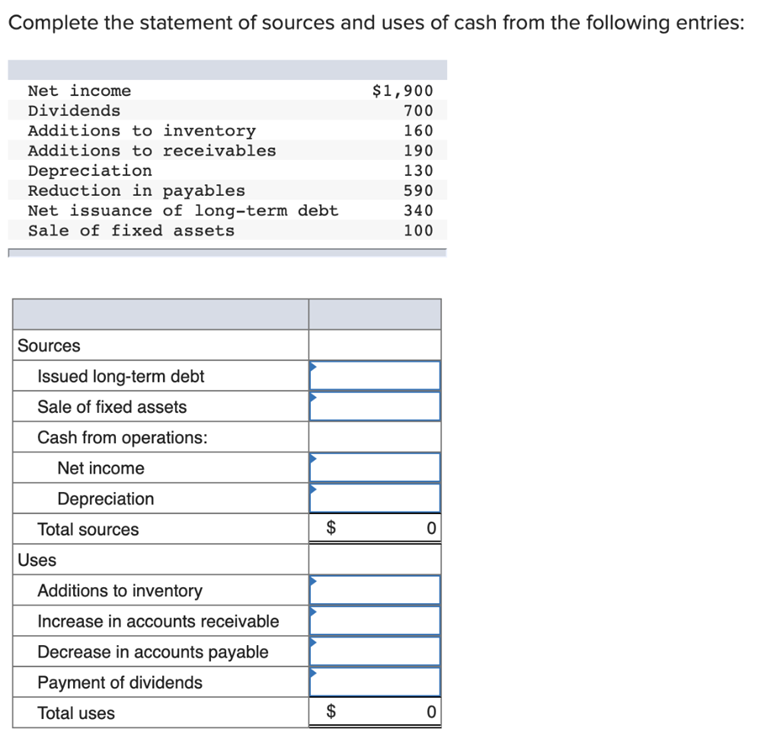

Putting It All Together: The Statement of Cash Flows

All these activities are summarized in a financial statement called the Statement of Cash Flows. It's like a detective report for your company's money, showing where it came from and where it went. It breaks down the cash flows into those three main categories we just discussed: operations, investing, and financing. Learning to read this statement is a superpower for any business owner or investor!

Why is all of this important? Understanding where your cash comes from allows you to:

- Make better financial decisions: Knowing your sources of cash helps you plan for the future, invest wisely, and avoid cash flow problems.

- Assess the health of a business: Is the business reliant on borrowing or is it generating cash from its core operations? This tells you a lot about its sustainability.

- Identify opportunities for improvement: Maybe you can find ways to boost sales, sell off underutilized assets, or negotiate better loan terms.

Beyond the Obvious: Other Potential Sources

While the above three are the main categories, there are some other less common, but still valid, sources of cash:

- Selling Intellectual Property: Patents, trademarks, copyrights – these can be valuable assets that can be sold for cash. Think of it like selling the recipe for your super-secret cupcake frosting!

- Insurance Settlements: Receiving compensation for damages or losses covered by insurance. Nobody *wants* this to happen, but it can be a source of cash if needed.

- Tax Refunds: Getting money back from the government after overpaying your taxes. Always a welcome surprise!

- Donations: For non-profit organizations, donations are a vital source of cash.

The Takeaway? Cash is king! Understanding where it comes from is crucial for making informed financial decisions, whether you're running a business, managing your personal finances, or just being a financially savvy individual. So, next time you're wondering where the money's coming from, remember these sources of cash and you'll be one step closer to financial mastery!

Now, go forth and conquer the financial world! And maybe treat yourself to a cupcake (from your bakery, of course – generating more cash!).