Hey there, coffee buddy! Ever wondered about LLCs? You know, those mysterious letters that seem to follow every small business name these days? Let's spill the beans (pun intended!) on what's actually true about them. Think of it as a super-casual LLC 101. No jargon, promise! Just you, me, and the truth about Limited Liability Companies.

LLCs: Myth vs. Reality – Let's Sort It Out!

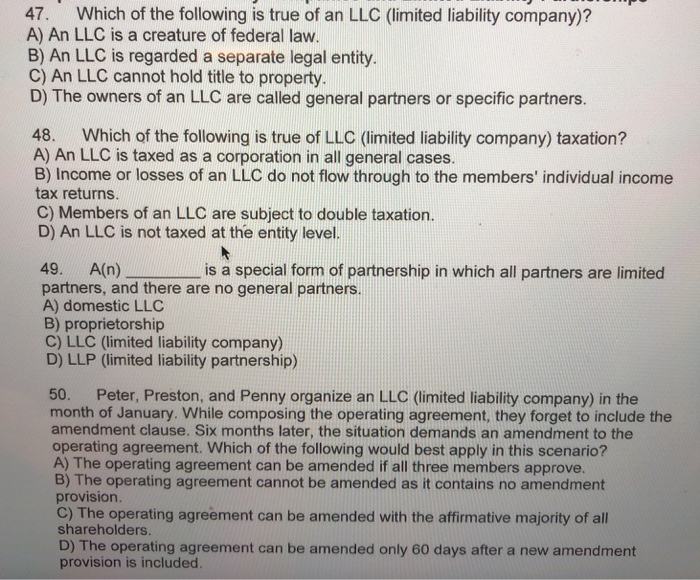

Okay, so you're scrolling through legal jargon, and everything sounds like a foreign language, right? Don't worry, we're breaking it down. When someone asks "Which of the following is true of an LLC?" prepare for a barrage of options. But what *really* matters?

Myth #1: LLCs Are Only for Big Businesses

Busted! This is a huge misconception. LLCs are actually incredibly popular with small businesses and even solo entrepreneurs. Think Etsy shop owners, freelance writers (like, uh, me!), and independent consultants. Why? Because they offer a sweet spot between simplicity and protection. Speaking of protection...

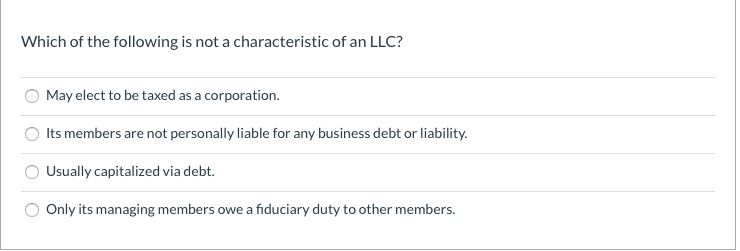

Truth #1: LLCs Offer Liability Protection (Mostly)

This is the big kahuna, the main reason why folks choose an LLC. It's all about protecting your personal assets. Imagine you're selling handcrafted gnomes, and one accidentally spontaneously combusts (hey, it could happen!). Without an LLC, you could be personally liable for damages. With an LLC, generally, your personal assets (house, car, savings) are shielded. Think of it like a financial superhero cape! But remember – it's not a *totally* impenetrable shield. More on that later.

Important caveat: This protection isn't absolute. If you personally guarantee a business loan or commit fraud, that liability protection can vanish faster than free donuts at a conference. So, play it straight!

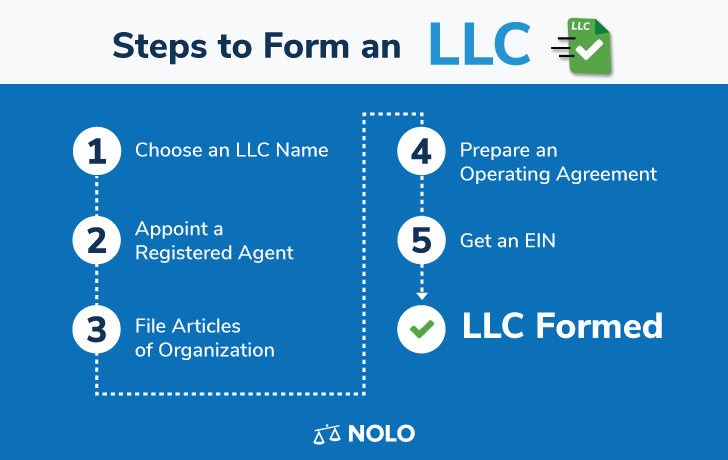

Myth #2: Setting Up an LLC is Rocket Science

Okay, it's not *rocket science*, but it's also not as simple as brewing a cup of coffee (although, wouldn't that be nice?). There's paperwork involved, folks. You need to file Articles of Organization (sounds scary, but it's basically just a form) with your state. You'll also need to choose a registered agent (someone who can receive legal documents on behalf of your LLC). It's doable, even without a law degree. You can use online services to help, or if you're feeling particularly ambitious, you can tackle it yourself. Just be prepared for some Googling!

