Ever tried to get a loan for, say, a ridiculously large inflatable flamingo for your pool? (Don't judge, we've all been there.) The bank probably looked at your credit score, right? Companies are kinda like us, but on a *much* larger scale. Instead of inflatable flamingos, they're buying factories and merging with other companies. And just like us, they sometimes need to borrow money to do it.

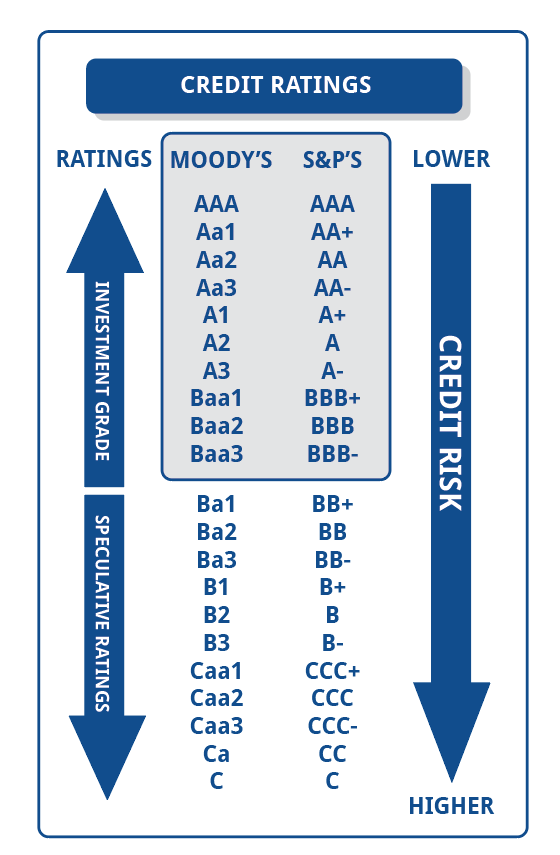

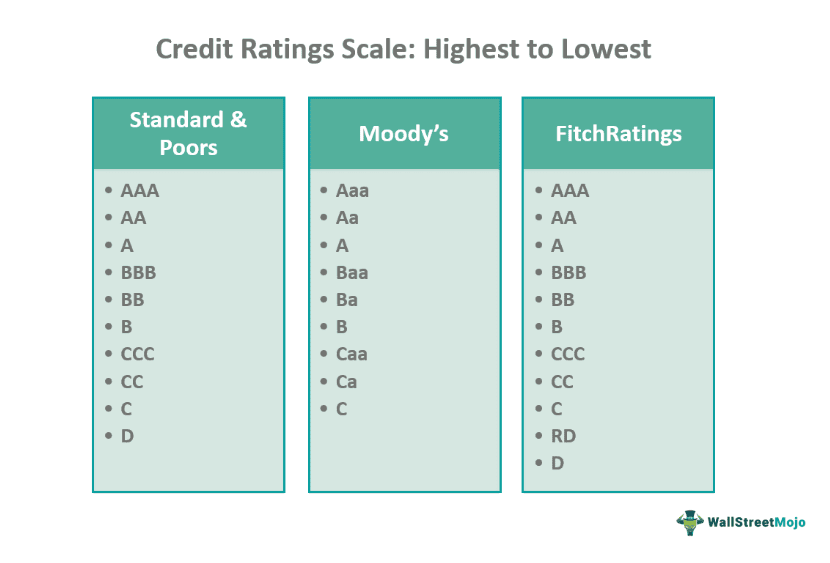

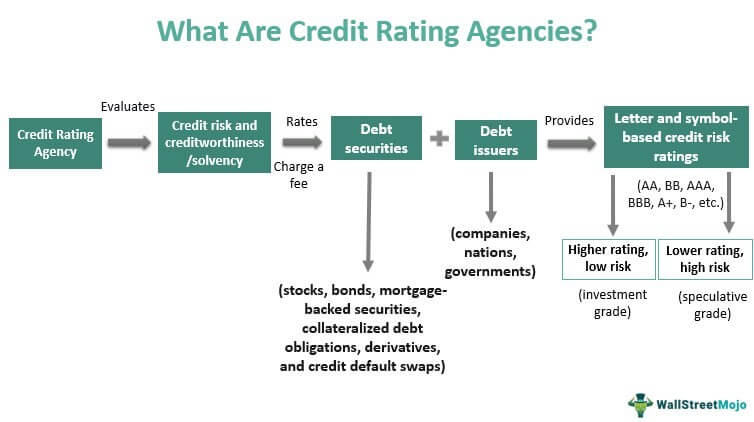

That's where credit ratings come in. Think of it as a report card for a company's financial health. But instead of grades, they get ratings like AAA (super awesome) or C (uh oh, maybe rethink those company pool parties). So, what exactly are these rating agencies like Moody's, Standard & Poor's (S&P), and Fitch looking at to decide if a company is a good risk? Let's dive in!

The Big Picture: Financial Ratios as Clues

Imagine you're a detective trying to solve the mystery of whether a company will pay back its debts. You wouldn't just look at one thing, would you? Nope! You'd gather clues from all over the place. Financial ratios are those clues, giving you insights into different aspects of the company's financial situation.

Profitability: Can They Make a Buck (or a Million)?

First up, we need to know if the company is actually making money! This isn't rocket science, right? A company consistently losing money is like that friend who always forgets their wallet – you love 'em, but lending them money is a risky proposition.

