Okay, let's talk about something that might not sound super thrilling at first: level term life insurance. But trust me, once you understand it, you'll see why it's actually pretty cool – in a responsible, future-planning kind of way. So, what exactly is it, and more importantly, what statements about it are actually true? Let's dive in.

What in the World is Level Term Life Insurance?

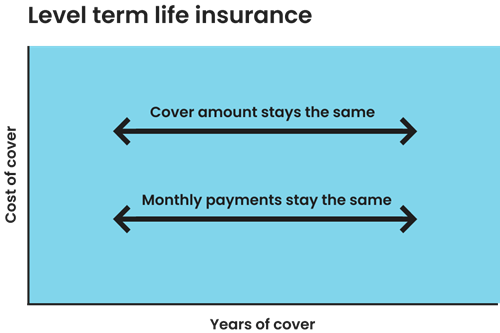

Imagine you're renting an apartment. You sign a lease for, say, a year, and your rent stays the same for that entire year. That's kind of what level term life insurance is like. You get coverage for a specific period (the "term"), and the amount you pay each month (the "premium") stays the same, or level, throughout that term. Simple, right?

Think of it like a subscription box. You know exactly how much you're paying each month for a specific length of time. No surprises! But instead of getting beauty products or gourmet snacks, you're getting peace of mind knowing your loved ones will be financially protected if something happens to you during that term.

Key Features to Keep in Mind

Here's a quick rundown of the core elements that make level term life insurance, well, level term life insurance:

- Fixed Premium: This is the big one. Your payment doesn't change during the term. Predictability is key!

- Defined Term: You choose how long you want the coverage to last – 10 years, 20 years, 30 years, etc. It's like choosing the length of your rental lease.

- Death Benefit: This is the amount of money your beneficiaries (the people you choose to receive the payout) get if you die during the term.

- No Cash Value: Unlike some other types of life insurance (like whole life), level term insurance usually doesn't build up any cash value that you can borrow against or withdraw. It's pure protection.

Which Statements Are Actually True About Level Term? Let's Play "Fact or Fiction"!

Alright, now for the fun part. Let's debunk some myths and nail down the truths about level term life insurance. Here are some common statements – can you spot which ones are accurate?

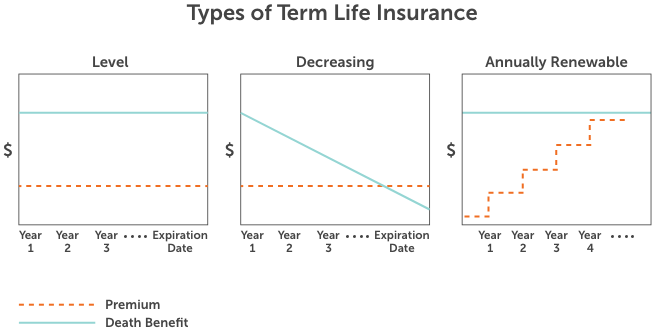

Statement 1: The Premium Increases Over Time.

Fiction! This is the opposite of what level term means. The "level" part means your premium stays the same throughout the term. If your premium is going up, you probably don't have a level term policy.

