Okay, let's talk about something super important, but often overlooked: cash. Not just the paper kind you find crumpled in your jeans (though, hey, that counts too!), but the lifeblood of your financial world. We're talking about where your money *actually* comes from. Because knowing where your money comes from is like knowing where the best coffee shop in town is – it can seriously improve your quality of life!

Imagine you're baking a cake. You need ingredients, right? Flour, sugar, eggs… all that good stuff. Cash is like your financial flour – it's the essential ingredient that lets you do, well, pretty much anything!

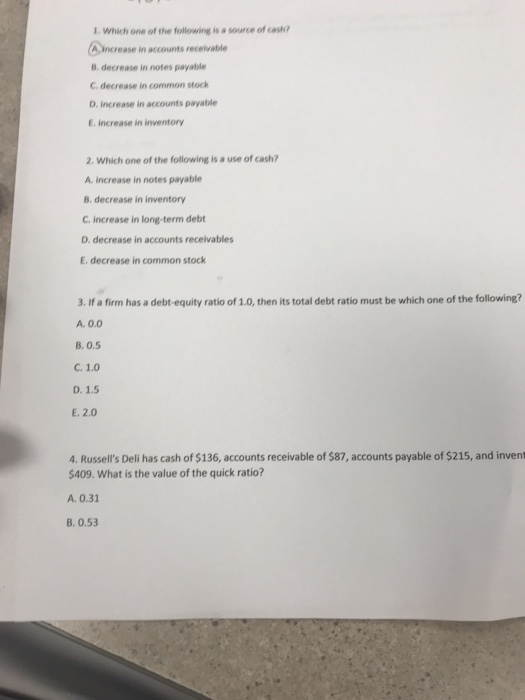

So, Which Of The Following *Is* a Source of Cash?

That's the million-dollar question (figuratively, of course, unless you're actually winning a million dollars... in which case, congrats!). To figure this out, let's break it down with some real-life scenarios.

The Obvious Ones: Your Job

This is the granddaddy of cash sources for most of us. Your paycheck is essentially a river of money flowing into your account every month (or week, or however often you get paid). It's the foundation upon which your financial house is built. Think of it as the reliable, dependable friend who always has your back. You go to work, you provide value, and *bam!* Cash appears.

But what if you’re between jobs? Or dreaming of something more than the 9-to-5 grind? Don't worry, we're just getting started!

The Side Hustle Symphony

Ah, the side hustle. The secret weapon of the financially savvy. This is where things get interesting! A side hustle is any activity you do outside of your main job that generates income. Think:

- Selling your handcrafted jewelry on Etsy.

- Driving for a ride-sharing service.

- Freelance writing or graphic design.

- Tutoring kids in math.

- Even selling those old clothes you haven't worn in years on Poshmark!

The beauty of a side hustle is that it's often something you're passionate about. It can be a way to turn your hobbies into a revenue stream. Plus, it diversifies your income, so you're not entirely reliant on that one paycheck.

I remember my friend Sarah who started baking cookies on the side. At first, it was just for fun, for friends and family. But then people started offering to pay her! Now, she has a thriving little cookie business and earns a significant chunk of her income from it. Talk about sweet success!