*Profit margins* are key here. Think of it like this: If you're selling lemonade for $1 a cup, but it costs you $0.90 to make, your profit margin isn't exactly stellar. Rating agencies look at different types of profit margins, like gross profit margin (revenue minus the cost of goods sold) and net profit margin (the ultimate bottom line – what's left after *all* expenses). The higher the margin, the more cushion the company has to weather tough times and still pay its debts.

Then there's *Return on Assets (ROA)* and *Return on Equity (ROE)*. ROA shows how efficiently the company is using its assets to generate profit. ROE shows how much profit the company is generating with the money invested by its shareholders. Basically, are they making the most of what they have? A higher ROA and ROE signal a financially stronger company.

Leverage: How Much Debt Are They Carrying?

Okay, so they're making money. Great! But how much did they *borrow* to make that money? Imagine your friend buying that massive TV on credit. Sure, they have a cool TV, but they're also swimming in debt. The same applies to companies.

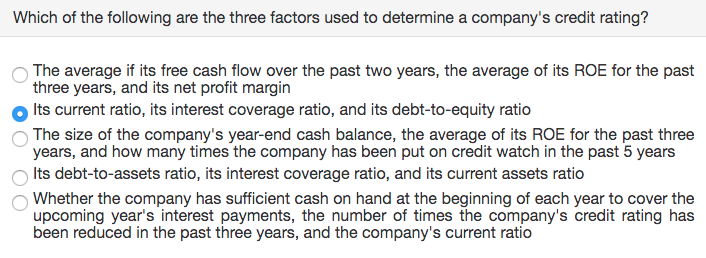

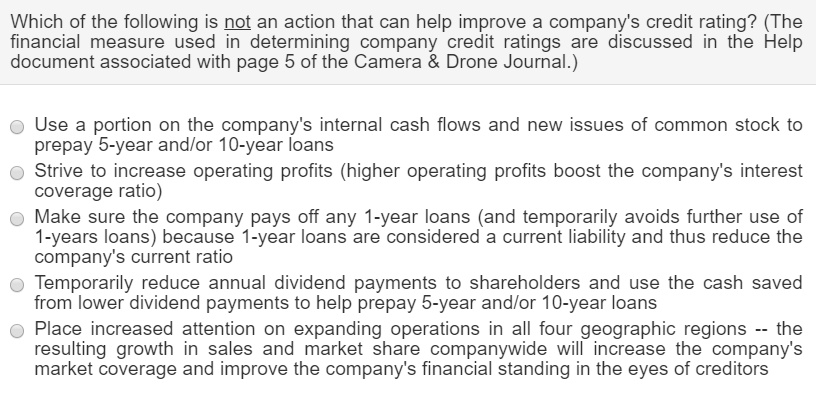

*Debt-to-Equity Ratio* is a big one. It compares a company's total debt to its shareholders' equity. A high ratio means the company is heavily reliant on debt, which can be risky. It's like borrowing a ton of money to buy lottery tickets – if you don't win, you're in trouble.

