Hey there, friend! Ever heard of amortization? Sounds kinda scary, right? Like some ancient dragon guarding gold coins. Well, it's not that dramatic. It's just a fancy way of spreading the cost of certain assets over time. Think of it as financial frosting – makes things a little easier to swallow!

So, What's the Deal with Amortization?

Amortization basically means you're not writing off the entire cost of something *all at once*. Instead, you're deducting a little bit each year. Like paying off a loan, bit by bit. It's all about matching the expense with the benefit you get from the asset.

Imagine buying a super-cool robot to help with your business. Are you going to expense the entire robot in year one? Probably not! You'll likely use that robot for years. Amortization lets you spread the cost over its useful life.

But Wait, There's a Catch!

Not *everything* gets amortized. Nope! It's a special club with specific rules about who gets in. We're talking about intangible assets. What are those, you ask?

Intangible assets are things you can't physically touch. Think of them as the ghosts of the asset world. They have value, but they're not, like, a brick or a blender. Think of it as buying the idea, the right or the privilege of something, rather than the thing itself.

Okay, Lay it on Me: Which Assets Get Amortized?

Alright, buckle up! Here's a rundown of some common assets that often get the amortization treatment. Get ready for some financial fireworks!

1. Patents: Got a brilliant invention? Congrats! That patent protecting it? That's an intangible asset! You can amortize the cost of obtaining the patent over its legal life (usually 20 years from the date of application). Think of it as paying for your exclusive rights over time. Did you know the first patent in America was issued in 1641? Mind. Blown.

2. Copyrights: Calling all authors, musicians, and artists! Copyrights protect your creative works. And guess what? You can amortize the cost of obtaining a copyright. Just imagine amortizing the cost of writing that epic novel! You're spreading the creative genius over time.