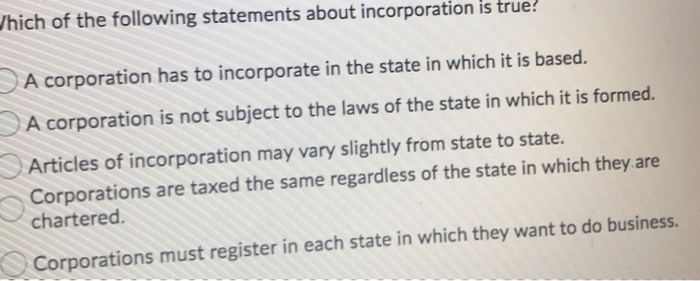

Truth #2: LLCs Need to Comply with State Regulations

Yep, Uncle Sam (or, more accurately, your state government) wants to know you exist. Each state has its own rules and regulations regarding LLCs. This can include things like filing annual reports, paying franchise taxes (in some states), and maintaining a registered agent. Failing to comply can result in penalties or even the dissolution of your LLC. Don't be that person! Mark those deadlines in your calendar!

Myth #3: LLCs Are a Tax Haven

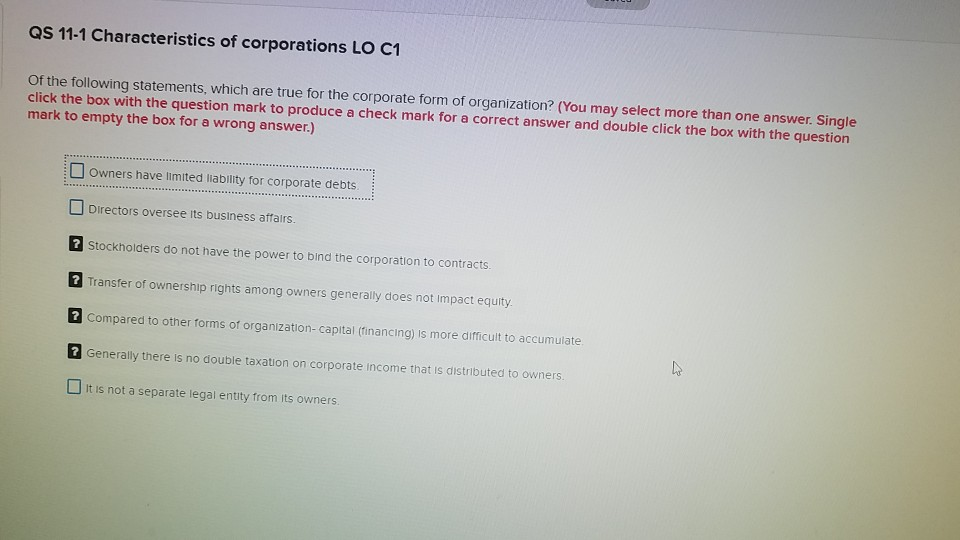

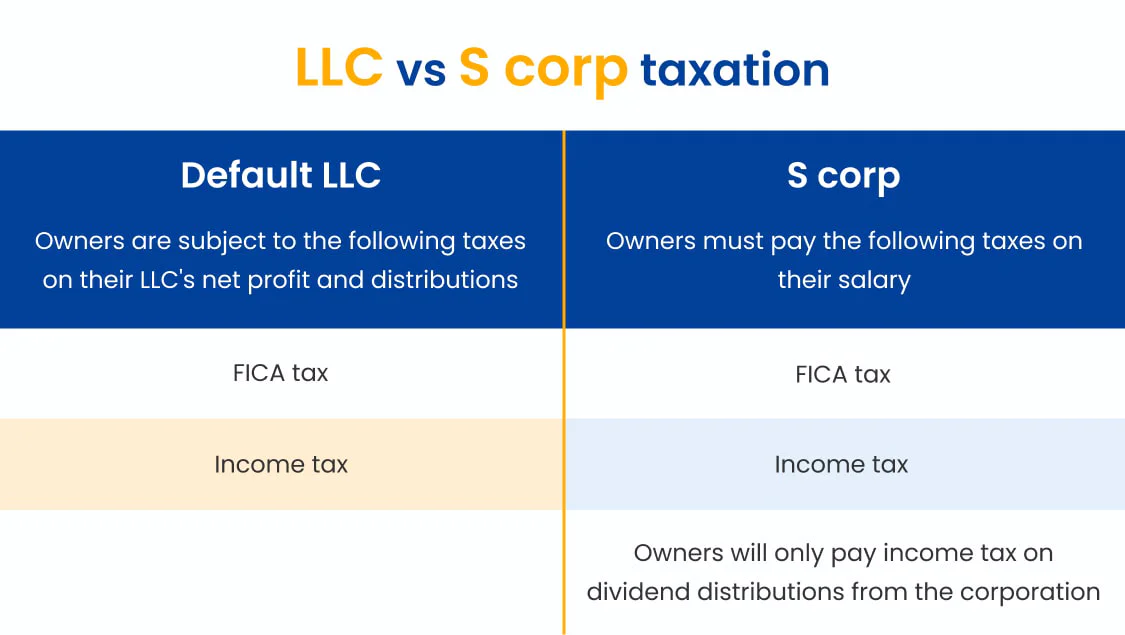

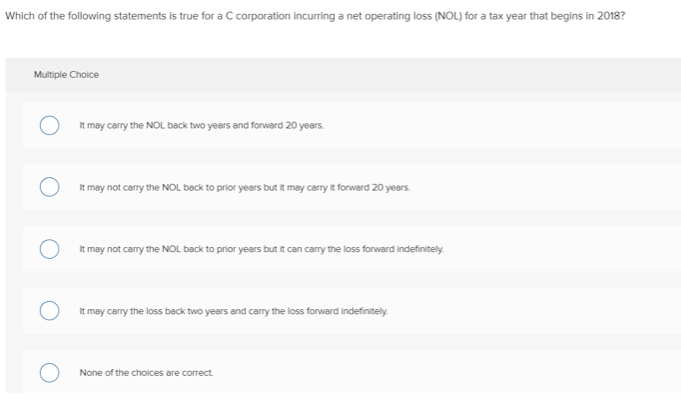

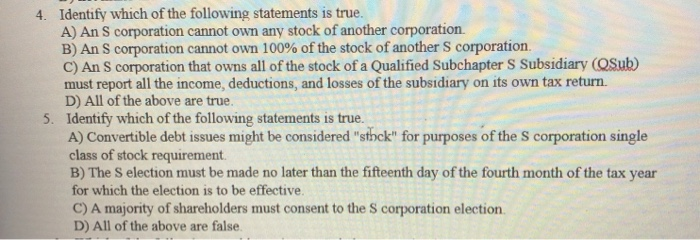

Absolutely not! An LLC itself isn't a tax haven. It's a legal structure, not a magical loophole. How your LLC is taxed depends on several factors, including the number of members (owners) and whether you've elected to be taxed as a corporation. Most LLCs are taxed as pass-through entities, meaning the profits (and losses) are passed through to the owners and reported on their individual tax returns. Consult with a tax professional to figure out the best tax strategy for your specific situation. Because, let's be honest, taxes are confusing enough without adding LLCs to the mix!

Truth #3: LLCs Offer Flexibility in Taxation

This is where things get interesting. While the default tax treatment for an LLC is pass-through taxation, you can actually elect to be taxed as an S corporation or even a C corporation. Why would you do that? Well, it depends on your specific financial situation and goals. For example, being taxed as an S corp can sometimes reduce your self-employment taxes. But again, talk to a tax pro! They'll help you navigate the labyrinthine world of tax regulations and ensure you're making the most tax-efficient choice.

Myth #4: LLCs Are Permanent

Sadly, no. An LLC doesn't last forever automatically. While you *can* set up an LLC with no specific end date (called perpetual existence), certain events can trigger its dissolution. This could include the death or withdrawal of a member, bankruptcy, or simply a decision by the members to wind down the business. Make sure you have an operating agreement (more on that in a bit!) that outlines the procedures for dissolving the LLC.

Truth #4: LLCs Benefit From an Operating Agreement

An operating agreement is like the constitution for your LLC. It outlines the rights and responsibilities of the members, how profits and losses are allocated, how decisions are made, and what happens if a member leaves or the LLC is dissolved. While not legally required in all states, having an operating agreement is highly recommended. It helps prevent disputes among members and provides clarity on how the business should be run. Think of it as a prenuptial agreement for your business. Nobody wants to think about things going wrong, but it's always better to be prepared!

Consider this: Without an operating agreement, state law dictates how your LLC is run. And those default state laws might not be what you want! A well-drafted operating agreement allows you to customize the rules to fit your specific needs and circumstances.