Another important metric is the *Debt-to-Asset Ratio*. This one shows the proportion of a company's assets that are financed by debt. Again, a higher ratio suggests a higher level of risk.

And we can't forget the *Interest Coverage Ratio*! This ratio tells us how easily a company can pay the interest on its debt. Think of it as the company's ability to keep up with the minimum payments on its credit card. A low ratio means they might struggle to make those payments, increasing the risk of default.

Liquidity: Can They Pay Their Bills on Time?

Making money is great, but can they actually *access* that money when they need it? Imagine having a million dollars in investments, but no cash to pay your rent this month. That's a liquidity problem!

*Current Ratio* is a simple but crucial measure of liquidity. It compares a company's current assets (things they can quickly turn into cash, like cash, accounts receivable, and inventory) to its current liabilities (debts they need to pay within a year). A current ratio of less than 1 suggests they might struggle to pay their short-term obligations.

The *Quick Ratio* (also known as the acid-test ratio) is a more conservative measure of liquidity. It's similar to the current ratio, but it excludes inventory. Why? Because inventory can be difficult to sell quickly, especially if it's, say, a warehouse full of slightly-used inflatable flamingos. A higher quick ratio indicates a stronger ability to meet short-term obligations.

And let's not forget *Cash Flow*! Ultimately, a company needs cash to pay its bills. Rating agencies look at various measures of cash flow, including cash flow from operations, to see if the company is generating enough cash to cover its debts and other expenses.

Efficiency: Are They Running a Tight Ship?

It's not just about making money; it's about how efficiently they're doing it. Imagine two restaurants selling the same burgers. One restaurant is always packed, turning over tables quickly, and keeping costs down. The other is half-empty, with slow service and lots of wasted food. Which restaurant is better managed? The same principle applies to companies.

*Inventory Turnover Ratio* shows how quickly a company is selling its inventory. A high turnover ratio suggests efficient inventory management. Think of it like a bakery that sells out of its bread every day – they're managing their inventory well.

*Accounts Receivable Turnover Ratio* measures how quickly a company is collecting payments from its customers. A high turnover ratio means they're getting paid promptly, which improves their cash flow.

*Asset Turnover Ratio* indicates how efficiently a company is using its assets to generate revenue. A higher ratio suggests they're squeezing the most out of their investments.

Beyond the Numbers: Qualitative Factors Matter Too!

Okay, we've covered the numbers, but credit rating isn't *just* about spreadsheets and calculators. It's also about the feel of the company, its position in the market, and the outlook for the future. Think of it like judging a pie-eating contest – you consider how much pie they ate (the numbers), but also their strategy, their enthusiasm, and whether they look like they're about to throw up (the qualitative factors).

Industry Risk

Some industries are just riskier than others. Think of the difference between selling electricity (pretty stable) and exploring for oil (very volatile). Rating agencies consider the inherent risks of the industry when assessing a company's creditworthiness. For example, a company operating in a highly regulated or rapidly changing industry might face greater challenges than a company in a more stable sector.

Management Quality

A good management team can make all the difference. Are they experienced? Do they have a proven track record? Do they have a clear strategy for the future? A strong management team can navigate challenges and make smart decisions, increasing the likelihood that the company will meet its obligations.

Competitive Position

Does the company have a strong market share? Does it have a unique product or service? Does it have strong brand recognition? A company with a strong competitive position is better able to withstand economic downturns and maintain its profitability.