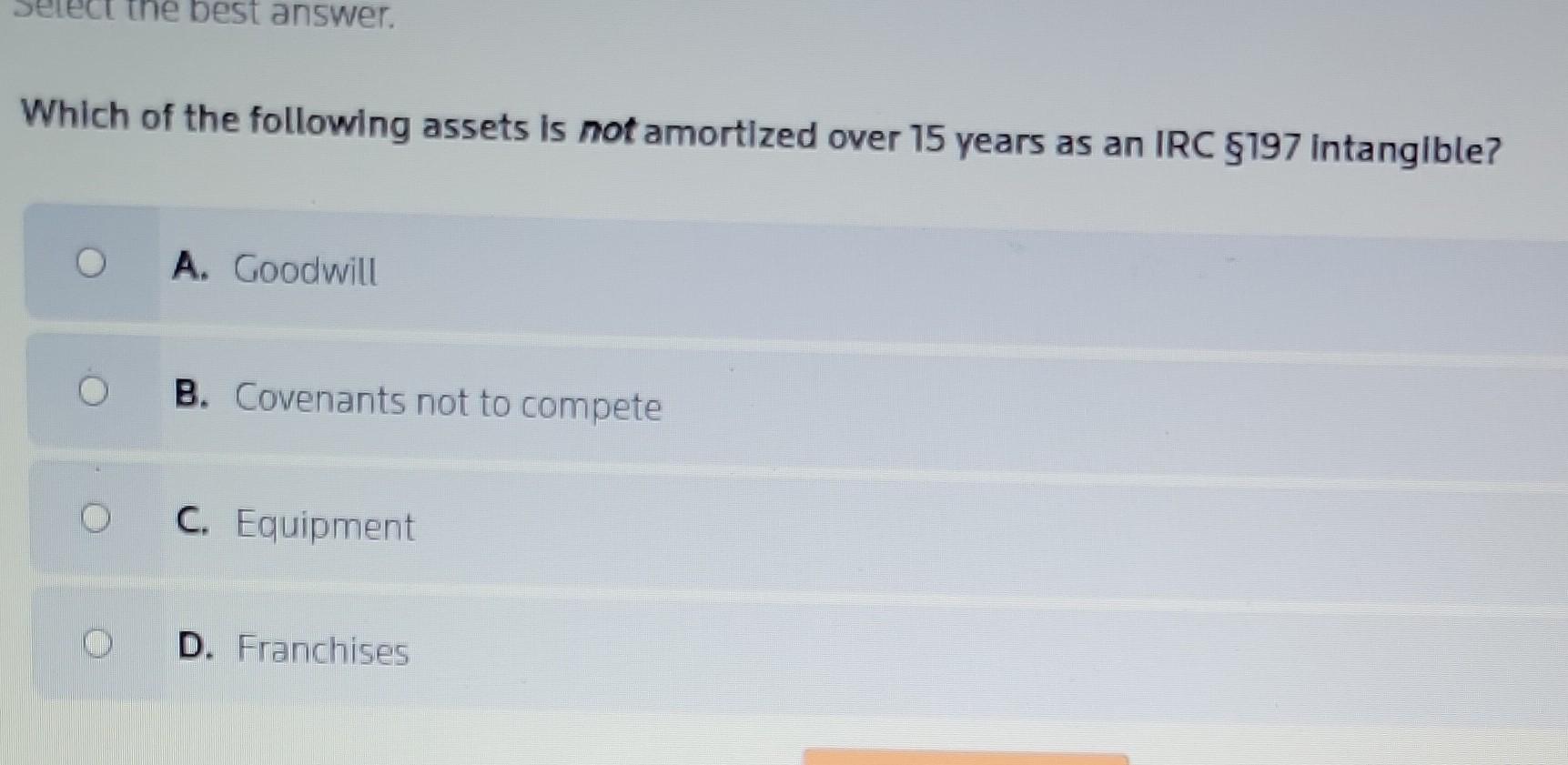

3. Trademarks and Trade Names: Ever notice the iconic swoosh on Nike products? Or the golden arches of McDonald's? Those are trademarks! And the name of the company itself is a trade name. If you spend money to register or acquire these, you can usually amortize the cost over 15 years (or potentially even longer if you renew them). Think of it as investing in your brand's long-term recognizability.

4. Franchise Agreements: Want to open your own burger joint under a big name brand? You'll likely need a franchise agreement. The initial fee you pay for that agreement? You guessed it! Amortizable! It's like paying for the business blueprint gradually over the term of the agreement.

5. Software Costs: Developing some cutting-edge software for your company? The costs associated with developing or purchasing software can often be amortized. Think of it as distributing the cost of your digital masterpiece over its useful life.

6. Leasehold Improvements: Imagine you're renting an office space and decide to install some fancy new lighting or build a custom reception desk. Those are leasehold improvements. Since they add value to the property but you don’t actually own it, you can amortize the cost over the shorter of the lease term or the useful life of the improvements.

7. Customer Lists: Sometimes, when a business buys another business, they're also acquiring a valuable list of customers! This customer list can be considered an intangible asset and therefore can be amortized over its useful life. Think of it as slowly reaping the benefits of having those customer relationships.

What *Doesn't* Get Amortized?

Now, let's talk about what *doesn't* get the amortization treatment. This is where it gets a little tricky, but we can handle it!

Land: You can't amortize land. Land is considered to have an unlimited useful life (at least, for accounting purposes!). Plus, the value of land usually goes *up* over time, not down.

Goodwill: Goodwill is a special type of intangible asset that arises when one company buys another. It represents the excess of the purchase price over the fair value of the identifiable net assets acquired. Unlike the assets we've mentioned above, Goodwill is actually not amortized. Instead, it is tested for impairment. An impairment test assesses whether the fair value of the Goodwill has fallen below its carrying amount on the balance sheet.

Assets with an Indefinite Life: If an intangible asset has an indefinite useful life, it's not amortized. Instead, it's also tested for impairment, similar to goodwill. A trademark, for example, could technically have an indefinite life as long as it is still being used and legally protected.

Why All the Fuss About Amortization?

You might be wondering, "Why do we even bother with all this amortization mumbo jumbo?" Well, it's all about painting an accurate picture of a company's financial performance.

Amortization helps to:

- Match expenses with revenues: By spreading the cost of an asset over its useful life, you're aligning the expense with the period in which the asset is generating revenue.

- Provide a more realistic view of profitability: If you expensed the entire cost of an asset in year one, it would artificially depress your profits for that year. Amortization smooths things out.

- Give investors a better understanding of a company's assets: It helps investors assess the true value of a company's assets and make informed investment decisions.

Amortization: Not as Scary as it Sounds!

So, there you have it! Amortization, demystified! It's not some terrifying financial monster. It's just a way of accounting for the value of those ghostly (intangible) assets over time.

Remember: Patents, copyrights, trademarks, franchise agreements, software costs, leasehold improvements and customer lists are all potentially amortizable assets. Land and goodwill are not! And always consult with a qualified accountant or financial advisor for specific advice tailored to your situation.

Now go forth and conquer the world of amortization! You got this!