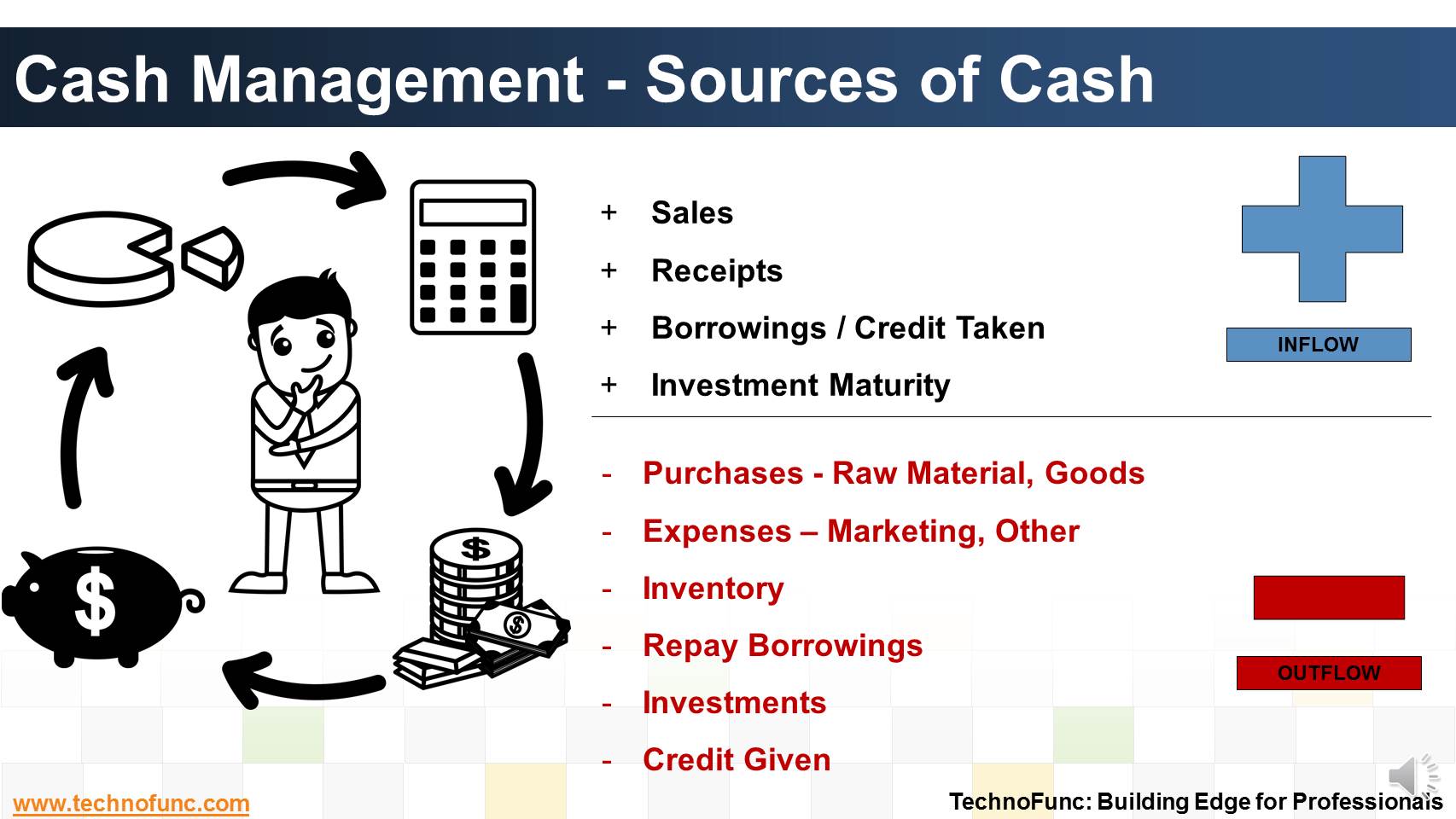

Investment Income: Making Your Money Work For You

This is where your money starts to get smart. Investment income is money you earn from your investments. Think of it as planting a seed and watching it grow into a money tree (okay, maybe not literally, but you get the idea!). Examples include:

- Dividends from stocks: Some companies share their profits with their shareholders in the form of dividends. It's like getting a little bonus just for owning stock in the company.

- Interest from bonds or savings accounts: When you lend money to a company or bank, they pay you interest in return.

- Rental income from properties: If you own a rental property, the rent you collect from tenants is a source of cash.

The key here is that you're not actively working for this money. Your investments are doing the work for you. It's like having little money-making robots working around the clock!

The "Unexpected Treasure" Trove

Sometimes, cash comes from the most unexpected places. Think of these as your financial Easter eggs:

- Tax refunds: Getting a tax refund is like finding money you forgot you had.

- Gifts: Birthday money from Grandma? Holiday bonuses? All cash!

- Selling unwanted items: That old bike gathering dust in the garage? The books you'll never read again? Sell them online or at a garage sale.

- Winning the lottery (or even just a scratch-off!): Okay, this is highly unlikely, but hey, it's technically a source of cash! Just don't rely on it as your primary income stream.

These aren't necessarily reliable sources of income, but they can provide a nice little boost when they happen. It's like finding a $20 bill in your pocket – a pleasant surprise!

Loans: Borrowing From The Future (Carefully!)

This one is a bit tricky. While a loan does provide you with cash now, it's important to remember that you'll have to pay it back later, often with interest. So, while it's technically a source of cash in the short term, it's crucial to use loans wisely and responsibly.

Think of a loan as a temporary bridge. It can help you cross a financial gap, but you need to make sure you can afford to pay the toll on the other side.

Why Should You Care About This?

Knowing where your cash comes from isn't just some abstract financial concept. It has a direct impact on your life. Here's why it matters:

- Financial Security: Understanding your income sources helps you create a budget, track your spending, and build a solid financial foundation.

- Opportunity: More cash means more opportunities. You can save for a down payment on a house, invest in your future, or pursue your passions.

- Peace of Mind: Knowing where your money comes from reduces stress and anxiety about finances. You'll feel more in control of your life.

- Goal Setting: When you're aware of the inflow of cash, you can set realistic and achievable goals.

Essentially, knowing your sources of cash allows you to be the CEO of your own financial life. You're no longer just passively receiving money; you're actively managing and maximizing it.

The Bottom Line

Cash comes from many different places. Your job is the most common, but you can supplement that with side hustles, investments, and even the occasional lucky break. The key is to be aware of all your potential income streams and to manage them wisely. So, go out there and find your financial flour – bake that amazing cake!