Regulatory Environment

Government regulations can have a significant impact on a company's financial performance. Changes in regulations can create new opportunities or pose new challenges. Rating agencies consider the regulatory environment when assessing a company's creditworthiness.

Economic Outlook

The overall state of the economy can also affect a company's financial performance. During a recession, even well-managed companies can struggle to meet their obligations. Rating agencies consider the economic outlook when assigning credit ratings.

Putting It All Together

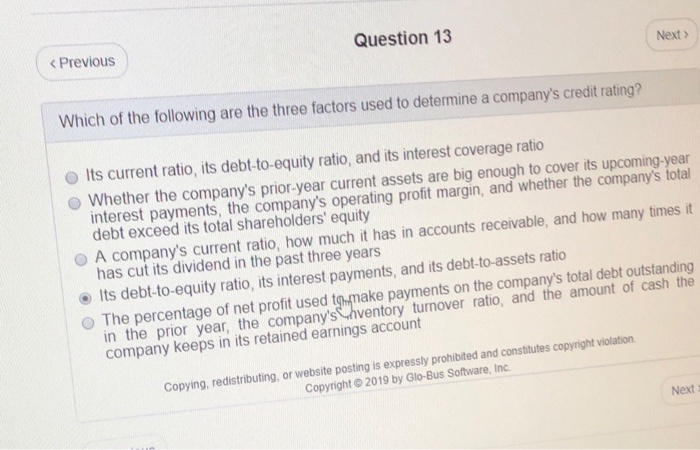

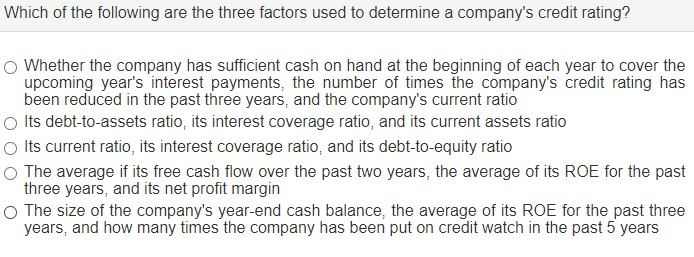

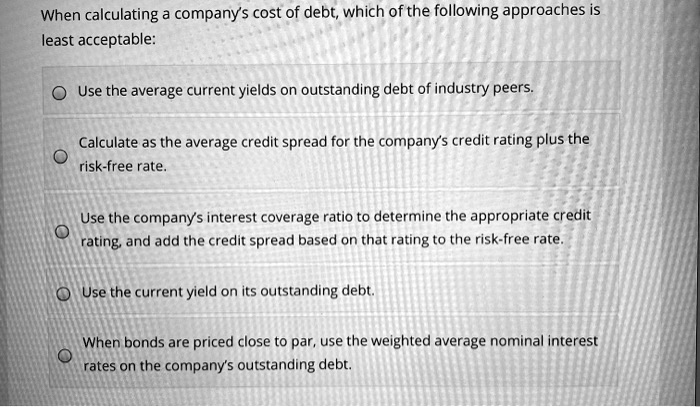

So, which financial measures are used to determine a company's credit rating? The answer is: *all of the above (and more!)*. It's a complex process that involves analyzing a wide range of financial and non-financial factors. Rating agencies use a combination of quantitative analysis (financial ratios) and qualitative analysis (industry risk, management quality, etc.) to assess a company's ability to repay its debts.

They're essentially trying to answer the question: "Is this company going to be able to pay us back?" And they use every tool in their arsenal to make that determination, from the mundane (profit margins) to the more subjective (management quality).

Think of it like baking a cake. You don't just need flour; you need sugar, eggs, butter, and a little bit of magic. Similarly, credit rating isn't just about one ratio; it's about the entire financial picture. So, the next time you hear about a company's credit rating, remember that it's the result of a thorough and comprehensive analysis of its financial health – a financial health checkup, if you will, to determine if it can afford that ridiculously large inflatable flamingo. (Or, you know, a factory.)