Myth #5: One LLC is Enough for Every Business

Not necessarily! If you have multiple businesses or assets, it might make sense to create separate LLCs for each. This can provide additional liability protection. For example, if you own rental properties, you might create a separate LLC for each property to isolate the liability. If something goes wrong with one property (e.g., someone gets injured), the assets of your other properties are protected. It's all about minimizing risk!

Truth #5: LLCs Require Ongoing Maintenance

Setting up an LLC is just the first step. You also need to maintain it. This includes keeping your business and personal finances separate (absolutely crucial!), filing annual reports, paying any required fees, and complying with all applicable laws and regulations. Failing to do so can jeopardize your liability protection. Think of it like owning a car – you can't just buy it and forget about it. You need to get regular maintenance to keep it running smoothly. Same goes for your LLC!

Myth #6: LLCs Can Do Anything

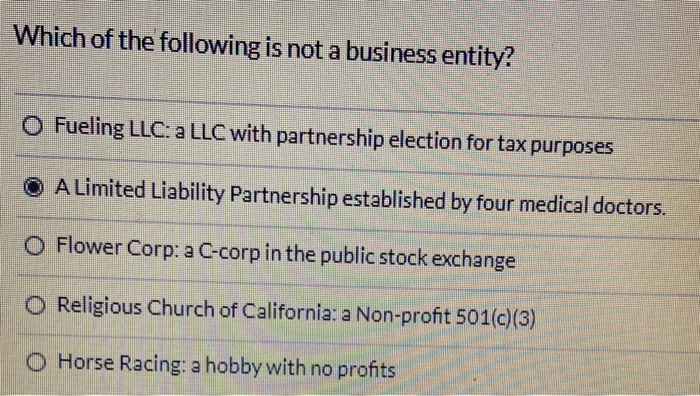

While LLCs are pretty versatile, there are some things they *can't* do. For example, certain professions (like lawyers and doctors) may be required to form a professional limited liability company (PLLC) instead of a regular LLC. Also, some states have restrictions on what types of businesses can form LLCs. Do your research to make sure an LLC is the right structure for your business!

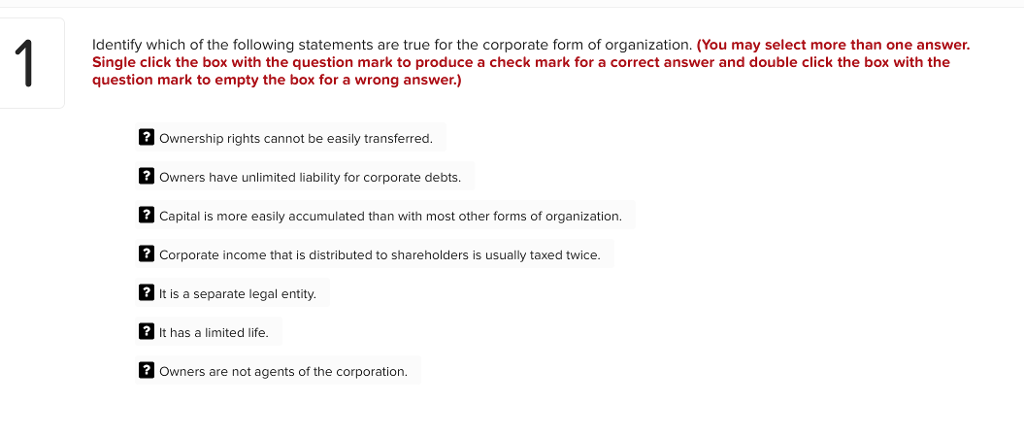

Truth #6: LLCs Are Relatively Easy to Set Up and Maintain (Compared to Corporations)

Okay, we've already established that setting up an LLC isn't *exactly* a walk in the park, but compared to forming a corporation (S corp or C corp), it's generally much simpler and less expensive. Corporations have more complex governance requirements and are subject to more regulations. LLCs offer a good balance of liability protection and ease of administration.

So, there you have it! A whirlwind tour of LLCs, demystified and (hopefully) made a little less intimidating. Remember, this is just a general overview. Before making any decisions, it's always best to consult with an attorney or other qualified professional. They can provide personalized advice based on your specific circumstances. Now go forth and conquer the business world! You got this!

The Final Scoop: What to Remember

Alright, let’s recap the most important points, shall we?

- Liability Protection: Key benefit, but not a magic shield.

- State Compliance: Follow the rules, or face the consequences.

- Tax Flexibility: Explore your options with a tax pro.

- Operating Agreement: Your LLC's constitution. Write it well!

- Maintenance: Keep it running smoothly, or risk losing protection.

And there you have it! May your LLC journey be filled with success, fewer spontaneously combusting gnomes, and minimal tax-related headaches. Cheers to your entrepreneurial spirit!