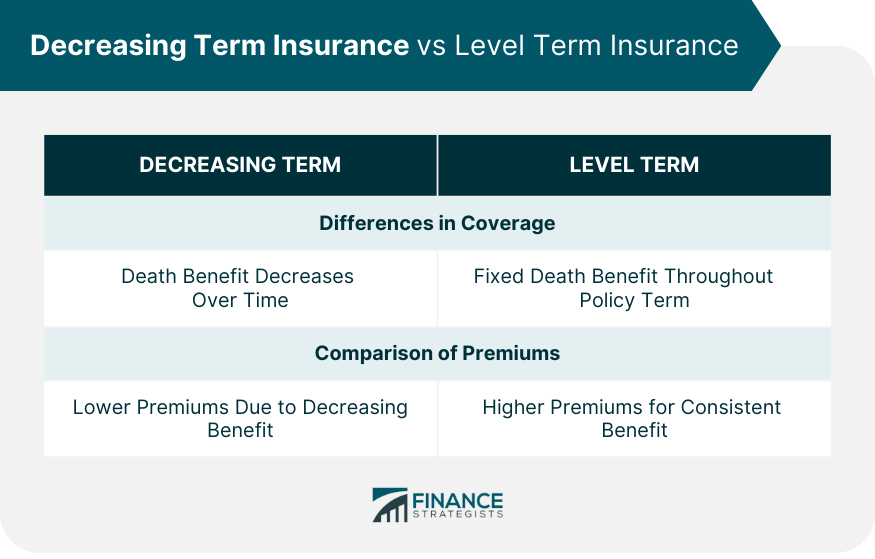

Statement 2: The Death Benefit Stays the Same Throughout the Term.

Fact! This is a crucial aspect of level term insurance. Just like your premium, the amount your beneficiaries receive if you pass away remains constant during the term. It's reliable and consistent coverage.

Imagine buying a brand new car with a set value. No matter how much you drive it within a certain period, that initial value used for insuring the vehicle stays put, right? That’s similar to how the death benefit works.

Statement 3: Level Term Insurance Builds Cash Value.

Fiction! As mentioned earlier, level term insurance is primarily about providing a death benefit. It's not designed to be an investment vehicle, so it doesn't accumulate cash value. Think of it as renting versus buying – you're paying for the protection, not owning a financial asset.

Statement 4: You Can Borrow Against a Level Term Life Insurance Policy.

Fiction! Since it doesn't build cash value, you can't borrow against it. This is another key difference between level term and other types of life insurance, such as whole life insurance.

Statement 5: Level Term Insurance is Generally More Affordable Than Whole Life Insurance.

Fact! Typically, level term insurance is significantly more affordable than whole life insurance, especially when you're younger. This is because you're only paying for the death benefit protection for a specific period, without the added cost of cash value accumulation.

Think of it like this: comparing a level term life insurance premium to a whole life premium is akin to comparing the price of a simple, functional bicycle to a top-of-the-line mountain bike with all the bells and whistles. Both get you where you need to go (provide life insurance coverage), but one is significantly less expensive.

Statement 6: Once the Term is Over, the Coverage Automatically Continues at the Same Premium.

Fiction! This is important to understand. When the term ends, your coverage expires. You'll generally need to renew the policy (usually at a higher premium based on your current age) or get a new one. Some policies offer a "convertible" option, which allows you to convert the term policy into a permanent policy (like whole life) without a medical exam, but that's a different ballgame altogether.

Statement 7: Level Term Life Insurance is a Good Option for Covering Specific Debts Like a Mortgage.

Fact! Many people use level term insurance to cover specific financial obligations, such as a mortgage or college tuition for their children. By choosing a term length that matches the duration of the debt, you can ensure your loved ones won't be burdened with these expenses if you die prematurely.

Statement 8: Medical Exams Are Always Required to Get Level Term Life Insurance.

Fiction! While medical exams are often part of the application process, some companies offer "no-exam" policies. However, these policies may have higher premiums or lower coverage amounts. It's all about weighing your options and finding what works best for you.

Think of a medical exam as a detailed inspection for a house you are considering buying. Standard procedure, right? But sometimes, you may opt for a quick walk-through if you're just looking for basic shelter and not overly concerned about the intricate details.

Why Should You Care About Level Term Insurance?

So, why is all this important? Well, understanding the basics of level term life insurance can help you make informed decisions about protecting your family's financial future. It's about peace of mind knowing that your loved ones will be taken care of if you're no longer around.

Here’s the takeaway. Level term life insurance is a straightforward and often affordable way to provide a safety net for your family. It's not the flashiest financial product out there, but it's a solid foundation for responsible financial planning. By understanding its key features and benefits, you can confidently choose a policy that meets your specific needs and provides the protection your loved ones deserve. Now, go forth and conquer your financial future!